freeamfva's blog

China's economy is in bad shape and could stay that way for a while

China is beset by severe economic problems. Growth has stalled, youth unemployment is at a record high, the housing market is collapsing, and companies are struggling with recurring supply chain headaches.To get more international business news china, you can visit shine news official website.

The world's second biggest economy is grappling with the impact of severe drought and its vast real estate sector is suffering the consequences of running up too much debt. But the situation is being made much worse by Bejing's adherence to a rigid zero-Covid policy, and there's no sign that's going to change this year.

Within the past two weeks, eight megacities have gone into full or partial lockdowns. Together these vital centers of manufacturing and transport are home to 127 million people.

Nationwide, at least 74 cities had been closed off since late August, affecting more than 313 million residents, according to CNN calculations based on government statistics. Goldman Sachs last week estimated that cities impacted by lockdowns account for 35% of China's gross domestic product (GDP).

The latest restrictions demonstrate China's uncompromising attitude to stamping out the virus with the strictest control measures, despite the damage.

"Beijing appears willing to absorb the economic and social costs that stem from its zero-Covid policy because the alternative — widespread infections along with corresponding hospitalizations and deaths — represents an even greater threat to the government's legitimacy," said Craig Singleton, senior China fellow at the Foundation for Defense of Democracies, a DC-based think tank.

For Chinese leader Xi Jinping, maintaining that legitimacy is more vital than ever as he seeks to be selected for an unprecedented third term when the Communist Party meets for its most important congress in a decade next month.

"Major policy shifts before the party congress appear unlikely, although we could see a softening in certain policies in early 2023 after Xi Jinping's political future has been assured," Singleton said.Even then, the Party is running short on both time and available policy levers to address many of the most pressing systemic threats to China's economy," he added.

The economy will continue to worsen in the next few months, said Raymond Yeung, chief Greater China economist for ANZ Research. Local governments will be "more inclined to prioritizing zero-Covid and snuffing out the virus outbreaks" as the party congress approaches, he added.

Tightening of Covid restrictions will hit consumption and investment during China's "Golden September, Silver October," traditionally the peak season for home sales.

In the meantime, a sharp slowdown in the global economy doesn't bode well for China's growth either, Yeung said, as weakening demand from the US and European markets will weigh on China's exports.

He now expects Chinese GDP to grow by just 3% this year, missing Beijing's official target of 5.5% by a wide margin. Other analysts are even more bearish. Nomura cut its forecast to 2.7% this week.

No exit until early 2023?

More than two years into the pandemic, Beijing is sticking to its extreme approach to the virus with forced quarantines, mass mandatory testing, and snap lockdowns.

The policy was deemed successful in the early stage of the pandemic. China managed to keep the virus at bay in 2020 and 2021 and stave off the large number of deaths many other countries suffered, while building a quick recovery following a record contraction in GDP. At a ceremony in 2020, Xi proclaimed that China's success in containing the virus was proof of the Communist Party's "superiority" over Western democracy.

But the premature declaration of victory has come back to haunt him, as the highly transmissible Omicron variant makes the zero-Covid policy less effective.

However, giving up on zero-Covid doesn't seem like an option for Xi, who this year has repeatedly put greater emphasis on defeating the virus than rescuing the economy.

In a trip to Wuhan in June, he said China must maintain its zero-Covid policy "even though it might hurt the economy." At a leadership meeting in July, he reaffirmed that approach and urged officials to look at the relationship between virus prevention and economic growth "from a political point of view."

"Beijing has sought to cast its zero-Covid policies as evidence of the Party's strength, and therefore, by extension, Xi Jinping's leadership," Singleton said.

Any change in approach may not come until next year, and even then it's most likely to be very gradual, said Zhiwei Zhang, president and chief economist for Pinpoint Asset Management.

"It will be a long process," he said, adding that Hong Kong — where quarantine and testing rules for visitors have recently been relaxed — could be "an important leading indicator for what will happen in the mainland."

The Best Keyless Lock For Every Need

Somewhere between a regular door lock and a full-blown smart lock, there sits a middle ground. These dumb locks, with keyless options like keypads, are that middle ground.To get more news about high security lock systems, you can visit securamsys.com official website.

