User blogs

Tag Search

In the digital age, consumers frequently purchase virtual goods, software, and online services. However, as digital transactions become more prevalent, the need for refund mechanisms also increases. Byte Refund is a process that ensures consumers can reclaim their digital purchases under specific conditions, making online transactions more transparent and secure.To get more news about byte refund, you can citynewsservice.cn official website.

What Is Byte Refund?

Byte Refund refers to the ability to return digital products and receive compensation, whether in the form of store credit, a direct refund, or alternative resolution. Unlike physical purchases, where returns typically involve shipping goods back to the seller, digital refunds deal with intangible assets such as software licenses, in-app purchases, streaming services, or virtual goods within gaming platforms.

Conditions for Byte Refunds

Different platforms establish refund conditions based on their policies. Here are some common factors:

Time Limits: Refund eligibility often depends on how quickly users request a refund after purchase. Some platforms allow requests within 24 to 48 hours, while others extend it up to 14 days.

Usage Restrictions: If the digital product has been fully utilized or extensively accessed, it may not qualify for a refund. For instance, streaming a purchased movie for more than a few minutes may void refund eligibility.

Purchase Type: Subscription-based services may offer partial refunds, prorating based on usage, whereas one-time purchases may have stricter conditions.

Technical Issues: Many companies provide refunds when users experience technical difficulties, such as software incompatibility or faulty downloads.

How to Request a Byte Refund

To maximize success in obtaining a refund, users should follow these steps:

Check Platform Policy: Each digital marketplace has specific refund guidelines, so understanding them is crucial before making a request.

Gather Evidence: If technical issues or unauthorized transactions are involved, providing screenshots or error logs can strengthen the request.

Contact Customer Support: Initiate the refund process through official channels, such as live chat, email, or automated refund request forms.

Be Polite and Clear: Clearly explain the issue and provide relevant details to facilitate a smooth resolution.

Industry Trends and the Future of Byte Refunds

As digital marketplaces continue evolving, refund policies may become more consumer-friendly, focusing on enhancing user experience and ensuring fair compensation. Companies are integrating AI-driven support systems to expedite refund requests and prevent fraudulent claims. Additionally, blockchain technology may revolutionize transaction security, reducing disputes over digital purchases.

Conclusion

Byte Refund plays a critical role in protecting consumer rights in the digital economy. By understanding refund policies, following platform guidelines, and engaging with customer support effectively, users can navigate digital transactions confidently. As technology advances, the evolution of Byte Refund processes will likely lead to greater transparency and convenience for online consumers.

Maximizing Efficiency: The Role of Forklifts in Modern Warehousing

In the fast-paced world of warehousing and logistics, efficiency is paramount. As businesses strive to meet the demands of modern commerce, forklifts have become indispensable tools in optimizing warehouse operations. These versatile machines play a crucial role in streamlining workflows, reducing labor costs, and enhancing overall productivity. In this article, we will explore the various ways in which forklifts contribute to maximizing efficiency in modern warehousing.

The Power of Forklifts

Forklifts are the workhorses of warehouses, renowned for their ability to lift and transport heavy loads with ease. Equipped with sturdy forks and advanced hydraulic systems, they can move pallets and materials quickly and efficiently. By mechanizing tasks that would otherwise be labor-intensive and time-consuming, forklifts empower warehouses to manage increased volumes of goods, thereby enhancing productivity and throughput.

ForkLift internal combustion| China Manufacturer Trade price on Materials Handling internal combustion Fork-lifts Truck Sale Buy Online Importer of Industrial Equipment BUY in USA/UK/India/Australia

ForkLift internal combustion| China Manufacturer Trade price on Materials Handling internal combustion Fork-lifts Truck Sale Buy Online Importer of Industrial Equipment BUY in USA/UK/India/Australia

Versatility in Action

One of the key advantages of forklifts is their exceptional adaptability and versatility. Whether navigating narrow aisles in crowded warehouses or reaching high storage racks with precision, forklifts demonstrate remarkable agility and efficiency. This versatility allows warehouses to optimize space utilization, accommodating diverse inventory types and fluctuating demand dynamics. By leveraging the capabilities of forklifts, warehouses can enhance overall operational efficiency and responsiveness to evolving business needs.

Technological Innovations

Advancements in technology have revolutionized the capabilities of forklifts, enhancing both efficiency and safety in warehouse operations. Modern forklifts are equipped with automated features such as navigation systems and proximity sensors, enabling them to operate with precision and awareness. Additionally, integrated telemetry systems provide real-time data on forklift performance, allowing for proactive maintenance and optimized fleet management strategies. These technological innovations not only improve productivity but also enhance workplace safety, creating a win-win scenario for warehouse operators.

Streamlining Workflows

Forklifts serve as indispensable assets in optimizing warehouse workflows, ensuring seamless material flow from receipt to dispatch. Their efficient movement of goods across storage areas, production lines, and shipping docks minimizes bottlenecks and maximizes throughput. Forklifts’ adaptability to shifting demand patterns and operational needs enables warehouses to sustain high productivity levels amid dynamic environments. With their versatility and reliability, forklifts play a pivotal role in maintaining efficient warehouse operations, ultimately contributing to overall business success.

Environmental Impact

As businesses become increasingly conscious of their environmental footprint, the role of forklifts in promoting sustainability cannot be overlooked. Electric forklifts, in particular, offer a greener alternative to their internal combustion counterparts. Powered by rechargeable batteries, electric forklifts produce zero emissions, contributing to a cleaner and healthier working environment. Additionally, their quieter operation reduces noise pollution, creating a more pleasant work environment for employees. By adopting electric forklifts, warehouses can enhance their sustainability efforts while maintaining high levels of efficiency.

Conclusion

In conclusion, forklifts are indispensable tools in modern warehousing, playing a critical role in maximizing efficiency and productivity. Their power, versatility, and technological advancements enable warehouses to streamline operations, reduce labor costs, and enhance overall performance. As businesses continue to evolve and adapt to the demands of modern commerce, the role of forklifts in optimizing warehouse efficiency will remain paramount. By embracing these versatile machines, warehouses can achieve new heights of productivity and success.

