freeamfva's blog

When it Comes to Progressing Cavity Pumps

Pumps are not living creatures, but with progressing cavity pumps (PCP) that can be a useful metaphor.To get more news about progressive cavity pump, you can visit brysonpump.com official website.

A case in point was a talk listing mistakes that “can doom a PCP to early failure” by Shauna Noonan, a former SPE president, currently a fellow and senior director at Occidental Resources and that day at the SPE Artificial Lift Conference, an engineer with 25 years of PCP experience.

The anthropomorphic descriptions are a product of the interactions within a PCP between the rotor—which moves multiphase fluids through helical cavities in the stator, which is typically comprised of an elastomer surrounding it.

The dimensions of the elastomeric stator change when the rotor begins rotating, increasing the differential pressure inside the pump and adding heat to the elastomer, causing the elastomer to swell and narrowing the tolerances between the rotor and stator. Note that there can be cases where the elastomer shrinks instead of swelling.

“The tolerance between rotor and stator is dynamic. The elastomer is a living, breathing element,” Noonan said.

The list of life-extending tips keeps coming back to understanding how changes to operating conditions, downhole fluids, and reservoir pressures can affect the PCP pump.

Noonan offered a sneak peek at results from a field in the Middle East where PCP run lives were doubled over a 4-year period by simply understanding PCP fundamentals and applying operating and pump selection criteria. The paper, SPE 206909, will be presented at the SPE Middle East Artificial Lift Conference and Exhibition in late October.

The thinking required to improved PCP performance is often counterintuitive. For these pumps, loose is better than tight and not targeting 100% volumetric efficiency downhole is the better long-term bet.

In order to account for the swell that the elastomer will see due to reservoir fluids and temperature, the acceptance pump efficiency from the bench test should not be any higher than 80% at the differential pressure that will be needed from the pump. This is only for low-viscosity fluids. For high-viscosity fluids, the acceptance criteria could be as low as 0% efficiency.

To better understand why that is the case, Noonan strongly recommended a paper by Evan Noble and Lonnie Dunn based on testing at Weatherford. The results showed many instances where the differential pressure across the pump was concentrated towards the discharge, rather than evenly spread over its length (SPE 153944).

The study showed why PCP pump failures often occur at the upper portion of the pump. It included a chart showing the importance of fluid slippage to distribute the differential pressure across the pump. The slippage is highest at 100% lift capacity.

Noonan talked about a field in Canada where the PCPs were failing early at the upper portion of the pump, and since the reservoir pressure had increased due to a waterflood, the differential pressure needed from the pumps was less. This chart demonstrates what occurred in the pumps and that the differential pressure had concentrated much closer to the discharge leading to elastomer failure.

The differential pressure curves will vary depending on the pump design (rotor/stator interference fit), operating speed, presence of free gas, and fluid viscosity. While the specifications can allow an expert an educated performance prediction, bench testing is needed to catch manufacturing defects and collect data needed to predict the interference fit between the rotor and elastomer once in the wellbore.

The dimensions of the elastomeric stator change when the rotor begins rotating, increasing the differential pressure inside the pump and adding heat to the elastomer, causing the elastomer to swell and narrowing the tolerances between the rotor and stator. Note that there can be cases where the elastomer shrinks instead of swelling.

“The tolerance between rotor and stator is dynamic. The elastomer is a living, breathing element,” Noonan said.

The list of life-extending tips keeps coming back to understanding how changes to operating conditions, downhole fluids, and reservoir pressures can affect the PCP pump.

Noonan offered a sneak peek at results from a field in the Middle East where PCP run lives were doubled over a 4-year period by simply understanding PCP fundamentals and applying operating and pump selection criteria. The paper, SPE 206909, will be presented at the SPE Middle East Artificial Lift Conference and Exhibition in late October.

The thinking required to improved PCP performance is often counterintuitive. For these pumps, loose is better than tight and not targeting 100% volumetric efficiency downhole is the better long-term bet.

In order to account for the swell that the elastomer will see due to reservoir fluids and temperature, the acceptance pump efficiency from the bench test should not be any higher than 80% at the differential pressure that will be needed from the pump. This is only for low-viscosity fluids. For high-viscosity fluids, the acceptance criteria could be as low as 0% efficiency.

To better understand why that is the case, Noonan strongly recommended a paper by Evan Noble and Lonnie Dunn based on testing at Weatherford. The results showed many instances where the differential pressure across the pump was concentrated towards the discharge, rather than evenly spread over its length (SPE 153944).

The study showed why PCP pump failures often occur at the upper portion of the pump. It included a chart showing the importance of fluid slippage to distribute the differential pressure across the pump. The slippage is highest at 100% lift capacity.

Noonan talked about a field in Canada where the PCPs were failing early at the upper portion of the pump, and since the reservoir pressure had increased due to a waterflood, the differential pressure needed from the pumps was less. This chart demonstrates what occurred in the pumps and that the differential pressure had concentrated much closer to the discharge leading to elastomer failure.

The differential pressure curves will vary depending on the pump design (rotor/stator interference fit), operating speed, presence of free gas, and fluid viscosity. While the specifications can allow an expert an educated performance prediction, bench testing is needed to catch manufacturing defects and collect data needed to predict the interference fit between the rotor and elastomer once in the wellbore.

The dimensions of the elastomeric stator change when the rotor begins rotating, increasing the differential pressure inside the pump and adding heat to the elastomer, causing the elastomer to swell and narrowing the tolerances between the rotor and stator. Note that there can be cases where the elastomer shrinks instead of swelling.

“The tolerance between rotor and stator is dynamic. The elastomer is a living, breathing element,” Noonan said.

The list of life-extending tips keeps coming back to understanding how changes to operating conditions, downhole fluids, and reservoir pressures can affect the PCP pump.

Noonan offered a sneak peek at results from a field in the Middle East where PCP run lives were doubled over a 4-year period by simply understanding PCP fundamentals and applying operating and pump selection criteria. The paper, SPE 206909, will be presented at the SPE Middle East Artificial Lift Conference and Exhibition in late October.

The thinking required to improved PCP performance is often counterintuitive. For these pumps, loose is better than tight and not targeting 100% volumetric efficiency downhole is the better long-term bet.

In order to account for the swell that the elastomer will see due to reservoir fluids and temperature, the acceptance pump efficiency from the bench test should not be any higher than 80% at the differential pressure that will be needed from the pump. This is only for low-viscosity fluids. For high-viscosity fluids, the acceptance criteria could be as low as 0% efficiency.

To better understand why that is the case, Noonan strongly recommended a paper by Evan Noble and Lonnie Dunn based on testing at Weatherford. The results showed many instances where the differential pressure across the pump was concentrated towards the discharge, rather than evenly spread over its length (SPE 153944).

The study showed why PCP pump failures often occur at the upper portion of the pump. It included a chart showing the importance of fluid slippage to distribute the differential pressure across the pump. The slippage is highest at 100% lift capacity.

Noonan talked about a field in Canada where the PCPs were failing early at the upper portion of the pump, and since the reservoir pressure had increased due to a waterflood, the differential pressure needed from the pumps was less. This chart demonstrates what occurred in the pumps and that the differential pressure had concentrated much closer to the discharge leading to elastomer failure.

The differential pressure curves will vary depending on the pump design (rotor/stator interference fit), operating speed, presence of free gas, and fluid viscosity. While the specifications can allow an expert an educated performance prediction, bench testing is needed to catch manufacturing defects and collect data needed to predict the interference fit between the rotor and elastomer once in the wellbore.