If you’re looking for a smart lock, we’ve got a roundup for you right here. However, you might also want a lock that gives you an alternative way into your house—like a passcode or even a fingerprint—without having to connect it to your phone or the internet. Whether your motivation is a distrust of an internet-connected lock, a search for a keyless entry system that works for your kids, or you just want a simple way to let the dog walker in (and “re-key” when you hire a new one), these locks have keyless options that cover those bases and more.

The Yale Real Living Assure Lock is a standalone lock designed to replace your deadbolt (meaning you can keep your existing door knob). In addition to the normal key hole, it has a ten-digit touchpad that can unlock the door with a 4-8 digit code. It can store up to 25 codes, so you can create specific codes for your friends, family, or any trusted people you want to let into your home.

Because keyless locks don’t connect to your phone, set up can be a pain on some models. Fortunately, this Yale lock has a voice guide that can walk you through the programming process. This immediately gives it an edge over other smart locks, especially if you want to gift this to a less tech-savvy friend or family member.

While this model doesn’t have any smart home features, it can be upgraded with a Yale Network Module for $65. This allows you to connect to Z-Wave smart home gadgets, like Samsung’s SmartThings. We wouldn’t recommend this route if you want a full smart lock, but it is an option if you think you’ll ever want to dip your toes into the smart home game in the future.

If you want to dive headfirst into a keyless world, it’s hard to do better than the Schlage Touch. This lock replaces your door knob and has no keyhole so you’re going to be using nothing but access codes once you install this. It can store up to 19 unique codes for you and everyone you trust to enter your home.

On the inside of the lock, there’s a knob that switches between unlocked and an auto-locking mode. In this mode, you can unlock the door with any of the access codes, and it will automatically re-lock itself after a short period of time. This ensures that even if someone forgets to lock the door behind them, it will still stay secured.

The Schlage Touch comes in four handle styles, and seven colors including nickel, bronze, brass, and chrome. Not every style is available in every color, but you still have a lot of flexibility to make sure the knob matches the outside of your home. Most smart and keyless locks tend to come with only a couple of styles so this is a refreshing approach. Most styles of this lock cost $110 on Amazon, but some can range up to $150 depending on which style you prefer and its availability.

If you want to get really fancy—and don’t mind spending a bunch of money to do it—there’s an alternative to access codes: your fingerprint. The Samsung SHS-H700 (it just rolls off the tongue, doesn’t it?) features a fingerprint scanner that can be programmed with up to 100 prints.

The upside to a fingerprint reader is that it’s harder for an unauthorized person to get your code. Plus it’s more convenient to tap a finger once, rather than type in a code. The downside is that it’s harder to give someone else access, as they, naturally, need to be there to set up access. Of course, if you need to keep very tight control over who gets through a door, then this one may be right up your alley.

The lock doesn’t have a normal keyhole and it will replace your door handle, but you do have a back up option. A keypad along the top allows you to enter an access code to get in. Unlock other options on this list, you can only enter one access code into Samsung’s lock. It’s unclear why Samsung lets you program in 100 fingerprints but only one access code, but it’s a limitation worth keeping in mind if you decide to go this route.

You don’t have to replace your front door lock to get easy access to your home. The Chamberlain Clicker lets you open your garage door with a four-digit access code. It’s compatible with nearly every automatic garage door made since 1993, so even if you have even a relatively recent garage door, it should work for you.

This device is particularly useful for two main reasons: first, it’s a lot cheaper than the other keyless locks. If all you want is a way to easily let someone inside without a key, going through the garage would be the method that costs the least. It’s also helpful if you have kids and want to give them a back up way into the house. Young children have a tendency to lose things like keys, but an easy to memorize code can’t fall out of their pocket.

CAD Pro is great for Mechanical Drawings!

Mechanical drawings with software from Cad Pro includes all the functionality of more expensive competitors, plus comprehensive libraries and tools for automating common mechanical drawing tasks.To get more news about mechanical cad drawings, you can visit shine news official website.

CAD Pro is excellent for preparing very detailed computer drafting projects such as; mechanical drawings of all types.

![]()

Quickly add your mechanical symbols, connect them using Cad Pro’s automated snap tools for perfect alignment, and see your vision turn into a professional looking mechanical drawing that is ready to be printed, shared online, or exported to Microsoft Office® or PDF with a single-click.Cad Pro helps you align and arrange everything perfectly. Cad Pro’s smart tools assist in precise alignment of your components even when you move them around.