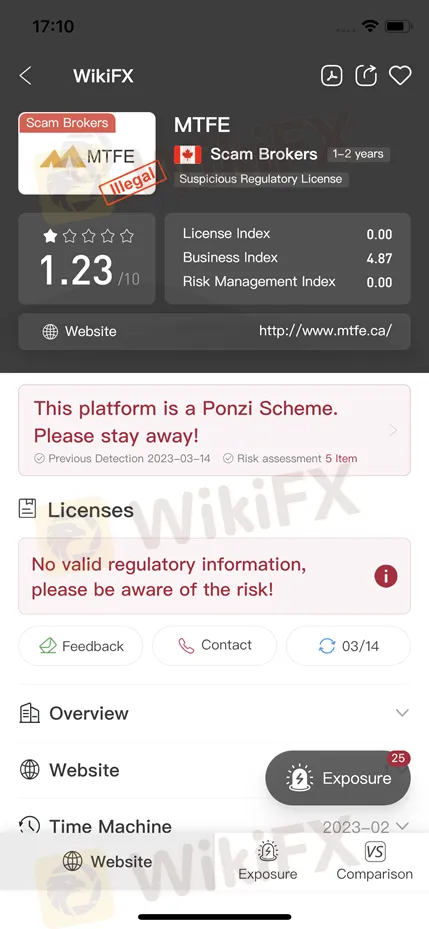

About WikiFX

WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 40,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

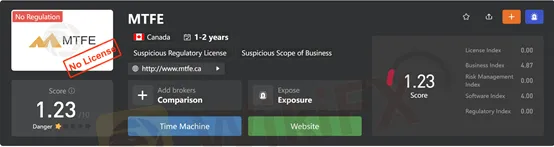

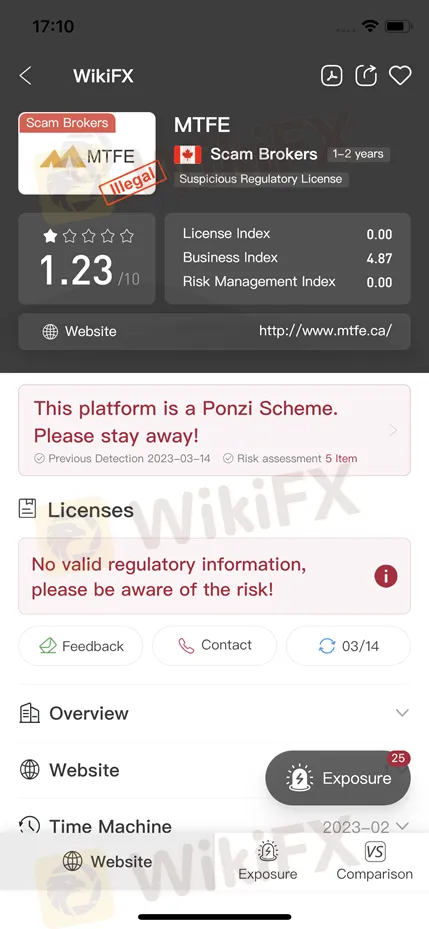

According to WikiFX, MTFE has been given a decent score of 1.23/10.

Description of the case in brief

UNABLE TO WITH FROM MTFE BROKER.

