freeamfva's blog

Protecting Progressive Cavity Pumps in Biosolids Systems

Progressive cavity pumps, or screw pumps, have long been fixtures in wastewater treatment facilities. PC pumps are known for being extremely adept at transporting viscous and abrasive fluids, making them an excellent fit for thickened liquids such as waste activated sludge. To get more news about progressive cavity pump, you can visit brysonpump.com official website.

PC pumps consist of a single-helix metal rotor that turns inside of a double-helix molded rubber stator. The rotor and stator construction forms a series of pockets that traverse the length of the pump, pushing fluid from the suction side to the discharge end in a smooth, pulseless flow that is proportional to the rotor speed. The tight tolerances between rotor and stator provide some superior operational benefits but also introduce weaknesses when dealing with wastewater sludge.

The sludge challenge

Wastewater sludge is a high-viscosity, solids-enriched fluid that often contains pump-clogging matter such as large solids, rags and fibers. It is inevitable that inorganic debris will slip through a plant’s headworks screens and become entrained in the process stream, which translates to trash in the plant sludge. This problem has become even worse in recent years with the proliferation of disposable wipes and personal hygiene products that are commonly found in today’s raw sewage. These materials settle within digesters and form larger masses that a PC pump cannot pass. Additionally some solid waste material like small rocks can cause damage to a PC pump’s rotor or stator requiring expensive repairs.

For as long as PC pumps have been pumping wastewater sludge around treatment facilities, operators have been trying to protect the pumps from clogs and damage caused by unwanted debris. Initial attempts were made with single-shafted comminutors. High-speed macerators, which use a spinning blade working against a static orifice plate, have also been tried as a solution to safeguard PC pumps. Both technologies have had limited success and typically break down when dealing with tougher solids or fibrous materials like disposable wipes. The technology that most plant engineers have settled on is two-shafted sewage grinders.

Two-shafted grinders

A leader in the two-shafted sewage grinders is JWC Environmental and its pipeline mounted Muffin Monster suite of grinders. The Muffin Monster grinders utilize low speed with high torque to turn two shafts of hardened steel cutters. The tight tolerance cutters easily shred through any rags and trash in the sludge systems. Due to the high-torque design these grinders can also slice through tougher debris like wood and small rocks that could otherwise damage PC pump components.

The in-line Muffin Monster grinders have been proven in plant sludge systems over the last 40 years to stop pump clogs. Plant operations personnel have benefited in that time from eliminating messy and costly pump repairs as well as stopping unnecessary employee exposure to biosolids. Treatment plant engineers have been so satisfied with Muffin Monsters over the years that the grinders have become a standard piece of equipment for protecting other sensitive plant systems like centrifuges and heat exchangers.

Keeping Monsters current

Over the last four decades the Muffin Monster grinders have also been evolving to keep up with changing requirements. For service and support JWC’s 30K Muffin Monster was updated to have a service-in-place cutter cartridge, that is supported by a cutter cartridge exchange program. This allows operators to order an exact replacement of the cutter cartridge from JWC and have it shipped to the treatment plant without ever taking the plant grinder out of service. The maintenance team can then quickly swap out the cutter cartridge without ever breaking the pipeline flange bolts. The pre-built cutter cartridge comes with a new one-year warranty and the confidence of a factory-certified replacement.

The sludge challenge

Wastewater sludge is a high-viscosity, solids-enriched fluid that often contains pump-clogging matter such as large solids, rags and fibers. It is inevitable that inorganic debris will slip through a plant’s headworks screens and become entrained in the process stream, which translates to trash in the plant sludge. This problem has become even worse in recent years with the proliferation of disposable wipes and personal hygiene products that are commonly found in today’s raw sewage. These materials settle within digesters and form larger masses that a PC pump cannot pass. Additionally some solid waste material like small rocks can cause damage to a PC pump’s rotor or stator requiring expensive repairs.

For as long as PC pumps have been pumping wastewater sludge around treatment facilities, operators have been trying to protect the pumps from clogs and damage caused by unwanted debris. Initial attempts were made with single-shafted comminutors. High-speed macerators, which use a spinning blade working against a static orifice plate, have also been tried as a solution to safeguard PC pumps. Both technologies have had limited success and typically break down when dealing with tougher solids or fibrous materials like disposable wipes. The technology that most plant engineers have settled on is two-shafted sewage grinders.

Two-shafted grinders

A leader in the two-shafted sewage grinders is JWC Environmental and its pipeline mounted Muffin Monster suite of grinders. The Muffin Monster grinders utilize low speed with high torque to turn two shafts of hardened steel cutters. The tight tolerance cutters easily shred through any rags and trash in the sludge systems. Due to the high-torque design these grinders can also slice through tougher debris like wood and small rocks that could otherwise damage PC pump components.

The in-line Muffin Monster grinders have been proven in plant sludge systems over the last 40 years to stop pump clogs. Plant operations personnel have benefited in that time from eliminating messy and costly pump repairs as well as stopping unnecessary employee exposure to biosolids. Treatment plant engineers have been so satisfied with Muffin Monsters over the years that the grinders have become a standard piece of equipment for protecting other sensitive plant systems like centrifuges and heat exchangers.

Keeping Monsters current

Over the last four decades the Muffin Monster grinders have also been evolving to keep up with changing requirements. For service and support JWC’s 30K Muffin Monster was updated to have a service-in-place cutter cartridge, that is supported by a cutter cartridge exchange program. This allows operators to order an exact replacement of the cutter cartridge from JWC and have it shipped to the treatment plant without ever taking the plant grinder out of service. The maintenance team can then quickly swap out the cutter cartridge without ever breaking the pipeline flange bolts. The pre-built cutter cartridge comes with a new one-year warranty and the confidence of a factory-certified replacement.

The sludge challenge

Wastewater sludge is a high-viscosity, solids-enriched fluid that often contains pump-clogging matter such as large solids, rags and fibers. It is inevitable that inorganic debris will slip through a plant’s headworks screens and become entrained in the process stream, which translates to trash in the plant sludge. This problem has become even worse in recent years with the proliferation of disposable wipes and personal hygiene products that are commonly found in today’s raw sewage. These materials settle within digesters and form larger masses that a PC pump cannot pass. Additionally some solid waste material like small rocks can cause damage to a PC pump’s rotor or stator requiring expensive repairs.

For as long as PC pumps have been pumping wastewater sludge around treatment facilities, operators have been trying to protect the pumps from clogs and damage caused by unwanted debris. Initial attempts were made with single-shafted comminutors. High-speed macerators, which use a spinning blade working against a static orifice plate, have also been tried as a solution to safeguard PC pumps. Both technologies have had limited success and typically break down when dealing with tougher solids or fibrous materials like disposable wipes. The technology that most plant engineers have settled on is two-shafted sewage grinders.

Two-shafted grinders

A leader in the two-shafted sewage grinders is JWC Environmental and its pipeline mounted Muffin Monster suite of grinders. The Muffin Monster grinders utilize low speed with high torque to turn two shafts of hardened steel cutters. The tight tolerance cutters easily shred through any rags and trash in the sludge systems. Due to the high-torque design these grinders can also slice through tougher debris like wood and small rocks that could otherwise damage PC pump components.

The in-line Muffin Monster grinders have been proven in plant sludge systems over the last 40 years to stop pump clogs. Plant operations personnel have benefited in that time from eliminating messy and costly pump repairs as well as stopping unnecessary employee exposure to biosolids. Treatment plant engineers have been so satisfied with Muffin Monsters over the years that the grinders have become a standard piece of equipment for protecting other sensitive plant systems like centrifuges and heat exchangers.

Keeping Monsters current

Over the last four decades the Muffin Monster grinders have also been evolving to keep up with changing requirements. For service and support JWC’s 30K Muffin Monster was updated to have a service-in-place cutter cartridge, that is supported by a cutter cartridge exchange program. This allows operators to order an exact replacement of the cutter cartridge from JWC and have it shipped to the treatment plant without ever taking the plant grinder out of service. The maintenance team can then quickly swap out the cutter cartridge without ever breaking the pipeline flange bolts. The pre-built cutter cartridge comes with a new one-year warranty and the confidence of a factory-certified replacement.