The dimensions of the elastomeric stator change when the rotor begins rotating, increasing the differential pressure inside the pump and adding heat to the elastomer, causing the elastomer to swell and narrowing the tolerances between the rotor and stator. Note that there can be cases where the elastomer shrinks instead of swelling.

“The tolerance between rotor and stator is dynamic. The elastomer is a living, breathing element,” Noonan said.

The list of life-extending tips keeps coming back to understanding how changes to operating conditions, downhole fluids, and reservoir pressures can affect the PCP pump.

Noonan offered a sneak peek at results from a field in the Middle East where PCP run lives were doubled over a 4-year period by simply understanding PCP fundamentals and applying operating and pump selection criteria. The paper, SPE 206909, will be presented at the SPE Middle East Artificial Lift Conference and Exhibition in late October.

The thinking required to improved PCP performance is often counterintuitive. For these pumps, loose is better than tight and not targeting 100% volumetric efficiency downhole is the better long-term bet.

In order to account for the swell that the elastomer will see due to reservoir fluids and temperature, the acceptance pump efficiency from the bench test should not be any higher than 80% at the differential pressure that will be needed from the pump. This is only for low-viscosity fluids. For high-viscosity fluids, the acceptance criteria could be as low as 0% efficiency.

To better understand why that is the case, Noonan strongly recommended a paper by Evan Noble and Lonnie Dunn based on testing at Weatherford. The results showed many instances where the differential pressure across the pump was concentrated towards the discharge, rather than evenly spread over its length (SPE 153944).

The study showed why PCP pump failures often occur at the upper portion of the pump. It included a chart showing the importance of fluid slippage to distribute the differential pressure across the pump. The slippage is highest at 100% lift capacity.

Noonan talked about a field in Canada where the PCPs were failing early at the upper portion of the pump, and since the reservoir pressure had increased due to a waterflood, the differential pressure needed from the pumps was less. This chart demonstrates what occurred in the pumps and that the differential pressure had concentrated much closer to the discharge leading to elastomer failure.

The differential pressure curves will vary depending on the pump design (rotor/stator interference fit), operating speed, presence of free gas, and fluid viscosity. While the specifications can allow an expert an educated performance prediction, bench testing is needed to catch manufacturing defects and collect data needed to predict the interference fit between the rotor and elastomer once in the wellbore.

Best Home Security Companies Of February 2023

Your home is a special place. It keeps you and your family protected and safe. Investing in a good home security system not only gives back to your home the protection it needs, but helps your house do its job even better. Home security systems provide protection against any number of threats to your home and your family’s safety by watching out for things like burglary, fire, flooding, suspicious activity and more.To get more news about security products for home, you can visit securamsys.com official website.

The best home security companies are the ones that provide their customers with the protection that they need without making them pay for services they don’t. Not every home needs the same kind or even the same level of security. With so many companies saying they’re the best, how can you know which one is right for you?

We’ve compared information on two dozen top-rated home security companies and ranked them based on cost, features, contracts, support, customer reviews and other factors, to come up with a list of the 10 best home security companies. In at least one of the companies below, you’re sure to find the security provider that has the combination of products and services that your home needs.

As the world becomes more connected, and more and more people are working from home, the demand for home security systems is increasing. Home security systems provide peace of mind by deterring criminals and protecting homeowners in the event of a break-in. There are a number of factors driving the increased demand for home security systems market. The first is the increased incidents of home invasions and burglaries. Home invasions are often violent, and can leave homeowners feeling violated and scared.

Another factor driving the demand for the products is the rise in “smart home” technology. Homeowners are increasingly adopting “smart” devices such as thermostats, lighting controls, and door locks that can be controlled remotely via a smartphone or tablet. This convenience comes at a price, however, as these devices are often targeted by criminals who know how to exploit their vulnerabilities.

In the SkyQuest’s latest analysis of the market, we found that the market is growing at a healthy rate with strong prospects for the future. The installed base of home security systems is expected to grow from 280 million in 2021 to 525 million by 2028, driven by increasing awareness of security threats and advances in technology. The do-it-yourself (DIY) segment is forecast to be the fastest-growing part of the market, expanding at a CAGR of 12% between 2022 and 2028.

Our analysis shows that there is a huge opportunity for growth in the home security systems market, especially in the DIY segment. With more people becoming aware of security threats and advances in technology making DIY systems more affordable and easier to install, we expect to see strong growth in this area in the years to come. This growth is being driven by a number of factors, including the increasing prevalence of smart devices and the growing need for security solutions that can protect people and property.

The report on global home security systems market provides an overview of the current state of the market, including key players, trends, and challenges. It also offers insights into the future of the industry, with a focus on growth opportunities and emerging technologies. The report is essential reading for anyone involved in the home security industry, or looking to enter it. It provides valuable insights that will help inform strategic decision-making and ensure success in this rapidly-growing market.

We’ve compared information on two dozen top-rated home security companies and ranked them based on cost, features, contracts, support, customer reviews and other factors, to come up with a list of the 10 best home security companies. In at least one of the companies below, you’re sure to find the security provider that has the combination of products and services that your home needs.

As the world becomes more connected, and more and more people are working from home, the demand for home security systems is increasing. Home security systems provide peace of mind by deterring criminals and protecting homeowners in the event of a break-in. There are a number of factors driving the increased demand for home security systems market. The first is the increased incidents of home invasions and burglaries. Home invasions are often violent, and can leave homeowners feeling violated and scared.

Another factor driving the demand for the products is the rise in “smart home” technology. Homeowners are increasingly adopting “smart” devices such as thermostats, lighting controls, and door locks that can be controlled remotely via a smartphone or tablet. This convenience comes at a price, however, as these devices are often targeted by criminals who know how to exploit their vulnerabilities.

In the SkyQuest’s latest analysis of the market, we found that the market is growing at a healthy rate with strong prospects for the future. The installed base of home security systems is expected to grow from 280 million in 2021 to 525 million by 2028, driven by increasing awareness of security threats and advances in technology. The do-it-yourself (DIY) segment is forecast to be the fastest-growing part of the market, expanding at a CAGR of 12% between 2022 and 2028.

Our analysis shows that there is a huge opportunity for growth in the home security systems market, especially in the DIY segment. With more people becoming aware of security threats and advances in technology making DIY systems more affordable and easier to install, we expect to see strong growth in this area in the years to come. This growth is being driven by a number of factors, including the increasing prevalence of smart devices and the growing need for security solutions that can protect people and property.

The report on global home security systems market provides an overview of the current state of the market, including key players, trends, and challenges. It also offers insights into the future of the industry, with a focus on growth opportunities and emerging technologies. The report is essential reading for anyone involved in the home security industry, or looking to enter it. It provides valuable insights that will help inform strategic decision-making and ensure success in this rapidly-growing market.

We’ve compared information on two dozen top-rated home security companies and ranked them based on cost, features, contracts, support, customer reviews and other factors, to come up with a list of the 10 best home security companies. In at least one of the companies below, you’re sure to find the security provider that has the combination of products and services that your home needs.

As the world becomes more connected, and more and more people are working from home, the demand for home security systems is increasing. Home security systems provide peace of mind by deterring criminals and protecting homeowners in the event of a break-in. There are a number of factors driving the increased demand for home security systems market. The first is the increased incidents of home invasions and burglaries. Home invasions are often violent, and can leave homeowners feeling violated and scared.

Another factor driving the demand for the products is the rise in “smart home” technology. Homeowners are increasingly adopting “smart” devices such as thermostats, lighting controls, and door locks that can be controlled remotely via a smartphone or tablet. This convenience comes at a price, however, as these devices are often targeted by criminals who know how to exploit their vulnerabilities.

