johnholmes's blog

The property and casualty insurance industry has seen a remarkable turnaround, flipping a USD 8.5 billion underwriting loss in Q1 2023 into a USD 9.3 billion gain by Q1 2024, with a combined ratio of 94.2%. This ratio, which falls below 100%, indicates a profitable outcome. But as the market continues to evolve, insurers must embrace new technologies to stay ahead of the competition and meet the rising expectations of their customers.

Generative AI (Gen AI) has emerged as a game-changer in the large language models insurance industry. According to a Deloitte survey, 75% of U.S. insurers are already using Gen AI in some form, particularly in claims processing and customer service. However, expanding its use across the industry isn’t as simple as flipping a switch. Insurers must tackle challenges such as data security, privacy concerns, and the integration of new technologies into existing systems.

While the potential for Gen AI is vast, so too are the risks. Insurers need to carefully consider compliance and operational challenges to fully unlock its benefits while maintaining profitability and trust.

How Generative AI is Reshaping Insurance Operations

According to a report from Capgemini Research Institute, 67% of high-performing insurers are preparing to leverage Generative AI by 2025 to enhance customer experiences and streamline operations.

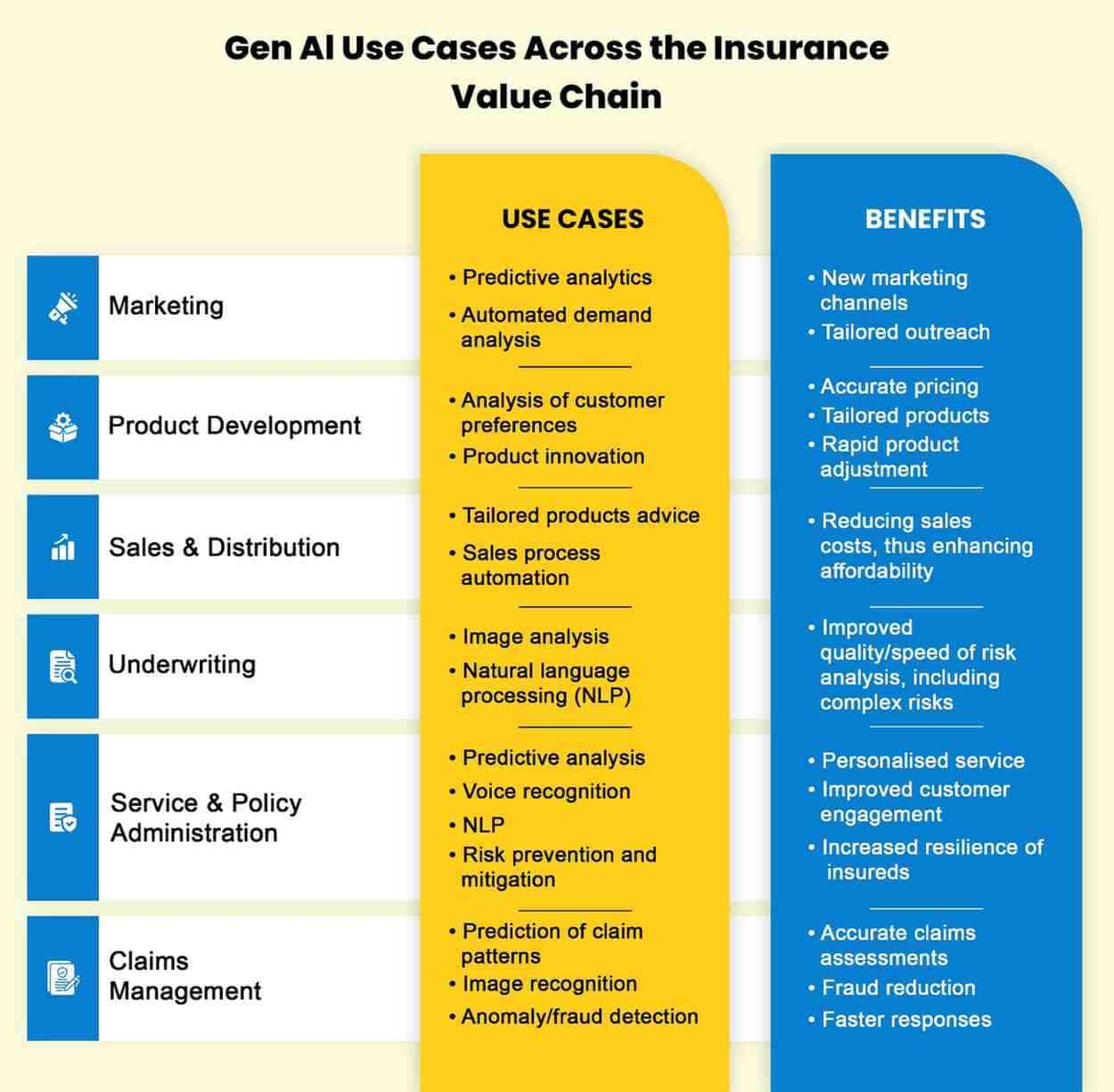

Unlike traditional AI, which focuses on analyzing data or automating predefined tasks, Gen AI goes further by creating new content and data. This ability to generate new, customized information is what sets Gen AI apart and makes it particularly valuable in transforming insurance operations. Here’s how it’s making an impact:

Automating Policy Document Creation and Boosting Claims Efficiency

One of the most promising applications of Gen AI in insurance is automating the creation of policy documents. By processing customer data, Gen AI can generate customized policy documents that not only meet regulatory standards but are tailored to individual customer needs. This significantly reduces the time and manual effort typically required for document creation.

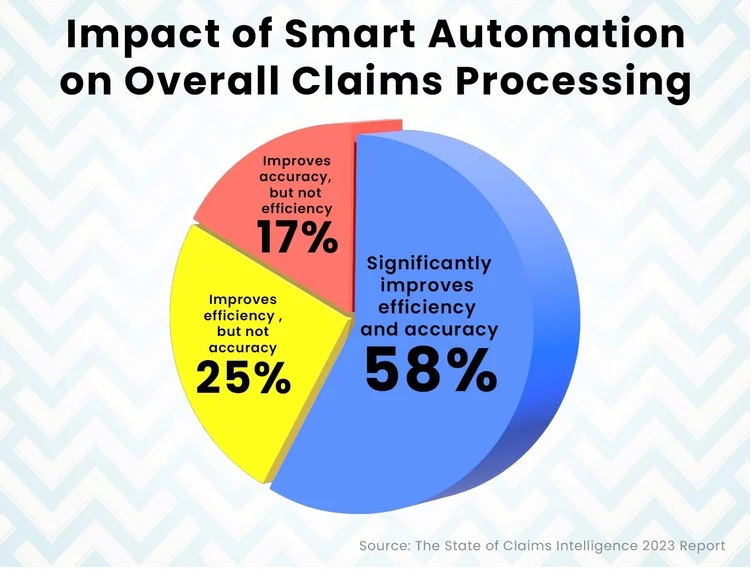