The sludge challenge

Wastewater sludge is a high-viscosity, solids-enriched fluid that often contains pump-clogging matter such as large solids, rags and fibers. It is inevitable that inorganic debris will slip through a plant’s headworks screens and become entrained in the process stream, which translates to trash in the plant sludge. This problem has become even worse in recent years with the proliferation of disposable wipes and personal hygiene products that are commonly found in today’s raw sewage. These materials settle within digesters and form larger masses that a PC pump cannot pass. Additionally some solid waste material like small rocks can cause damage to a PC pump’s rotor or stator requiring expensive repairs.

For as long as PC pumps have been pumping wastewater sludge around treatment facilities, operators have been trying to protect the pumps from clogs and damage caused by unwanted debris. Initial attempts were made with single-shafted comminutors. High-speed macerators, which use a spinning blade working against a static orifice plate, have also been tried as a solution to safeguard PC pumps. Both technologies have had limited success and typically break down when dealing with tougher solids or fibrous materials like disposable wipes. The technology that most plant engineers have settled on is two-shafted sewage grinders.

Two-shafted grinders

A leader in the two-shafted sewage grinders is JWC Environmental and its pipeline mounted Muffin Monster suite of grinders. The Muffin Monster grinders utilize low speed with high torque to turn two shafts of hardened steel cutters. The tight tolerance cutters easily shred through any rags and trash in the sludge systems. Due to the high-torque design these grinders can also slice through tougher debris like wood and small rocks that could otherwise damage PC pump components.

The in-line Muffin Monster grinders have been proven in plant sludge systems over the last 40 years to stop pump clogs. Plant operations personnel have benefited in that time from eliminating messy and costly pump repairs as well as stopping unnecessary employee exposure to biosolids. Treatment plant engineers have been so satisfied with Muffin Monsters over the years that the grinders have become a standard piece of equipment for protecting other sensitive plant systems like centrifuges and heat exchangers.

Keeping Monsters current

Over the last four decades the Muffin Monster grinders have also been evolving to keep up with changing requirements. For service and support JWC’s 30K Muffin Monster was updated to have a service-in-place cutter cartridge, that is supported by a cutter cartridge exchange program. This allows operators to order an exact replacement of the cutter cartridge from JWC and have it shipped to the treatment plant without ever taking the plant grinder out of service. The maintenance team can then quickly swap out the cutter cartridge without ever breaking the pipeline flange bolts. The pre-built cutter cartridge comes with a new one-year warranty and the confidence of a factory-certified replacement.

FAIL SAFE VS. FAIL SECURE LOCKS: WHICH DO YOU NEED?

When it comes to your workplace, security is of the utmost importance. No matter what industry you work in, you need a holistic security system that keeps your business-critical data, equipment and people safe.To get more news about commercial safe locks, you can visit securamsys.com official website.

An important part of any comprehensive security system is the locks on your doors – but which type of lock should you choose? There are two main types of electromagnetic locks that can be used to keep your premises safe: fail safe electromagnetic locks and fail secure electromagnetic locks.

Let’s take a look at fail secure vs. fail safe, what they are and the differences between each type.

What are fail safe magnetic door locks?

A fail safe lock is a common type of lock that requires power consumption to keep it locked. They can be unlocked when a valid credential, like a keycard or a fob, is presented. This briefly interrupts the flow of power and the door can be opened.

If there is a power failure, the door will be unlocked completely, allowing people to get both in and out of the room or building and keeping your people safe in emergency situations. In the event of an emergency or natural disaster, people can escape easily, making them a popular choice for main access doors and entry points like office doors.

Using fail safe locks on entry and exit doors in commercial buildings or for classroom locks also allows emergency services access, even if the power goes out.

What are fail secure magnetic door locks?

Fail secure products, or a fail lock, on the other hand, need electrical power to unlock. If your power goes out or fails, then your doors will remain locked from the outside, keeping the room secure. That’s the main difference between fail safe and fail security – one stays locked even if the electricity fails, and the other doesn’t.

If there’s a power outage, types of commercial doors with a fail secure magnetic door lock will remain locked from the outside. However, a fail secure magnetic door lock can be unlocked manually from the inside. So, while fail secure locks make it harder for unauthorized persons to gain access during an emergency, anyone inside the room can still get out with ease. This type of lock can also be overridden to allow for emergency egress.

However, this type of fail secure electronic lock does provide more security. That makes a fail secure lock a good choice for areas which require additional protection or robust secure locks, such as server closets or rooms with valuable data or equipment.

Now you know the difference between fail safe and fail secure locks, but which kind do you need for your workplace or commercial setting?

It’s important to check your local building codes and regulations for emergency systems to ensure you’re complying with the rules in your local area.

Generally speaking though, it makes sense to use fail safe locks in high-traffic areas, where people are continually coming and going. That means that, in the event of an emergency, people can easily get out, and the emergency services can get in without any access issues.

Let’s take a look at fail secure vs. fail safe, what they are and the differences between each type.

What are fail safe magnetic door locks?

A fail safe lock is a common type of lock that requires power consumption to keep it locked. They can be unlocked when a valid credential, like a keycard or a fob, is presented. This briefly interrupts the flow of power and the door can be opened.

If there is a power failure, the door will be unlocked completely, allowing people to get both in and out of the room or building and keeping your people safe in emergency situations. In the event of an emergency or natural disaster, people can escape easily, making them a popular choice for main access doors and entry points like office doors.

Using fail safe locks on entry and exit doors in commercial buildings or for classroom locks also allows emergency services access, even if the power goes out.

What are fail secure magnetic door locks?

Fail secure products, or a fail lock, on the other hand, need electrical power to unlock. If your power goes out or fails, then your doors will remain locked from the outside, keeping the room secure. That’s the main difference between fail safe and fail security – one stays locked even if the electricity fails, and the other doesn’t.

If there’s a power outage, types of commercial doors with a fail secure magnetic door lock will remain locked from the outside. However, a fail secure magnetic door lock can be unlocked manually from the inside. So, while fail secure locks make it harder for unauthorized persons to gain access during an emergency, anyone inside the room can still get out with ease. This type of lock can also be overridden to allow for emergency egress.

However, this type of fail secure electronic lock does provide more security. That makes a fail secure lock a good choice for areas which require additional protection or robust secure locks, such as server closets or rooms with valuable data or equipment.

Now you know the difference between fail safe and fail secure locks, but which kind do you need for your workplace or commercial setting?

It’s important to check your local building codes and regulations for emergency systems to ensure you’re complying with the rules in your local area.

Generally speaking though, it makes sense to use fail safe locks in high-traffic areas, where people are continually coming and going. That means that, in the event of an emergency, people can easily get out, and the emergency services can get in without any access issues.

Let’s take a look at fail secure vs. fail safe, what they are and the differences between each type.

What are fail safe magnetic door locks?

A fail safe lock is a common type of lock that requires power consumption to keep it locked. They can be unlocked when a valid credential, like a keycard or a fob, is presented. This briefly interrupts the flow of power and the door can be opened.

If there is a power failure, the door will be unlocked completely, allowing people to get both in and out of the room or building and keeping your people safe in emergency situations. In the event of an emergency or natural disaster, people can escape easily, making them a popular choice for main access doors and entry points like office doors.

Using fail safe locks on entry and exit doors in commercial buildings or for classroom locks also allows emergency services access, even if the power goes out.

What are fail secure magnetic door locks?

Fail secure products, or a fail lock, on the other hand, need electrical power to unlock. If your power goes out or fails, then your doors will remain locked from the outside, keeping the room secure. That’s the main difference between fail safe and fail security – one stays locked even if the electricity fails, and the other doesn’t.

If there’s a power outage, types of commercial doors with a fail secure magnetic door lock will remain locked from the outside. However, a fail secure magnetic door lock can be unlocked manually from the inside. So, while fail secure locks make it harder for unauthorized persons to gain access during an emergency, anyone inside the room can still get out with ease. This type of lock can also be overridden to allow for emergency egress.

However, this type of fail secure electronic lock does provide more security. That makes a fail secure lock a good choice for areas which require additional protection or robust secure locks, such as server closets or rooms with valuable data or equipment.

Now you know the difference between fail safe and fail secure locks, but which kind do you need for your workplace or commercial setting?

It’s important to check your local building codes and regulations for emergency systems to ensure you’re complying with the rules in your local area.

