freeamfva's blog

BEST FOREX BROKERS IN MEXICO 2023

Finding the best brokerage firm as a Mexican can be a difficult process. Especially getting the ones that accept Mexican traders and would allow you to invest in your currency, the Mexican peso. Don’t worry, you’re not alone.To get more news about best forex brokers in mexico, you can visit wikifx.com official website.

We’ve listed the best trading sites that would let you as a Mexican trader, trade Indices, Forex, Stocks, ETFs, Binary Options, CDFs, and some cryptocurrencies like Ethereum and Bitcoin.

These brokers also support payment options that will allow you as a Mexican trader to make your deposit and quick withdrawal of your profit. They provide the lowest fees and support cTrader, MT4, and MT5 trading platforms.

They also provide the best signup bonuses for new traders from Mexico, and are trusted, safe, and have a long term record in the forex world.

HERE’S HOW WE CHOOSE THE BEST BROKER FOR YOU!

Regulated – Before any Mexican trader signs up to a new broker, the trader needs to check if the broker is regulated. A Regulated broker is one that follows the strict rules of the forex regulators to prevent scamming small investors like you and i.

Major regulators in the industry include DFSA, SCB, CySEC, FCA, FSB, MiFID, ASIC, IFSC, BaFin, and many others. Before creating our list of the best brokers for Mexicans, we had to make sure they were all regulated and trusted brokers.

Offers Demo Account – A Demo trading account is a virtual account made by a broker for new traders who want to test the brokers’ platform before depositing real money. This feature is essential for beginners who are still new to forex trading and won’t like to lose their investment while learning how to trade.

Asset Coverage – Assets are financial instruments available for us to trade on. They range from commodities like gold and silver to cryptocurrencies, stocks, CFDs, ETFs, indices and currency pairs. Most brokers offer all asset types, while some offer a selected range asset type.

Offers Mobile Trading – Every Mexican forex trader needs to have access to the inter-bank market irrespective of which device they own. This is why brokers make available mobile apps for android and ios, desktop, and web apps for traders. This makes trading seamless and less stressful.

Easy Deposit/Withdrawal – As a Mexican forex trader, you need to choose a broker that supports the payment option that works in Mexico. Also, the payment option needs to provide the lowest fees and fast in processing payments. For Mexicans, Skrill, Neteller, Master Card, Visa Card, and WebMoney are the best payment options.

Effective Customer Service – Before signing up to a broker, you need to first visit the brokers’ website and ask as many questions as possible. This helps you gain confidence in the platform and helps you resolve any issues that might come up during trading.

These brokers also support payment options that will allow you as a Mexican trader to make your deposit and quick withdrawal of your profit. They provide the lowest fees and support cTrader, MT4, and MT5 trading platforms.

They also provide the best signup bonuses for new traders from Mexico, and are trusted, safe, and have a long term record in the forex world.

HERE’S HOW WE CHOOSE THE BEST BROKER FOR YOU!

Regulated – Before any Mexican trader signs up to a new broker, the trader needs to check if the broker is regulated. A Regulated broker is one that follows the strict rules of the forex regulators to prevent scamming small investors like you and i.

Major regulators in the industry include DFSA, SCB, CySEC, FCA, FSB, MiFID, ASIC, IFSC, BaFin, and many others. Before creating our list of the best brokers for Mexicans, we had to make sure they were all regulated and trusted brokers.

Offers Demo Account – A Demo trading account is a virtual account made by a broker for new traders who want to test the brokers’ platform before depositing real money. This feature is essential for beginners who are still new to forex trading and won’t like to lose their investment while learning how to trade.

Asset Coverage – Assets are financial instruments available for us to trade on. They range from commodities like gold and silver to cryptocurrencies, stocks, CFDs, ETFs, indices and currency pairs. Most brokers offer all asset types, while some offer a selected range asset type.

Offers Mobile Trading – Every Mexican forex trader needs to have access to the inter-bank market irrespective of which device they own. This is why brokers make available mobile apps for android and ios, desktop, and web apps for traders. This makes trading seamless and less stressful.

Easy Deposit/Withdrawal – As a Mexican forex trader, you need to choose a broker that supports the payment option that works in Mexico. Also, the payment option needs to provide the lowest fees and fast in processing payments. For Mexicans, Skrill, Neteller, Master Card, Visa Card, and WebMoney are the best payment options.

Effective Customer Service – Before signing up to a broker, you need to first visit the brokers’ website and ask as many questions as possible. This helps you gain confidence in the platform and helps you resolve any issues that might come up during trading.

These brokers also support payment options that will allow you as a Mexican trader to make your deposit and quick withdrawal of your profit. They provide the lowest fees and support cTrader, MT4, and MT5 trading platforms.

They also provide the best signup bonuses for new traders from Mexico, and are trusted, safe, and have a long term record in the forex world.

HERE’S HOW WE CHOOSE THE BEST BROKER FOR YOU!

Regulated – Before any Mexican trader signs up to a new broker, the trader needs to check if the broker is regulated. A Regulated broker is one that follows the strict rules of the forex regulators to prevent scamming small investors like you and i.

Major regulators in the industry include DFSA, SCB, CySEC, FCA, FSB, MiFID, ASIC, IFSC, BaFin, and many others. Before creating our list of the best brokers for Mexicans, we had to make sure they were all regulated and trusted brokers.

Offers Demo Account – A Demo trading account is a virtual account made by a broker for new traders who want to test the brokers’ platform before depositing real money. This feature is essential for beginners who are still new to forex trading and won’t like to lose their investment while learning how to trade.

Asset Coverage – Assets are financial instruments available for us to trade on. They range from commodities like gold and silver to cryptocurrencies, stocks, CFDs, ETFs, indices and currency pairs. Most brokers offer all asset types, while some offer a selected range asset type.

Offers Mobile Trading – Every Mexican forex trader needs to have access to the inter-bank market irrespective of which device they own. This is why brokers make available mobile apps for android and ios, desktop, and web apps for traders. This makes trading seamless and less stressful.

Easy Deposit/Withdrawal – As a Mexican forex trader, you need to choose a broker that supports the payment option that works in Mexico. Also, the payment option needs to provide the lowest fees and fast in processing payments. For Mexicans, Skrill, Neteller, Master Card, Visa Card, and WebMoney are the best payment options.

Effective Customer Service – Before signing up to a broker, you need to first visit the brokers’ website and ask as many questions as possible. This helps you gain confidence in the platform and helps you resolve any issues that might come up during trading.

These brokers also support payment options that will allow you as a Mexican trader to make your deposit and quick withdrawal of your profit. They provide the lowest fees and support cTrader, MT4, and MT5 trading platforms.

They also provide the best signup bonuses for new traders from Mexico, and are trusted, safe, and have a long term record in the forex world.

HERE’S HOW WE CHOOSE THE BEST BROKER FOR YOU!

Regulated – Before any Mexican trader signs up to a new broker, the trader needs to check if the broker is regulated. A Regulated broker is one that follows the strict rules of the forex regulators to prevent scamming small investors like you and i.

Major regulators in the industry include DFSA, SCB, CySEC, FCA, FSB, MiFID, ASIC, IFSC, BaFin, and many others. Before creating our list of the best brokers for Mexicans, we had to make sure they were all regulated and trusted brokers.

Offers Demo Account – A Demo trading account is a virtual account made by a broker for new traders who want to test the brokers’ platform before depositing real money. This feature is essential for beginners who are still new to forex trading and won’t like to lose their investment while learning how to trade.

Asset Coverage – Assets are financial instruments available for us to trade on. They range from commodities like gold and silver to cryptocurrencies, stocks, CFDs, ETFs, indices and currency pairs. Most brokers offer all asset types, while some offer a selected range asset type.

Offers Mobile Trading – Every Mexican forex trader needs to have access to the inter-bank market irrespective of which device they own. This is why brokers make available mobile apps for android and ios, desktop, and web apps for traders. This makes trading seamless and less stressful.

Easy Deposit/Withdrawal – As a Mexican forex trader, you need to choose a broker that supports the payment option that works in Mexico. Also, the payment option needs to provide the lowest fees and fast in processing payments. For Mexicans, Skrill, Neteller, Master Card, Visa Card, and WebMoney are the best payment options.

Effective Customer Service – Before signing up to a broker, you need to first visit the brokers’ website and ask as many questions as possible. This helps you gain confidence in the platform and helps you resolve any issues that might come up during trading.