In the realm of claims processing, Gen AI is helping insurers increase efficiency. It works alongside industry professionals like underwriters, actuaries, and claims adjusters to analyze and synthesize large volumes of data from various sources, such as call transcripts, medical records, and legal documents. This enhances productivity and shortens the claims lifecycle, resulting in quicker processing and improved accuracy, especially in property and casualty insurance.

Using Synthetic Data to Train Models and Predict Risks

Another key benefit of Gen AI is its ability to generate synthetic datasets that simulate potential risk scenarios. These datasets, built from historical customer data, are useful for training machine learning models in areas like fraud detection and risk assessment.

By using these realistic simulations, insurers can fine-tune their large language models insurance to more accurately predict future risks and customer behavior. This enables better pricing strategies and more accurate risk evaluations, keeping insurers ahead of the competition.

Personalized Marketing and Customer Engagement

Insurers are also turning to Gen AI to create personalized marketing content that resonates with each customer. By analyzing customer data and preferences, Gen AI can generate targeted marketing materials, including brochures, blog posts, and social media content. This not only improves customer engagement but also boosts conversion rates.

Moreover, Gen AI can streamline customer communication by automating tasks such as sending service emails, policy updates, and reminders. This ensures that interactions are timely and relevant, which helps build stronger relationships with customers. However, it’s important to have human oversight to ensure the quality and accuracy of AI-generated content.

Enhancing Customer Service with Context-Aware AI

Some insurers are incorporating Gen AI into their customer service platforms to create more personalized, context-driven interactions. By analyzing past customer interactions and policy details, Gen AI can provide precise, personalized responses to inquiries. For example, when a policyholder asks about the status of a claim or details of their coverage, the AI can pull relevant information from internal systems, significantly reducing response times and the need for human intervention.

This shift toward Gen AI is not just about improving efficiency; it’s about creating a more engaging and personalized experience for customers, which can lead to higher satisfaction and loyalty.