In the SkyQuest’s latest analysis of the market, we found that the market is growing at a healthy rate with strong prospects for the future. The installed base of home security systems is expected to grow from 280 million in 2021 to 525 million by 2028, driven by increasing awareness of security threats and advances in technology. The do-it-yourself (DIY) segment is forecast to be the fastest-growing part of the market, expanding at a CAGR of 12% between 2022 and 2028.

Our analysis shows that there is a huge opportunity for growth in the home security systems market, especially in the DIY segment. With more people becoming aware of security threats and advances in technology making DIY systems more affordable and easier to install, we expect to see strong growth in this area in the years to come. This growth is being driven by a number of factors, including the increasing prevalence of smart devices and the growing need for security solutions that can protect people and property.

The report on global home security systems market provides an overview of the current state of the market, including key players, trends, and challenges. It also offers insights into the future of the industry, with a focus on growth opportunities and emerging technologies. The report is essential reading for anyone involved in the home security industry, or looking to enter it. It provides valuable insights that will help inform strategic decision-making and ensure success in this rapidly-growing market.

We’ve compared information on two dozen top-rated home security companies and ranked them based on cost, features, contracts, support, customer reviews and other factors, to come up with a list of the 10 best home security companies. In at least one of the companies below, you’re sure to find the security provider that has the combination of products and services that your home needs.

As the world becomes more connected, and more and more people are working from home, the demand for home security systems is increasing. Home security systems provide peace of mind by deterring criminals and protecting homeowners in the event of a break-in. There are a number of factors driving the increased demand for home security systems market. The first is the increased incidents of home invasions and burglaries. Home invasions are often violent, and can leave homeowners feeling violated and scared.

Another factor driving the demand for the products is the rise in “smart home” technology. Homeowners are increasingly adopting “smart” devices such as thermostats, lighting controls, and door locks that can be controlled remotely via a smartphone or tablet. This convenience comes at a price, however, as these devices are often targeted by criminals who know how to exploit their vulnerabilities.

In the SkyQuest’s latest analysis of the market, we found that the market is growing at a healthy rate with strong prospects for the future. The installed base of home security systems is expected to grow from 280 million in 2021 to 525 million by 2028, driven by increasing awareness of security threats and advances in technology. The do-it-yourself (DIY) segment is forecast to be the fastest-growing part of the market, expanding at a CAGR of 12% between 2022 and 2028.

Our analysis shows that there is a huge opportunity for growth in the home security systems market, especially in the DIY segment. With more people becoming aware of security threats and advances in technology making DIY systems more affordable and easier to install, we expect to see strong growth in this area in the years to come. This growth is being driven by a number of factors, including the increasing prevalence of smart devices and the growing need for security solutions that can protect people and property.

The report on global home security systems market provides an overview of the current state of the market, including key players, trends, and challenges. It also offers insights into the future of the industry, with a focus on growth opportunities and emerging technologies. The report is essential reading for anyone involved in the home security industry, or looking to enter it. It provides valuable insights that will help inform strategic decision-making and ensure success in this rapidly-growing market.

CAD File Formats

This page describes how Datasmith imports scenes from most supported CAD file formats into Unreal Editor. It follows the basic process outlined by the Datasmith Overview and Datasmith Import Process pages, but adds some special translation behavior that is specific to CAD files. If you're planning to use Datasmith to import scenes from CAD files into Unreal Editor, reading this page can help you understand how your scene is translated, and how you can work with the results in Unreal Editor.To get more news about download cad, you can visit shine news official website.

In CAD formats, you often use curves and mathematical functions to define surfaces and solids. The precision and smoothness of these surfaces is ideal for the manufacturing process. However, modern GPU chips are highly optimized for rendering surfaces that are made up of triangular meshes. Real-time renderers and game engines like Unreal, which need to push the limits of these GPUs in order to produce dozens of stunning photoreal quality images every second, typically only work with geometry that is made up of triangular meshes.

Datasmith bridges this gap by automatically computing triangular meshes that closely approximate any curved surfaces in your CAD file that don't already have mesh representations. This process is called tessellation, and it is an essential step in preparing your CAD data for use in real time.

For example, the image on the left shows a surface rendered in a native CAD viewer. The image on the right shows a wireframe of a triangular mesh that was generated for that surface.

Tessellating a surface for real-time rendering involves an implicit tradeoff between the accuracy of the surface and the speed that it can be rendered.

By nature, a triangular mesh can never exactly match the mathematically precise surface it was generated from. Tessellation always implies sampling the original surface at some level of detail to create an approximation that allows the GPU to render the geometry more quickly. Typically, the closer your mesh is to the original surface, the more complex it will be — that is, it will contain more triangles, and those triangles will be smaller. This may look better when it's rendered, but places higher demands on the GPU. If you lower the accuracy of your tessellated mesh, so that it contains fewer, larger triangles, the GPU will be able to render it faster, but that rendering may not give you the visual fidelity you're looking for — it may look blocky or jagged.

Therefore, your goal in the tessellation process is to minimize the number of triangles in your mesh, while maximizing its visual fidelity to the source. This usually means that you aim to have a relatively small number of larger triangles in places where the surface is smoother and flatter, and a relatively large number of smaller triangles in places where the surface is more complex and uneven.

Datasmith offers three parameters that you can adjust when you import a CAD scene, described in the following sections. By tweaking these values, you can control the complexity and fidelity of the Static Mesh geometry that Datasmith creates for your curved surfaces.

Lowering the value of this parameter makes the tessellated surface stay closer to the original surface, producing more small triangles.

The effect of this setting is most visible in areas with greater curvature: as the tolerance value increases, the generated triangles become larger and the surface smoothness is reduced.

Datasmith bridges this gap by automatically computing triangular meshes that closely approximate any curved surfaces in your CAD file that don't already have mesh representations. This process is called tessellation, and it is an essential step in preparing your CAD data for use in real time.

For example, the image on the left shows a surface rendered in a native CAD viewer. The image on the right shows a wireframe of a triangular mesh that was generated for that surface.

Tessellating a surface for real-time rendering involves an implicit tradeoff between the accuracy of the surface and the speed that it can be rendered.

By nature, a triangular mesh can never exactly match the mathematically precise surface it was generated from. Tessellation always implies sampling the original surface at some level of detail to create an approximation that allows the GPU to render the geometry more quickly. Typically, the closer your mesh is to the original surface, the more complex it will be — that is, it will contain more triangles, and those triangles will be smaller. This may look better when it's rendered, but places higher demands on the GPU. If you lower the accuracy of your tessellated mesh, so that it contains fewer, larger triangles, the GPU will be able to render it faster, but that rendering may not give you the visual fidelity you're looking for — it may look blocky or jagged.

Therefore, your goal in the tessellation process is to minimize the number of triangles in your mesh, while maximizing its visual fidelity to the source. This usually means that you aim to have a relatively small number of larger triangles in places where the surface is smoother and flatter, and a relatively large number of smaller triangles in places where the surface is more complex and uneven.

Datasmith offers three parameters that you can adjust when you import a CAD scene, described in the following sections. By tweaking these values, you can control the complexity and fidelity of the Static Mesh geometry that Datasmith creates for your curved surfaces.

Lowering the value of this parameter makes the tessellated surface stay closer to the original surface, producing more small triangles.

The effect of this setting is most visible in areas with greater curvature: as the tolerance value increases, the generated triangles become larger and the surface smoothness is reduced.