Best Forex Brokers In Europe 2023

The low spreads, no-dealing desk ECN pricing, low trading costs, top-tier trading platforms, CFDs offered, execution speed and range of funding methods combine to make Pepperstone the best forex broker in Europe. Although headquartered in Melbourne, Australia, Pepperstone is regulated by various financial authorities around the world.To get more news about best forex brokers in europe, you can visit wikifx.com official website.

The broker serves the needs of European forex traders through its UK branch which is regulated by the Financial Conduct Authority (FCA). The broker is also regulated in Germany and Austria by BaFin in Cyprus by CySEC. Outside of Europe and the UK, Pepperstone is overseen by the DFSA in Dubai, CMA in Kenya and the SCB in the Bahamas.

Using a broker with tier-1 regulation means you are using a broker that has measures to protect the integrity of their trading operation of their clients and systems in place to ensure clients’ funds are safe.

Forex Trading With Spreads From 0.0 Pips

At Pepperstone, European traders can benefit from forex trading with spreads starting from 0.0 pips. The average spread on the most popular currency pairs is 0.16 pips on EUR/USD respectively 0.4 pips on GBP/USD – found on the Razor trading account. The table below compares European forex brokers with the lowest spreads.

On top of the charged spread, Pepperstone has a rock-bottom commission rate from USD 3.50 for one standard lot traded or EUR 2.61 for the EUR-based trading account.

3 Powerful Trading Platforms

MetaTrader 4, MetaTrader 5 and cTrader make up the suite of trading platforms offered by Pepperstone. The trading terminals are supported across multiple devices including desktops, browsers and mobile Apps. The unique trading features and tools included help beginner traders and professional traders eliminate the market noise and make decisions on the spot.

Also, the trading platform boasts a reliable high order execution speed of 85ms. The graph below compares the best forex brokers in Europe and the tested order execution speed using MT4 market orders.

Commission And Commission-Free Trading

If you want to trade on the foreign exchange market, you need a brokerage trading account. At Pepperstone, you can choose between two account types – the Standard account and Razor account.

Standard Account

The Standard account charges no commission, meaning the main trading cost you’ll run into is the bid-ask spread.

This account is a safe choice for beginner traders as traders don’t need to concern themselves with commission costs which can be confusing when calculating costs.

Razor Account

The Razor account comes with commission costs of USD$3.50 side-trip or $7.00 round-turn for each standard lot (100,000 units) you trade on top of the spread. If you are looking for lower fees, then this account is the best choice. While all traders can use this account, this account is most popular with experienced traders.

Pepperstone tops all European forex brokers and stole the first place. The top-notch financial services offered by this FX broker include low spreads, a good selection of trading platforms, lightning-fast order speed, a low entry barrier and a dedicated trading account with zero commissions. Claim your free demo account by clicking the button below.

Using a broker with tier-1 regulation means you are using a broker that has measures to protect the integrity of their trading operation of their clients and systems in place to ensure clients’ funds are safe.

Forex Trading With Spreads From 0.0 Pips

At Pepperstone, European traders can benefit from forex trading with spreads starting from 0.0 pips. The average spread on the most popular currency pairs is 0.16 pips on EUR/USD respectively 0.4 pips on GBP/USD – found on the Razor trading account. The table below compares European forex brokers with the lowest spreads.

On top of the charged spread, Pepperstone has a rock-bottom commission rate from USD 3.50 for one standard lot traded or EUR 2.61 for the EUR-based trading account.

3 Powerful Trading Platforms

MetaTrader 4, MetaTrader 5 and cTrader make up the suite of trading platforms offered by Pepperstone. The trading terminals are supported across multiple devices including desktops, browsers and mobile Apps. The unique trading features and tools included help beginner traders and professional traders eliminate the market noise and make decisions on the spot.

Also, the trading platform boasts a reliable high order execution speed of 85ms. The graph below compares the best forex brokers in Europe and the tested order execution speed using MT4 market orders.

Commission And Commission-Free Trading

If you want to trade on the foreign exchange market, you need a brokerage trading account. At Pepperstone, you can choose between two account types – the Standard account and Razor account.

Standard Account

The Standard account charges no commission, meaning the main trading cost you’ll run into is the bid-ask spread.

This account is a safe choice for beginner traders as traders don’t need to concern themselves with commission costs which can be confusing when calculating costs.

Razor Account

The Razor account comes with commission costs of USD$3.50 side-trip or $7.00 round-turn for each standard lot (100,000 units) you trade on top of the spread. If you are looking for lower fees, then this account is the best choice. While all traders can use this account, this account is most popular with experienced traders.

Pepperstone tops all European forex brokers and stole the first place. The top-notch financial services offered by this FX broker include low spreads, a good selection of trading platforms, lightning-fast order speed, a low entry barrier and a dedicated trading account with zero commissions. Claim your free demo account by clicking the button below.

Using a broker with tier-1 regulation means you are using a broker that has measures to protect the integrity of their trading operation of their clients and systems in place to ensure clients’ funds are safe.

Forex Trading With Spreads From 0.0 Pips

At Pepperstone, European traders can benefit from forex trading with spreads starting from 0.0 pips. The average spread on the most popular currency pairs is 0.16 pips on EUR/USD respectively 0.4 pips on GBP/USD – found on the Razor trading account. The table below compares European forex brokers with the lowest spreads.

On top of the charged spread, Pepperstone has a rock-bottom commission rate from USD 3.50 for one standard lot traded or EUR 2.61 for the EUR-based trading account.

3 Powerful Trading Platforms

MetaTrader 4, MetaTrader 5 and cTrader make up the suite of trading platforms offered by Pepperstone. The trading terminals are supported across multiple devices including desktops, browsers and mobile Apps. The unique trading features and tools included help beginner traders and professional traders eliminate the market noise and make decisions on the spot.

Also, the trading platform boasts a reliable high order execution speed of 85ms. The graph below compares the best forex brokers in Europe and the tested order execution speed using MT4 market orders.

Commission And Commission-Free Trading

If you want to trade on the foreign exchange market, you need a brokerage trading account. At Pepperstone, you can choose between two account types – the Standard account and Razor account.

Standard Account

The Standard account charges no commission, meaning the main trading cost you’ll run into is the bid-ask spread.

This account is a safe choice for beginner traders as traders don’t need to concern themselves with commission costs which can be confusing when calculating costs.

Razor Account

The Razor account comes with commission costs of USD$3.50 side-trip or $7.00 round-turn for each standard lot (100,000 units) you trade on top of the spread. If you are looking for lower fees, then this account is the best choice. While all traders can use this account, this account is most popular with experienced traders.

Pepperstone tops all European forex brokers and stole the first place. The top-notch financial services offered by this FX broker include low spreads, a good selection of trading platforms, lightning-fast order speed, a low entry barrier and a dedicated trading account with zero commissions. Claim your free demo account by clicking the button below.

Using a broker with tier-1 regulation means you are using a broker that has measures to protect the integrity of their trading operation of their clients and systems in place to ensure clients’ funds are safe.

Forex Trading With Spreads From 0.0 Pips

At Pepperstone, European traders can benefit from forex trading with spreads starting from 0.0 pips. The average spread on the most popular currency pairs is 0.16 pips on EUR/USD respectively 0.4 pips on GBP/USD – found on the Razor trading account. The table below compares European forex brokers with the lowest spreads.

On top of the charged spread, Pepperstone has a rock-bottom commission rate from USD 3.50 for one standard lot traded or EUR 2.61 for the EUR-based trading account.

3 Powerful Trading Platforms

MetaTrader 4, MetaTrader 5 and cTrader make up the suite of trading platforms offered by Pepperstone. The trading terminals are supported across multiple devices including desktops, browsers and mobile Apps. The unique trading features and tools included help beginner traders and professional traders eliminate the market noise and make decisions on the spot.

Also, the trading platform boasts a reliable high order execution speed of 85ms. The graph below compares the best forex brokers in Europe and the tested order execution speed using MT4 market orders.

Commission And Commission-Free Trading

If you want to trade on the foreign exchange market, you need a brokerage trading account. At Pepperstone, you can choose between two account types – the Standard account and Razor account.

Standard Account

The Standard account charges no commission, meaning the main trading cost you’ll run into is the bid-ask spread.

This account is a safe choice for beginner traders as traders don’t need to concern themselves with commission costs which can be confusing when calculating costs.

Razor Account

The Razor account comes with commission costs of USD$3.50 side-trip or $7.00 round-turn for each standard lot (100,000 units) you trade on top of the spread. If you are looking for lower fees, then this account is the best choice. While all traders can use this account, this account is most popular with experienced traders.

