ITG Undertakes Review from freeamfva's blog

ITG Undertakes Review

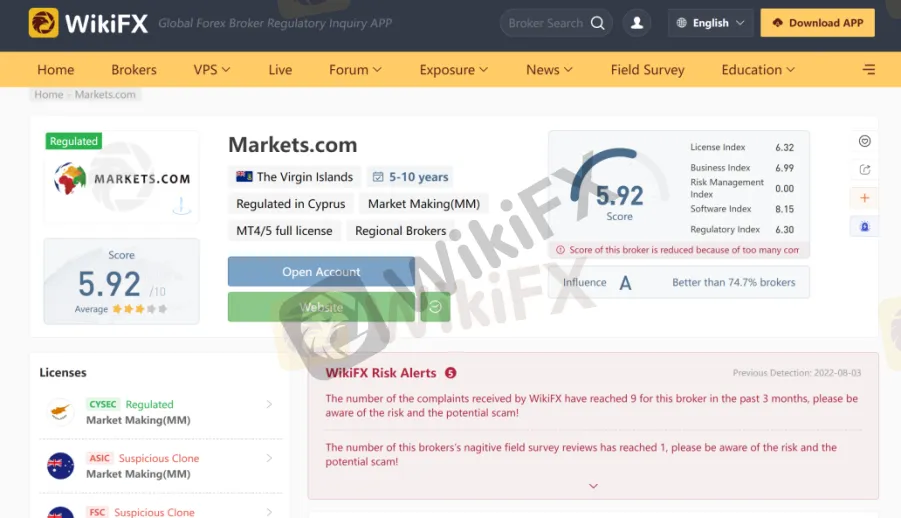

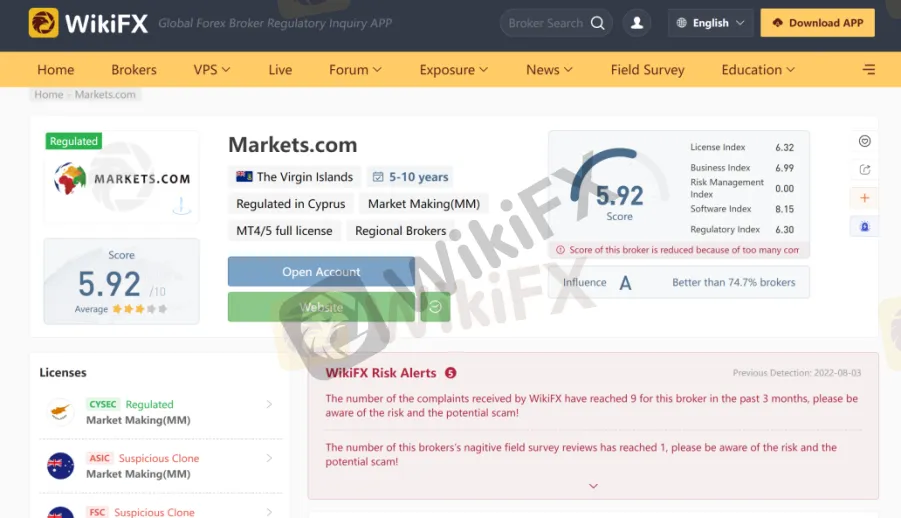

After a second year of losses, ITG announced it would begin monitoring and measuring its financial performance by line of business, leading to speculation that cuts to its research may result. ITG has not announced any new cuts to its workforce.To get more news about itg review, you can visit wikifx.com official website.

ITG reported a net loss of $247.9 million for 2012 on revenues of $504.4 million. An ITG spokesperson said that the losses were largely due to write downs of goodwill associated with past acquisitions and that, excluding non-operating or one-time events, the firm earned “adjusted” operating profits of $8.2 million and $28.6 million in 2012 and 2011, respectively.

ITG acquired Ross Smith Energy Group for $38.5 million in August 2011 at a 2.6x revenue multiple and it acquired Majestic Research for $56 million in October 2010 at a 2.9x multiple on 2009 revenues. It its earnings call, ITG said the 2012 results included $4.3 million in write downs from its investment in Disclosure Insight, a research firm that it had invested in prior to its acquisition of Majestic Research. It is not clear whether goodwill for other research acquisitions have been written down.

