wisepowder's blog

Oil Market Expected to be Worse Because of Dropping in US Stock and Oil

the

US stock index and yields have reported to bounce off recently after

the release of the US non-farm payrolls report, or NFP, in August, with

the index rising to an intraday high level of 93.24, hitting a week

high; WIT crude oil falling to an intraday low level of 39.35 dollars,

recording a month low.To get more news about WikiFX, you can visit wikifx official website.

The NFP in August showed that jobs increased by 1.371 million and

unemployment rate decreased by 8.4%. Although it revealed an optimistic

market, the working population, objectively speaking, presents a sign of

slowdown. In addition, the permanent unemployment rose to 3.4 million.

Therefore, there are great uncertainties about the recovery in the US

economy.

According to the performance of US stock on Sept. 4th, it

is obvious that the US stock wasnt stronger for benefiting from the NFP

and three benchmark indexes generally dropped. It is expected that the

oil may encounter further the sustained selling pressure from the US

stock.

This Saturday will see the interest rate decision in September by the

European Central Bank (ECB). Considering the worse European coronavirus

situation, the ECB warned last week that the euro depreciated fast. The

more easing signals by the ECB may put pressure on the euro, strengthen

the US stock index and drive further downside in the gold price.

Moreover, the adds are that the oil demand becomes worse during the

upcoming seasonal shutdown maintenance of oil refineries. The oil price,

so far, has fallen below the level of 40 dollars, and is expected to be

confronted with selling pressure if it cannot break upward the level of

41.3 dollars in the near term.

All the above is provided by

WikiFX, a platform world-renowned for foreign exchange information. For

details, please download the WikiFX App: bit.ly/WIKIFX

Paytm Money Aims To Be India’s Top Wealth Manager

Paytm Money,

the online platform for mutual fund investments that recently forayed

into equity broking, aims to be India‘s top wealth manager as the owner

of the nation’s largest e-wallet expands its financial services

footprint.To get more news about WikiFX, you can visit wikifx official website.

“As we progress in this journey of becoming the preferred platform

for users to save and invest, our goal is to provide a simple platform

for users to do so,” Varun Sridhar, chief executive officer at digital

investment unit of One97 Communications Pvt., told BloombergQuint in an

interview. “With a few clicks you are able to save and make your money

work harder.”

Paytm Money, which has 200-300 million customers doing 20-30 million

transactions daily, aims to capitalise on its existing user base. “We

see about 80%-odd users who are, what Id call, important or very loyal

Paytm users, and about 20% come from outside the system.”

By far, in order to bridge the gap between vision and reality, 3D architectural visualization, AR, VR, and 3D printing, as frontiers, are gradually adopted in the interior design. Arguably, they will ride the future wave of the industry.

1. 3D architectural visualization – Previewing designer’s ideas

3D architectural visualization is the art of creating two-dimensional and three-dimensional images showing the attributes of a proposed architectural design. This technology benefits interior design in three ways. Firstly, the application of the technology shows the beauty of the details of interior decoration. The details decide the whole, which makes a room unique, and the decorating outstanding. They enrich the viewing experience and communicate the ingenuity in interior design. By contrast, it takes plenty of time to finish it in other ways such as sketches and blueprints. Secondly, 3D architectural visualization can help us build a portfolio of the projects in the market campaign, which can bring more potential customers. We can put them on your website or other social media networks. This can help establish a good image and reduce the hesitation of potential customers. Thirdly, the application of VR and AR in interior design is also based on 3D architectural visualization. The basic material to create VR and AR scenes is rendered by 3D architectural visualization.

2. VR- Are you really there?

VR architectural services also play an important role in interior design. VR is defined as “a simulated experience of virtual walkthrough that can be similar to or completely different from the real world.” At the very beginning, VR is applied to the game industry to immerse the players in the game world. However, its potential is far more than that. For instance, it has come into wide use in the interior design industry. The application of VR makes people feel like they are actually in the house where every furniture is visualized. In this way, it is easier for the client to preview the final result and choose the style they most wanted. Therefore, it is possible to accurately locate the needs of customers from every detail.

3. AR – Trying to interact with the surrounding

The commercial running of IKEA, being a significant milestone, marks the great application of AR in the interior design industry. The advantages of AR are obvious. First of all, AR has very low requirements for hardware facilities. A tablet running the AR app is capable of doing the magic. Thereby, it saves a lot of resources including time and money. Secondly, AR allows customers to get instant changes when they walk through the room, so as to give customers timely feedback and meet the client’s demand. In addition, because of the great interactivity of AR, the experience of choosing the right interior design goes from boring activities to the enjoyable delight.

Generally speaking, due to the said upsides, AR is also considered to be the key technology to lead the future interior design.

4. 3D printing – Everything becomes touchable

3D printing is the technology used to be costly and difficult to operate. However, nowadays it’s affordable for most people. Operating a 3D printing machine is no longer a difficult job which involves chunky and massive machine and complex instructions. Through 3D printing techniques, nearly anything can be made. It’s no exaggeration to say it may lead to the next industrial revolution.

When the 3D printing technology is applied to the interior design industry, its effectiveness and convenience will be brought into full play. By showing the prototype of the house built by cheap 3D printing materials, the elusive design style becomes so touchable. In addition, 3D printing reduces the time spent from an idea, prototype, and production. It can achieve the same effect of 3D rendering or even greater.