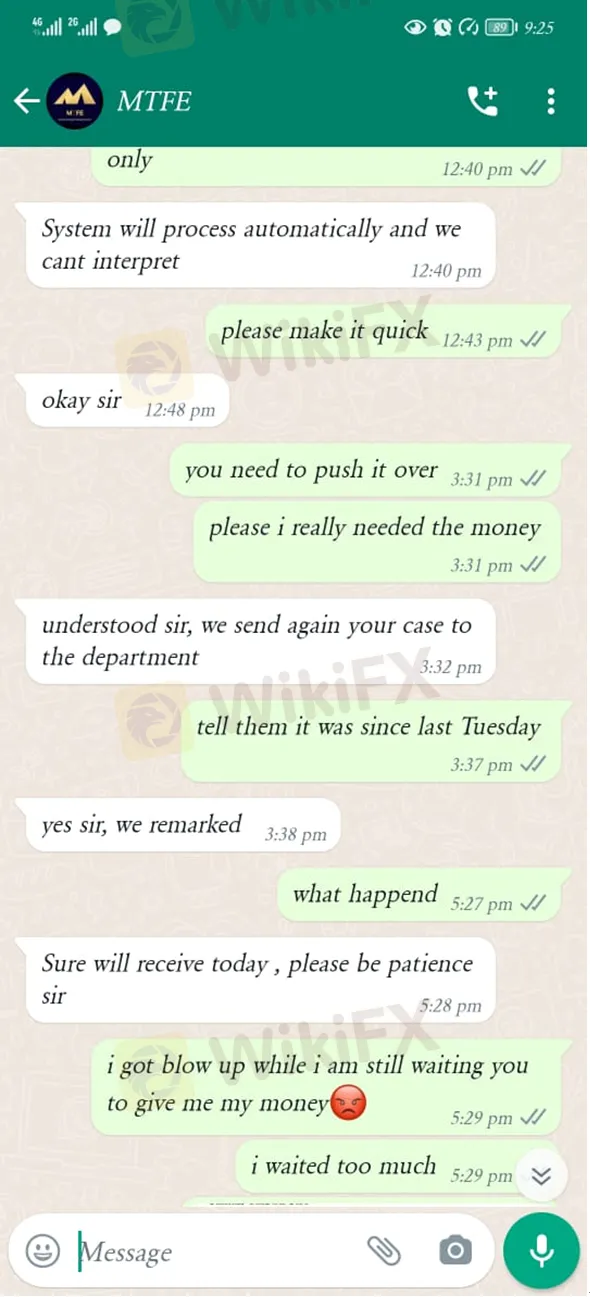

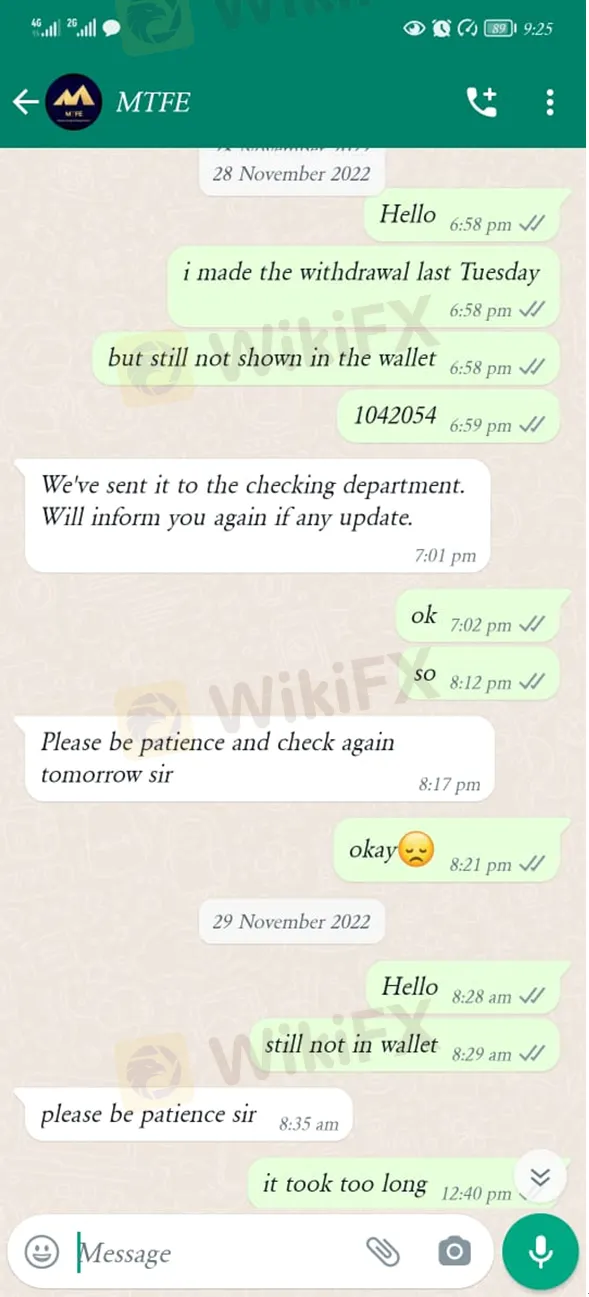

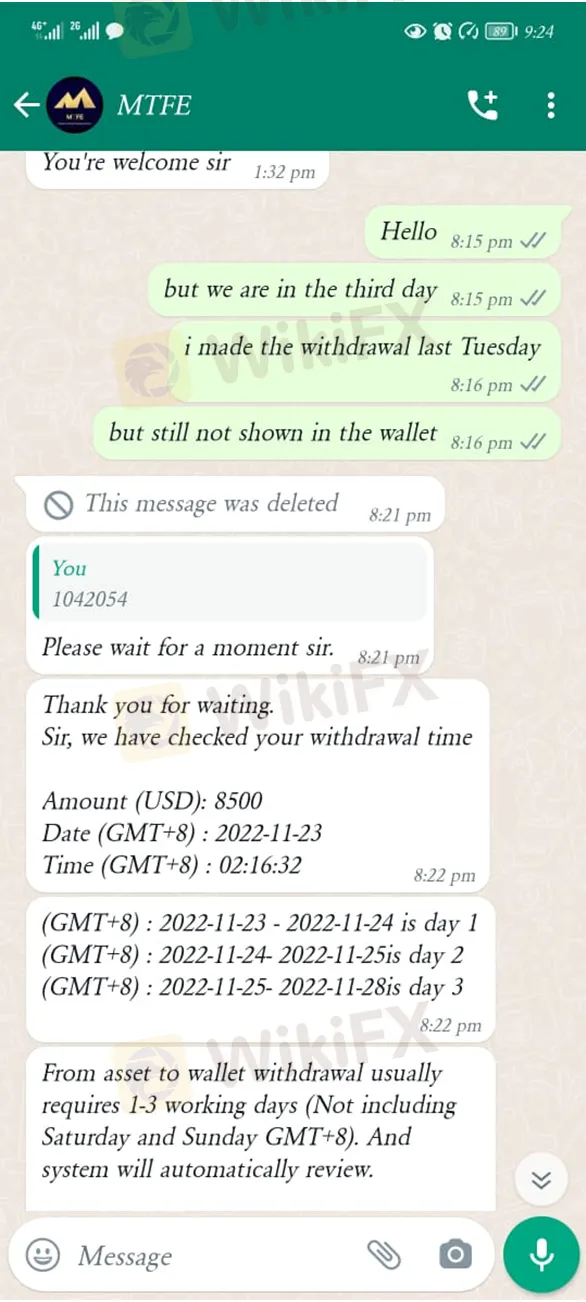

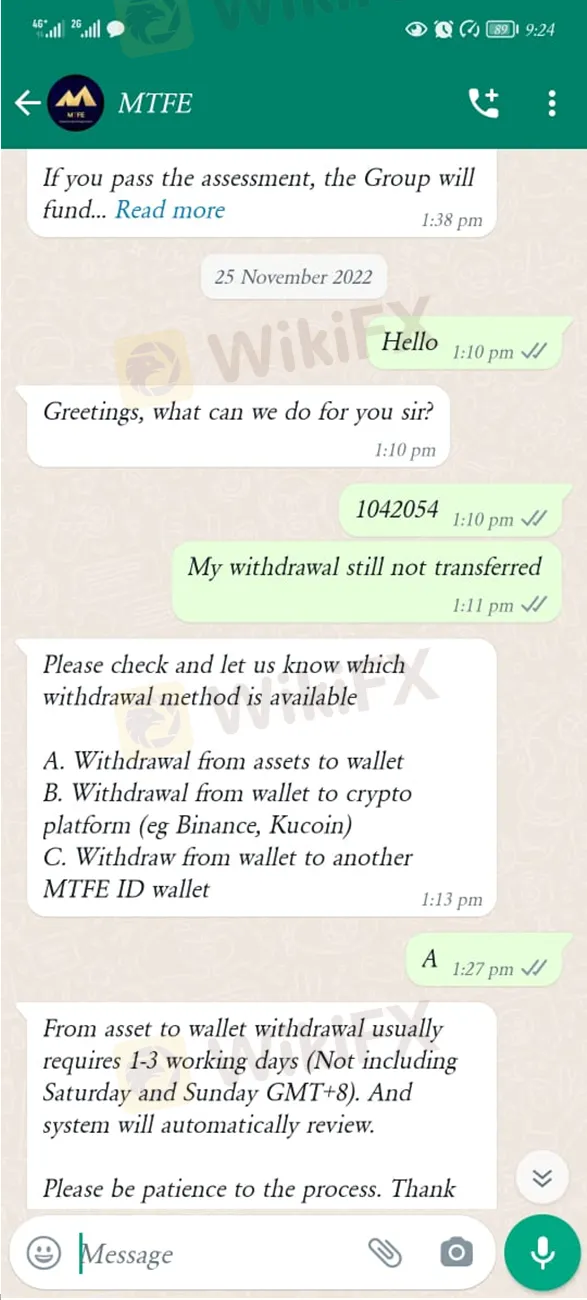

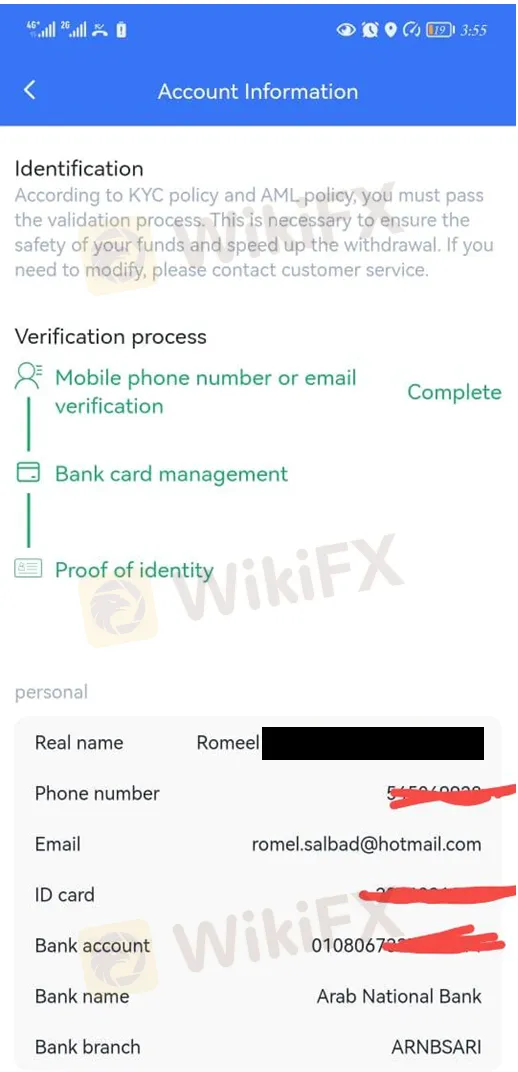

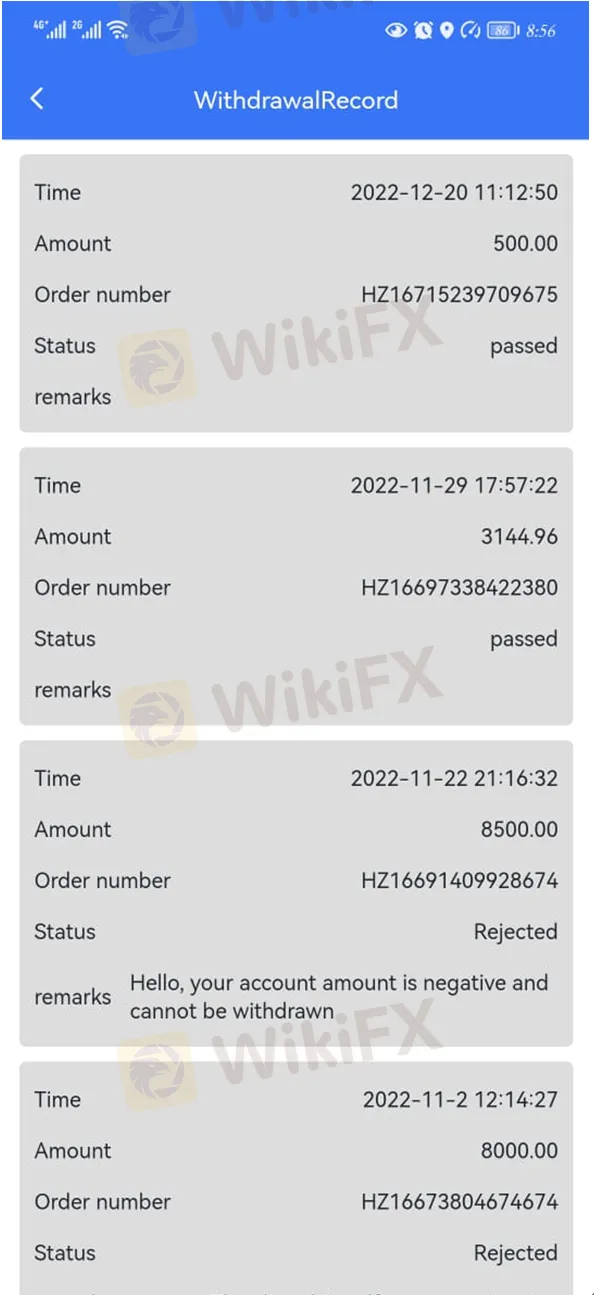

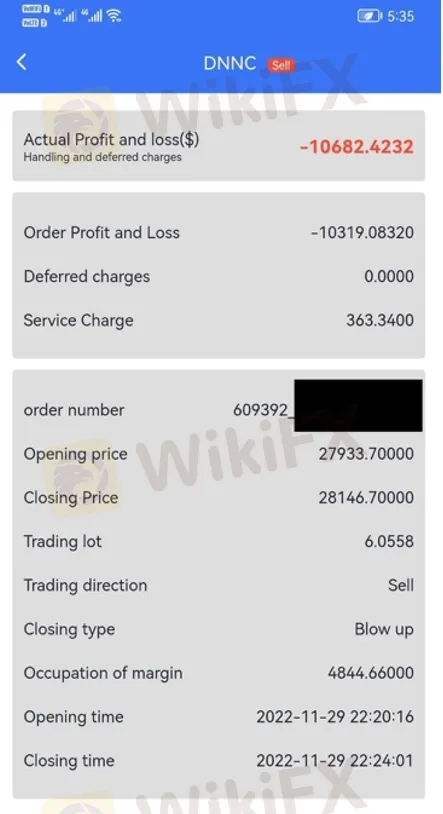

One trader told WikiFX that he used to have 4800usd in his wallet. MTFE keeps delaying the withdrawal. The withdrawal should take 2 to 3 working days but they made him wait 4 days which was the blow day like they knew the trader will trade the signal. The customer service keeps wasting this trader’s time, which makes the trader become angry.