Generally speaking though, it makes sense to use fail safe locks in high-traffic areas, where people are continually coming and going. That means that, in the event of an emergency, people can easily get out, and the emergency services can get in without any access issues.

Let’s take a look at fail secure vs. fail safe, what they are and the differences between each type.

What are fail safe magnetic door locks?

A fail safe lock is a common type of lock that requires power consumption to keep it locked. They can be unlocked when a valid credential, like a keycard or a fob, is presented. This briefly interrupts the flow of power and the door can be opened.

If there is a power failure, the door will be unlocked completely, allowing people to get both in and out of the room or building and keeping your people safe in emergency situations. In the event of an emergency or natural disaster, people can escape easily, making them a popular choice for main access doors and entry points like office doors.

Using fail safe locks on entry and exit doors in commercial buildings or for classroom locks also allows emergency services access, even if the power goes out.

What are fail secure magnetic door locks?

Fail secure products, or a fail lock, on the other hand, need electrical power to unlock. If your power goes out or fails, then your doors will remain locked from the outside, keeping the room secure. That’s the main difference between fail safe and fail security – one stays locked even if the electricity fails, and the other doesn’t.

If there’s a power outage, types of commercial doors with a fail secure magnetic door lock will remain locked from the outside. However, a fail secure magnetic door lock can be unlocked manually from the inside. So, while fail secure locks make it harder for unauthorized persons to gain access during an emergency, anyone inside the room can still get out with ease. This type of lock can also be overridden to allow for emergency egress.

However, this type of fail secure electronic lock does provide more security. That makes a fail secure lock a good choice for areas which require additional protection or robust secure locks, such as server closets or rooms with valuable data or equipment.

Now you know the difference between fail safe and fail secure locks, but which kind do you need for your workplace or commercial setting?

It’s important to check your local building codes and regulations for emergency systems to ensure you’re complying with the rules in your local area.

Generally speaking though, it makes sense to use fail safe locks in high-traffic areas, where people are continually coming and going. That means that, in the event of an emergency, people can easily get out, and the emergency services can get in without any access issues.

Vonway Forex Review

Vonway Forex is an online trading broker owned by Vonway Global Limited and located at Suite 305, Griffith Corporate Centre, P.O.Box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines.To get more news about vonway review, you can visit wikifx.com official website.

The first step to protecting yourself from fraudulent parties online is to do thorough due diligence on the companies and entities that you are planning to send the funds to. In all probability, there have been other users who have already used the same service, and have expressed their opinions and feedback online on various forums.

After conducting some research on various social media platforms (Facebook, Twitter, Instagram), as well as online trading forums, a general theme emerged where users were dissatisfied with their experience with Vonway Forex. Based on this user feedback, it appears that Vonway Forex is not a trustworthy broker, and hence, extreme caution should be applied before investing through their brokerage platform.

There are a lot of brokers out there operating under fake company names or that have other fraudulent operations. A little bit of preliminary research can go a long way in protecting you and your finances.

Is Vonway Forex Legit or a Scam?

When searching for brokers to conduct your trading activities with, the first and most important step should always be to learn about their certification(s). This will tell you whether they are regulated by a central authority or if Vonway Forex is an offshore and/or unregulated entity.

When a broker is unregulated or regulated by an entity outside of your jurisdiction, you have limited to no legal recourse in the event that your funds are compromised. In an event of theft, complaints can only be made if that broker is licensed by the regulator in your jurisdiction. Some examples of regulatory authorities that issue brokerage licenses are:

How Online Trading Scams Work?

One of the most prevalent online trading scams is to initially display profitable trades that give the investor a false sense of confidence, and get them hooked to the idea of ‘easy money’. Once this confidence is established, the investor will be marketed the idea of investing more money to earn greater returns. Additionally, other incentives may also be provided to encourage the investor to get their friends and family onboard the platform too.

Once the brokerage believes that they have extracted all available funds from an investor and his/her network, they will then proceed to suspend the account, and the investor will no longer be able to access the funds put in.

Many fraudulent firms will even claim to be domiciled in a regulated jurisdiction, and display fake regulatory licenses and addresses on their websites to try and improve their credibility with unsuspecting investors.

Be careful and verify your information through multiple sources. Constant vigilance should be applied at all times when sending money online.

After conducting some research on various social media platforms (Facebook, Twitter, Instagram), as well as online trading forums, a general theme emerged where users were dissatisfied with their experience with Vonway Forex. Based on this user feedback, it appears that Vonway Forex is not a trustworthy broker, and hence, extreme caution should be applied before investing through their brokerage platform.

There are a lot of brokers out there operating under fake company names or that have other fraudulent operations. A little bit of preliminary research can go a long way in protecting you and your finances.

Is Vonway Forex Legit or a Scam?

When searching for brokers to conduct your trading activities with, the first and most important step should always be to learn about their certification(s). This will tell you whether they are regulated by a central authority or if Vonway Forex is an offshore and/or unregulated entity.

When a broker is unregulated or regulated by an entity outside of your jurisdiction, you have limited to no legal recourse in the event that your funds are compromised. In an event of theft, complaints can only be made if that broker is licensed by the regulator in your jurisdiction. Some examples of regulatory authorities that issue brokerage licenses are:

How Online Trading Scams Work?

One of the most prevalent online trading scams is to initially display profitable trades that give the investor a false sense of confidence, and get them hooked to the idea of ‘easy money’. Once this confidence is established, the investor will be marketed the idea of investing more money to earn greater returns. Additionally, other incentives may also be provided to encourage the investor to get their friends and family onboard the platform too.

Once the brokerage believes that they have extracted all available funds from an investor and his/her network, they will then proceed to suspend the account, and the investor will no longer be able to access the funds put in.

Many fraudulent firms will even claim to be domiciled in a regulated jurisdiction, and display fake regulatory licenses and addresses on their websites to try and improve their credibility with unsuspecting investors.

Be careful and verify your information through multiple sources. Constant vigilance should be applied at all times when sending money online.

After conducting some research on various social media platforms (Facebook, Twitter, Instagram), as well as online trading forums, a general theme emerged where users were dissatisfied with their experience with Vonway Forex. Based on this user feedback, it appears that Vonway Forex is not a trustworthy broker, and hence, extreme caution should be applied before investing through their brokerage platform.

There are a lot of brokers out there operating under fake company names or that have other fraudulent operations. A little bit of preliminary research can go a long way in protecting you and your finances.

Is Vonway Forex Legit or a Scam?

When searching for brokers to conduct your trading activities with, the first and most important step should always be to learn about their certification(s). This will tell you whether they are regulated by a central authority or if Vonway Forex is an offshore and/or unregulated entity.

When a broker is unregulated or regulated by an entity outside of your jurisdiction, you have limited to no legal recourse in the event that your funds are compromised. In an event of theft, complaints can only be made if that broker is licensed by the regulator in your jurisdiction. Some examples of regulatory authorities that issue brokerage licenses are:

How Online Trading Scams Work?

One of the most prevalent online trading scams is to initially display profitable trades that give the investor a false sense of confidence, and get them hooked to the idea of ‘easy money’. Once this confidence is established, the investor will be marketed the idea of investing more money to earn greater returns. Additionally, other incentives may also be provided to encourage the investor to get their friends and family onboard the platform too.

Once the brokerage believes that they have extracted all available funds from an investor and his/her network, they will then proceed to suspend the account, and the investor will no longer be able to access the funds put in.

Many fraudulent firms will even claim to be domiciled in a regulated jurisdiction, and display fake regulatory licenses and addresses on their websites to try and improve their credibility with unsuspecting investors.

Be careful and verify your information through multiple sources. Constant vigilance should be applied at all times when sending money online.

After conducting some research on various social media platforms (Facebook, Twitter, Instagram), as well as online trading forums, a general theme emerged where users were dissatisfied with their experience with Vonway Forex. Based on this user feedback, it appears that Vonway Forex is not a trustworthy broker, and hence, extreme caution should be applied before investing through their brokerage platform.

There are a lot of brokers out there operating under fake company names or that have other fraudulent operations. A little bit of preliminary research can go a long way in protecting you and your finances.

Is Vonway Forex Legit or a Scam?

When searching for brokers to conduct your trading activities with, the first and most important step should always be to learn about their certification(s). This will tell you whether they are regulated by a central authority or if Vonway Forex is an offshore and/or unregulated entity.