Navigating the Risks of Generative AI in Insurance

While the advantages of large language models insurance are undeniable, its integration also brings significant risks. These risks stem from the inherent challenges of ensuring the accuracy, security, and compliance of AI-generated content.

Hallucinations and Maintaining Decision Accuracy

A key risk with Gen AI is the possibility of “hallucinations”—when the AI generates plausible-sounding but incorrect outputs. In insurance, this can lead to flawed risk assessments, inaccurate policy pricing, and errors in claims decisions. Such mistakes can undermine the integrity of the underwriting and claims processes, leading to financial losses and reputational damage.

Despite these concerns, Gen AI can still be incredibly valuable for insurers. It boosts efficiency by quickly generating drafts for policies and coverage options and ensures consistency across documents. To mitigate the risks of hallucinations, insurers are implementing checks and validations and keeping humans in the loop to verify AI-generated content before it is finalized.

Vulnerabilities to Adversarial Attacks

Generative AI systems can also be vulnerable to adversarial attacks, where malicious actors manipulate inputs to deceive the AI into making incorrect decisions. In the insurance industry, this could mean AI systems approving fraudulent claims or altering risk assessments in favor of bad actors.

To protect against such risks, insurers need to put in place robust security measures. This includes data encryption, secure training practices for AI models, adversarial testing, and regular system audits. Additionally, strong authentication methods and continuous monitoring of AI systems can help detect and respond to unusual behavior, safeguarding the integrity of AI systems.

Balancing Innovation with Risk Management

Generative AI offers significant opportunities for insurers to improve efficiency, enhance customer service, and stay competitive in an ever-changing market. However, insurers must also remain vigilant about the risks associated with this powerful technology. By adopting best practices for security, compliance, and oversight, insurers can leverage the full potential of Gen AI without compromising on accuracy, trust, or governance.

The key to success lies in balancing innovation with prudent risk management, ensuring that AI enhances operations while protecting the interests of both the insurer and the customer.

A key distinction in how insurers utilize APIs lies in the concept of data fluidity. While many insurers have adopted iot and api, the extent of their integration varies greatly. Traditional systems often implement APIs as a superficial overlay, enabling point-to-point data exchanges without deeply integrating core systems. This results in fragmented data flow, leading to inefficiencies in customer service, underwriting, and overall operational effectiveness.

On the other hand, insurers leveraging modern, cloud-native architectures design api and microservices as fundamental building blocks, allowing for real-time data streaming and analysis across multiple touchpoints. These insurers use APIs not only to extract data from external sources but also to feed insights back into their core systems, creating a dynamic feedback loop that enhances pricing models, underwriting precision, and customer engagement strategies. This level of integration enables real-time policy adjustments—something legacy systems struggle to achieve due to reliance on batch processing and periodic data synchronization.

Real-Time Behavioral Insights: Expanding Beyond TelematicsInsurance api and microservices are advancing beyond their initial telematics applications to encompass real-time behavioral analytics across various customer interactions. While companies like Progressive and Allstate have pioneered telematics-driven models, a new wave of behavioral APIs is emerging to track customer habits beyond driving patterns.

For instance, Moody’s RMS Location Intelligence api and microservices incorporates detailed property attributes and hazard data to enhance underwriting accuracy. This sophisticated API-driven approach delivers granular, real-time insights that enable insurers to assess risks more effectively and reduce loss ratios. According to an Accenture study, data-driven risk management could lead to a 20% reduction in loss ratios, shifting the industry from reactive claims handling to proactive risk mitigation.

The Future of Open Insurance: Expanding API ApplicationsA transformative shift is underway in Europe with the rise of open insurance, which utilizes APIs to grant third-party providers access to insurers' data, mirroring the open banking model. While still in its early stages in the U.S., forward-thinking insurers are already experimenting with API-powered insurance ecosystems.

For example, open embedded insurance api facilitate collaborations where insurers partner with real estate platforms, healthcare services, and gig economy applications to embed insurance seamlessly within other services. This innovative API adoption not only unlocks new revenue opportunities but also repositions insurers as comprehensive service providers rather than mere claim processors.

The insurance industry, often seen as a bastion of tradition and stability, is undergoing a seismic shift. At the heart of this transformation is the emergence of insurance ecosystem api networks. These interconnected systems promise to revolutionize the way insurers, customers, and partners interact, but are they a true game-changer or just another fleeting trend?