Evidence gathered by WikiFX

Below are the victim’s proof and chats with the MTFE customer service.

About WikiFX

WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 40,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

According to WikiFX, MTFE has been given a decent score of 1.23/10.

Description of the case in brief

UNABLE TO WITH FROM MTFE BROKER.

One trader told WikiFX that he used to have 4800usd in his wallet. MTFE keeps delaying the withdrawal. The withdrawal should take 2 to 3 working days but they made him wait 4 days which was the blow day like they knew the trader will trade the signal. The customer service keeps wasting this trader’s time, which makes the trader become angry.

Evidence gathered by WikiFX

Below are the victim’s proof and chats with the MTFE customer service.

Conclusion

Many scam brokers like to make an excuse to delay clients’ withdrawals and ask the clients to deposit more money when the clients want to withdraw. We believe that MTFE is getting involved in a scam. The reason why WikiFX exposed this case to the public is to remind all traders of the potential risks. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help him resolve the problem. Please stay tuned for more information.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFX’s official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Conclusion

Many scam brokers like to make an excuse to delay clients’ withdrawals and ask the clients to deposit more money when the clients want to withdraw. We believe that MTFE is getting involved in a scam. The reason why WikiFX exposed this case to the public is to remind all traders of the potential risks. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help him resolve the problem. Please stay tuned for more information.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFX’s official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!  Read this article here for more information about MTFE: https://www.wikifx.com/en/newsdetail/202303138194434301.html