Pepperstone tops all European forex brokers and stole the first place. The top-notch financial services offered by this FX broker include low spreads, a good selection of trading platforms, lightning-fast order speed, a low entry barrier and a dedicated trading account with zero commissions. Claim your free demo account by clicking the button below.

5 Best Forex Brokers for Beginners in 2023

Trading with the right broker remains essential but finding the best one among thousands on offer can be a tough challenge. That is why we have done intensive research to compile a must-read list for you below of the best Forex brokers for beginners.To get more news about best forex brokers for beginners, you can visit wikifx.com official website.

Forex trading basically refers to exchanging one currency for another one and speculating on price action. One example is buying euros for US dollars. Currencies remain quoted in pairs, with the EUR/USD the most liquid one. The first currency is known as the base currency, and the second one is a quote currency. Traders may buy or sell currency pairs, most conveniently online, via Forex brokers. A trader who buys or sells the EUR/USD exchanges euros for US dollars. One of the most notable benefits of Forex trading is leverage, which results in lower capital entry requirements versus other assets, like equities. The Forex market is the most liquid one globally, with daily turnover slowly approaching $7 trillion.

What is a Forex Broker?

A Forex broker acts as the intermediary between Forex traders and the Forex market. Some Forex brokers deploy the market-making model, profiting directly from client losses where they remain the counterparty. Other brokers use the ECN/STP/NDD execution model, matching orders and granting access to liquidity. The former has higher mark-ups in a commission-free pricing environment versus raw spreads for a fee and often a volume-based rebate program. A Forex broker also provided traders with a trading platform, either a proprietary solution, the retail market leading MT4 or the ECN favorite cTrader. Some try to push the MT5 trading platform, widely considered the failed successor to MT4. The best Forex brokers for beginners maintain a high-quality educational section, competitive market research and commentary, and excellent trading tools.

How Much Money Do You Need to Trade Forex?

One of the most frequent questions of beginner traders is “How Much Money Do I Need to Start Trading Forex?” While the answer depends on individual circumstances, new traders should consider no less than $100 and only trade micro-lots. One micro-lot equals 0.01 lots or 1,000 currency units in a standard Forex trading account and is usually the minimum trade size at most brokers. A $100 portfolio suffices for beginner traders to learn how to trade in a live trading environment and presents tremendous educational value.

What Are the Most Popular Currency Pairs?

The most liquid currency pair is the EUR/USD. Other major currency pairs include the EUR/JPY, the EUR/GBP, the EUR/CHF, the GBP/USD, the USD/JPY, the USD/CHF, the USD/CAD, the AUD/USD, and the NZD/USD. Per the latest Triennial Survey by the Bank for International Settlements (BIS), 88% of all Forex traders include the US dollar. The Chinese yuan (CNY) is the eighth most traded currency globally, positioned to become more dominant moving forward. Other emerging currencies to monitor are the Russian ruble, the Mexican peso, the Indian rupee, the Brazilian real and the South African rand.

Can You Get Rich by Trading Forex?

Getting rich by trading Forex remains a possibility, but a rare one. It requires discipline, patience, time, and capital. Traders must first master the psychology of trading before thinking about a trading strategy. It may require more than a decade of successful trading before a portfolio reaches the necessary size to take it to the next level and become rich. Most retail traders, between 70% and 85%, face trading losses, and less than 2% earn sufficient money from trading to rely on it as their sole source of income.

How Do I Start Trading Forex?

There are heated discussions about the best approach, but I recommend reading about trading psychology and Forex trading strategies suitable for beginners as first steps. The subsequent topics to study are fundamental and technical analysis. From there, learning in a live account with a small deposit and trading micro-lots presents the successful approach traders take. Many retail traders fall into the demo account trap, which provides no trading experience but can create a false sense of accomplishment.

How Do I Choose a Forex Broker?

Trading with a regulated Forex broker is a must, but the regulation should not diminish the competitiveness. One example is brokers in the US and EU, which are among the most regulated ones but are equally home to the least competitive trading environments. The best brokers offer a business-friendly regulatory environment with additional safety measures. I also recommend Forex brokers with a trader-friendly commission-based pricing environment and a volume-based rebate program. Traders must ensure that their preferred broker will offer the assets they wish to trade. A cutting-edge trading platform, not just the out-of-the-box MT4/MT5 trading platforms, is another aspect to demand. High-quality trading tools demonstrate the willingness of the broker to invest in its trading environment. Finally, traders should evaluate the execution statistics of a broker, if available.

What is a Forex Broker?

A Forex broker acts as the intermediary between Forex traders and the Forex market. Some Forex brokers deploy the market-making model, profiting directly from client losses where they remain the counterparty. Other brokers use the ECN/STP/NDD execution model, matching orders and granting access to liquidity. The former has higher mark-ups in a commission-free pricing environment versus raw spreads for a fee and often a volume-based rebate program. A Forex broker also provided traders with a trading platform, either a proprietary solution, the retail market leading MT4 or the ECN favorite cTrader. Some try to push the MT5 trading platform, widely considered the failed successor to MT4. The best Forex brokers for beginners maintain a high-quality educational section, competitive market research and commentary, and excellent trading tools.

How Much Money Do You Need to Trade Forex?

One of the most frequent questions of beginner traders is “How Much Money Do I Need to Start Trading Forex?” While the answer depends on individual circumstances, new traders should consider no less than $100 and only trade micro-lots. One micro-lot equals 0.01 lots or 1,000 currency units in a standard Forex trading account and is usually the minimum trade size at most brokers. A $100 portfolio suffices for beginner traders to learn how to trade in a live trading environment and presents tremendous educational value.

What Are the Most Popular Currency Pairs?

The most liquid currency pair is the EUR/USD. Other major currency pairs include the EUR/JPY, the EUR/GBP, the EUR/CHF, the GBP/USD, the USD/JPY, the USD/CHF, the USD/CAD, the AUD/USD, and the NZD/USD. Per the latest Triennial Survey by the Bank for International Settlements (BIS), 88% of all Forex traders include the US dollar. The Chinese yuan (CNY) is the eighth most traded currency globally, positioned to become more dominant moving forward. Other emerging currencies to monitor are the Russian ruble, the Mexican peso, the Indian rupee, the Brazilian real and the South African rand.

Can You Get Rich by Trading Forex?

Getting rich by trading Forex remains a possibility, but a rare one. It requires discipline, patience, time, and capital. Traders must first master the psychology of trading before thinking about a trading strategy. It may require more than a decade of successful trading before a portfolio reaches the necessary size to take it to the next level and become rich. Most retail traders, between 70% and 85%, face trading losses, and less than 2% earn sufficient money from trading to rely on it as their sole source of income.

How Do I Start Trading Forex?

There are heated discussions about the best approach, but I recommend reading about trading psychology and Forex trading strategies suitable for beginners as first steps. The subsequent topics to study are fundamental and technical analysis. From there, learning in a live account with a small deposit and trading micro-lots presents the successful approach traders take. Many retail traders fall into the demo account trap, which provides no trading experience but can create a false sense of accomplishment.

How Do I Choose a Forex Broker?

Trading with a regulated Forex broker is a must, but the regulation should not diminish the competitiveness. One example is brokers in the US and EU, which are among the most regulated ones but are equally home to the least competitive trading environments. The best brokers offer a business-friendly regulatory environment with additional safety measures. I also recommend Forex brokers with a trader-friendly commission-based pricing environment and a volume-based rebate program. Traders must ensure that their preferred broker will offer the assets they wish to trade. A cutting-edge trading platform, not just the out-of-the-box MT4/MT5 trading platforms, is another aspect to demand. High-quality trading tools demonstrate the willingness of the broker to invest in its trading environment. Finally, traders should evaluate the execution statistics of a broker, if available.

What is a Forex Broker?

A Forex broker acts as the intermediary between Forex traders and the Forex market. Some Forex brokers deploy the market-making model, profiting directly from client losses where they remain the counterparty. Other brokers use the ECN/STP/NDD execution model, matching orders and granting access to liquidity. The former has higher mark-ups in a commission-free pricing environment versus raw spreads for a fee and often a volume-based rebate program. A Forex broker also provided traders with a trading platform, either a proprietary solution, the retail market leading MT4 or the ECN favorite cTrader. Some try to push the MT5 trading platform, widely considered the failed successor to MT4. The best Forex brokers for beginners maintain a high-quality educational section, competitive market research and commentary, and excellent trading tools.