Sales of Robots for the Service Sector Grew

Sales of professional service robots rose by an impressive 37% in 2021. By region, the strongest growth came from Europe with a market share of 38% followed by North America with 32% and Asia with 30%. At the same time, sales of new consumer service robots grew by 9%, according to the “World Robotics 2022–Service Robots” report, issued by the International Federation of Robotics (IFR).To get more news about GRS, you can visit glprobotics.com official website.

“Service robots for professional use are extremely diverse,” said IFR´s President Marina Bill. “They are usually designed to perform a specific task and can be found in warehouses, in hospitals and airports or even helping on dairy farms automatically milking cows.”

About 121,000 professional service robots were sold in 2021–more than one out of every three built were targeted for the transportation of goods or cargo. The majority thereof are used in indoor environments e.g factories, where the general public has no access to, so that these robots are not designed to deal with public traffic. A total of 286 companies are producing service robots in this category.

Hospitality robots enjoy growing popularity but compared to market potential, sales figures are still low: More than 20,000 units (+85%) were sold in 2021. Robots in this category are either used for food and drink preparation or for mobile guidance, information, and telepresence.

Sales of medical robots were up 23% to 14,823 units. The majority are surgical robots, followed by robots for rehabilitation and non-invasive therapy, while the share of robots for diagnostics is still comparably low.

Demand for professional cleaning robots grew by 31%. Sales of more than 12,600 units were reported. The main application in this group is floor cleaning. Disinfection robots that spray disinfectant fluids or use ultraviolet light to destroy viruses have also seen a strongly growing demand since the start of the Covid-19 pandemic. Other professional cleaning helpers are, for instance, professional window, pool- and solar panel-cleaning robots.

Robotics plays an important part in the digitalization of agriculture with more than 8,000 units (+6%) sold in 2021. Robots are well established in cow milking, assisted by robotic barn cleaners and feeding robots. Robots for the cultivation of crops are still in their early days.

“Service robots for consumers are mainly used in domestic environments: They help with vacuuming, floor-cleaning, or gardening, and are also used for social interaction and education,” said IFR´s President Marina Bill. “These service robots are produced for a mass market with completely different pricing and marketing compared to service robots for professional use.”Robots for domestic tasks constituted the largest group of consumer robots. Almost 19 million units (+12%) were sold in 2021. Vacuuming robots and other robots for indoor domestic floor cleaning are currently the most used application. This kind of service robot is available in almost every convenience store, making it easily accessible to consumers. Today, gardening robots usually comprise lawn-mowing robots. This market is expected to grow by low double-digit growth rates on average each year over the next few years.

Although the service robotics industry is a young and growing industry, 87% of service robot producers worldwide are considered incumbents that were established before 2017. The share of start-ups has been decreasing in recent years because the industry’s focus has shifted towards software and application development. Many service robot suppliers use third-party hardware to create a solution and are therefore not counted as a service robot producer in IFR industry structure statistics.

The IFR’s market observation suggests two reasons for the decreasing share of start-ups: Some market segments have already achieved a level of maturity that sees companies growing, for instance AMRs for warehouse logistics. Further, founding activities shifted away from the development of hardware towards software development and application development. Many service applications are based on collaborative industrial robots, purchased from an industrial producer. The service robot supplier is therefore not considered a robot producer–the robot is purchased from a third party. These companies act like system integrators, combining different components and developing software to create a solution.

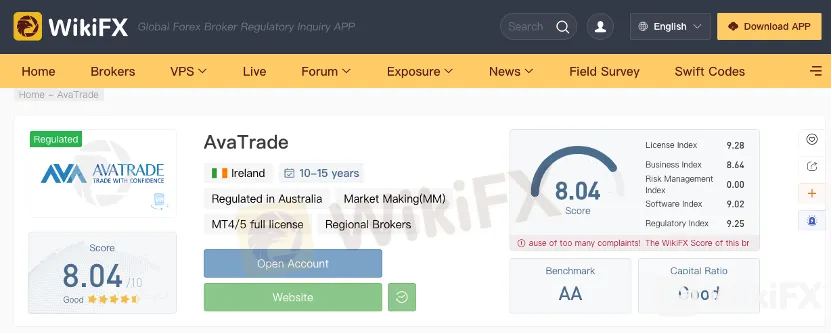

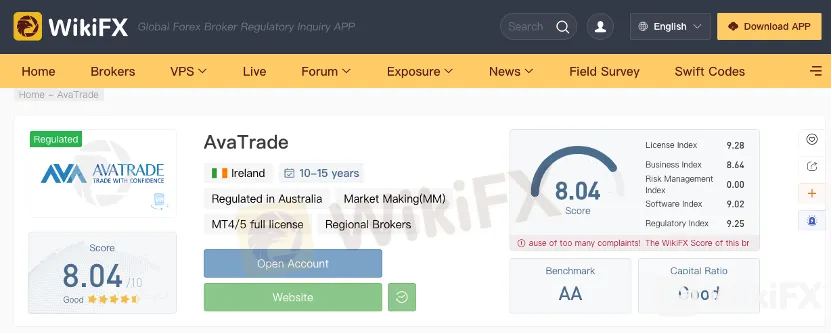

Hankotrade vs KOT4X: Which Broker Is Better For You?

If you’re interested in trading CFDs (Contracts for Differences), including forex, crypto, stocks, and commodities, look no further than The Kings of Transparency (KOT4X) and Hankotrade online forex broker. KOT4X offers a variety of benefits, including four distinct account types, a minimal minimum deposit requirement, fair commissions, and access to the widely used MetaTrader 4 (MT4) platform. However, it also has several serious flaws, such as a lack of regulation, poor quality customer support, and unclear methods for withdrawing funds from and depositing funds into an account using bitcoin.To get more news about hankotrade, you can visit wikifx.com official website.

In contrast, Hankotrade is a Seychelles-based brokerage. The firm promotes its service as “real ECN trading,” with tight spreads (as low as 0 pips), significant leverage, and access to several currency pairings, digital currencies, commodities, and indexes.

One way Hankotrade stands apart from more conventional brokers is its complete acceptance of cryptocurrency for deposits and withdrawals. But the money in the account is worthless paper bills. Hankotrade is an ECN broker that boasts excellent trading conditions at rock-bottom prices. The highest leverage that may be used on Hankotrade is 1:500. The funds you deposit or withdraw from Hankotrade will never cost you a dime. Blockchain and foreign exchange fees still apply.

Research indicates that Hankotrade was established in 2018 and is headquartered in Seychelles. The broker must adhere to the rules set out by the FSA (Financial Services Authority of Seychelles).

When clients place orders with Hankotrade, those requests go straight to the liquidity providers, eliminating potential delays or bias in the trade execution process. The robust MetaTrader 4 trading platforms are made available by the broker for online trading of various financial instruments in various asset classes, such as foreign exchange, indices, commodities, and cryptocurrencies. They provide advantageous market circumstances for trading, various trading accounts to suit individual needs, and a selection of trading instruments to facilitate routine transactions.

Providing retail and institutional clients throughout the globe with an excellent trading environment and the means to fulfill their full potential is stated as Hankotrade’s primary purpose. The broker’s workforce comprises seasoned traders who have worked in global markets, from Asia to North America.

Consider them if you need a no-frills broker who can get you into the market quickly and easily. The online broker Hankotrade offers a wide variety of trading tools and services.

Trade Forex, cryptocurrencies, stocks, and commodities with narrow spreads from 0.0 pips, no commissions, fast trade execution rates, and high leverage of up to 1:500 on user-friendly trading platforms. The minimum first deposit needed by the broker is only $10. Simultaneously, they provide no-cost trial accounts and accept bitcoin deposits. They also provide an Islamic swap-free account to cater to Muslim traders. All of this is supported by a first-rate customer service team available anytime.