ITG operates four lines of business: electronic brokerage, trading platforms, analytics, and research sales and trading. Up until now, it has been reporting its results by geography. During its recent earnings call, it said that it recently reviewed performance by business line: “This review should help us better assess our competitive position and help to ensure that we are getting the full value for the individual products and services we offer.”

According to a recent article in Traders Magazine, there is increasing pressure on ITG to merge or sell. “‘The persistent industry malaise in equity trading volume and structural changes in the industry make it increasingly compelling for small and midcap brokers to combine operation for scale efficiencies,’ Niamh Alexander, an analyst at Keefe, Bruyette & Woods, wrote in a report last year. The analyst noted that ITG had spent a lot of money in the past five years without much earnings growth to show for it.”

According to ITG, the review is intended to align costs with revenues and “yield incremental savings,” and was not precipitated by any plans to sell the company.

ITG said that market conditions, namely shrinking volumes and commissions, where a major factor it in its results. It said that conditions seemed to be improving this year but it was too early to pronounce it a trend: “January has brought a reversal of this trend with strong inflows into U.S. domestic mutual funds and stronger overall trading volumes. While these are very welcome indicators, we believe it is a little early to predict the lasting reversal after more than three years of fund outflows and decline in volumes.”

In its conference call it credited research for improving its commission rates: “We are very encouraged by the improvement in the buy-side rate card, which is at its highest level since mid 2010, reflecting the impact of accounts paying for research”, but praise for its research was otherwise scant. A review by business line is not typically flattering to research. Research costs are significant while revenues are difficult to attribute, and often claimed by other units within the company. It will be interesting to see what conclusions ITG comes up with as it tries to align costs with revenues.

ITG acquired Ross Smith Energy Group for $38.5 million in August 2011 at a 2.6x revenue multiple and it acquired Majestic Research for $56 million in October 2010 at a 2.9x multiple on 2009 revenues. It its earnings call, ITG said the 2012 results included $4.3 million in write downs from its investment in Disclosure Insight, a research firm that it had invested in prior to its acquisition of Majestic Research. It is not clear whether goodwill for other research acquisitions have been written down.

ITG operates four lines of business: electronic brokerage, trading platforms, analytics, and research sales and trading. Up until now, it has been reporting its results by geography. During its recent earnings call, it said that it recently reviewed performance by business line: “This review should help us better assess our competitive position and help to ensure that we are getting the full value for the individual products and services we offer.”

According to a recent article in Traders Magazine, there is increasing pressure on ITG to merge or sell. “‘The persistent industry malaise in equity trading volume and structural changes in the industry make it increasingly compelling for small and midcap brokers to combine operation for scale efficiencies,’ Niamh Alexander, an analyst at Keefe, Bruyette & Woods, wrote in a report last year. The analyst noted that ITG had spent a lot of money in the past five years without much earnings growth to show for it.”

According to ITG, the review is intended to align costs with revenues and “yield incremental savings,” and was not precipitated by any plans to sell the company.

ITG said that market conditions, namely shrinking volumes and commissions, where a major factor it in its results. It said that conditions seemed to be improving this year but it was too early to pronounce it a trend: “January has brought a reversal of this trend with strong inflows into U.S. domestic mutual funds and stronger overall trading volumes. While these are very welcome indicators, we believe it is a little early to predict the lasting reversal after more than three years of fund outflows and decline in volumes.”

In its conference call it credited research for improving its commission rates: “We are very encouraged by the improvement in the buy-side rate card, which is at its highest level since mid 2010, reflecting the impact of accounts paying for research”, but praise for its research was otherwise scant. A review by business line is not typically flattering to research. Research costs are significant while revenues are difficult to attribute, and often claimed by other units within the company. It will be interesting to see what conclusions ITG comes up with as it tries to align costs with revenues.

ITG acquired Ross Smith Energy Group for $38.5 million in August 2011 at a 2.6x revenue multiple and it acquired Majestic Research for $56 million in October 2010 at a 2.9x multiple on 2009 revenues. It its earnings call, ITG said the 2012 results included $4.3 million in write downs from its investment in Disclosure Insight, a research firm that it had invested in prior to its acquisition of Majestic Research. It is not clear whether goodwill for other research acquisitions have been written down.