What Are Insurance Ecosystem Networks?An insurance ecosystem network is a collaborative framework where insurers partner with various stakeholders, including technology providers, healthcare organizations, financial institutions, and even governments. These networks aim to provide integrated solutions that go beyond traditional insurance products, offering services such as risk prevention, health management, and financial planning.

Key components of these ecosystems include:

Digital Platforms: Centralized hubs where stakeholders can interact, share data, and co-create solutions.

Advanced Analytics: AI and machine learning tools that analyze vast amounts of data to personalize offerings and predict risks.

Partnership Models: Strategic alliances that leverage the strengths of each participant to deliver value-added services.

Customer Expectations: Today’s consumers demand seamless, personalized experiences. Ecosystem networks allow insurers to meet these expectations by integrating diverse services into a single, cohesive journey.

Technological Advancements: The proliferation of IoT devices, telematics, and wearable technology provides insurers with unprecedented access to real-time data, enabling more accurate risk assessments and proactive engagement.

Regulatory Shifts: Governments and regulatory bodies are encouraging innovation to improve transparency, efficiency, and accessibility in the insurance sector.

Competitive Pressure: As insurtech startups disrupt the market, traditional insurers are adopting ecosystem strategies to stay relevant and competitive.

Enhanced Customer Experience: Ecosystems enable insurers to offer holistic solutions, such as bundling health insurance with wellness programs or integrating auto insurance with vehicle maintenance services.

Improved Risk Management: Access to real-time data allows insurers to predict and mitigate risks more effectively.

Operational Efficiency: Automation and data sharing reduce administrative costs and streamline processes.

Revenue Diversification: Ecosystems open new revenue streams through cross-industry partnerships and innovative products.

Despite their potential, insurance ecosystem networks are not without challenges:

Data Privacy and Security: The integration of multiple stakeholders increases the risk of data breaches and compliance issues.

Implementation Complexity: Building and managing an ecosystem requires significant investment in technology and collaboration.

Cultural Resistance: Traditional insurers may struggle to adopt the agile, customer-centric mindset needed to thrive in an ecosystem model.

Partner Dependence: Over-reliance on partners can expose insurers to risks if a key stakeholder fails to deliver.

The answer lies in execution. Insurance ecosystem networks have the potential to redefine the industry, but their success depends on how well insurers can navigate the challenges and capitalize on the opportunities. Those who embrace innovation, foster collaboration, and prioritize customer needs are likely to emerge as leaders in this new era.

On the other hand, insurers that view ecosystems as a short-term trend or fail to invest in the necessary infrastructure may find themselves left behind.

ConclusionInsurance ecosystem networks are more than just a passing fad. They represent a fundamental shift in how the industry operates, driven by evolving customer expectations and technological advancements. While challenges remain, the potential benefits far outweigh the risks for those willing to adapt and innovate.

For insurers, the question is not whether to participate in an ecosystem, but how to build one that delivers lasting value. The time to act is now—because in the rapidly evolving world of insurance, standing still is not an option.

In an industry where trust and compliance are paramount, Explainable AI (XAI) plays a pivotal role in demystifying complex underwriting automation decisions. Unlike traditional black-box AI models, XAI offers insights into the factors driving outcomes, ensuring that insurers maintain regulatory standards and build stronger client relationships.

Beyond SHAP and LIME:

While SHAP and LIME are instrumental in explaining AI outputs, insurers are also leveraging newer methodologies, such as Counterfactual Explanations. These tools allow underwriters to identify minimal changes a policyholder could make to improve their risk profile—providing actionable guidance and fostering goodwill.

Example:

A life insurer utilizing Counterfactual Explanations might show a policyholder how improving their cholesterol level or exercise frequency could lower their premium. This empowers clients with tangible steps, while the insurer benefits from enhanced health metrics across its portfolio.

Insurers are expanding their simulation capabilities to model not just natural disasters but also emerging global threats like pandemics and cyberattacks. These advanced techniques enable companies to identify vulnerabilities and design adaptive strategies.

Beyond Monte Carlo Simulations:

Tools such as agent-based modeling and digital twin simulations are gaining traction. These methods allow insurers to model complex interactions between individual entities (like policyholders or systems) and their environments, providing granular insights into cascading effects.

Example:

A global health insurer employs agent-based modeling to simulate the spread of infectious diseases under varying intervention strategies. This allows the company to design flexible policies with pandemic-specific coverage and adjust premiums dynamically during outbreaks.