When a broker is unregulated or regulated by an entity outside of your jurisdiction, you have limited to no legal recourse in the event that your funds are compromised. In an event of theft, complaints can only be made if that broker is licensed by the regulator in your jurisdiction. Some examples of regulatory authorities that issue brokerage licenses are:

How Online Trading Scams Work?

One of the most prevalent online trading scams is to initially display profitable trades that give the investor a false sense of confidence, and get them hooked to the idea of ‘easy money’. Once this confidence is established, the investor will be marketed the idea of investing more money to earn greater returns. Additionally, other incentives may also be provided to encourage the investor to get their friends and family onboard the platform too.

Once the brokerage believes that they have extracted all available funds from an investor and his/her network, they will then proceed to suspend the account, and the investor will no longer be able to access the funds put in.

Many fraudulent firms will even claim to be domiciled in a regulated jurisdiction, and display fake regulatory licenses and addresses on their websites to try and improve their credibility with unsuspecting investors.

Be careful and verify your information through multiple sources. Constant vigilance should be applied at all times when sending money online.

ActivTrades Review 2023

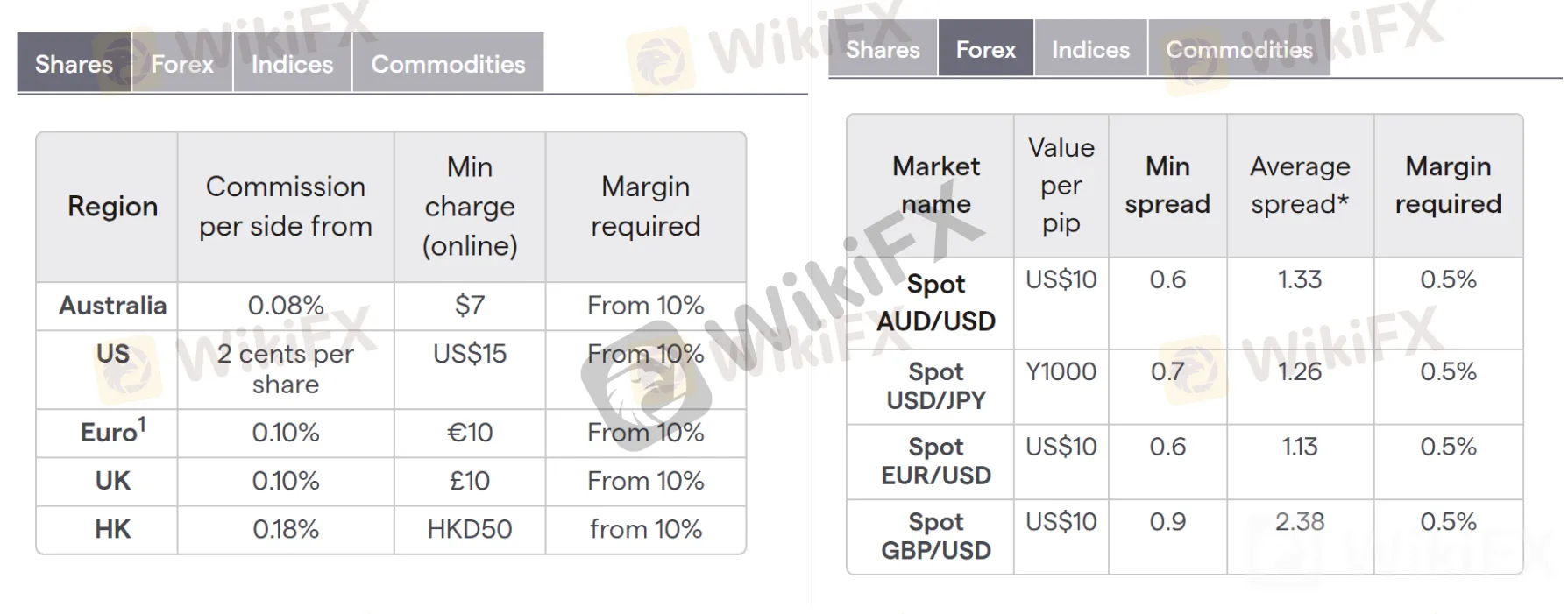

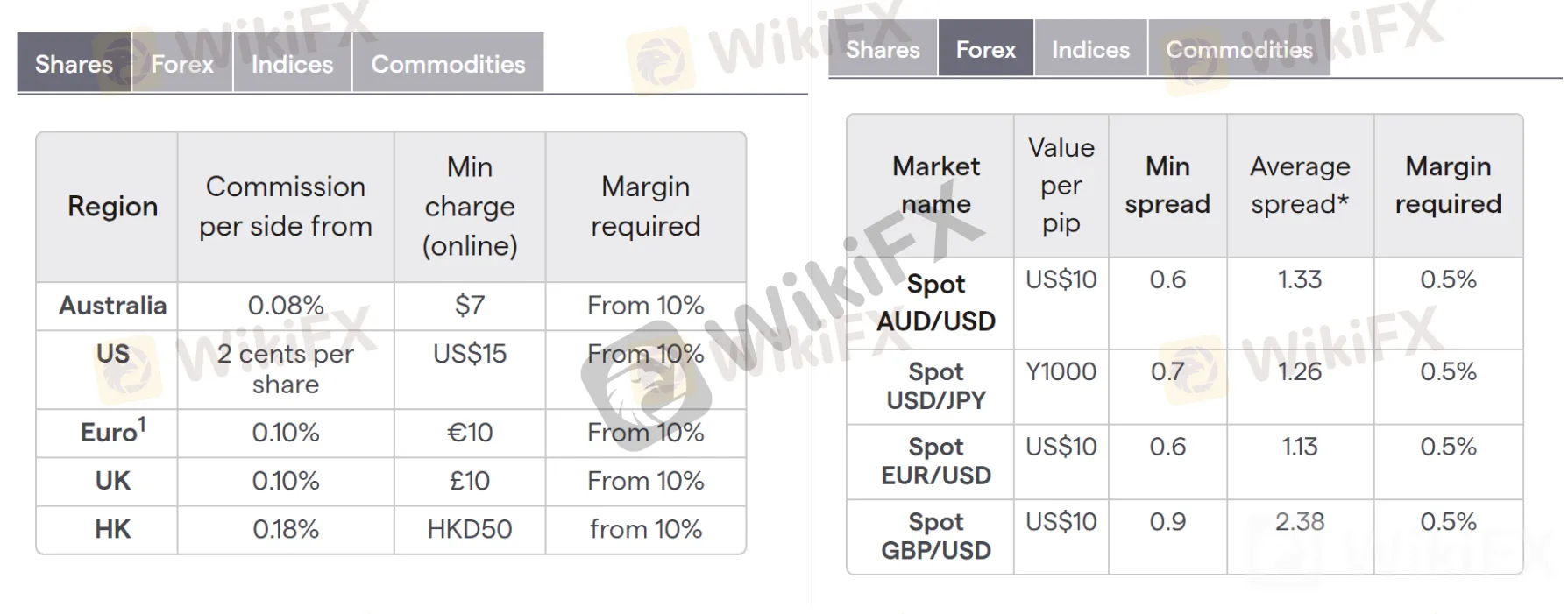

The ActivTrades broker has been operating since 2001. The company allows clients to trade on the Forex market, CFDs on stocks, ETFs, and other instruments. In total, the broker has six types of assets available. ActivTrades is headquartered in London, with additional offices in Milan, Sofia, and Nassau. The company operates under two licenses, the UK (FCA), the Bahamas (SCB), the CSSF (Luxembourg) and CONSOB (Italy). During its tenure, the broker has received 26 awards.To get more news about activtrades review, you can visit wikifx.com official website.

This broker is ideal for me and there’s no better company for trading. Forex spreads are very tight here, from 0.5 pips. Not only are currency pairs available for trading, but also a vast array of other instruments, such as: CFDs on stocks, ETFs, commodities, indices, metals, and more than 1,000 positions in total. I am overjoyed with their convenient add-ons for technical analysis and deal management. I actively use SmartLines and SmartOrder. They are designed for seasoned professionals, but a beginner can figure it out in two shakes. Also, the broker has a convenient trading terminal with a proprietary design. There are loads of functions for analyzing charts, and the speed is optimal. For classic lovers, there are MT4 and MT5 terminals. I like everything, and I do not plan to change the broker.