KOT4X Overview

Kings of Transparency (KOT4X) is global online forex, crypto, and CFD broker with state-of-the-art trading technologies. They provide a safe ECN trading environment and over 250 trading instruments spanning various asset classes, including currency pairs, commodities, cryptocurrencies, equities, indexes, metals, and alternative energy sources. When compared to traditional brokers, cryptocurrency exchanges are always open for business. For the many reasons I will outline in my comprehensive KOT4X review, the exchange ranks among my top choices for trading cryptocurrencies.

Opening an account with KOT4X is quick and easy, and you may be ready to trade in just a few minutes. You may deposit and invest with as little as $10, which is a shallow minimum. And suppose you want to try out their trading platform before committing any real money. In that case, they provide demo trading accounts so you can become comfortable with the platform and practice your trading techniques without risk.

One way Hankotrade stands apart from more conventional brokers is its complete acceptance of cryptocurrency for deposits and withdrawals. But the money in the account is worthless paper bills. Hankotrade is an ECN broker that boasts excellent trading conditions at rock-bottom prices. The highest leverage that may be used on Hankotrade is 1:500. The funds you deposit or withdraw from Hankotrade will never cost you a dime. Blockchain and foreign exchange fees still apply.

Research indicates that Hankotrade was established in 2018 and is headquartered in Seychelles. The broker must adhere to the rules set out by the FSA (Financial Services Authority of Seychelles).

When clients place orders with Hankotrade, those requests go straight to the liquidity providers, eliminating potential delays or bias in the trade execution process. The robust MetaTrader 4 trading platforms are made available by the broker for online trading of various financial instruments in various asset classes, such as foreign exchange, indices, commodities, and cryptocurrencies. They provide advantageous market circumstances for trading, various trading accounts to suit individual needs, and a selection of trading instruments to facilitate routine transactions.

Providing retail and institutional clients throughout the globe with an excellent trading environment and the means to fulfill their full potential is stated as Hankotrade’s primary purpose. The broker’s workforce comprises seasoned traders who have worked in global markets, from Asia to North America.

Consider them if you need a no-frills broker who can get you into the market quickly and easily. The online broker Hankotrade offers a wide variety of trading tools and services.

Trade Forex, cryptocurrencies, stocks, and commodities with narrow spreads from 0.0 pips, no commissions, fast trade execution rates, and high leverage of up to 1:500 on user-friendly trading platforms. The minimum first deposit needed by the broker is only $10. Simultaneously, they provide no-cost trial accounts and accept bitcoin deposits. They also provide an Islamic swap-free account to cater to Muslim traders. All of this is supported by a first-rate customer service team available anytime.

KOT4X Overview

Kings of Transparency (KOT4X) is global online forex, crypto, and CFD broker with state-of-the-art trading technologies. They provide a safe ECN trading environment and over 250 trading instruments spanning various asset classes, including currency pairs, commodities, cryptocurrencies, equities, indexes, metals, and alternative energy sources. When compared to traditional brokers, cryptocurrency exchanges are always open for business. For the many reasons I will outline in my comprehensive KOT4X review, the exchange ranks among my top choices for trading cryptocurrencies.

Opening an account with KOT4X is quick and easy, and you may be ready to trade in just a few minutes. You may deposit and invest with as little as $10, which is a shallow minimum. And suppose you want to try out their trading platform before committing any real money. In that case, they provide demo trading accounts so you can become comfortable with the platform and practice your trading techniques without risk.

One way Hankotrade stands apart from more conventional brokers is its complete acceptance of cryptocurrency for deposits and withdrawals. But the money in the account is worthless paper bills. Hankotrade is an ECN broker that boasts excellent trading conditions at rock-bottom prices. The highest leverage that may be used on Hankotrade is 1:500. The funds you deposit or withdraw from Hankotrade will never cost you a dime. Blockchain and foreign exchange fees still apply.

Research indicates that Hankotrade was established in 2018 and is headquartered in Seychelles. The broker must adhere to the rules set out by the FSA (Financial Services Authority of Seychelles).

When clients place orders with Hankotrade, those requests go straight to the liquidity providers, eliminating potential delays or bias in the trade execution process. The robust MetaTrader 4 trading platforms are made available by the broker for online trading of various financial instruments in various asset classes, such as foreign exchange, indices, commodities, and cryptocurrencies. They provide advantageous market circumstances for trading, various trading accounts to suit individual needs, and a selection of trading instruments to facilitate routine transactions.

Providing retail and institutional clients throughout the globe with an excellent trading environment and the means to fulfill their full potential is stated as Hankotrade’s primary purpose. The broker’s workforce comprises seasoned traders who have worked in global markets, from Asia to North America.

Consider them if you need a no-frills broker who can get you into the market quickly and easily. The online broker Hankotrade offers a wide variety of trading tools and services.

Trade Forex, cryptocurrencies, stocks, and commodities with narrow spreads from 0.0 pips, no commissions, fast trade execution rates, and high leverage of up to 1:500 on user-friendly trading platforms. The minimum first deposit needed by the broker is only $10. Simultaneously, they provide no-cost trial accounts and accept bitcoin deposits. They also provide an Islamic swap-free account to cater to Muslim traders. All of this is supported by a first-rate customer service team available anytime.

KOT4X Overview

Kings of Transparency (KOT4X) is global online forex, crypto, and CFD broker with state-of-the-art trading technologies. They provide a safe ECN trading environment and over 250 trading instruments spanning various asset classes, including currency pairs, commodities, cryptocurrencies, equities, indexes, metals, and alternative energy sources. When compared to traditional brokers, cryptocurrency exchanges are always open for business. For the many reasons I will outline in my comprehensive KOT4X review, the exchange ranks among my top choices for trading cryptocurrencies.

Opening an account with KOT4X is quick and easy, and you may be ready to trade in just a few minutes. You may deposit and invest with as little as $10, which is a shallow minimum. And suppose you want to try out their trading platform before committing any real money. In that case, they provide demo trading accounts so you can become comfortable with the platform and practice your trading techniques without risk.

One way Hankotrade stands apart from more conventional brokers is its complete acceptance of cryptocurrency for deposits and withdrawals. But the money in the account is worthless paper bills. Hankotrade is an ECN broker that boasts excellent trading conditions at rock-bottom prices. The highest leverage that may be used on Hankotrade is 1:500. The funds you deposit or withdraw from Hankotrade will never cost you a dime. Blockchain and foreign exchange fees still apply.

Research indicates that Hankotrade was established in 2018 and is headquartered in Seychelles. The broker must adhere to the rules set out by the FSA (Financial Services Authority of Seychelles).

When clients place orders with Hankotrade, those requests go straight to the liquidity providers, eliminating potential delays or bias in the trade execution process. The robust MetaTrader 4 trading platforms are made available by the broker for online trading of various financial instruments in various asset classes, such as foreign exchange, indices, commodities, and cryptocurrencies. They provide advantageous market circumstances for trading, various trading accounts to suit individual needs, and a selection of trading instruments to facilitate routine transactions.

Providing retail and institutional clients throughout the globe with an excellent trading environment and the means to fulfill their full potential is stated as Hankotrade’s primary purpose. The broker’s workforce comprises seasoned traders who have worked in global markets, from Asia to North America.

Consider them if you need a no-frills broker who can get you into the market quickly and easily. The online broker Hankotrade offers a wide variety of trading tools and services.

Trade Forex, cryptocurrencies, stocks, and commodities with narrow spreads from 0.0 pips, no commissions, fast trade execution rates, and high leverage of up to 1:500 on user-friendly trading platforms. The minimum first deposit needed by the broker is only $10. Simultaneously, they provide no-cost trial accounts and accept bitcoin deposits. They also provide an Islamic swap-free account to cater to Muslim traders. All of this is supported by a first-rate customer service team available anytime.