The shift from static to dynamic underwriting is revolutionizing risk management, with real-time analytics enabling insurers to respond instantly to changes in risk environments. This proactive approach ensures better alignment with evolving customer needs and market conditions.

Beyond Apache Kafka:

Innovations like stream processing platforms (e.g., Flink and Pulsar) and real-time predictive analytics models are further enhancing insurers’ ability to make instant adjustments.

Example:

A commercial property insurer uses real-time weather data from IoT sensors to monitor flood risks. When sensors detect rising water levels, the insurer automatically triggers notifications for preventive measures and recalculates coverage terms, protecting both the client and the company's bottom line.

By combining the transparency of XAI, the foresight of advanced simulations, and the adaptability of real-time analytics, insurers can address not only current challenges but also prepare for future disruptions. These technologies work in harmony, creating a robust framework for intelligent underwriting that prioritizes compliance, customer trust, and long-term sustainability.

Looking Ahead:

As these tools evolve, the insurance industry will likely see a greater emphasis on hyper-personalization, where every decision—whether pricing, coverage, or claims—reflects an in-depth understanding of individual needs, powered by cutting-edge AI and data integration.

In the insurance industry, the claims processing systems is a critical moment for clients. They expect claims handlers to demonstrate empathy, speed, and efficiency, ensuring a fair outcome. However, this can be challenging, as the transactional nature of claims has remained largely unchanged for decades. Forward-thinking insurers are now reimagining claims as a strategic function, working alongside traditional roles like underwriting to enhance the overall customer experience.

By adopting a connected operating model, insurers are transforming both underwriting and claims functions into customer-centric, digitally-enabled systems that drive greater efficiency and satisfaction.

When upgrading to a new claims management system, there are several key features to consider. The following are the top five essential capabilities for modern claims management software:

The insurance claims lifecycle begins with the First Notice of Loss (FNOL). For example, in the case of a car accident, the insurance company promptly receives the FNOL, and an adjuster begins assessing the damage by reviewing relevant reports to determine the settlement amount.

However, many insurers still rely on manual FNOL processing and document handling, leading to fragmented claims, multiple file transfers, and unnecessary delays. This outdated approach can frustrate customers who expect fast, transparent, and automated service.

Modern claims management systems automate FNOL handling by processing a variety of data formats, including text descriptions, images, and documents. AI-driven Optical Character Recognition (OCR) technology can easily process handwritten FNOL documents, such as police reports, even when submitted through digital channels. Additionally, advanced systems support telematics for verifying key accident details, such as date, time, and location, ensuring greater accuracy and faster claim initiation.

A top-tier claims management system should support the entire claims lifecycle seamlessly, from the initial loss reporting through investigation, evaluation, and settlement. It should enable automation and optimization across every stage and integrate smoothly with various lines of business, including homeowners, commercial property, general liability, personal and commercial auto, workers' compensation, and more.

Automation is key to streamlining workflows for both insurers and policyholders. The software should enhance adjuster workflows by sending task alerts, tracking claim statuses, and enabling real-time updates. Additionally, the system should allow for customizable workflows, such as automating task assignments based on adjuster expertise, workload, or other criteria. This ensures efficient claims handling while maintaining flexibility to meet specific insurer needs.

To optimize the claims process and improve customer experience, modern claims software should offer a centralized data repository. This ensures seamless integration with various data sources, eliminates data silos, and improves accuracy.

The system should provide instant access to key policy information, including coverage details, limits, deductibles, and impacted coverage. It should also enable easy access to reserve settings and allow for attaching policy snapshots to individual claims for review.

Advanced analytics and reporting tools within the system can further enhance decision-making by providing deep insights into claims data, enabling insurers to make more informed, data-driven decisions.

In today’s fast-paced claims environment, real-time communication is essential. A modern claims management system should enable seamless communication and collaboration between all parties involved—policyholders, adjusters, third-party service providers, and other stakeholders.

Features like secure messaging, document sharing, and integrated communication channels within the software can speed up the claims process and reduce delays. Automated notifications and alerts ensure that everyone stays informed, and that any required actions are taken promptly.

The future of claims management lies in leveraging artificial intelligence (AI) and machine learning to support decision-making and optimize claims outcomes. A modern system should use AI to analyze historical claims data, identify patterns, and predict trends, helping insurers make faster, more accurate decisions.

AI-powered analytics can also assist in identifying potential fraud, optimizing resource allocation, and improving claims forecasting. With the ability to continuously learn from data, these systems can become more efficient over time, further enhancing both operational efficiency and customer satisfaction.