The speed of execution of transactions is vital for managing clients' assets. And ActivTrades has a high rate of 0.004 seconds. Trading conditions are eye-catching, with the possibility of using leverage up to 1:400 on professional accounts. I am actively trading CFDs with a broker and am pleased with the choices, which include more than 500 ETF contracts, more than 600 contracts for shares, and the ability to trade shares in three markets. Fees for CFDs on stocks are profitable at 0.02 USD per lot for American stocks, and that suits me. Analytics and the ability to obtain market data are also mind-blowing. The broker made a good impression, no technical problems were observed during my work sessions. Among the disadvantages for beginners is the lack of options for passive earnings. Nevertheless, this is a must-have for a broker.

I always choose brokers based on reliability. And there are no questions that ActivTrades fits the bill. Regulation by the reputable FCA regulator and large deposit insurance (up to 1 million USD) inspires confidence in the company. The broker is well suited for traders who work on Forex. But there are practically no instruments for investors. I use this broker to trade stock CFDs. But I would like to get investment tools such as PAMM, copy-trading services, etc. I would also like to note that 500 bucks are not a small deposit for beginners. Take this nuance into account. But the broker's training program is excellent, there are a lot of training and webinars.

ActivTrades is a broker that has been providing services on the market for over 20 years. The company is focused primarily on active traders. More than 1,000 instruments and favorable trading conditions (spreads from 0.5 pips) are offered. The broker has practically no instruments for passive investments. The company has a medium-sized entry threshold of $500, and there is a demo account. It is worth noting the high-quality training for beginners. The broker regularly conducts webinars that are of interest to both novice and experienced clients who seek to improve their trading skills.

ActivTrades offers clients individual and professional account types. For private traders, the company limits the leverage to a maximum of 1:30. Professionals can work with leverage up to 1:400. Traders who open a Professional account with 1:1 leverage and no swaps can trade CFDs on shares with a zero fee.

ActivTrades is a trusted broker that is regulated by the FCA and SCB. For additional security of clients, the broker maintains deposit insurance up to $1 million and protection against a negative balance. The company is focused on different regions and has a wide audience of users from various countries. Affiliate programs allow private traders to receive bonuses and institutional investors to improve the quality of their services.

This broker is ideal for me and there’s no better company for trading. Forex spreads are very tight here, from 0.5 pips. Not only are currency pairs available for trading, but also a vast array of other instruments, such as: CFDs on stocks, ETFs, commodities, indices, metals, and more than 1,000 positions in total. I am overjoyed with their convenient add-ons for technical analysis and deal management. I actively use SmartLines and SmartOrder. They are designed for seasoned professionals, but a beginner can figure it out in two shakes. Also, the broker has a convenient trading terminal with a proprietary design. There are loads of functions for analyzing charts, and the speed is optimal. For classic lovers, there are MT4 and MT5 terminals. I like everything, and I do not plan to change the broker.

The speed of execution of transactions is vital for managing clients' assets. And ActivTrades has a high rate of 0.004 seconds. Trading conditions are eye-catching, with the possibility of using leverage up to 1:400 on professional accounts. I am actively trading CFDs with a broker and am pleased with the choices, which include more than 500 ETF contracts, more than 600 contracts for shares, and the ability to trade shares in three markets. Fees for CFDs on stocks are profitable at 0.02 USD per lot for American stocks, and that suits me. Analytics and the ability to obtain market data are also mind-blowing. The broker made a good impression, no technical problems were observed during my work sessions. Among the disadvantages for beginners is the lack of options for passive earnings. Nevertheless, this is a must-have for a broker.

I always choose brokers based on reliability. And there are no questions that ActivTrades fits the bill. Regulation by the reputable FCA regulator and large deposit insurance (up to 1 million USD) inspires confidence in the company. The broker is well suited for traders who work on Forex. But there are practically no instruments for investors. I use this broker to trade stock CFDs. But I would like to get investment tools such as PAMM, copy-trading services, etc. I would also like to note that 500 bucks are not a small deposit for beginners. Take this nuance into account. But the broker's training program is excellent, there are a lot of training and webinars.

ActivTrades is a broker that has been providing services on the market for over 20 years. The company is focused primarily on active traders. More than 1,000 instruments and favorable trading conditions (spreads from 0.5 pips) are offered. The broker has practically no instruments for passive investments. The company has a medium-sized entry threshold of $500, and there is a demo account. It is worth noting the high-quality training for beginners. The broker regularly conducts webinars that are of interest to both novice and experienced clients who seek to improve their trading skills.

ActivTrades offers clients individual and professional account types. For private traders, the company limits the leverage to a maximum of 1:30. Professionals can work with leverage up to 1:400. Traders who open a Professional account with 1:1 leverage and no swaps can trade CFDs on shares with a zero fee.

ActivTrades is a trusted broker that is regulated by the FCA and SCB. For additional security of clients, the broker maintains deposit insurance up to $1 million and protection against a negative balance. The company is focused on different regions and has a wide audience of users from various countries. Affiliate programs allow private traders to receive bonuses and institutional investors to improve the quality of their services.

This broker is ideal for me and there’s no better company for trading. Forex spreads are very tight here, from 0.5 pips. Not only are currency pairs available for trading, but also a vast array of other instruments, such as: CFDs on stocks, ETFs, commodities, indices, metals, and more than 1,000 positions in total. I am overjoyed with their convenient add-ons for technical analysis and deal management. I actively use SmartLines and SmartOrder. They are designed for seasoned professionals, but a beginner can figure it out in two shakes. Also, the broker has a convenient trading terminal with a proprietary design. There are loads of functions for analyzing charts, and the speed is optimal. For classic lovers, there are MT4 and MT5 terminals. I like everything, and I do not plan to change the broker.

The speed of execution of transactions is vital for managing clients' assets. And ActivTrades has a high rate of 0.004 seconds. Trading conditions are eye-catching, with the possibility of using leverage up to 1:400 on professional accounts. I am actively trading CFDs with a broker and am pleased with the choices, which include more than 500 ETF contracts, more than 600 contracts for shares, and the ability to trade shares in three markets. Fees for CFDs on stocks are profitable at 0.02 USD per lot for American stocks, and that suits me. Analytics and the ability to obtain market data are also mind-blowing. The broker made a good impression, no technical problems were observed during my work sessions. Among the disadvantages for beginners is the lack of options for passive earnings. Nevertheless, this is a must-have for a broker.

I always choose brokers based on reliability. And there are no questions that ActivTrades fits the bill. Regulation by the reputable FCA regulator and large deposit insurance (up to 1 million USD) inspires confidence in the company. The broker is well suited for traders who work on Forex. But there are practically no instruments for investors. I use this broker to trade stock CFDs. But I would like to get investment tools such as PAMM, copy-trading services, etc. I would also like to note that 500 bucks are not a small deposit for beginners. Take this nuance into account. But the broker's training program is excellent, there are a lot of training and webinars.

ActivTrades is a broker that has been providing services on the market for over 20 years. The company is focused primarily on active traders. More than 1,000 instruments and favorable trading conditions (spreads from 0.5 pips) are offered. The broker has practically no instruments for passive investments. The company has a medium-sized entry threshold of $500, and there is a demo account. It is worth noting the high-quality training for beginners. The broker regularly conducts webinars that are of interest to both novice and experienced clients who seek to improve their trading skills.

ActivTrades offers clients individual and professional account types. For private traders, the company limits the leverage to a maximum of 1:30. Professionals can work with leverage up to 1:400. Traders who open a Professional account with 1:1 leverage and no swaps can trade CFDs on shares with a zero fee.

ActivTrades is a trusted broker that is regulated by the FCA and SCB. For additional security of clients, the broker maintains deposit insurance up to $1 million and protection against a negative balance. The company is focused on different regions and has a wide audience of users from various countries. Affiliate programs allow private traders to receive bonuses and institutional investors to improve the quality of their services.

This broker is ideal for me and there’s no better company for trading. Forex spreads are very tight here, from 0.5 pips. Not only are currency pairs available for trading, but also a vast array of other instruments, such as: CFDs on stocks, ETFs, commodities, indices, metals, and more than 1,000 positions in total. I am overjoyed with their convenient add-ons for technical analysis and deal management. I actively use SmartLines and SmartOrder. They are designed for seasoned professionals, but a beginner can figure it out in two shakes. Also, the broker has a convenient trading terminal with a proprietary design. There are loads of functions for analyzing charts, and the speed is optimal. For classic lovers, there are MT4 and MT5 terminals. I like everything, and I do not plan to change the broker.