Common mechanical symbols and their proper use can assist you in the creation process of your mechanical drawings. CAD Pro includes a variety of pre-drawn mechanical symbols which save time and money when creating your mechanical drawings.

If needed you can quickly create your own mechanical symbols save them as a mechanical symbol for future use. Also, create Custom Clipboard Files which contain your custom mechanical symbols!

Mechanical Drawings for patent designs!

Cad Pro drawings can be presented to a patent attorney or patent agent. This allows them to quickly review your mechanical drawings and gain an accurate understanding of your patent submission or invention. Your detailed drawings created with CAD Pro, will save a lot of expensive time for your patent attorney.

Sketch Tracing

Sketch your drawings on a piece of paper, and then scan it. Now open your scanned drawing in CAD Pro and it becomes a traceable template that you can easily modify.

Easy to Use Photo Tracing Software

Simply open up your mechanical drawing photos from any smartphone or digital camera and trace over them with CAD Pro’s easy-to-use design tools.

Smart dimensions for added precision!

When creating mechanical drawings or mechanical blueprints that require precise dimensions, let CAD Pro take the work out of the process. CAD Pro’s “Smart Dimensioning” tools will automatically create all your mechanical drawing dimensions with a few simple clicks.

Save your drawings as a PDF file!

Save your CAD Pro drawings as a PDF file, this will allow you to quickly communicate your mechanical design ideas with friends, family, engineers and patent consultants. Great when submitting your invention to the Patent Office.

Service robotics market overview

Robotics in professional applications has already had a significant impact in areas such as agriculture, surgery, logistics or public relations and is growing in economic importance. There is a growing demand to monitor our everyday surroundings which results in increased and difficult-to-manage workloads and data flows. To meet this demand, robots will play an even greater role in the maintenance, security and rescue markets.To get more news about Global Robotics Services, you can visit glprobotics.com official website.

Robotics in personal and domestic applications has experienced strong global growth with a limited number of mass-market products: floor cleaning robots, robo-mowers and

robots for edutainment. Future product visions point to domestic robots of higher sophistication, capability and value, such as assistive robots for supporting the elderly, for helping with household chores and for entertainment.

In terms of value, the sales forecast 2018-2020 indicates a cumulative volume of around 27 billion U.S. dollars for the professional service segment”, says Gudrun Litzenberger,

General Secretary of the IFR. “Robots for medical, logistics and field services are the most significant contributors.”

At the same time, the market for personal service robots which assist humans in their everyday lives is also progressingrapidly; it is projected that sales of all types of robots for domestic tasks –e.g. vacuum cleaning, lawn mowing or window cleaning - could reach an estimatedvalue of around 11 billion U.S. dollars (2018-2020).

“Robots are clearly on the rise, in manufacturing and increasingly in everyday environments”, says Martin H?gele, IFR Service Robot Group.” The growinginterest in service robotics is partly due to the variety and number of new start-ups which currently account for 29 percent of all robot companies. Further-more, large companies are increasingly investing in robotics, often through the acquisition of start-ups.”

Service robot manufacturers and start-ups by regions

European service robot manufacturers play an important role in the global market: about 290 out of the 700 registered companies supplying service robots come from Europe.North America ranks second with about 240 manufacturers and Asia third with about 130.

Further progress will rely on entrepreneurs taking up disruptive technologies and deploying them for new applications and markets. In the US, about 200 start-up companies are working on new service robots. The European Union plus Switzerland count 170 companies that are creating a new entrepreneurial culture for the service robotics industry - followed by Asia with 135 start-ups. Virtually all economies are attempting to foster a vibrant entrepreneurial environment and the service robotics industry has become one of the focus areas of their public policies.

World Robotics - Service Robots: This unique report provides global statistics on service robots, market analyses, case studies and international research strategies on service robots. The study is jointly prepared with our partner Fraunhofer IPA, Stuttgart.