How Much Money Do You Need to Trade Forex?

One of the most frequent questions of beginner traders is “How Much Money Do I Need to Start Trading Forex?” While the answer depends on individual circumstances, new traders should consider no less than $100 and only trade micro-lots. One micro-lot equals 0.01 lots or 1,000 currency units in a standard Forex trading account and is usually the minimum trade size at most brokers. A $100 portfolio suffices for beginner traders to learn how to trade in a live trading environment and presents tremendous educational value.

What Are the Most Popular Currency Pairs?

The most liquid currency pair is the EUR/USD. Other major currency pairs include the EUR/JPY, the EUR/GBP, the EUR/CHF, the GBP/USD, the USD/JPY, the USD/CHF, the USD/CAD, the AUD/USD, and the NZD/USD. Per the latest Triennial Survey by the Bank for International Settlements (BIS), 88% of all Forex traders include the US dollar. The Chinese yuan (CNY) is the eighth most traded currency globally, positioned to become more dominant moving forward. Other emerging currencies to monitor are the Russian ruble, the Mexican peso, the Indian rupee, the Brazilian real and the South African rand.

Can You Get Rich by Trading Forex?

Getting rich by trading Forex remains a possibility, but a rare one. It requires discipline, patience, time, and capital. Traders must first master the psychology of trading before thinking about a trading strategy. It may require more than a decade of successful trading before a portfolio reaches the necessary size to take it to the next level and become rich. Most retail traders, between 70% and 85%, face trading losses, and less than 2% earn sufficient money from trading to rely on it as their sole source of income.

How Do I Start Trading Forex?

There are heated discussions about the best approach, but I recommend reading about trading psychology and Forex trading strategies suitable for beginners as first steps. The subsequent topics to study are fundamental and technical analysis. From there, learning in a live account with a small deposit and trading micro-lots presents the successful approach traders take. Many retail traders fall into the demo account trap, which provides no trading experience but can create a false sense of accomplishment.

How Do I Choose a Forex Broker?

Trading with a regulated Forex broker is a must, but the regulation should not diminish the competitiveness. One example is brokers in the US and EU, which are among the most regulated ones but are equally home to the least competitive trading environments. The best brokers offer a business-friendly regulatory environment with additional safety measures. I also recommend Forex brokers with a trader-friendly commission-based pricing environment and a volume-based rebate program. Traders must ensure that their preferred broker will offer the assets they wish to trade. A cutting-edge trading platform, not just the out-of-the-box MT4/MT5 trading platforms, is another aspect to demand. High-quality trading tools demonstrate the willingness of the broker to invest in its trading environment. Finally, traders should evaluate the execution statistics of a broker, if available.

What is a Forex Broker?

A Forex broker acts as the intermediary between Forex traders and the Forex market. Some Forex brokers deploy the market-making model, profiting directly from client losses where they remain the counterparty. Other brokers use the ECN/STP/NDD execution model, matching orders and granting access to liquidity. The former has higher mark-ups in a commission-free pricing environment versus raw spreads for a fee and often a volume-based rebate program. A Forex broker also provided traders with a trading platform, either a proprietary solution, the retail market leading MT4 or the ECN favorite cTrader. Some try to push the MT5 trading platform, widely considered the failed successor to MT4. The best Forex brokers for beginners maintain a high-quality educational section, competitive market research and commentary, and excellent trading tools.

How Much Money Do You Need to Trade Forex?

One of the most frequent questions of beginner traders is “How Much Money Do I Need to Start Trading Forex?” While the answer depends on individual circumstances, new traders should consider no less than $100 and only trade micro-lots. One micro-lot equals 0.01 lots or 1,000 currency units in a standard Forex trading account and is usually the minimum trade size at most brokers. A $100 portfolio suffices for beginner traders to learn how to trade in a live trading environment and presents tremendous educational value.

What Are the Most Popular Currency Pairs?

The most liquid currency pair is the EUR/USD. Other major currency pairs include the EUR/JPY, the EUR/GBP, the EUR/CHF, the GBP/USD, the USD/JPY, the USD/CHF, the USD/CAD, the AUD/USD, and the NZD/USD. Per the latest Triennial Survey by the Bank for International Settlements (BIS), 88% of all Forex traders include the US dollar. The Chinese yuan (CNY) is the eighth most traded currency globally, positioned to become more dominant moving forward. Other emerging currencies to monitor are the Russian ruble, the Mexican peso, the Indian rupee, the Brazilian real and the South African rand.

Can You Get Rich by Trading Forex?

Getting rich by trading Forex remains a possibility, but a rare one. It requires discipline, patience, time, and capital. Traders must first master the psychology of trading before thinking about a trading strategy. It may require more than a decade of successful trading before a portfolio reaches the necessary size to take it to the next level and become rich. Most retail traders, between 70% and 85%, face trading losses, and less than 2% earn sufficient money from trading to rely on it as their sole source of income.

How Do I Start Trading Forex?

There are heated discussions about the best approach, but I recommend reading about trading psychology and Forex trading strategies suitable for beginners as first steps. The subsequent topics to study are fundamental and technical analysis. From there, learning in a live account with a small deposit and trading micro-lots presents the successful approach traders take. Many retail traders fall into the demo account trap, which provides no trading experience but can create a false sense of accomplishment.

How Do I Choose a Forex Broker?

Trading with a regulated Forex broker is a must, but the regulation should not diminish the competitiveness. One example is brokers in the US and EU, which are among the most regulated ones but are equally home to the least competitive trading environments. The best brokers offer a business-friendly regulatory environment with additional safety measures. I also recommend Forex brokers with a trader-friendly commission-based pricing environment and a volume-based rebate program. Traders must ensure that their preferred broker will offer the assets they wish to trade. A cutting-edge trading platform, not just the out-of-the-box MT4/MT5 trading platforms, is another aspect to demand. High-quality trading tools demonstrate the willingness of the broker to invest in its trading environment. Finally, traders should evaluate the execution statistics of a broker, if available.

Best Forex Brokers for 2023

Trading forex, which involves exchanging one currency for another on the foreign exchange market, involves a level of risk and complexity that you might not find in traditional investing. That's why it's especially important to choose a broker that helps you understand and navigate the potential costs and benefits associated with forex. To get more news about best forex brokers, you can visit wikifx.com official website.

When selecting your forex broker, you should consider trading platforms and tools, the number of currency pairs offered, customer service and, of course, trading costs.

But comparing costs is tricky in forex trading. Some brokers charge a commission, while others are compensated with a spread, or a markup between the price they pay for an asset and what they sell it for.

That’s just one reason why the search for the best forex broker is complex. Another is that there are a variety of brokers, many of them unregulated or regulated in countries outside of the U.S. For our list of best currency trading brokers, we considered only those that are regulated by the National Futures Association and the Commodity Futures Trading Commission.