The speed of execution of transactions is vital for managing clients' assets. And ActivTrades has a high rate of 0.004 seconds. Trading conditions are eye-catching, with the possibility of using leverage up to 1:400 on professional accounts. I am actively trading CFDs with a broker and am pleased with the choices, which include more than 500 ETF contracts, more than 600 contracts for shares, and the ability to trade shares in three markets. Fees for CFDs on stocks are profitable at 0.02 USD per lot for American stocks, and that suits me. Analytics and the ability to obtain market data are also mind-blowing. The broker made a good impression, no technical problems were observed during my work sessions. Among the disadvantages for beginners is the lack of options for passive earnings. Nevertheless, this is a must-have for a broker.

I always choose brokers based on reliability. And there are no questions that ActivTrades fits the bill. Regulation by the reputable FCA regulator and large deposit insurance (up to 1 million USD) inspires confidence in the company. The broker is well suited for traders who work on Forex. But there are practically no instruments for investors. I use this broker to trade stock CFDs. But I would like to get investment tools such as PAMM, copy-trading services, etc. I would also like to note that 500 bucks are not a small deposit for beginners. Take this nuance into account. But the broker's training program is excellent, there are a lot of training and webinars.

ActivTrades is a broker that has been providing services on the market for over 20 years. The company is focused primarily on active traders. More than 1,000 instruments and favorable trading conditions (spreads from 0.5 pips) are offered. The broker has practically no instruments for passive investments. The company has a medium-sized entry threshold of $500, and there is a demo account. It is worth noting the high-quality training for beginners. The broker regularly conducts webinars that are of interest to both novice and experienced clients who seek to improve their trading skills.

ActivTrades offers clients individual and professional account types. For private traders, the company limits the leverage to a maximum of 1:30. Professionals can work with leverage up to 1:400. Traders who open a Professional account with 1:1 leverage and no swaps can trade CFDs on shares with a zero fee.

ActivTrades is a trusted broker that is regulated by the FCA and SCB. For additional security of clients, the broker maintains deposit insurance up to $1 million and protection against a negative balance. The company is focused on different regions and has a wide audience of users from various countries. Affiliate programs allow private traders to receive bonuses and institutional investors to improve the quality of their services.

XTrend Speed Review 2023

XTrend Speed is a classic broker providing CFD trading services for all major types of financial assets. The company works with traders from over 170 countries. The regulator of XTrend Speed is FSCA (South Africa), and CySEC is the regulator of Xtrend's subsidiary, which represents the mobile platform Micro Trading.To get more news about xtrend speed review, you can visit wikifx.com official website.

This is a good broker for active trading. It has everything from currency pairs to cryptocurrencies. The interesting mobile platform has a user-friendly interface and no overload of functions and buttons. It has high commissions, but it is not critical if you open long-term positions. My opinion of the application is positive.

The Xtrend mobile app is a good idea for those who see trading not as their main job, but as a pastime and for those who enjoy participating, but not for profit. I am often on business trips and can’t fully trade on my computer or laptop. I installed the Xtrend app and sometimes open and close Bitcoin trades. I don't need complex functional trading platforms and don't want to understand it all in-depth. I installed Xtrend on my smartphone and opened trades with a couple of clicks. I don't have a goal to earn 100% a month, I don't do technical analysis. When I hear the news and see a growing trend, I open a small position. I don’t feel sorry for my money in case I make a loss. I like the process, the trading excitement, and the understanding that I am part of the financial markets.

I read the FAQs section of the Xtrend mobile platform and have many questions. First, what does "minimum lot size 100" mean? What asset is it for? If there are only a few currency pairs, what do they mean by 100? Second, why does it say sometimes that the deposit amounts to $50 and sometimes it is $5? Third, the FAQs indicated the currency of the deposit is USD, while the withdrawal section also indicated EUR and GBP? And these are just questions about the mobile app itself! I couldn't find any info about deposit/withdrawal on XTrend Speed's main website, and no information about trading terms. If I have to ask for support, is it worth my time? There are more questions than answers.

We need to be clear about the brands. There are two companies: Rynat Capital and Rynat Trading. The companies are registered in different jurisdictions but share the same corporate mark. Rynat Capital owns the rights to the XTrend Speed brand and is a classic broker whose website has a relative lack of information. Rynat Trading owns the XTrend brand, a mobile trading platform that complements the information the XTrend Speed website doesn’t have. And both websites prove that XTrend Speed and XTrend can be considered as one.

The company offers trading of over 150 assets on two platforms: MT4 and STrader. MT4 implies adding custom indicators and algorithmic trading. STrader is focused on social trading.

An evaluation of the XTrend Speed (XTrend) broker, results in a solid 4 on a 5-point scale. It can be said that the developers' attempt to offer a budget niche version of the trading product was a success, but the platform and the idea itself require improvement. The broker focuses on mobile trading. The developers position their product as a Micro Trading application for those who like to trade on the go.

XTrend Speed investment programs are represented by external and internal social trading services. The external service is the MQL5 community trade copying service and it is available from the MT4 platform. Any XTrend Speed client can subscribe to it after registration on the MQL5 website and linking the live deposited account to the platform. The feature is a paid subscription irrespective of the signals provider's performance.

STrader is social trading for active investors

STrader is XTrend Speed’s trading platform and has the service of transaction copying integrated into it. The signal providers are traders of the broker. An investor connects his account to one or more traders, then their trades are automatically copied to his account. The investor can disconnect from an account at any time. For successful trades, the investor receives remuneration from the investor's profit.

This is a good broker for active trading. It has everything from currency pairs to cryptocurrencies. The interesting mobile platform has a user-friendly interface and no overload of functions and buttons. It has high commissions, but it is not critical if you open long-term positions. My opinion of the application is positive.

The Xtrend mobile app is a good idea for those who see trading not as their main job, but as a pastime and for those who enjoy participating, but not for profit. I am often on business trips and can’t fully trade on my computer or laptop. I installed the Xtrend app and sometimes open and close Bitcoin trades. I don't need complex functional trading platforms and don't want to understand it all in-depth. I installed Xtrend on my smartphone and opened trades with a couple of clicks. I don't have a goal to earn 100% a month, I don't do technical analysis. When I hear the news and see a growing trend, I open a small position. I don’t feel sorry for my money in case I make a loss. I like the process, the trading excitement, and the understanding that I am part of the financial markets.

I read the FAQs section of the Xtrend mobile platform and have many questions. First, what does "minimum lot size 100" mean? What asset is it for? If there are only a few currency pairs, what do they mean by 100? Second, why does it say sometimes that the deposit amounts to $50 and sometimes it is $5? Third, the FAQs indicated the currency of the deposit is USD, while the withdrawal section also indicated EUR and GBP? And these are just questions about the mobile app itself! I couldn't find any info about deposit/withdrawal on XTrend Speed's main website, and no information about trading terms. If I have to ask for support, is it worth my time? There are more questions than answers.

We need to be clear about the brands. There are two companies: Rynat Capital and Rynat Trading. The companies are registered in different jurisdictions but share the same corporate mark. Rynat Capital owns the rights to the XTrend Speed brand and is a classic broker whose website has a relative lack of information. Rynat Trading owns the XTrend brand, a mobile trading platform that complements the information the XTrend Speed website doesn’t have. And both websites prove that XTrend Speed and XTrend can be considered as one.

The company offers trading of over 150 assets on two platforms: MT4 and STrader. MT4 implies adding custom indicators and algorithmic trading. STrader is focused on social trading.

An evaluation of the XTrend Speed (XTrend) broker, results in a solid 4 on a 5-point scale. It can be said that the developers' attempt to offer a budget niche version of the trading product was a success, but the platform and the idea itself require improvement. The broker focuses on mobile trading. The developers position their product as a Micro Trading application for those who like to trade on the go.

XTrend Speed investment programs are represented by external and internal social trading services. The external service is the MQL5 community trade copying service and it is available from the MT4 platform. Any XTrend Speed client can subscribe to it after registration on the MQL5 website and linking the live deposited account to the platform. The feature is a paid subscription irrespective of the signals provider's performance.