World Robotics - Industrial Robots: This unique report provides global statistics on industrial robots in standardizedtables and enables national comparisons to be made. It contains statisticaldata from around 40 countries broken down into areas of application, industrialsectors, types of robots and other technical and economic aspects. Production,

export and import data is listed for selected countries. It also describes thetrends in relation to robotic density, e.g. the number of robots per 10,000 employees in relevant sectors.

The pros, cons, and fees of AvaTrade

AvaTrade is an international CFD broker that has been around since 2006, although it was originally launched under the brand name AvaFX. It’s fair to say that AvaTrade has already attained a degree of popularity, as it has more than 300,000.To get more news about avatrade pros & cons, you can visit wikifx.com official website.

It claims to operate as a regulated broker in seven different countries, including Ireland, Australia, Japan, and a few others. It promises a user-friendly platform and it seems to offer competitive spreads (fees).But, of course, there are many questions that need answers before you can determine whether AvaTrade is a good option for you. For instance, which financial instruments am I able to trade, are there any hidden fees, is it a scam?, etc.

In order to answer all these questions, I prepared this review of AvaTrade and I’ll tell you all you need to know about this trading platform.

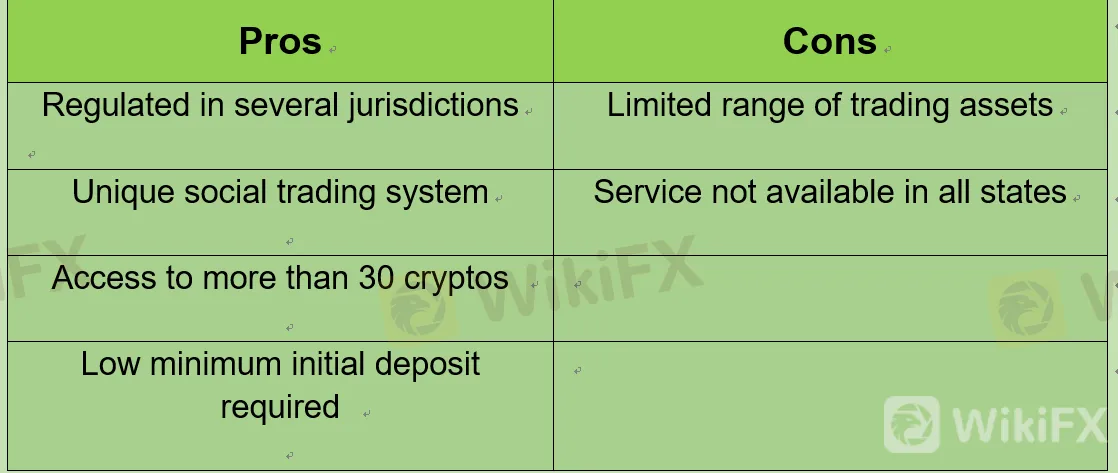

The pros and cons of AvaTrade

Before I explain all the features offered by AvaTrade, I want to tell you about its advantages and drawbacks, and about who might benefit from opening an account with AvaTrade.

Who should be using AvaTrade?

AvaTrade is a broker for investors who intend to invest exclusively in derivatives such as CFDs and Forex options. If you want to buy stocks, ETFs, or even cryptocurrency, there are better alternatives out there, like DEGIRO, eToro, or Interactive Brokers.

Is AvaTrade secure?

AvaTrade does go to great lengths to have a secure platform on which your investments are not at risk of being stolen/hacked by cybercriminals. For instance, it uses SSL encryption and has several security protocols in place, including McAfee Secure – not sure what this last one is, but sounds good.

That said, I’d prefer having two-step authentication – like DEGIRO or eToro offer. With that process, AvaTrade would ask you to confirm your identity with a verification code sent to your mobile, as is done by many banking apps. This would provide an extra layer of security to your account. Regrettably, it’s not available.

Who regulates AvaTrade?

If you are afraid that AvaTrade might be a scam, rest assured that it is regulated in a number of (reputable) countries, with many regulatory bodies supervising its activities.

What AvaTrade does with these spreads is it offers one price if you’re selling and a different one if you’re buying. This spread, which is already built into the transaction cost, is how AvaTrade and other market makers finance themselves.

The bottom line is that AvaTrade doesn’t allow you to invest in many different types of financial products. It’s really only possible to invest in derivatives. So, if you want to invest in stocks, investment funds, ETFs, or cryptocurrencies, it’s best you look for an alternative.