KOT4X Overview

Kings of Transparency (KOT4X) is global online forex, crypto, and CFD broker with state-of-the-art trading technologies. They provide a safe ECN trading environment and over 250 trading instruments spanning various asset classes, including currency pairs, commodities, cryptocurrencies, equities, indexes, metals, and alternative energy sources. When compared to traditional brokers, cryptocurrency exchanges are always open for business. For the many reasons I will outline in my comprehensive KOT4X review, the exchange ranks among my top choices for trading cryptocurrencies.

Opening an account with KOT4X is quick and easy, and you may be ready to trade in just a few minutes. You may deposit and invest with as little as $10, which is a shallow minimum. And suppose you want to try out their trading platform before committing any real money. In that case, they provide demo trading accounts so you can become comfortable with the platform and practice your trading techniques without risk.

Vault Markets Review

Vault Markets can be summarised as a credible broker that is very competitive in terms of its ultra-low latency trading, customizable accounts, immediate withdrawals, and comprehensive educational resources. Vault Markets has an overall rating of 7/10.To get more news about vault markets, you can visit wikifx.com official website.

Vault Markets is an award-winning Forex broker based in South Africa, which aims to provide high-quality trading technology and advanced trading features to traders throughout the African continent.

Trading with Vault Markets is facilitated on the highly popular MetaTrader 4 and MetaTrader 5 platforms, and the broker provides ultra-low latency trading, customizable accounts, immediate withdrawals, and comprehensive educational resources.

Vault Markets Safe or Scam

When traders evaluate brokers, regulation is one of the most crucial components that must be considered. Regulated brokers are required to comply with stringent rules and regulations set by regulatory entities and through this, client fund security can be ensured.

The activities of regulated brokers are also overseen by such entities to ensure that there is no fraud or foul play, and to ensure that traders are always protected against such activities. Vault Markets is technically owned by Egoli Forex (Pty) Ltd, company number 2017/157566/07, which is regulated by the FSCA in South Africa, with license number FSP 49015.

The FSCA is the market conduct regulator of financial institutions that provide financial products and financial services, financial institutions that are licensed in terms of a financial sector law, including banks, insurers, retirement funds, and administrators, and market infrastructures.

The Financial Sector Conduct Authority (FSCA) is responsible for market conduct regulation and supervision. The FSCA aims to enhance and support the efficiency and integrity of financial markets and to protect financial customers by promoting their fair treatment by financial institutions, as well as providing financial customers with financial education.

As such, the FSCA is the most reputable financial regulating body in South Africa, which oversees all of Vault Markets’ operations and ensures the safety of client funds with the broker.

Vault Markets Leverage

Vault Markets provides a maximum leverage ratio of 1:500 across all of its various account types, except for the special Vault1000 account, which provides a high leverage ratio of up to 1:1000. This leverage ratio is in-line with FSCA requirements regarding the instrument and will allow traders a decent opportunity to increase their positions without too high a risk of loss.

Leverage is a tool that is offered by numerous brokers to traders. With leverage, traders can open larger positions, allowing traders more exposure to the market in which they are trading despite their initial deposit.

However, as beneficial as leverage may be, it can also be detrimental when used incorrectly or abused. Leverage increases a trader’s chance of gains and thus, it also increases the risk of losses.

Traders are at risk of incurring losses that may exceed their initial deposit, leading to a negative balance on their trading account if the trader does not have the benefit of negative balance protection.

Leverage is expressed as a ratio, for instance, 1:1, 1:50, 1:100, 1:500, and even up to 1:3000. Leverage and margin go together, with the margin being the amount required from the trader at the start of the trade. This amount serves as collateral for any credit risks which may arise. When traders apply leverage, the margin requirement is reduced, and the trader can open larger positions.

Trading with Vault Markets is facilitated on the highly popular MetaTrader 4 and MetaTrader 5 platforms, and the broker provides ultra-low latency trading, customizable accounts, immediate withdrawals, and comprehensive educational resources.

Vault Markets Safe or Scam

When traders evaluate brokers, regulation is one of the most crucial components that must be considered. Regulated brokers are required to comply with stringent rules and regulations set by regulatory entities and through this, client fund security can be ensured.

The activities of regulated brokers are also overseen by such entities to ensure that there is no fraud or foul play, and to ensure that traders are always protected against such activities. Vault Markets is technically owned by Egoli Forex (Pty) Ltd, company number 2017/157566/07, which is regulated by the FSCA in South Africa, with license number FSP 49015.

The FSCA is the market conduct regulator of financial institutions that provide financial products and financial services, financial institutions that are licensed in terms of a financial sector law, including banks, insurers, retirement funds, and administrators, and market infrastructures.

The Financial Sector Conduct Authority (FSCA) is responsible for market conduct regulation and supervision. The FSCA aims to enhance and support the efficiency and integrity of financial markets and to protect financial customers by promoting their fair treatment by financial institutions, as well as providing financial customers with financial education.

As such, the FSCA is the most reputable financial regulating body in South Africa, which oversees all of Vault Markets’ operations and ensures the safety of client funds with the broker.

Vault Markets Leverage

Vault Markets provides a maximum leverage ratio of 1:500 across all of its various account types, except for the special Vault1000 account, which provides a high leverage ratio of up to 1:1000. This leverage ratio is in-line with FSCA requirements regarding the instrument and will allow traders a decent opportunity to increase their positions without too high a risk of loss.

Leverage is a tool that is offered by numerous brokers to traders. With leverage, traders can open larger positions, allowing traders more exposure to the market in which they are trading despite their initial deposit.

However, as beneficial as leverage may be, it can also be detrimental when used incorrectly or abused. Leverage increases a trader’s chance of gains and thus, it also increases the risk of losses.

Traders are at risk of incurring losses that may exceed their initial deposit, leading to a negative balance on their trading account if the trader does not have the benefit of negative balance protection.

Leverage is expressed as a ratio, for instance, 1:1, 1:50, 1:100, 1:500, and even up to 1:3000. Leverage and margin go together, with the margin being the amount required from the trader at the start of the trade. This amount serves as collateral for any credit risks which may arise. When traders apply leverage, the margin requirement is reduced, and the trader can open larger positions.

Trading with Vault Markets is facilitated on the highly popular MetaTrader 4 and MetaTrader 5 platforms, and the broker provides ultra-low latency trading, customizable accounts, immediate withdrawals, and comprehensive educational resources.

Vault Markets Safe or Scam

When traders evaluate brokers, regulation is one of the most crucial components that must be considered. Regulated brokers are required to comply with stringent rules and regulations set by regulatory entities and through this, client fund security can be ensured.

The activities of regulated brokers are also overseen by such entities to ensure that there is no fraud or foul play, and to ensure that traders are always protected against such activities. Vault Markets is technically owned by Egoli Forex (Pty) Ltd, company number 2017/157566/07, which is regulated by the FSCA in South Africa, with license number FSP 49015.

The FSCA is the market conduct regulator of financial institutions that provide financial products and financial services, financial institutions that are licensed in terms of a financial sector law, including banks, insurers, retirement funds, and administrators, and market infrastructures.

The Financial Sector Conduct Authority (FSCA) is responsible for market conduct regulation and supervision. The FSCA aims to enhance and support the efficiency and integrity of financial markets and to protect financial customers by promoting their fair treatment by financial institutions, as well as providing financial customers with financial education.