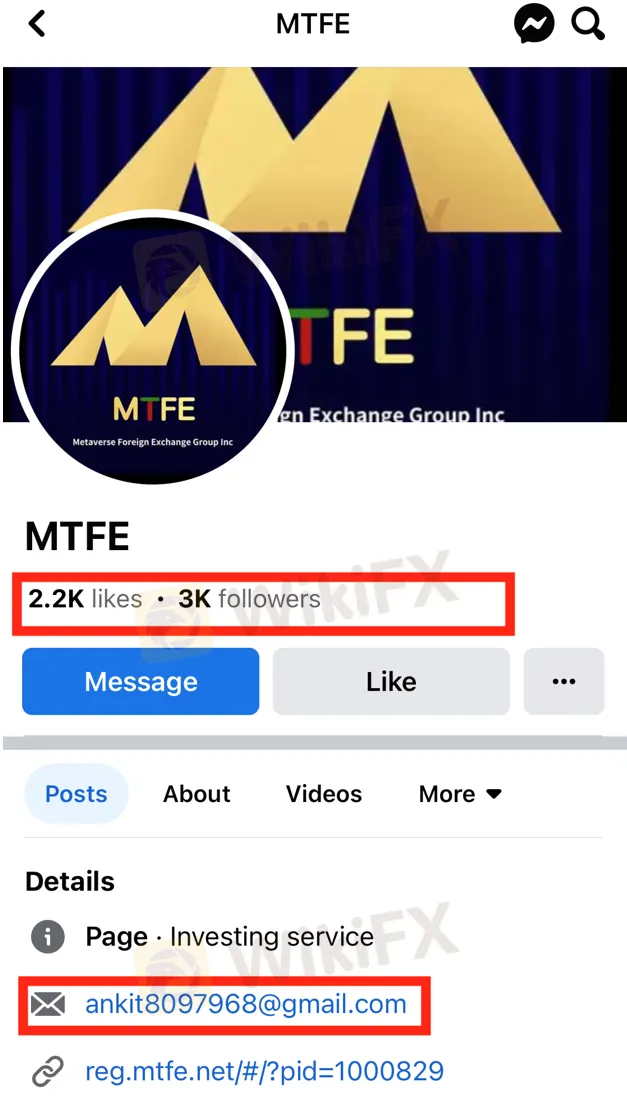

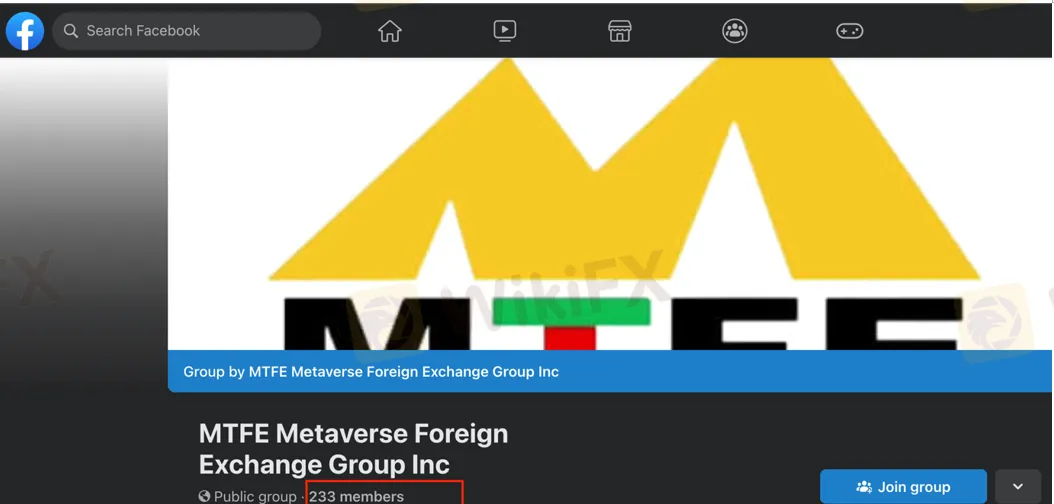

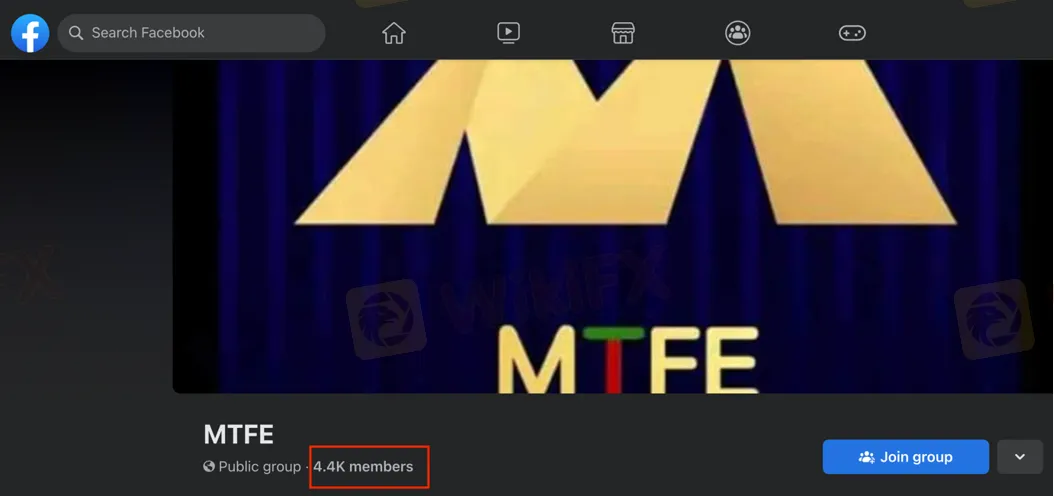

Upon checking, no information was found on MTFE's official website (www.mtfe.ca) regarding its signal trading services. However, WikiFX found several pages promoting MTFE's signal trading services on Facebook – some of these pages have up to thousands of followers.

Read this article here for more information about MTFE: https://www.wikifx.com/en/newsdetail/202303138194434301.html

Upon checking, no information was found on MTFE's official website (www.mtfe.ca) regarding its signal trading services. However, WikiFX found several pages promoting MTFE's signal trading services on Facebook – some of these pages have up to thousands of followers.

The tricky thing is that there is no evidence to prove that these Facebook pages and signal providers are directly (or officially) associated with MTFE. It could also be possible that MTFE hired individuals to market its signal trading services separately.

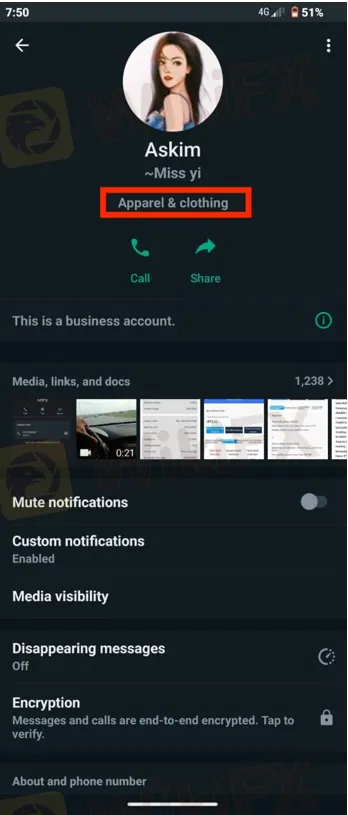

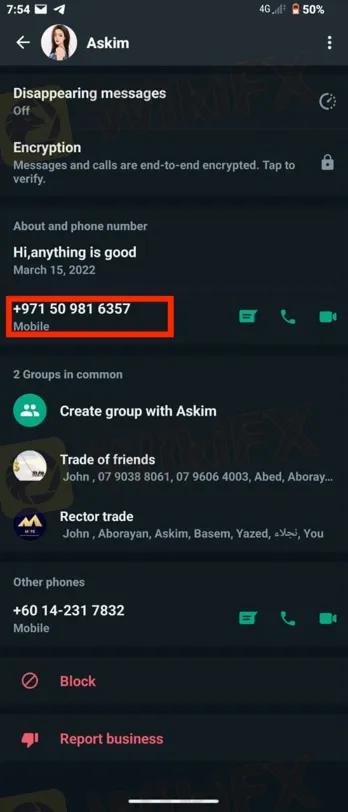

In this Exposure case, the client disclosed the phone number of MTFE's representative, and we found a red flag instantly!

The tricky thing is that there is no evidence to prove that these Facebook pages and signal providers are directly (or officially) associated with MTFE. It could also be possible that MTFE hired individuals to market its signal trading services separately.

In this Exposure case, the client disclosed the phone number of MTFE's representative, and we found a red flag instantly!

The client who sought help from WikiFX provided these two photos that showcase the Whatsapp profile of Askim/Miss Yi, who had been in charge of the client's case with her contact number. However, why is Miss Yi, who represents MTFE labelling herself as someone who dabbles in the apparel and clothing industry? That is a question worth pondering.

The client who sought help from WikiFX provided these two photos that showcase the Whatsapp profile of Askim/Miss Yi, who had been in charge of the client's case with her contact number. However, why is Miss Yi, who represents MTFE labelling herself as someone who dabbles in the apparel and clothing industry? That is a question worth pondering.

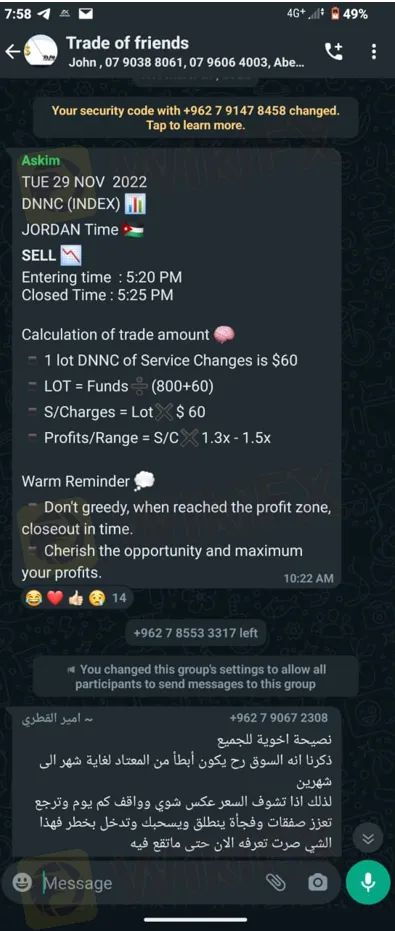

The client also shared a screenshot from a Whatsapp group chat that he participated. This was how he received trading signals alongside other followers.