On the other hand, it can be your gateway into the world of trading via CFDs (contracts for difference). This type of product is suitable for short-term speculation, as the trading cost (the spread that I mentioned earlier) is low.

How does AvaTrade work?

With AvaTrade, there are only two types of accounts: retail investor accounts and professional investor accounts.

The main difference between these two types of accounts is that if you are a professional trader, you will have access to higher risk trades; e.g. the leverage levels are increased. Please bear in mind that these professional investor accounts may not be available in all countries.

Are Forex Demo Accounts Accurate?

For those who might not know, forex demo accounts are training accounts that you can make and practice trading. They do not use real money, and so there is absolutely no risk involved. You can use them to test out different trading strategies and get a feel of the market.To get more news about forex demo and real accounts, you can visit wikifx.com official website.

You can use them to see how the prices change, test entering and exiting positions, and try to earn some money without investing anything. Of course, the money you will earn will also be fake money that you can't cash out and use, but it is still good enough for practice.

With them, you can learn some basic, but still important concepts that you need to know for trading forex. Things like entering and exiting positions, long and short positions, pips, and alike are all necessary knowledge that you can pick up and test with a demo account.

You can also use them to test a new platform if you decide to move and give a new broker's platform a chance. This is certainly preferable to arriving at a new platform and going live immediately, without knowing which way is up. Lastly, if you wish to make a change in your trading strategy, test out a new approach, and alike — it is always good to use a demo account for such tests than to try them out live straight away.

That way, if they end up not working, you will lose some of your fake money and not have to worry about actual losses. You can learn on your mistakes here, and approach live trading with all the necessary knowledge for avoiding such events in the future when you actually start using real money.

However, you should still be cautious when using them, because it is too easy to forget that they are not so accurate and that things may still be quite different when you start trading live. Let's discuss why that is, and in what way do demo forex accounts differ from live accounts.

Demo accounts vs. live accounts: The biggest differences

1. You do not use real money

As mentioned, one of the biggest differences between demo accounts and live accounts is that you don't use real money when you trade on demo accounts. You might be thinking — why is this important?

This matters because it changes the way you think and approaches your trades. When it comes to demo accounts, you are much more likely to take risks because you know that you don't have anything to lose. This could lead to some risky moves, which you may regret if you repeat them later on, with real money.

2. Demo losses do not feel real

Also, it is harder to develop the feel for the trade for this same reason. Finally, you will not have to face the feeling of losing actual money. After losing fake money in case the trade goes bad, you would simply make a point to be more careful in the future. When you lose real money, that can hit you quite strongly, as you will realize that this is not a game. Your actual money — that you worked for and earned — is gone.

This can be very discouraging for first-time traders, and many abandon trading completely after seeing their first losses. This should not discourage you from trading, but you should keep in mind that it is a possibility and that it will happen. Someone always has to lose in order for someone else to win. Of course, your goal is to be on the winning side as much as possible.

3. Your demo order is always taken

Another big difference is how your trades will perform when you trade on demo vs. when you trade live. Demo accounts are created for orders to always go through. You need to experience the trade and see how the prices are moving. You also need to test out new strategies, and you have no time to lose.

This is not the case when it comes to live trading, where your order might not get taken right away, or at all. This can happen for a number of reasons. If there is low volume, or you just start trading in the time of day when the volume is low, your order might not take.

With demo accounts, this is simply not an issue, which can be quite frustrating for new traders that are just now going live for the first time.

4. Demo accounts are not always accurate

Another thing to remember is that demo accounts are created by brokers who want you to start trading as soon as possible. They offer demo accounts for you to practice and test out strategies, but they can only provide you wish some typical situations, which will not prepare you for all the scenarios.

As a result, the trades that you make while on Demo Account should not be taken as real situations. There are plenty of textbook situations that can take a weird turn in the actual market. The developments do not always follow the rules, and things do not happen as they should.

However, Demo accounts won't prepare you for that. This allows you to gain confidence and move on to the real, live account quicker. However, it can also give you a false sense that you cannot lose, which will, of course, lead to losses as soon as you start putting actual dollars on the line.