As such, the FSCA is the most reputable financial regulating body in South Africa, which oversees all of Vault Markets’ operations and ensures the safety of client funds with the broker.

Vault Markets Leverage

Vault Markets provides a maximum leverage ratio of 1:500 across all of its various account types, except for the special Vault1000 account, which provides a high leverage ratio of up to 1:1000. This leverage ratio is in-line with FSCA requirements regarding the instrument and will allow traders a decent opportunity to increase their positions without too high a risk of loss.

Leverage is a tool that is offered by numerous brokers to traders. With leverage, traders can open larger positions, allowing traders more exposure to the market in which they are trading despite their initial deposit.

However, as beneficial as leverage may be, it can also be detrimental when used incorrectly or abused. Leverage increases a trader’s chance of gains and thus, it also increases the risk of losses.

Traders are at risk of incurring losses that may exceed their initial deposit, leading to a negative balance on their trading account if the trader does not have the benefit of negative balance protection.

Leverage is expressed as a ratio, for instance, 1:1, 1:50, 1:100, 1:500, and even up to 1:3000. Leverage and margin go together, with the margin being the amount required from the trader at the start of the trade. This amount serves as collateral for any credit risks which may arise. When traders apply leverage, the margin requirement is reduced, and the trader can open larger positions.

Trading with Vault Markets is facilitated on the highly popular MetaTrader 4 and MetaTrader 5 platforms, and the broker provides ultra-low latency trading, customizable accounts, immediate withdrawals, and comprehensive educational resources.

Vault Markets Safe or Scam

When traders evaluate brokers, regulation is one of the most crucial components that must be considered. Regulated brokers are required to comply with stringent rules and regulations set by regulatory entities and through this, client fund security can be ensured.

The activities of regulated brokers are also overseen by such entities to ensure that there is no fraud or foul play, and to ensure that traders are always protected against such activities. Vault Markets is technically owned by Egoli Forex (Pty) Ltd, company number 2017/157566/07, which is regulated by the FSCA in South Africa, with license number FSP 49015.

The FSCA is the market conduct regulator of financial institutions that provide financial products and financial services, financial institutions that are licensed in terms of a financial sector law, including banks, insurers, retirement funds, and administrators, and market infrastructures.

The Financial Sector Conduct Authority (FSCA) is responsible for market conduct regulation and supervision. The FSCA aims to enhance and support the efficiency and integrity of financial markets and to protect financial customers by promoting their fair treatment by financial institutions, as well as providing financial customers with financial education.

As such, the FSCA is the most reputable financial regulating body in South Africa, which oversees all of Vault Markets’ operations and ensures the safety of client funds with the broker.

Vault Markets Leverage

Vault Markets provides a maximum leverage ratio of 1:500 across all of its various account types, except for the special Vault1000 account, which provides a high leverage ratio of up to 1:1000. This leverage ratio is in-line with FSCA requirements regarding the instrument and will allow traders a decent opportunity to increase their positions without too high a risk of loss.

Leverage is a tool that is offered by numerous brokers to traders. With leverage, traders can open larger positions, allowing traders more exposure to the market in which they are trading despite their initial deposit.

However, as beneficial as leverage may be, it can also be detrimental when used incorrectly or abused. Leverage increases a trader’s chance of gains and thus, it also increases the risk of losses.

Traders are at risk of incurring losses that may exceed their initial deposit, leading to a negative balance on their trading account if the trader does not have the benefit of negative balance protection.

Leverage is expressed as a ratio, for instance, 1:1, 1:50, 1:100, 1:500, and even up to 1:3000. Leverage and margin go together, with the margin being the amount required from the trader at the start of the trade. This amount serves as collateral for any credit risks which may arise. When traders apply leverage, the margin requirement is reduced, and the trader can open larger positions.

How to Calculate Expected Rate of Return

When investing, you often want to know how much money an investment is likely to earn you. That’s where the expected rate of return comes in; it’s calculated using the probabilities of investment returns for various potential outcomes. Investors can utilize the expected return formula to help project future returns.To get more news about risk and return calculator, you can visit wikifx.com official website.

Though it’s impossible to predict the future, having some idea of what to expect can be critical in setting expectations for a good return on investment.The expected rate of return — also known as expected return — is the profit or loss an investor expects from an investment, given historical rates of return and the probability of certain returns under different scenarios. The expected return formula projects potential future returns.

Expected return is a speculative financial metric investors can use to determine where to invest their money. By calculating the expected rate of return on an investment, investors get an idea of how that investment may perform in the future.

This financial concept can be useful when there is a robust pool of historical data on the returns of a particular investment. Investors can use the historical data to determine the probability that an investment will perform similarly in the future.

However, it’s important to remember that past performance is far from a guarantee of future performance. Investors should be careful not to rely on expected returns alone when making investment decisions.To calculate the expected rate of return on a stock or other security, you need to think about the different scenarios in which the asset could see a gain or loss. For each scenario, multiply that amount of gain or loss (return) by its probability. Finally, add up the numbers you get from each scenario.

The expected rate of return mentioned above looks at an investment’s potential profit and loss. In contrast, the rate of return looks at the past performance of an asset.

A rate of return is the percentage change in value of an investment from its initial cost. When calculating the rate of return, you look at the net gain or loss in an investment over a particular time period. The simple rate of return is also known as the return on investment (ROI).When using probable rates of return, you’ll need the data point of the expected probability of an outcome in a given scenario. This probability can be calculated, or you can make assumptions for the probability of a return. Remember, the probability column must add up to 100%. Here’s an example of how this would look.

Historical data can be a good place to start in understanding how an investment behaves. That said, investors may want to be leery of extrapolating past returns for the future. Historical data is a guide; it’s not necessarily predictive.

Another limitation to the expected returns formula is that it does not consider the risk involved by investing in a particular stock or other asset class. The risk involved in an investment is not represented by its expected rate of return.

In this historical return example above, 10% is the expected rate of return. What that number doesn’t reveal is the risk taken in order to achieve that rate of return. The investment experienced negative returns in the years 2014 and 2016.

Expected return is a speculative financial metric investors can use to determine where to invest their money. By calculating the expected rate of return on an investment, investors get an idea of how that investment may perform in the future.

This financial concept can be useful when there is a robust pool of historical data on the returns of a particular investment. Investors can use the historical data to determine the probability that an investment will perform similarly in the future.

However, it’s important to remember that past performance is far from a guarantee of future performance. Investors should be careful not to rely on expected returns alone when making investment decisions.To calculate the expected rate of return on a stock or other security, you need to think about the different scenarios in which the asset could see a gain or loss. For each scenario, multiply that amount of gain or loss (return) by its probability. Finally, add up the numbers you get from each scenario.

The expected rate of return mentioned above looks at an investment’s potential profit and loss. In contrast, the rate of return looks at the past performance of an asset.

A rate of return is the percentage change in value of an investment from its initial cost. When calculating the rate of return, you look at the net gain or loss in an investment over a particular time period. The simple rate of return is also known as the return on investment (ROI).When using probable rates of return, you’ll need the data point of the expected probability of an outcome in a given scenario. This probability can be calculated, or you can make assumptions for the probability of a return. Remember, the probability column must add up to 100%. Here’s an example of how this would look.

Historical data can be a good place to start in understanding how an investment behaves. That said, investors may want to be leery of extrapolating past returns for the future. Historical data is a guide; it’s not necessarily predictive.

Another limitation to the expected returns formula is that it does not consider the risk involved by investing in a particular stock or other asset class. The risk involved in an investment is not represented by its expected rate of return.

In this historical return example above, 10% is the expected rate of return. What that number doesn’t reveal is the risk taken in order to achieve that rate of return. The investment experienced negative returns in the years 2014 and 2016.