The client also shared a screenshot from a Whatsapp group chat that he participated. This was how he received trading signals alongside other followers.

Unfortunately, signal trading did not turn out the way the client imagined. He suffered a huge loss and wanted to quit trading when he realised that MTFE did not entertain his withdrawal request.

Unfortunately, signal trading did not turn out the way the client imagined. He suffered a huge loss and wanted to quit trading when he realised that MTFE did not entertain his withdrawal request.

The intricate world of currency exchange can be dangerous for people with little or no prior knowledge of how forex-automated trading systems function.

It is risky for any trader to presume they are immune to this specific form of forex scam because many traders can become victims. Long-term foreign currency traders will better understand what information is reliable and what is not. Yet, those with little currency experience are the most at risk. Beginner forex traders may be more willing to take greater risks and expose themselves than more experienced traders. This is where WikiFX comes into play - to make due diligence easy for both beginner and experienced traders. All you need to do is download our free WikiFX mobile application, visit www.wikifx.com and fully utilise our search bar. Whether opening a trading account or engaging in copy-trading, or signal trading services, it is important to take note of the said broker's credibility. Always opt for a long-established, reputable broker that has withstood the test of time and is highly regulated by recognised authorities with a WikiFX Score of at least 7.0 and above.

If you would like to seek help or guidance from WikiFX, please feel free to contact us through the mediums below:

The intricate world of currency exchange can be dangerous for people with little or no prior knowledge of how forex-automated trading systems function.

It is risky for any trader to presume they are immune to this specific form of forex scam because many traders can become victims. Long-term foreign currency traders will better understand what information is reliable and what is not. Yet, those with little currency experience are the most at risk. Beginner forex traders may be more willing to take greater risks and expose themselves than more experienced traders. This is where WikiFX comes into play - to make due diligence easy for both beginner and experienced traders. All you need to do is download our free WikiFX mobile application, visit www.wikifx.com and fully utilise our search bar. Whether opening a trading account or engaging in copy-trading, or signal trading services, it is important to take note of the said broker's credibility. Always opt for a long-established, reputable broker that has withstood the test of time and is highly regulated by recognised authorities with a WikiFX Score of at least 7.0 and above.

If you would like to seek help or guidance from WikiFX, please feel free to contact us through the mediums below:

Fed’s go-slow approach likely to keep USD weaker

A sleepy mountain resort amid the ski fields of Wyoming becomes the focus of the currency world’s attention for a few days every year. It’s host to an economic symposium sponsored by the Federal Reserve Bank of Kansas City that attracts central bankers and finance ministers from around the world to prognosticate on the big issues of the day. This year’s event was held virtually due to Covid-19 but it was scrutinised just as closely by market participants.To get more news about KCM柯尔凯思, you can visit wikifx.com official website.

Jackson Hole is known for wild variations in temperature, but in his keynote, US Federal Reserve Chairman Jay Powell served up a “not too hot, not too cold” speech that markets lapped up.

Powell had been trying to find the middle ground amid a Federal Reserve Board that is becoming increasingly split between hawks – those who believe interest rates should rise – and doves who believe they shouldn’t.

The hawks are particularly concerned that the continued use of quantitative easing (QE), a method of purchasing bonds to stimulate the economy – must end soon. Otherwise, the central bank could “really get into trouble” if it followed a “go-slow” approach to fighting inflation.1

But the doves feel that moving too fast, too soon could derail the US’s economic recovery, particularly as the virulent Delta strain sweeps through the country.

The market had expected Powell to side more with hawks and give a clearer view of when the Fed would start ‘tapering’ QE and putting upward pressure on interest rates. Indeed, so sure were hedge funds that Powell’s statement would cause the US dollar to rise that they invested heavily in the outcome, pouring $US8.4 billion into the US dollar in the lead to the symposium, compared to just $800 million the previous week.2

It was the culmination of a 3% rise in the greenback against a basket of currencies over the last three months, and an indicator of the strengthening of the US economy relative to peers.

Instead, Powell split the middle between the doves and the hawks by flagging the need for tapering but without setting a timetable for when.

As OFX Treasurer Sebastian Schinkel notes, “Powell somehow managed to acknowledge both sides of the equation and although he conceded on tapering, he made it clear that it will not translate into interest rate hikes ‘for which we have articulated a different and more stringent test’”.

That sent the US stock market to new highs and caused bond yields to fall as investors cheered the prospect of continued stimulus. (A higher stock market and lower bond yields are typically both correlated to a lower US dollar.)First, the Delta variant continues to impact the US economy, with the Southeast particularly badly affected. Many workers still haven’t returned to offices, meaning central business districts still haven’t fully recovered. Consumer sentiment recorded its biggest fall in a decade3 in August as the high infection rate quashed hopes of a full reopening.

A record number of job openings is also crimping the economy, as workers continue to stay home out of fear for their health, or because unemployment benefits continue to be generous relative to pre-Covid.4 The Federal Reserve has stated that it will keep rates accommodative until it sees the economy return to “maximum employment”5, a subjective term which is more based on art than science. Disappointing August employment figures indicated the Fed is still yet to reach that target. That hiring gap along with supply chain issues due to Delta is filtering through to higher inflation. Fuel, food and many services are seeing price spikes,6 another factor behind tumbling consumer sentiment.

So, the Federal Reserve needs to determine whether rising inflation is an issue that will need to be controlled with interest rates or if it is just a transitory phase as the economy returns to normal.

Growth rates remain high at 6.6% annualised, according to the latest quarterly data and in a normal world the Fed would be putting on the brakes by raising interest rates. That would likely push the US dollar higher relative to peers but, for now, it appears the Fed is less worried about the economy getting too hot than the prospect of it going cold.

UK INFLATION HITS NEW 40-YEAR HIGH

UK headline inflation hit a new 40-year high in June, aggravating the cost-of-living crisis and increasing the pressure on the Bank of England (BoE) to deliver bigger interest-rate hikes over the coming months. GBP/USD has peeped over $1.20, but will it hold for long?To get more news about easyMarkets易信外汇, you can visit wikifx.com official website.