5. The emotional difference

When you trade real money, you may often approach without controlling your emotions. This is a trap that many can easily fall into. Whether you are experiencing losses or gains, if they keep coming one after another, you may start getting emotional and taking one risk after another, only for things to end really badly for your funds.

This is not something that you will get when trading with a demo account, as you don't use real money. Therefore, there is no emotional response. Wins mean nothing, as you can't use the money you have won. Losses mean nothing, as you did not invest real funds.

Trading Forex vs Stocks: What's the difference?

Anyone new to trading is likely to wonder, "Which is better: Forex or stocks?". Let's begin answering our question with a little economics 101. We find ourselves today in a low interest rate environment. Central banks around the world are still wrestling with low growth for the most part. Loose monetary policy has been their main answer over the years. So what's the upshot for you?To get more news about forex vs. stock, you can visit wikifx.com official website.

Basically, leaving money in the bank does you little good. In many of the major economies, interest paid on savings is less than the rate of inflation. As a natural result, people are searching for better alternatives to invest their money into, such as the well-established financial markets of Forex and stocks. This article will consider the pros and cons of Forex vs stock trading.

FX vs Stock Trading: Markets

There is no hard or fast answer to the question of which is better, forex vs stock trading. Whether we are talking about for experienced traders or the stock market vs Forex trading for beginners, when comparing, there will be benefits and drawbacks for each market and for each type of trader.

It ultimately comes down to how important those features are to you personally. Let's take a look at an overview of each market first, and then we can move on to drawing some conclusions about Forex vs. stock trading.

What is Forex:

The Forex market is decentralized. It represents a trading network of participants from around the world. The large players in the Forex market include investment banks, central banks, hedge funds, and commercial companies.

What are Stocks:

Stock market trading is the overarching name given to the combined group of buyers and sellers of shares, or or people trading stocks. Shares in a company, as the name suggests, offer a share in the ownership. Usually, though not always, these transactions are conducted on stock exchanges. In order to raise capital, many companies choose to float shares of their stock.

Stock exchanges provide a transparent, regulated, and convenient marketplace for buyers to conduct business with sellers. Trading on these exchanges has historically been conducted by "open outcry," but the trend in recent years has been strongly toward electronic trading.

Stock market trading is immensely popular, but it is exceeded in size by the Forex market, which is the largest financial market in the world. When we weigh up the stock market vs Forex trading in terms of size, Forex takes the round. Why do we care about the size? The greater the size of the Forex market, the greater its liquidity will be.

If you are considering stock market trading to build your portfolio with the best shares for 2021, you need to have access to the best products available. One such product is Invest.MT5. Invest.MT5 enables you to start trading stocks and ETFs across 15 of the world's largest stock exchanges with the MetaTrader 5 trading platform.

Other benefits include free real-time market data, premium market updates, zero account maintenance fee, low transaction commissions, and dividend payouts.

Comparing Liquidity

The next important aspect to consider in the Forex vs stock trading debate is liquidity. The Forex market is extremely liquid. This is a result of the vast number of participants involved in trading at any given time.

If you are trading stocks, you will notice that large, popular stocks can also be very liquid. Vodafone and Microsoft are prime examples. Though once you move away from the blue chips, trading stocks can become significantly less liquid.

Why do we care about liquidity?

Liquidity makes it easier to trade an instrument. Generally speaking, superior liquidity tends to equate to proportionally tighter spreads, and lower transaction costs. Let's consider a trading example, and compare some typical costs. Let's use Microsoft as our liquid share, and EUR/USD as our liquid currency pair.

Best Forex Signals 2022 – Top Free Signals

If you’re looking to actively trade forex online but in a passive manner – forex signals could be the solution. This is because your chosen signal provider will send you suggestions on which currency pair to trade and what entry and exit orders to place.To get more news about free forex signals, you can visit wikifx.com official website.

In this guide, we review the Best Forex Signals for 2022 and walk you through the process of getting started today!

Stuck for time and looking to get started with the best forex signals right now? Check out which providers made the cut below. You can scroll down to read a full review of each forex signal provider!

With hundreds of forex signals services online – knowing which service to sign up with can be really challenging. In fact, you will find that the vast majority of forex signal providers make really bold claims that in reality – are impossible to validate with any certainty.