Expected return is a speculative financial metric investors can use to determine where to invest their money. By calculating the expected rate of return on an investment, investors get an idea of how that investment may perform in the future.

This financial concept can be useful when there is a robust pool of historical data on the returns of a particular investment. Investors can use the historical data to determine the probability that an investment will perform similarly in the future.

However, it’s important to remember that past performance is far from a guarantee of future performance. Investors should be careful not to rely on expected returns alone when making investment decisions.To calculate the expected rate of return on a stock or other security, you need to think about the different scenarios in which the asset could see a gain or loss. For each scenario, multiply that amount of gain or loss (return) by its probability. Finally, add up the numbers you get from each scenario.

The expected rate of return mentioned above looks at an investment’s potential profit and loss. In contrast, the rate of return looks at the past performance of an asset.

A rate of return is the percentage change in value of an investment from its initial cost. When calculating the rate of return, you look at the net gain or loss in an investment over a particular time period. The simple rate of return is also known as the return on investment (ROI).When using probable rates of return, you’ll need the data point of the expected probability of an outcome in a given scenario. This probability can be calculated, or you can make assumptions for the probability of a return. Remember, the probability column must add up to 100%. Here’s an example of how this would look.

Historical data can be a good place to start in understanding how an investment behaves. That said, investors may want to be leery of extrapolating past returns for the future. Historical data is a guide; it’s not necessarily predictive.

Another limitation to the expected returns formula is that it does not consider the risk involved by investing in a particular stock or other asset class. The risk involved in an investment is not represented by its expected rate of return.

In this historical return example above, 10% is the expected rate of return. What that number doesn’t reveal is the risk taken in order to achieve that rate of return. The investment experienced negative returns in the years 2014 and 2016.

Expected return is a speculative financial metric investors can use to determine where to invest their money. By calculating the expected rate of return on an investment, investors get an idea of how that investment may perform in the future.

This financial concept can be useful when there is a robust pool of historical data on the returns of a particular investment. Investors can use the historical data to determine the probability that an investment will perform similarly in the future.

However, it’s important to remember that past performance is far from a guarantee of future performance. Investors should be careful not to rely on expected returns alone when making investment decisions.To calculate the expected rate of return on a stock or other security, you need to think about the different scenarios in which the asset could see a gain or loss. For each scenario, multiply that amount of gain or loss (return) by its probability. Finally, add up the numbers you get from each scenario.

The expected rate of return mentioned above looks at an investment’s potential profit and loss. In contrast, the rate of return looks at the past performance of an asset.

A rate of return is the percentage change in value of an investment from its initial cost. When calculating the rate of return, you look at the net gain or loss in an investment over a particular time period. The simple rate of return is also known as the return on investment (ROI).When using probable rates of return, you’ll need the data point of the expected probability of an outcome in a given scenario. This probability can be calculated, or you can make assumptions for the probability of a return. Remember, the probability column must add up to 100%. Here’s an example of how this would look.

Historical data can be a good place to start in understanding how an investment behaves. That said, investors may want to be leery of extrapolating past returns for the future. Historical data is a guide; it’s not necessarily predictive.

Another limitation to the expected returns formula is that it does not consider the risk involved by investing in a particular stock or other asset class. The risk involved in an investment is not represented by its expected rate of return.

In this historical return example above, 10% is the expected rate of return. What that number doesn’t reveal is the risk taken in order to achieve that rate of return. The investment experienced negative returns in the years 2014 and 2016.

Forex Trading Calculators for Better Trading

The Forex trading marketplace is a global platform where traders, banks and institutions trade and speculate on currencies. The forex market is also referred to as the OTC (Over The Counter) market as it does not have a centralized marketplace for the exchange of national currencies. All acts of forex trading are carried out electronically through computer networks.To get more news about forex pip calculator, you can visit wikifx.com official website.

With so many traders involved in the act of forex trading around the globe, the need for profit and loss estimation has risen to a great extent. Traders are keenly speculating and calculating potential profit and loss on their trade activity by using a variety of forex trading calculators like forex pip calculator. The need for such forex trading calculators have surged over the years due to the accuracy and clarity they provide.

What are Forex Trading Calculators?

As the name suggests, a forex trading calculator is a tool designed to help traders calculate potential profits and losses of various transactions. Forex trading calculators are designed in a way that enables a trader to calculate profit and loss for a diverse range of currency pairings including minors, majors, exotics and crosses. Forex trading calculators are equipped with advanced mathematical algorithms that enable the calculation of complex financial equations with accuracy and provide results within seconds.

Pip is short for 'point in percentage'. In forex trading, pip refers to the smallest change in price for a particular currency pair or a movement in the rate of exchange between two currencies. For calculating forex pip a trader needs to select the preferred currency along with the trade size. After this, the pip calculator will compute the pip value with standard, micro and mini lots with the ongoing market rates. In most currency pairs, the pip value lies on the fourth decimal place. Forex pip calculators are an essential part of forex trading as it helps in analyzing growth of an account in a very easy format and enables a trader to plan trading strategy accordingly.

What is a Forex Margin Calculator?

A forex margin calculator computes the margin required for each trade. It estimates the minimum amount that is needed to be kept in a traders account in order to open and maintain a buy-sell position. Forex margin calculators allow a trader to check the availability of funds to proceed with the trading strategy. Margin calculators are an essential part of forex trading as they help a trader to work out the position size and the level of leverage needed. The margin calculator computes the margin based on the lot size or notional value along with the maximum leverage offered by the company.

In order to calculate margin requirements a trader needs to enter a base currency of preference, select the currency pair, select the leverage and then enter the size of position in lots. The forex margin calculator gives accurate results in seconds without the chance of potential error and bias.

Forex profit calculators are powerful trading tools designed to enable a trader to evaluate potential profit and loss based on the outcome of the trade. In other words, a profit calculator computes the profit and loss in monetary value of a particular trade position using trade directions, market data and number of lots traded. The forex profit calculator allows to compute profit loss situations for all major currency pairs including cross currency sets.

The forex market is one of the largest and the most liquid markets in the world. With each passing day, more and more people are joining the forex market in order to maximize returns and reap benefits like other experienced traders. There are plenty of forex trading tools available online that can be easily put to use for magnifying gains and minimizing losses. A trader should use tools that fit his trading requirement and strategy easily. Forex pip calculators are a great tool to calculate the smallest changes in the currency pairs along with a margin calculator for calculating the required margin and leverage to run trading strategy smoothly. And forex profit calculator should also be used to strategize accordingly. By making use of various tools that are available, a trader can make his trading journey easier and increase chances of success in the market.

What are Forex Trading Calculators?

As the name suggests, a forex trading calculator is a tool designed to help traders calculate potential profits and losses of various transactions. Forex trading calculators are designed in a way that enables a trader to calculate profit and loss for a diverse range of currency pairings including minors, majors, exotics and crosses. Forex trading calculators are equipped with advanced mathematical algorithms that enable the calculation of complex financial equations with accuracy and provide results within seconds.

Pip is short for 'point in percentage'. In forex trading, pip refers to the smallest change in price for a particular currency pair or a movement in the rate of exchange between two currencies. For calculating forex pip a trader needs to select the preferred currency along with the trade size. After this, the pip calculator will compute the pip value with standard, micro and mini lots with the ongoing market rates. In most currency pairs, the pip value lies on the fourth decimal place. Forex pip calculators are an essential part of forex trading as it helps in analyzing growth of an account in a very easy format and enables a trader to plan trading strategy accordingly.

What is a Forex Margin Calculator?