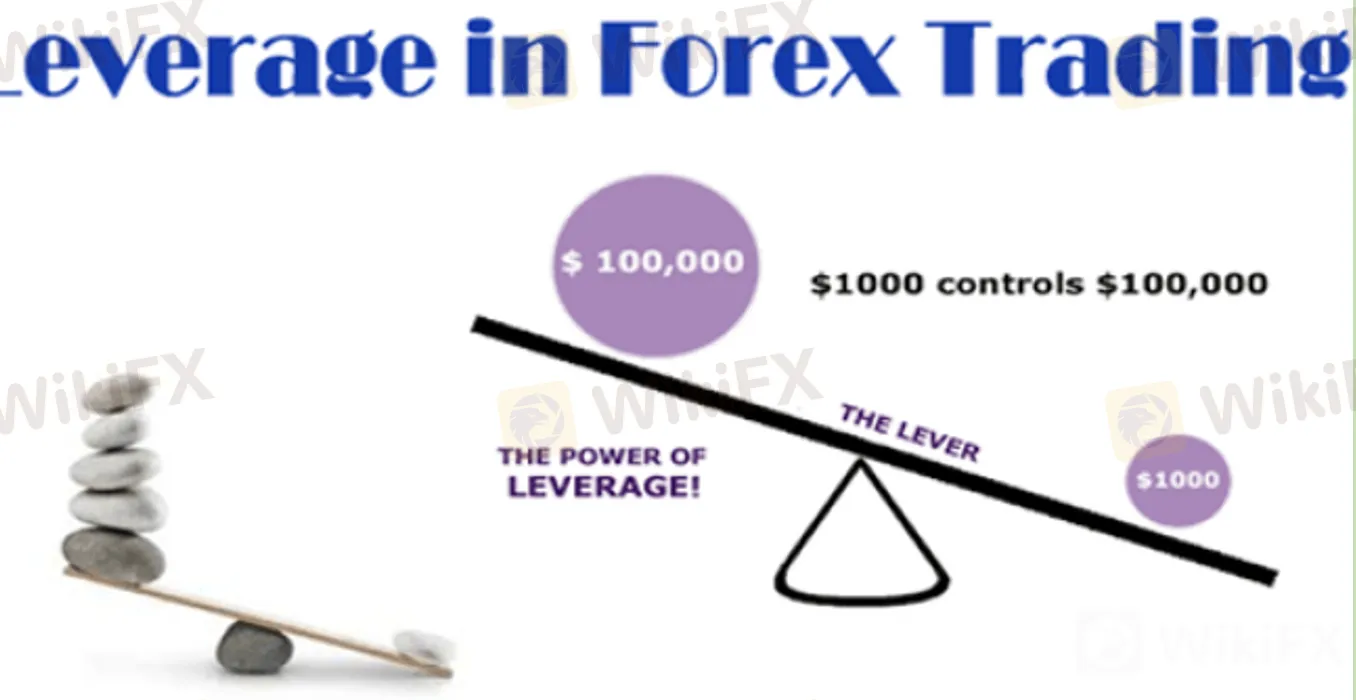

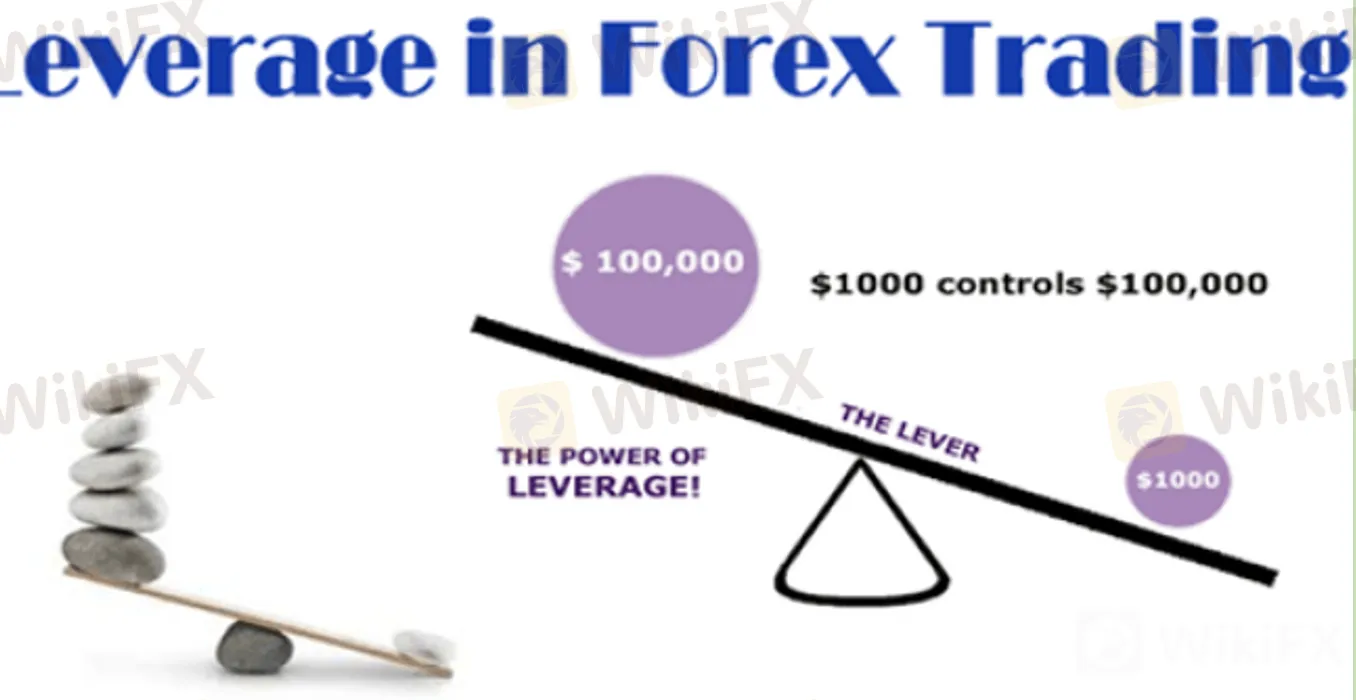

Among the riskier elements of forex trading is the rapid pace at which transactions are carried out. Forex trades also often use high leverage, which means investors can quickly lose more than their initial investments.

Of course, leverage means you can also profit at the same speed, which — combined with liquidity — is what attracts investors to currency trading.

One suggestion: All of these brokers offer free demo accounts so you can test the market with virtual dollars. Dip a toe in with some play money before using your own cash.

How do we review brokers?

NerdWallet’s comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists’ hands-on research, fuel our proprietary assessment process that scores each provider’s performance across more than 20 factors. The final output produces star ratings from poor (one star) to excellent (five stars).

But comparing costs is tricky in forex trading. Some brokers charge a commission, while others are compensated with a spread, or a markup between the price they pay for an asset and what they sell it for.

That’s just one reason why the search for the best forex broker is complex. Another is that there are a variety of brokers, many of them unregulated or regulated in countries outside of the U.S. For our list of best currency trading brokers, we considered only those that are regulated by the National Futures Association and the Commodity Futures Trading Commission.

Among the riskier elements of forex trading is the rapid pace at which transactions are carried out. Forex trades also often use high leverage, which means investors can quickly lose more than their initial investments.

Of course, leverage means you can also profit at the same speed, which — combined with liquidity — is what attracts investors to currency trading.

One suggestion: All of these brokers offer free demo accounts so you can test the market with virtual dollars. Dip a toe in with some play money before using your own cash.

How do we review brokers?

NerdWallet’s comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists’ hands-on research, fuel our proprietary assessment process that scores each provider’s performance across more than 20 factors. The final output produces star ratings from poor (one star) to excellent (five stars).

But comparing costs is tricky in forex trading. Some brokers charge a commission, while others are compensated with a spread, or a markup between the price they pay for an asset and what they sell it for.

That’s just one reason why the search for the best forex broker is complex. Another is that there are a variety of brokers, many of them unregulated or regulated in countries outside of the U.S. For our list of best currency trading brokers, we considered only those that are regulated by the National Futures Association and the Commodity Futures Trading Commission.

Among the riskier elements of forex trading is the rapid pace at which transactions are carried out. Forex trades also often use high leverage, which means investors can quickly lose more than their initial investments.

Of course, leverage means you can also profit at the same speed, which — combined with liquidity — is what attracts investors to currency trading.

One suggestion: All of these brokers offer free demo accounts so you can test the market with virtual dollars. Dip a toe in with some play money before using your own cash.

How do we review brokers?

NerdWallet’s comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists’ hands-on research, fuel our proprietary assessment process that scores each provider’s performance across more than 20 factors. The final output produces star ratings from poor (one star) to excellent (five stars).

But comparing costs is tricky in forex trading. Some brokers charge a commission, while others are compensated with a spread, or a markup between the price they pay for an asset and what they sell it for.

That’s just one reason why the search for the best forex broker is complex. Another is that there are a variety of brokers, many of them unregulated or regulated in countries outside of the U.S. For our list of best currency trading brokers, we considered only those that are regulated by the National Futures Association and the Commodity Futures Trading Commission.

Among the riskier elements of forex trading is the rapid pace at which transactions are carried out. Forex trades also often use high leverage, which means investors can quickly lose more than their initial investments.

Of course, leverage means you can also profit at the same speed, which — combined with liquidity — is what attracts investors to currency trading.

One suggestion: All of these brokers offer free demo accounts so you can test the market with virtual dollars. Dip a toe in with some play money before using your own cash.

How do we review brokers?

NerdWallet’s comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists’ hands-on research, fuel our proprietary assessment process that scores each provider’s performance across more than 20 factors. The final output produces star ratings from poor (one star) to excellent (five stars).

Top Forex Brokers for 2023

Choosing the best Forex broker that will help you become successful in the Forex market is a challenging task.To get more news about forex broker rankings, you can visit wikifx.com official website.

To choose a reliable Forex broker, you need to spend hours and even days analyzing several companies and reading reviews about their work. But Surprise! We at Traders Union have done the work for you.