STrader is social trading for active investors

STrader is XTrend Speed’s trading platform and has the service of transaction copying integrated into it. The signal providers are traders of the broker. An investor connects his account to one or more traders, then their trades are automatically copied to his account. The investor can disconnect from an account at any time. For successful trades, the investor receives remuneration from the investor's profit.

This is a good broker for active trading. It has everything from currency pairs to cryptocurrencies. The interesting mobile platform has a user-friendly interface and no overload of functions and buttons. It has high commissions, but it is not critical if you open long-term positions. My opinion of the application is positive.

The Xtrend mobile app is a good idea for those who see trading not as their main job, but as a pastime and for those who enjoy participating, but not for profit. I am often on business trips and can’t fully trade on my computer or laptop. I installed the Xtrend app and sometimes open and close Bitcoin trades. I don't need complex functional trading platforms and don't want to understand it all in-depth. I installed Xtrend on my smartphone and opened trades with a couple of clicks. I don't have a goal to earn 100% a month, I don't do technical analysis. When I hear the news and see a growing trend, I open a small position. I don’t feel sorry for my money in case I make a loss. I like the process, the trading excitement, and the understanding that I am part of the financial markets.

I read the FAQs section of the Xtrend mobile platform and have many questions. First, what does "minimum lot size 100" mean? What asset is it for? If there are only a few currency pairs, what do they mean by 100? Second, why does it say sometimes that the deposit amounts to $50 and sometimes it is $5? Third, the FAQs indicated the currency of the deposit is USD, while the withdrawal section also indicated EUR and GBP? And these are just questions about the mobile app itself! I couldn't find any info about deposit/withdrawal on XTrend Speed's main website, and no information about trading terms. If I have to ask for support, is it worth my time? There are more questions than answers.

We need to be clear about the brands. There are two companies: Rynat Capital and Rynat Trading. The companies are registered in different jurisdictions but share the same corporate mark. Rynat Capital owns the rights to the XTrend Speed brand and is a classic broker whose website has a relative lack of information. Rynat Trading owns the XTrend brand, a mobile trading platform that complements the information the XTrend Speed website doesn’t have. And both websites prove that XTrend Speed and XTrend can be considered as one.

The company offers trading of over 150 assets on two platforms: MT4 and STrader. MT4 implies adding custom indicators and algorithmic trading. STrader is focused on social trading.

An evaluation of the XTrend Speed (XTrend) broker, results in a solid 4 on a 5-point scale. It can be said that the developers' attempt to offer a budget niche version of the trading product was a success, but the platform and the idea itself require improvement. The broker focuses on mobile trading. The developers position their product as a Micro Trading application for those who like to trade on the go.

XTrend Speed investment programs are represented by external and internal social trading services. The external service is the MQL5 community trade copying service and it is available from the MT4 platform. Any XTrend Speed client can subscribe to it after registration on the MQL5 website and linking the live deposited account to the platform. The feature is a paid subscription irrespective of the signals provider's performance.

STrader is social trading for active investors

STrader is XTrend Speed’s trading platform and has the service of transaction copying integrated into it. The signal providers are traders of the broker. An investor connects his account to one or more traders, then their trades are automatically copied to his account. The investor can disconnect from an account at any time. For successful trades, the investor receives remuneration from the investor's profit.

This is a good broker for active trading. It has everything from currency pairs to cryptocurrencies. The interesting mobile platform has a user-friendly interface and no overload of functions and buttons. It has high commissions, but it is not critical if you open long-term positions. My opinion of the application is positive.

The Xtrend mobile app is a good idea for those who see trading not as their main job, but as a pastime and for those who enjoy participating, but not for profit. I am often on business trips and can’t fully trade on my computer or laptop. I installed the Xtrend app and sometimes open and close Bitcoin trades. I don't need complex functional trading platforms and don't want to understand it all in-depth. I installed Xtrend on my smartphone and opened trades with a couple of clicks. I don't have a goal to earn 100% a month, I don't do technical analysis. When I hear the news and see a growing trend, I open a small position. I don’t feel sorry for my money in case I make a loss. I like the process, the trading excitement, and the understanding that I am part of the financial markets.

I read the FAQs section of the Xtrend mobile platform and have many questions. First, what does "minimum lot size 100" mean? What asset is it for? If there are only a few currency pairs, what do they mean by 100? Second, why does it say sometimes that the deposit amounts to $50 and sometimes it is $5? Third, the FAQs indicated the currency of the deposit is USD, while the withdrawal section also indicated EUR and GBP? And these are just questions about the mobile app itself! I couldn't find any info about deposit/withdrawal on XTrend Speed's main website, and no information about trading terms. If I have to ask for support, is it worth my time? There are more questions than answers.

We need to be clear about the brands. There are two companies: Rynat Capital and Rynat Trading. The companies are registered in different jurisdictions but share the same corporate mark. Rynat Capital owns the rights to the XTrend Speed brand and is a classic broker whose website has a relative lack of information. Rynat Trading owns the XTrend brand, a mobile trading platform that complements the information the XTrend Speed website doesn’t have. And both websites prove that XTrend Speed and XTrend can be considered as one.

The company offers trading of over 150 assets on two platforms: MT4 and STrader. MT4 implies adding custom indicators and algorithmic trading. STrader is focused on social trading.

An evaluation of the XTrend Speed (XTrend) broker, results in a solid 4 on a 5-point scale. It can be said that the developers' attempt to offer a budget niche version of the trading product was a success, but the platform and the idea itself require improvement. The broker focuses on mobile trading. The developers position their product as a Micro Trading application for those who like to trade on the go.

XTrend Speed investment programs are represented by external and internal social trading services. The external service is the MQL5 community trade copying service and it is available from the MT4 platform. Any XTrend Speed client can subscribe to it after registration on the MQL5 website and linking the live deposited account to the platform. The feature is a paid subscription irrespective of the signals provider's performance.

STrader is social trading for active investors

STrader is XTrend Speed’s trading platform and has the service of transaction copying integrated into it. The signal providers are traders of the broker. An investor connects his account to one or more traders, then their trades are automatically copied to his account. The investor can disconnect from an account at any time. For successful trades, the investor receives remuneration from the investor's profit.

Veracity Markets (VeracityMarkets) Review 2023

Veracity Markets is an STP and ECN broker, which has been providing online access to trading Forex and CFD instruments since 2020. The broker’s focus is the traders from African countries, although the company accepts clients from all around the world. The broker offers 250+ instruments for trading, a wide selection of accounts, 24h support and the most popular trading platforms MT4 and MT5. The operation of Veracity Markets is regulated by the Financial Sector Conduct Authority (FSCA).To get more news about veracity markets review, you can visit wikifx.com official website.

Veracity Markets appeared in the market quite recently. I learned about it three months ago and opened an account right away. I didn’t like the work of customer support right away; the operators responded vaguely, without providing specific information. Some questions were answered by parts of text simply copied from the website. So what is the purpose of customer support then? Well, that’s not the most important thing in a broker, so let me go over the conditions. Order execution speed is excellent, the platform operates quickly, while the spreads on the Standard Account are high. I haven’t reached the level of an ECN account, so I invest in MAM and trade indices from time to time via Veracity Markets. For Forex trading I use a different broker.

Veracity Markets hasn’t impressed me that much, because dozens of other brokers offer similar trading conditions. The spreads are floating and with a tranquil market they are average. You can trade with leverage up to 1:500 and that’s enough for me. It takes the broker a very long time to withdraw money via a wire transfer. On some occasions I had to wait for 3 or even 5 days. Transfers to electronic wallets are instant, but a fee is charged. The broker does not offer bonuses, while the partnership programs are only available to companies. I still trade on Veracity Markets sometimes, but not very often.

I’ve been trading with Veracity Markets for almost a year and so far I haven’t been disappointed. I started working with an ECN account on MT4 right away. I trade stock and index CFDs, and the broker does not charge any additional commissions, only spread. Withdrawals via a wire transfer take a bit long, but the most important thing is that the money is transferred, so it is worth waiting for a couple of days. Also, you have to search other websites for analytics and news. I didn’t like it at first, but now I’ve just gotten used to it. I like it that you can use Expert Advisors. I don’t care much about the bonuses. We all know that in the majority of cases you have to work them off, therefore I’m even happy that there aren’t any unnecessary temptations.