Yesterday, BoE Governor Andrew Bailey floated the possibility of a 50-basis point hike next month to try and battle inflation down to its 2% target rate. Money markets are now pricing an 85% chance of this happening and for the rates to reach 3% by year-end. Consumer prices rose 9.4% from a year earlier – the biggest rise since 1982 – and was fuelled mainly by surging energy prices, which threaten to exacerbate the problem when energy bills jump again in October. Despite the spike in UK interest rate expectations, the current difficult economic climate is similar to that of the early 1980s when inflation was at these same levels and the UK’s terms of trade shock relative to the US was as bad as it is now.

The US dollar remains on the backfoot this week, largely as a result of improved global risk sentiment evidenced by the rally in global stocks and commodity-linked currencies. Money markets are pricing in a lower probability of a larger 100-basis point US rate hike this month.

Stronger-than-expected results from US companies this week have helped boost risk appetite with the US benchmark S&P500 stock index rising 2.8% yesterday. Furthermore, narrowing yield differentials as a result of reduced US rate-hike bets due to peaking inflation indicators compared to increased rate-hike bets in the UK and Europe, have helped GBP/USD and EUR/USD extend around 2% higher this week. However, long-term chart formations point to another run at lower levels unless EUR/USD can climb back above $1.05 next month. GBP/USD is currently testing the top of its sharp 2022 downtrend channel – meaning this $1.20 battle could prove pivotal.

Further boosting risk sentiment and supporting the euro today is the news that Russia will reopen the Nord Stream 1 pipeline, which supplies more than a third of gas exports to the EU. The European Central Bank (ECB) meeting tomorrow and the Italian political risk are also key factors driving euro demand.

Due to inflation prints consistently surprising higher across Europe, money markets have raised the probability of a larger 50-basis point ECB rate hike tomorrow, which could send EUR/USD higher and weigh on GBP/EUR. However, the energy crisis likely trumps this supporting theme and although Nord Stream 1 is reopening, the EU is considering a voluntary 10-15% cut in natural gas use by member states once gas storage is sufficiently built up ahead of winter. There is still a risk that Russia will halt supplies in retaliation, which would exacerbate the energy crisis, increase Europe’s terms of trade shock and drag EUR/USD under parity.

BOE’S RECESSION WARNING, US JOBS REPORT UP NEXT

Markets got it right, the Bank of England (BoE) raised interest rates by 50-basis points – its biggest hike in over half a century and taking its Bank Rate to a new 13-year high. This wasn’t enough to support the pound though as the UK central bank warned of a more than year long recession with inflation upwardly revised once again to peak above 13% this year.To get more news about FxPro浦汇, you can visit wikifx.com official website.

The Monetary Policy Committee voted by a majority of 8–1 to increase the Bank Rate by 0.5 percentage points, to 1.75%. One member preferred to increase by 0.25 percentage points, to 1.5%. Despite signals for equally large hikes in the future, the pound failed to climb. Again, it proves that large hikes don’t always result in currency strength and it was dire economic outlook that weighed on sterling. The BoE forecasts the UK economy to slide into recession in the final quarter of this year and won’t return to growth for years to come. Wholesale gas prices have nearly doubled since May owing to Russia’s restriction of gas supplies and when this further feeds into retail prices, it will exacerbate the fall in real incomes for UK households. Meanwhile, data this morning has revealed UK house prices declined for the first time in a year in July, as rising interest rates and soaring inflation finally took their toll.

Earlier this week, we saw US job openings fell in June to a 9-month low, suggesting tightness in the labour market is easing somewhat amid growing economic pressures. Today’s US report is currently forecast to show the US added roughly 250,000 payrolls in July and the unemployment rate held near a 50-year low but given weaker signs such as job openings and jobless claims, we could see a disappointing set of results today. But what might this mean for the US dollar?

The current mantra of bad news is good news for risk appetite and bad for the US dollar is because markets expect the US Federal Reserve (Fed) might therefore ease its aggressive tightening cycle in light of recession fears. However, as we saw from the BoE, despite recession risks rising, central banks remain fixed on taming inflation and next week’s inflation print is likely to top 9% y/y again. We’ve also witnessed a pushback from several Fed speakers this week, which has limited the downside for easing rate expectations. Currencies remain volatile amidst this inflation vs. recession debate and how central banks will react, and given the dollar has modestly risen in the aftermath of US non-farm payrolls releases this year, we wouldn’t be surprised to see more dollar strength to end the week.

Another turbulent week across markets has resulted in a mixed reaction across different assets. Global stocks are near a 2-month high, gold is a at a 1-month peak and oil prices are languishing on recession fears, compounded by the inversion between 2-year and 10-year US bond yields, which remains near the deepest since 2000.

Investors continue to flip-flop between risk-on and risk-off sentiment as they weigh up inflation vs. recession. The bond market is saying there is a high chance of recession, while the equity market is focused on the US labour data and speculating that a poor print will slow the Fed’s tightening pace (but again this is related to recession fears). Oil prices are also near their lowest since February (before the war in Ukraine) on demand concerns due to plunging consumer confidence and purchasing power. In the currency space this morning - risk-on dominates, with the pound falling against commodity linked currencies like the Aussie dollar South African rand and rising against traditional safe havens like the Japanese yen and Swiss franc.

Forwards and Futures Markets

A forward contract is a private agreement between two parties to buy a currency at a future date and at a predetermined price in the OTC markets. A futures contract is a standardized agreement between two parties to take delivery of a currency at a future date and at a predetermined price. Futures trade on exchanges and not OTC.To get more news about FXCM福汇, you can visit wikifx.com official website.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves. In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange (CME).

In the United States, the National Futures Association (NFA) regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterparty to the trader, providing clearance and settlement services.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

In addition to forwards and futures, options contracts are also traded on certain currency pairs. Forex options give holders the right, but not the obligation, to enter into a forex trade at a future date and for a pre-set exchange rate, before the option expires.

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in Europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. firm plans to sell it for €150—which is competitive with other blenders that were made in Europe. If this plan is successful, then the company will make $50 in profit per sale because the EUR/USD exchange rate is even. Unfortunately, the U.S. dollar begins to rise in value vs. the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem facing the company is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150—which, when translated back into dollars, is only $120 (€150 × 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by short selling the euro and buying the U.S. dollar when they were at parity. That way, if the U.S. dollar rose in value, then the profits from the trade would offset the reduced profit from the sale of blenders. If the U.S. dollar fell in value, then the more favorable exchange rate would increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world.