Our site is a service that simplifies the process of selecting a broker, thereby saving you time and frustration, and reducing the analysis of the Forex market to just a few minutes of studying our special ratings list.The experts at Traders Union have been analyzing brokers in the Forex market for over 10 years while collecting all their respective reviews and posting them on our website. Thus, on the Traders Union website, you can find at once all the reviews about any Forex broker in one place.

The rating of Forex brokers was created also based on the members of the Union trade characteristics, as the Traders Union has access to them. No one else in the Forex market has such an opportunity to analyze data from hundreds of thousands of traders simultaneously. This is precisely why the Traders Union ratings of Forex brokers is the best and most objective ratings system of Forex brokers today.

How to analyze company data compiled by Traders Union

Find a list of the most reliable and best brokers in the Forex market in the table below. The market leaders are at the top because they have the highest average aggregate score. Then brokers are ranked by popularity.

You can click on the "Profile and reviews" button and read about each broker in detail in the popup window. You can immediately open a real account or try trading for free on a demo account on the broker's website.

The broker's footprint in the Forex market.

The longer a brokerage company has been in the market, the more reviews there will be from its clients. Moreover, the older (i.e., more established) a company is the more it tends to value its reputation, which means it is more likely to fulfill its obligations.

2

Licenses.

Only reliable brokers are licensed and they are strictly regulated by independent governmental monitors to protect traders and their investments. Maintaining a license is expensive, so not all companies can afford it.

3

Country of registration of the broker; representative offices and physical offices.

Representative offices and broker offices are important components of selecting a reliable broker. A branching network of representative offices characterizes the company’s rate and commitment to the brokerage profession, although more and more brokers prefer online relationships with their clients.

4

Forex broker trading conditions.

Each brokerage company offers its clients a variety of competitive conditions for trading, such as: minimum spreads, a large number of trading instruments, additional services, and bonuses. The combination of benefits offered is an important factor in the selection process.

5

Customer support and service quality.

How quickly a broker’s customer support responds to a customer is important when assessing a broker's reliability. Top companies always respond quickly to every client's request and try to resolve the issue in the shortest possible time using the utmost courtesy.

6

Reviews of traders about the Forex broker.

Clients who already work with one or more Forex brokers can reveal a lot about the broker’s reliability and professionalism. We study — and verify — the reviews of each company before posting our ratings.

7

The company’s position in the Traders Union’s Forex ratings.

This criterion is important when making your selection because the position of the broker in the Traders Union’s Forex broker rating reflects the final audit based on 100+ objective characteristics as compared to its competitors.

The rating of Forex brokers was created also based on the members of the Union trade characteristics, as the Traders Union has access to them. No one else in the Forex market has such an opportunity to analyze data from hundreds of thousands of traders simultaneously. This is precisely why the Traders Union ratings of Forex brokers is the best and most objective ratings system of Forex brokers today.

How to analyze company data compiled by Traders Union

Find a list of the most reliable and best brokers in the Forex market in the table below. The market leaders are at the top because they have the highest average aggregate score. Then brokers are ranked by popularity.

You can click on the "Profile and reviews" button and read about each broker in detail in the popup window. You can immediately open a real account or try trading for free on a demo account on the broker's website.

The broker's footprint in the Forex market.

The longer a brokerage company has been in the market, the more reviews there will be from its clients. Moreover, the older (i.e., more established) a company is the more it tends to value its reputation, which means it is more likely to fulfill its obligations.

2

Licenses.

Only reliable brokers are licensed and they are strictly regulated by independent governmental monitors to protect traders and their investments. Maintaining a license is expensive, so not all companies can afford it.

3

Country of registration of the broker; representative offices and physical offices.

Representative offices and broker offices are important components of selecting a reliable broker. A branching network of representative offices characterizes the company’s rate and commitment to the brokerage profession, although more and more brokers prefer online relationships with their clients.

4

Forex broker trading conditions.

Each brokerage company offers its clients a variety of competitive conditions for trading, such as: minimum spreads, a large number of trading instruments, additional services, and bonuses. The combination of benefits offered is an important factor in the selection process.

5

Customer support and service quality.

How quickly a broker’s customer support responds to a customer is important when assessing a broker's reliability. Top companies always respond quickly to every client's request and try to resolve the issue in the shortest possible time using the utmost courtesy.

6

Reviews of traders about the Forex broker.

Clients who already work with one or more Forex brokers can reveal a lot about the broker’s reliability and professionalism. We study — and verify — the reviews of each company before posting our ratings.

7

The company’s position in the Traders Union’s Forex ratings.

This criterion is important when making your selection because the position of the broker in the Traders Union’s Forex broker rating reflects the final audit based on 100+ objective characteristics as compared to its competitors.

The rating of Forex brokers was created also based on the members of the Union trade characteristics, as the Traders Union has access to them. No one else in the Forex market has such an opportunity to analyze data from hundreds of thousands of traders simultaneously. This is precisely why the Traders Union ratings of Forex brokers is the best and most objective ratings system of Forex brokers today.

How to analyze company data compiled by Traders Union

Find a list of the most reliable and best brokers in the Forex market in the table below. The market leaders are at the top because they have the highest average aggregate score. Then brokers are ranked by popularity.

You can click on the "Profile and reviews" button and read about each broker in detail in the popup window. You can immediately open a real account or try trading for free on a demo account on the broker's website.

The broker's footprint in the Forex market.

The longer a brokerage company has been in the market, the more reviews there will be from its clients. Moreover, the older (i.e., more established) a company is the more it tends to value its reputation, which means it is more likely to fulfill its obligations.

2

Licenses.

Only reliable brokers are licensed and they are strictly regulated by independent governmental monitors to protect traders and their investments. Maintaining a license is expensive, so not all companies can afford it.

3

Country of registration of the broker; representative offices and physical offices.

Representative offices and broker offices are important components of selecting a reliable broker. A branching network of representative offices characterizes the company’s rate and commitment to the brokerage profession, although more and more brokers prefer online relationships with their clients.

4

Forex broker trading conditions.

Each brokerage company offers its clients a variety of competitive conditions for trading, such as: minimum spreads, a large number of trading instruments, additional services, and bonuses. The combination of benefits offered is an important factor in the selection process.

5

Customer support and service quality.

How quickly a broker’s customer support responds to a customer is important when assessing a broker's reliability. Top companies always respond quickly to every client's request and try to resolve the issue in the shortest possible time using the utmost courtesy.

6

Reviews of traders about the Forex broker.

Clients who already work with one or more Forex brokers can reveal a lot about the broker’s reliability and professionalism. We study — and verify — the reviews of each company before posting our ratings.

7

The company’s position in the Traders Union’s Forex ratings.

This criterion is important when making your selection because the position of the broker in the Traders Union’s Forex broker rating reflects the final audit based on 100+ objective characteristics as compared to its competitors.

The rating of Forex brokers was created also based on the members of the Union trade characteristics, as the Traders Union has access to them. No one else in the Forex market has such an opportunity to analyze data from hundreds of thousands of traders simultaneously. This is precisely why the Traders Union ratings of Forex brokers is the best and most objective ratings system of Forex brokers today.

How to analyze company data compiled by Traders Union

Find a list of the most reliable and best brokers in the Forex market in the table below. The market leaders are at the top because they have the highest average aggregate score. Then brokers are ranked by popularity.

You can click on the "Profile and reviews" button and read about each broker in detail in the popup window. You can immediately open a real account or try trading for free on a demo account on the broker's website.

The broker's footprint in the Forex market.

The longer a brokerage company has been in the market, the more reviews there will be from its clients. Moreover, the older (i.e., more established) a company is the more it tends to value its reputation, which means it is more likely to fulfill its obligations.

2

Licenses.

Only reliable brokers are licensed and they are strictly regulated by independent governmental monitors to protect traders and their investments. Maintaining a license is expensive, so not all companies can afford it.

3

Country of registration of the broker; representative offices and physical offices.

Representative offices and broker offices are important components of selecting a reliable broker. A branching network of representative offices characterizes the company’s rate and commitment to the brokerage profession, although more and more brokers prefer online relationships with their clients.

4

Forex broker trading conditions.

Each brokerage company offers its clients a variety of competitive conditions for trading, such as: minimum spreads, a large number of trading instruments, additional services, and bonuses. The combination of benefits offered is an important factor in the selection process.

5

Customer support and service quality.

How quickly a broker’s customer support responds to a customer is important when assessing a broker's reliability. Top companies always respond quickly to every client's request and try to resolve the issue in the shortest possible time using the utmost courtesy.