This is why it’s really important to perform lots of research in your search for the best forex signal platforms to ensure you are joining a legitimate provider.

To help point you in the right direction, below we discuss some of the most popular forex trading signals for 2022.

1. Learn2Trade – Overall Best Platform for Trading Signals

learn 2 trade best forex signal Telegram groupAfter reviewing the credentials of dozens of providers, we found that Learn2Trade offers the best forex signals in the market. The signal platform has been offering its service for many years – and reviews in the public domain are largely very positive. In terms of how the platform works, Learn2Trade specializes in forex and cryptocurrency trading signals.

It also offers a side package that includes stock trading signals. All signals are posted to the Learn2Trade Telegram group – which at the time of writing has more than 17,000 members. Upon receiving a signal, you will be told what forex pair to trade and whether you should place a buy or sell order. You will also be told what entry price action to execute the trade at, alongside the suggested stop-loss and take-profit order.

All in all, Learn2Trade forex signals provide you with all the required information to trade in a risk-averse manner – without needing to perform any research yourself. There are two forex signal plans offered by this top-rated provider. First, you might consider the free plan – which includes three forex trading signals per week. Or, if you want to get the full trading experience, the premium plans get you 3-5 signals per day.

2. PriceAction FX- Best Platform For Daily Expert Signals

Among the many forex signal service providers in the market, PriceAction Forex Ltd. has definitely positioned itself at the top. PriceAction Ltd. provides robust trading solutions for forex traders. Since its launch, the company has been serving hundreds of thousands of global traders. PriceAction Forex Ltd. has the biggest trading community on the Telegram platform, which it uses to communicate and provide its signal service.

Operating from the UK, PriceAction Ltd. was founded by a group of professional and veteran traders in the year 2017. On its Telegram platform, it serves 260K+ global clients with the most accurate and precise trading signals. Every day, approximately 5 to 7 signals are sent. The sent signals consist of the entry position, take-profit, and stop-loss. Traders just need to copy the position and paste it on their MT4 or MT5 platform. PriceAction Forex Ltd.’s signals are so accurate that in the year 2022, it has kept its signal accuracy level above 92%, a 19.079+ pips gain already.

3. Mega FX- A Complete Solution To Forex Trading

MegaFX Signals is one of the most popular forex signal providers in the market due to its high accuracy and transparent team behind the firm. This highly reputed signals provider is committed to serve traders of forex, indices, commodities and others simultaneously. MegaFX Signals has 100K+ clients around the world.

After trying out the forex signals from the MegaFX Signals VIP Telegram channel, we are pleased with its services. Keeping its promises of high accuracy, we have profited within this short period of experience. MegaFX Signals provides 5 to 6 forex signals every day on their Telegram VIP Channel. For the fastest and smoothest trading experience, the company sends signals with the entry position, take profit, and stop loss.

4. 1000pip Builder - Best Trading Signals for MT4

1000pip Climber System 1000pip Builder is a fully-automated forex signal service that allows you to trade in a 100% passive manner. This is because the signals come in the shape of a forex EA (Expert Advisor). For those unaware, EAs are trading robot files that you install and deploy through a third-party platform like MT4.

This means that the signals offered by 1000pip Builder will be traded on your behalf via your chosen MT4 broker. As such, there is no requirement to evaluate each signal nor head over to your trading platform to place the suggested orders.

5. Forex Signal Factory - Telegram Forex Trading Signals with 83k Members

Forex Signals Factory is an established signal provider that has a huge Telegram channel with over 83,000 members. This makes the provider one of the largest signal service groups globally.

The provider explains that it has no conflict of interest because it is not partnered with any third-party broker. Most forex signals are sent with two take-profit prices. This allows you to trade a risk/reward level you feel comfortable with.

What are Bollinger Bands?

Bollinger Bands are a technical analysis tool developed by John Bollinger in the 1980s for trading stocks. The bands comprise a volatility indicator that measures the relative high or low of a security’s price in relation to previous trades. Volatility is measured using standard deviation, which changes with increases or decreases in volatility. The bands widen when there is a price increase, and narrow when there is a price decrease. Due to their dynamic nature, Bollinger Bands can be applied to the trading of various securities.To get more news about bollinger band, you can visit wikifx.com official website.