ITG operates four lines of business: electronic brokerage, trading platforms, analytics, and research sales and trading. Up until now, it has been reporting its results by geography. During its recent earnings call, it said that it recently reviewed performance by business line: “This review should help us better assess our competitive position and help to ensure that we are getting the full value for the individual products and services we offer.”

According to a recent article in Traders Magazine, there is increasing pressure on ITG to merge or sell. “‘The persistent industry malaise in equity trading volume and structural changes in the industry make it increasingly compelling for small and midcap brokers to combine operation for scale efficiencies,’ Niamh Alexander, an analyst at Keefe, Bruyette & Woods, wrote in a report last year. The analyst noted that ITG had spent a lot of money in the past five years without much earnings growth to show for it.”

According to ITG, the review is intended to align costs with revenues and “yield incremental savings,” and was not precipitated by any plans to sell the company.

ITG said that market conditions, namely shrinking volumes and commissions, where a major factor it in its results. It said that conditions seemed to be improving this year but it was too early to pronounce it a trend: “January has brought a reversal of this trend with strong inflows into U.S. domestic mutual funds and stronger overall trading volumes. While these are very welcome indicators, we believe it is a little early to predict the lasting reversal after more than three years of fund outflows and decline in volumes.”

In its conference call it credited research for improving its commission rates: “We are very encouraged by the improvement in the buy-side rate card, which is at its highest level since mid 2010, reflecting the impact of accounts paying for research”, but praise for its research was otherwise scant. A review by business line is not typically flattering to research. Research costs are significant while revenues are difficult to attribute, and often claimed by other units within the company. It will be interesting to see what conclusions ITG comes up with as it tries to align costs with revenues.

ITG acquired Ross Smith Energy Group for $38.5 million in August 2011 at a 2.6x revenue multiple and it acquired Majestic Research for $56 million in October 2010 at a 2.9x multiple on 2009 revenues. It its earnings call, ITG said the 2012 results included $4.3 million in write downs from its investment in Disclosure Insight, a research firm that it had invested in prior to its acquisition of Majestic Research. It is not clear whether goodwill for other research acquisitions have been written down.

ITG operates four lines of business: electronic brokerage, trading platforms, analytics, and research sales and trading. Up until now, it has been reporting its results by geography. During its recent earnings call, it said that it recently reviewed performance by business line: “This review should help us better assess our competitive position and help to ensure that we are getting the full value for the individual products and services we offer.”

According to a recent article in Traders Magazine, there is increasing pressure on ITG to merge or sell. “‘The persistent industry malaise in equity trading volume and structural changes in the industry make it increasingly compelling for small and midcap brokers to combine operation for scale efficiencies,’ Niamh Alexander, an analyst at Keefe, Bruyette & Woods, wrote in a report last year. The analyst noted that ITG had spent a lot of money in the past five years without much earnings growth to show for it.”

According to ITG, the review is intended to align costs with revenues and “yield incremental savings,” and was not precipitated by any plans to sell the company.

ITG said that market conditions, namely shrinking volumes and commissions, where a major factor it in its results. It said that conditions seemed to be improving this year but it was too early to pronounce it a trend: “January has brought a reversal of this trend with strong inflows into U.S. domestic mutual funds and stronger overall trading volumes. While these are very welcome indicators, we believe it is a little early to predict the lasting reversal after more than three years of fund outflows and decline in volumes.”

In its conference call it credited research for improving its commission rates: “We are very encouraged by the improvement in the buy-side rate card, which is at its highest level since mid 2010, reflecting the impact of accounts paying for research”, but praise for its research was otherwise scant. A review by business line is not typically flattering to research. Research costs are significant while revenues are difficult to attribute, and often claimed by other units within the company. It will be interesting to see what conclusions ITG comes up with as it tries to align costs with revenues.

Post

| By | freeamfva |

| Added | Feb 22 '23 |

Tags

Rate

Archives

- All

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

The Wall