6

Reviews of traders about the Forex broker.

Clients who already work with one or more Forex brokers can reveal a lot about the broker’s reliability and professionalism. We study — and verify — the reviews of each company before posting our ratings.

7

The company’s position in the Traders Union’s Forex ratings.

This criterion is important when making your selection because the position of the broker in the Traders Union’s Forex broker rating reflects the final audit based on 100+ objective characteristics as compared to its competitors.

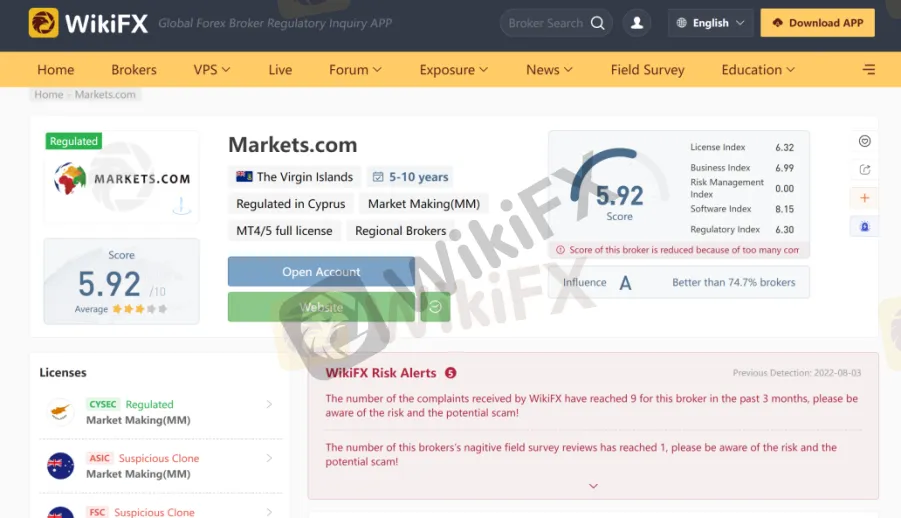

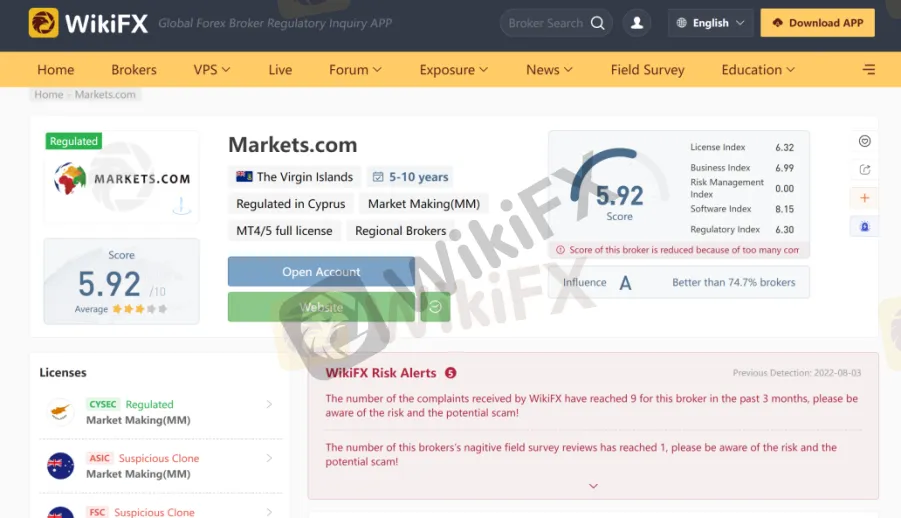

Fake Forex Brokers List in the UK

The UK became one of the first countries to regulate brokers and control their relationships with traders. Owning a license issued by the local FCA regulator is considered very prestigious, and many financial institutions seek to obtain it. A client who opens an account with a broker registered and licensed in the UK can be sure that the company will faithfully comply with the requirements of international legislation and will be liable in case of violation of agreements.To get more news about blacklist of forex scam brokers, you can visit wikifx.com official website.

From this material, you will find out how to distinguish a reliable financial partner from a typical scammer and what advantages FCA protection gives to traders. The Traders Union will also present the Fake Forex Brokers List in the UK and tell you how you can quickly identify a scam.

Forex trading is completely legal in the UK. The basic law is the Financial Services Act 2012, according to which all clients of brokers with a local license are protected from losses of up to 50,000 GBP (the FSCS compensation fund is in force).

The main regulator that monitors the activities of brokers in the United Kingdom is the FCA (initially called the FSA). It has been operating since 2013 and guarantees the legal protection of traders. This body ensures an audit of brokers' activities and investigates complaints from their clients. The regulator cares about the financial security of users and also strives to maximize the integrity of the UK financial system.

Forex is a highly liquid market, and transactions worth trillions of dollars are carried out there every day. You can earn money, but for this, you need to have adequate knowledge and practical experience, plus choose the right broker that will meet the FCA standards.

Fake brokers are well aware that having a British registration and FCA license is highly respected. That is why many such companies falsely indicate the presence of such a permit on their platforms. Moreover, they steal other people's banking details from the open register of legal entities of the Companies House and pass them off as their own. The scammers hope that novice traders will not go into legal details and verify the information.The Traders Union will tell you about the main signs of a scam that its experts detected in these companies. Be careful; don't fall for the empty promises of financial scammers!

Lucror Capital Markets LP is a brokerage company registered in New Zealand. This company promises profitable cooperation with both institutional clients and retail traders. However, real users in their reviews note that this company has major non-compliance issues with both trading and payment discipline. It pursues exclusively its own interests and does not care about the comfort and safety of trading.

Zenfinex was founded in 2017, and initially, the company received an FCA license. The broker promises comfortable trading in currency pairs, indices, commodities, and spot metals. The financial partner has a universal MT4 terminal, a demo account with 10,000 virtual dollars, and a bunch of "goodies". However, all promises remain unfulfilled. It is because of numerous complaints that this company was blacklisted by the British regulator, and its license was revoked.

Europa Trade Capital is an offshore broker registered in Saint Vincent and the Grenadines. The brand is managed by FD Trade Llc. The company claims to have been successfully providing services for 20 years. At the same time, it has not yet taken care of regulation. The FCA blacklisted this broker because numerous complaints were received against it and because of non-compliance with trading and payment discipline. There are several tariff plans, and access to margin trading with a leverage of up to 1:500. The minimum losses in the project are $10,000.

On the Brown Finance platform, it is stated that the brand is managed by Old Mutual Funds and Wellness Management. The broker promises a wide range of tools for increasing capital such as transactions with stocks, digital currencies, etc. According to its false claims, this brokerage company is the leader of the FinTech revolution. However, the company neglects to get a license. Moreover, the FCA has already included Brown Finance in its blacklist of brokers and warned the public about the dangers of cooperation with it.

The main regulator that monitors the activities of brokers in the United Kingdom is the FCA (initially called the FSA). It has been operating since 2013 and guarantees the legal protection of traders. This body ensures an audit of brokers' activities and investigates complaints from their clients. The regulator cares about the financial security of users and also strives to maximize the integrity of the UK financial system.

Forex is a highly liquid market, and transactions worth trillions of dollars are carried out there every day. You can earn money, but for this, you need to have adequate knowledge and practical experience, plus choose the right broker that will meet the FCA standards.

Fake brokers are well aware that having a British registration and FCA license is highly respected. That is why many such companies falsely indicate the presence of such a permit on their platforms. Moreover, they steal other people's banking details from the open register of legal entities of the Companies House and pass them off as their own. The scammers hope that novice traders will not go into legal details and verify the information.The Traders Union will tell you about the main signs of a scam that its experts detected in these companies. Be careful; don't fall for the empty promises of financial scammers!

Lucror Capital Markets LP is a brokerage company registered in New Zealand. This company promises profitable cooperation with both institutional clients and retail traders. However, real users in their reviews note that this company has major non-compliance issues with both trading and payment discipline. It pursues exclusively its own interests and does not care about the comfort and safety of trading.

Zenfinex was founded in 2017, and initially, the company received an FCA license. The broker promises comfortable trading in currency pairs, indices, commodities, and spot metals. The financial partner has a universal MT4 terminal, a demo account with 10,000 virtual dollars, and a bunch of "goodies". However, all promises remain unfulfilled. It is because of numerous complaints that this company was blacklisted by the British regulator, and its license was revoked.