Bollinger Bands are comprised of three lines – the upper, middle, and lower band. The middle band is a moving average, and its parameters are chosen by the trader. The upper and lower bands are positioned on either side of the moving average band. The trader decides the number of standard deviations they need the volatility indicator set at. The number of standard deviations, in turn, determines the distance between the middle band and the upper and lower bands. The position of these bands provides information on how strong the trend is and the potential high and low price levels that may be expected in the immediate future.

Day Trading Uptrends With Bollinger Bands

Bollinger Bands can be used to determine how strongly an asset is rising and when it is potentially reversing or losing strength. If an uptrend is strong enough, it will reach the upper band regularly. An uptrend that reaches the upper band indicates that the stock is pushing higher and traders can exploit the opportunity to make a buy decision.

If the price pulls back within the uptrends, and it stays above the middle band and moves back to the upper band, that indicates a lot of strength. Generally, a price in the uptrend should not touch the lower band, and if it does, it is a warning sign for a reverse or that the stock is losing strength.

Most technical traders aim to profit from the strong uptrends before a reversal occurs. Once a stock fails to reach a new peak, traders tend to sell the asset at this point to avoid incurring losses from a reversed trend. Technical traders monitor the behavior of an uptrend to know when it shows strength or weakness, and they use this as an indication of a possible trend reversal.

Day Trading Downtrends With Bollinger Bands

Bollinger Bands can be used to determine how strongly an asset is falling and when it is potentially reversing to an upside trend. In a strong downtrend, the price will run along the lower band, and this shows that selling activity remains strong. But if the price fails to touch or move along the lower band, it is an indication that the downtrend may be losing momentum.

When there are price pullbacks (highs), and the price stays below the middle band and then moves back to the lower band, it is an indication of a lot of downtrend strength. In a downtrend, prices should not break above the upper band since this would indicate that the trend may be reversing, or it is slowing.

Many traders avoid trading during downtrends, other than looking for an opportunity to buy when the trend begins to change. The downtrend can last for short or long durations – either minutes, hours, weeks, days, months, or even years. Investors must identify any sign of downtrends early enough to protect their investments. If the lower bands show a steady downtrend, traders must be cautious to avoid entering into long trades that will prove unprofitable.

Trading W-Bottoms and M-Tops

W-Bottoms and M-Tops were part of Arthur Merrill’s work that identifies 16 patterns with a basic W-Pattern and M-Pattern, respectively. Bollinger Bands use W patterns to identify W-Bottoms when the second low is lower than the first low but holds above the lower band. It occurs when a reaction low forms close to or below the lower band.

The price then pulls back towards the middle band or higher and creates a new price low that holds the lower band. When the price moves above the high of the first pullback, the W-button is in place as shown in the figure below, and indicates that the price will likely rise to a new high.

John Bollinger used the M patterns with Bollinger Bands to identify M-Tops. In its basic form, an M-Top is similar to a Double Top chart pattern. An M-Top occurs when there is a reaction that moves close to or above the upper band. The price then pulls back towards the middle band or lower and creates a new price high, but does not close above the upper band. If the price then moves below the low of the prior pullback, the M-Top is in place as shown in the figure below.

Limitations of Bollinger Bands

Although Bollinger Bands are helpful tools for technical traders, there are a few limitations that traders should consider before using them. One of these limitations is that Bollinger Bands are primarily reactive, not predictive. The bands will react to changes in price movements, either uptrends or downtrends, but will not predict prices. In other words, like most technical indicators, Bollinger Bands are a lagging indicator. This is because the tool is based on a simple moving average, which takes the average price of several price bars.

Although traders may use the bands to gauge the trends, they cannot use the tool alone to make price predictions. John Bollinger, the Bollinger Bands’ developer, recommends that traders should use the system along with two or three non-correlated tools that provide more direct market signals.

Another limitation of Bollinger Bands is that the standard settings will not work for all traders. Traders must find settings that allow them to set guidelines for specific stocks that they are trading. If the selected band settings fail to work, traders may alter the settings or use a different tool altogether. The effectiveness of Bollinger Bands varies from one market to another, and traders may need to adjust the settings even if they are trading the same security over a period of time.

What are Forex trading bots? + 6 Best Forex Trading Robots 2022

Archives

- All

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021