Veracity Markets is a private South African company with offices in Cape Town and Sandton, which was established in 2020. It is an execution-only intermediary and uses regulated liquidity providers for clearing the trades of its clients. The broker works not only with the traders from South Africa. At the moment, it services more than 300,000 trading accounts of clients from all around the world.

Veracity Markets offers dynamic leverage: its value automatically adjusts to the used margin and trading volume of a chosen financial instrument. Therefore, as the trading volume increases the percentage of the margin also increases in accordance with the dynamic value of leverage for an asset. Clients have access to a wide range of trading accounts with floating spreads from cent accounts to ECN. The minimum deposit on all account types is $250.

The spread on the accounts that are not for professional trading start from 1.6-2 pips. The number of available Forex pairs is 38, which is fewer than other brokers offer. Also, Veracity Markets does not provide access to trading via WebTrader. The available platforms MT4 and MT5 must be installed on a PC, tablet or smartphone.

Veracity Markets does not offer its own investment options, but its clients can use all available passive income features offered by MT4 and MT5. The company allows traders to use Expert Advisors, copy signals from MQL5.com or provide signals. Also, for additional profit, clients can connect to MAM service and participate in partnership programs that offer different types of rewards.

Multi-Account Manager — a passive income service

Multi-Account Manager or MAM allows managers to execute trades on an unlimited number of connected sub-accounts. At that, the funds of the manager and investors are separated and the manager does not have access to the deposits of the subscribers. The main features of MAM service include:

An investor can monitor trades and profit in real time mode.

There is no account servicing fee for MAM accounts. Investors connect to the system for free.

Several types of distribution are available: Balance, Lot, Percentage or Equity.

An unlimited number of investors can connect to the manager’s account.

After a trader chooses the manager and connects to his/her account, all trades executed on it are mirrored on the sub-accounts of subscribers. If the manager executes a successful trade, both parties win: an investor earns profit without trading on their own and the manager earns a part of profit of the subscribers, thus increasing his/her total profit.

Veracity Markets offers dynamic leverage: its value automatically adjusts to the used margin and trading volume of a chosen financial instrument. Therefore, as the trading volume increases the percentage of the margin also increases in accordance with the dynamic value of leverage for an asset. Clients have access to a wide range of trading accounts with floating spreads from cent accounts to ECN. The minimum deposit on all account types is $250.

The spread on the accounts that are not for professional trading start from 1.6-2 pips. The number of available Forex pairs is 38, which is fewer than other brokers offer. Also, Veracity Markets does not provide access to trading via WebTrader. The available platforms MT4 and MT5 must be installed on a PC, tablet or smartphone.

Veracity Markets does not offer its own investment options, but its clients can use all available passive income features offered by MT4 and MT5. The company allows traders to use Expert Advisors, copy signals from MQL5.com or provide signals. Also, for additional profit, clients can connect to MAM service and participate in partnership programs that offer different types of rewards.

Multi-Account Manager — a passive income service

Multi-Account Manager or MAM allows managers to execute trades on an unlimited number of connected sub-accounts. At that, the funds of the manager and investors are separated and the manager does not have access to the deposits of the subscribers. The main features of MAM service include:

An investor can monitor trades and profit in real time mode.

There is no account servicing fee for MAM accounts. Investors connect to the system for free.

Several types of distribution are available: Balance, Lot, Percentage or Equity.

An unlimited number of investors can connect to the manager’s account.

After a trader chooses the manager and connects to his/her account, all trades executed on it are mirrored on the sub-accounts of subscribers. If the manager executes a successful trade, both parties win: an investor earns profit without trading on their own and the manager earns a part of profit of the subscribers, thus increasing his/her total profit.

Veracity Markets offers dynamic leverage: its value automatically adjusts to the used margin and trading volume of a chosen financial instrument. Therefore, as the trading volume increases the percentage of the margin also increases in accordance with the dynamic value of leverage for an asset. Clients have access to a wide range of trading accounts with floating spreads from cent accounts to ECN. The minimum deposit on all account types is $250.

The spread on the accounts that are not for professional trading start from 1.6-2 pips. The number of available Forex pairs is 38, which is fewer than other brokers offer. Also, Veracity Markets does not provide access to trading via WebTrader. The available platforms MT4 and MT5 must be installed on a PC, tablet or smartphone.

Veracity Markets does not offer its own investment options, but its clients can use all available passive income features offered by MT4 and MT5. The company allows traders to use Expert Advisors, copy signals from MQL5.com or provide signals. Also, for additional profit, clients can connect to MAM service and participate in partnership programs that offer different types of rewards.

Multi-Account Manager — a passive income service

Multi-Account Manager or MAM allows managers to execute trades on an unlimited number of connected sub-accounts. At that, the funds of the manager and investors are separated and the manager does not have access to the deposits of the subscribers. The main features of MAM service include:

An investor can monitor trades and profit in real time mode.

There is no account servicing fee for MAM accounts. Investors connect to the system for free.

Several types of distribution are available: Balance, Lot, Percentage or Equity.

An unlimited number of investors can connect to the manager’s account.

After a trader chooses the manager and connects to his/her account, all trades executed on it are mirrored on the sub-accounts of subscribers. If the manager executes a successful trade, both parties win: an investor earns profit without trading on their own and the manager earns a part of profit of the subscribers, thus increasing his/her total profit.

Veracity Markets offers dynamic leverage: its value automatically adjusts to the used margin and trading volume of a chosen financial instrument. Therefore, as the trading volume increases the percentage of the margin also increases in accordance with the dynamic value of leverage for an asset. Clients have access to a wide range of trading accounts with floating spreads from cent accounts to ECN. The minimum deposit on all account types is $250.

The spread on the accounts that are not for professional trading start from 1.6-2 pips. The number of available Forex pairs is 38, which is fewer than other brokers offer. Also, Veracity Markets does not provide access to trading via WebTrader. The available platforms MT4 and MT5 must be installed on a PC, tablet or smartphone.

Veracity Markets does not offer its own investment options, but its clients can use all available passive income features offered by MT4 and MT5. The company allows traders to use Expert Advisors, copy signals from MQL5.com or provide signals. Also, for additional profit, clients can connect to MAM service and participate in partnership programs that offer different types of rewards.

Multi-Account Manager — a passive income service

Multi-Account Manager or MAM allows managers to execute trades on an unlimited number of connected sub-accounts. At that, the funds of the manager and investors are separated and the manager does not have access to the deposits of the subscribers. The main features of MAM service include:

An investor can monitor trades and profit in real time mode.

There is no account servicing fee for MAM accounts. Investors connect to the system for free.

Several types of distribution are available: Balance, Lot, Percentage or Equity.

An unlimited number of investors can connect to the manager’s account.

After a trader chooses the manager and connects to his/her account, all trades executed on it are mirrored on the sub-accounts of subscribers. If the manager executes a successful trade, both parties win: an investor earns profit without trading on their own and the manager earns a part of profit of the subscribers, thus increasing his/her total profit.

TopFX Review

What is TopFX?

TopFX is an international multi-asset brokerage firm specializing in liquidity provision. The broker has been providing liquidity solutions to brokers and other investment firms since 2010. They provide leveraged trading of over 1000 assets across Forex, Shares, Indices, Metals, Energies, ETFs, and other CFDs with the market’s tightest spreads and razor-sharp execution.To get more news about topfx review, you can visit wikifx.com official website.

Throughout its decade-long presence in the CFDs industry, TopFX has offered superior liquidity solutions to over 180 Forex brokers, investment firms, and hedge funds.

Over the last years, TopFX enhanced its offering with comprehensive packages for startups, eliminating the high barrier to entering the competitive Forex Industry.

TopFX is an STP Forex Broker with high standards of secure trading environment, as of the regulation it imposes. The broker has an active customer base across Europe, Asia and Africa, including Indonesia, Thailand, Malaysia, Vietnam and Nigeria. The offering to the clients is wide and even comprehensive since proposes the same if not more investment opportunities to the world trading community.

TopFX Pros and Cons

Our experts find TopFX a well-regulated Cyprus-based broker, offering good trading conditions and transparency. Account opening is fast and there are various trading instruments and platforms available for traders, including advanced cTrader and copy trading.