Europa Trade Capital is an offshore broker registered in Saint Vincent and the Grenadines. The brand is managed by FD Trade Llc. The company claims to have been successfully providing services for 20 years. At the same time, it has not yet taken care of regulation. The FCA blacklisted this broker because numerous complaints were received against it and because of non-compliance with trading and payment discipline. There are several tariff plans, and access to margin trading with a leverage of up to 1:500. The minimum losses in the project are $10,000.

On the Brown Finance platform, it is stated that the brand is managed by Old Mutual Funds and Wellness Management. The broker promises a wide range of tools for increasing capital such as transactions with stocks, digital currencies, etc. According to its false claims, this brokerage company is the leader of the FinTech revolution. However, the company neglects to get a license. Moreover, the FCA has already included Brown Finance in its blacklist of brokers and warned the public about the dangers of cooperation with it.

The main regulator that monitors the activities of brokers in the United Kingdom is the FCA (initially called the FSA). It has been operating since 2013 and guarantees the legal protection of traders. This body ensures an audit of brokers' activities and investigates complaints from their clients. The regulator cares about the financial security of users and also strives to maximize the integrity of the UK financial system.

Forex is a highly liquid market, and transactions worth trillions of dollars are carried out there every day. You can earn money, but for this, you need to have adequate knowledge and practical experience, plus choose the right broker that will meet the FCA standards.

Fake brokers are well aware that having a British registration and FCA license is highly respected. That is why many such companies falsely indicate the presence of such a permit on their platforms. Moreover, they steal other people's banking details from the open register of legal entities of the Companies House and pass them off as their own. The scammers hope that novice traders will not go into legal details and verify the information.The Traders Union will tell you about the main signs of a scam that its experts detected in these companies. Be careful; don't fall for the empty promises of financial scammers!

Lucror Capital Markets LP is a brokerage company registered in New Zealand. This company promises profitable cooperation with both institutional clients and retail traders. However, real users in their reviews note that this company has major non-compliance issues with both trading and payment discipline. It pursues exclusively its own interests and does not care about the comfort and safety of trading.

Zenfinex was founded in 2017, and initially, the company received an FCA license. The broker promises comfortable trading in currency pairs, indices, commodities, and spot metals. The financial partner has a universal MT4 terminal, a demo account with 10,000 virtual dollars, and a bunch of "goodies". However, all promises remain unfulfilled. It is because of numerous complaints that this company was blacklisted by the British regulator, and its license was revoked.

Europa Trade Capital is an offshore broker registered in Saint Vincent and the Grenadines. The brand is managed by FD Trade Llc. The company claims to have been successfully providing services for 20 years. At the same time, it has not yet taken care of regulation. The FCA blacklisted this broker because numerous complaints were received against it and because of non-compliance with trading and payment discipline. There are several tariff plans, and access to margin trading with a leverage of up to 1:500. The minimum losses in the project are $10,000.

On the Brown Finance platform, it is stated that the brand is managed by Old Mutual Funds and Wellness Management. The broker promises a wide range of tools for increasing capital such as transactions with stocks, digital currencies, etc. According to its false claims, this brokerage company is the leader of the FinTech revolution. However, the company neglects to get a license. Moreover, the FCA has already included Brown Finance in its blacklist of brokers and warned the public about the dangers of cooperation with it.

The main regulator that monitors the activities of brokers in the United Kingdom is the FCA (initially called the FSA). It has been operating since 2013 and guarantees the legal protection of traders. This body ensures an audit of brokers' activities and investigates complaints from their clients. The regulator cares about the financial security of users and also strives to maximize the integrity of the UK financial system.

Forex is a highly liquid market, and transactions worth trillions of dollars are carried out there every day. You can earn money, but for this, you need to have adequate knowledge and practical experience, plus choose the right broker that will meet the FCA standards.

Fake brokers are well aware that having a British registration and FCA license is highly respected. That is why many such companies falsely indicate the presence of such a permit on their platforms. Moreover, they steal other people's banking details from the open register of legal entities of the Companies House and pass them off as their own. The scammers hope that novice traders will not go into legal details and verify the information.The Traders Union will tell you about the main signs of a scam that its experts detected in these companies. Be careful; don't fall for the empty promises of financial scammers!

Lucror Capital Markets LP is a brokerage company registered in New Zealand. This company promises profitable cooperation with both institutional clients and retail traders. However, real users in their reviews note that this company has major non-compliance issues with both trading and payment discipline. It pursues exclusively its own interests and does not care about the comfort and safety of trading.

Zenfinex was founded in 2017, and initially, the company received an FCA license. The broker promises comfortable trading in currency pairs, indices, commodities, and spot metals. The financial partner has a universal MT4 terminal, a demo account with 10,000 virtual dollars, and a bunch of "goodies". However, all promises remain unfulfilled. It is because of numerous complaints that this company was blacklisted by the British regulator, and its license was revoked.

Europa Trade Capital is an offshore broker registered in Saint Vincent and the Grenadines. The brand is managed by FD Trade Llc. The company claims to have been successfully providing services for 20 years. At the same time, it has not yet taken care of regulation. The FCA blacklisted this broker because numerous complaints were received against it and because of non-compliance with trading and payment discipline. There are several tariff plans, and access to margin trading with a leverage of up to 1:500. The minimum losses in the project are $10,000.

On the Brown Finance platform, it is stated that the brand is managed by Old Mutual Funds and Wellness Management. The broker promises a wide range of tools for increasing capital such as transactions with stocks, digital currencies, etc. According to its false claims, this brokerage company is the leader of the FinTech revolution. However, the company neglects to get a license. Moreover, the FCA has already included Brown Finance in its blacklist of brokers and warned the public about the dangers of cooperation with it.

Top Regulated Forex Brokers

Your first step in seeking the best Forex brokers is to restrict your shortlist to include only the brokers you feel comfortable trusting as a custodian of your money. Ideally, you should only be looking at regulated Forex brokers, and it is advisable to consider the stronger financial centers such as brokers regulated in the U.S.A.., brokers regulated in Cyprus or brokers regulated in the U.K . Consider also whether you would be in a stronger position choosing a Forex broker regulated in the same country in which you live.To get more news about best forex brokers in the world, you can visit wikifx.com official website.

Your second priority should be determining whether a broker gives value for money to its customers in return for the services it provides.

Below is a list of the factors worth using to assess any Forex broker.

Broker Regulation & Reputation - A quick google search can determine if a broker has ever been fined by their regulator for a breach of rules, and which rules were breached. Are they a public company? Does their financial position look healthy? Have they been in business a long time?

Minimum Deposit – Most brokers require minimum deposits to open a real money account, usually at affordable amounts. Some brokers ask for higher minimum deposits for their accounts with the best trading conditions. Typically, the more you can deposit up to $10,000, the better the trading conditions (including fees) you will be able to access.

Fees - The most important fees charged by brokers are spreads and commissions applied to every trade you make, but there are other, more hidden fees as well, such as swaps (overnight financing) inactivity fees, and withdrawal fees.

Trading Conditions - A good Forex broker should offer consistently good liquidity and smooth execution without requotes or slippage, which are the mainstays of smooth trading conditions.

Choice of Markets - Will you be able to trade everything you want? If you are only interested in the major Forex currency pairs, that will be easy, but if you really want to trade individual stocks and shares, or the less common commodity offerings, you will find that not all brokers offer them, although most offer some of them wrapped as CFDs.

Does the Broker Suit My Trading Style? - Some brokers offer better conditions for longer-term traders than short-term traders, or vice versa. This is because short-term traders will pay nearly all their trading costs in spreads, while longer-term traders will likely pay more in overnight financing fees (also known as swaps).

Suitable Account Types – Traders with smaller deposits may want a micro account, where position sizes as low as 0.01 lots (1 micro-lot) can be traded.

Ease of Deposits and Withdrawals - A broker that will not speedily send you funds which you have requested and are in your account, raises a big red flag, and is to be avoided at all costs.

Execution Method - Forex brokers typically advertise themselves as one of the following:ECN brokers, STP brokers, or market-makers. Some brokers claim they are a hybrid of two of these. Some traders are very keen to deposit with ECN brokers because they think the cost of trading will be less or that this model makes the broker more honest somehow. The truth is more complicated: each execution method has both potential advantages and disadvantages.

Choice of Trading Platforms - The best Forex trading platforms are widely held to be MetaTrader 4 and cTrader, although many brokers have their own unique proprietary platforms that are arguably as good. MetaTrader 5 is usually seen as acceptable and eay to use too.

Demo Account – Almost all brokers offer one, and any broker which does not should be questioned.