Three Things Dominating Forex Markets

First of all, will technology stocks continue correcting? The Nasdaq composite has remained in correction since hitting a record high on September 2. As of September 11, the index has retraced by over 10% from its highs. The reason for the sustained decline is rumored to be Masayoshi Son, the richest person in Japan, whos position was squeezed after trading options. Whether or not the statement is right, it is normal for Nasdaq to see correction when accumulating large gains. Therefore, the correction is expected to continue until finding its initial support at 10,180. In this case, the U.S. dollar index may keep climbing this week.To get more news about WikiFX, you can visit wikifx official website.

Secondly, the British Parliament conducted the second reading debate on Johnson's Internal Market Bill on September 14. The bill may put the UK in the risk of no-deal Brexit, spurring more selling of the pound. I hold a pessimistic view that the UK is probably to stage a hard Brexit. This is mainly because the country's breach of the agreement, through which it hopes to force the EU to make concessions, will instead push the EU to fight every inch of the way. As the EU has declared it would accuse the UK of violating international law, the two parties can hardly reach a consensus in the face of such differences and trends. The dilemma is difficult to resolve unless Conservative MPs of the British Parliament dramatically change their sides, thus the pound is almost certain to see a deep loss.

The third thing is the leadership election of the Liberal Democratic

Party of Japan on September 14. Unless something unexpected happens,

Yoshihide Suga is set to win the election and the Abenomics policy will

be maintained, not surprisingly, as he repeatedly stressed. One key

unknown is whether Suga will call a snap general election soon after

taking office, which will thrust the country on a knife-edge, hampering

Japanese stocks. In this case, the Japanese yen has a chance to grow

along with the good news that the US stocks seem to perform enduring

consolidation. Eyes should also turn to the rate decision of the Bank of

Japan on September 17, so as to see whether the Bank will greet the new

prime minister with further quantitative easing, which is possible but

not probable from my point of view.

Gold Price Rebounds with Stability Expected at High

From the

start of the week, gold price is little changed compared with last week

as it has quickly rallied from the fresh monthly low of $1,907; while

current market trends may keep gold afloat as the crowding behavior in

the US dollar persists in September.To get more news about WikiFX, you can visit wikifx official website.

Gold price may continue to consolidate as global stock markets are

under pressure with the Nasdaq and S&P 500 sitting at a precarious

position. However, the crowding behavior in the greenback may continue

to coincide with the bullish behavior in gold as a bear-flag formation

emerges in the DXY.

The FED seems to persist with the plan of

“achieving an inflation that averages 2% over time”, which may not be

changed before the US election. Gold price is expected to be lifted once

the Chairman Powell raises the FEDs balance sheet back above $7

trillion.

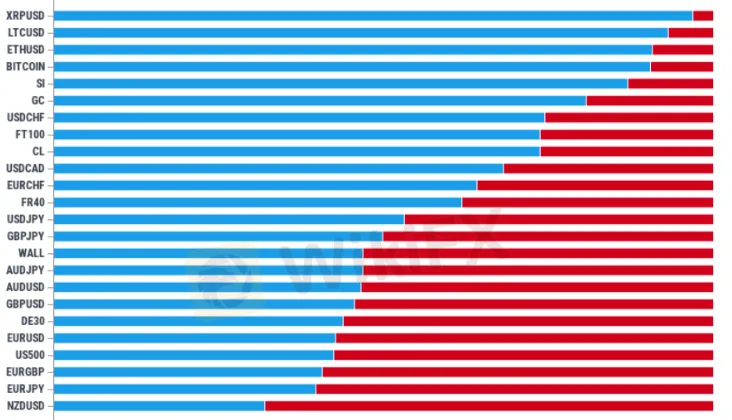

According to the IG Client Sentiment report, retail investors all

hold net-long USD/CHF, USD/CAD and USD/JPY while remaining net-short

AUD/USD, GBP/USD, EUR/USD and NZD/USD.

Gold price may continue to

consolidate before a successful attempt of closing below $1,907-1,920.

Only when a break/close above $2,016-2,025 appears can the record high

price ($2075) finds its way. The next area of focus comes around $2,064

followed by $2,092.

All the above is provided by WikiFX, a

platform world-renowned for foreign exchange information. For details,

please download the WikiFX App: bit.ly/WIKIFX

MFs have many options to meet 25% limit requirement on multi-cap schemes

Market

regulator Sebi on Sunday said mutual funds (MFs) have many options to

meet with the requirement of 25 per cent limits on multi-cap schemes

based on the preference of their unitholders.To get more news about WikiFX, you can visit wikifx official website.

Apart from rebalancing their portfolio in the multi-cap schemes,

mutual funds could facilitate switch to other schemes by unitholders,

merge their multi-cap scheme with their large-cap scheme or convert

their multi-cap scheme to another scheme category (for instance

large-cum-mid cap scheme), the Securities and Exchange Board of India

(Sebi) said in a clarification.

The capital markets regulator, in a

circular issued on Friday, specified that minimum investment in equity

and equity related instruments of large-, mid- and small-cap companies

should be minimum 25 per cent each of total assets.

“Sebi is conscious of market stability and therefore has given time

to the mutual funds till January 31, 2021 to achieve compliance with the

circular, through its preferred route of which rebalancing of the

portfolio is only one such route,” the circular stated.

Design a desired house or building with 3D rendering, and discover just how much it adds value in the process. We’re sharing why it provides value here. The world of 3D Interior Decoration is all about styles and colors.To get more news about design rendering services, you can visit https://www.madpainter.net official website.

Do you recollect that line “a photo speaks a thousand words”? What happens if that image was in 3D as opposed to 2D? It does without saying that 3D Images are the most potent marketing tools for your projects.

Utilizing 3D to render your 3d Interior Decoration project is the most effective means to display your skill in design. This modern strategy to design presents indoor and outside rooms with fluidity and harmony.

Before the advent of 3D rendering software, hand-drawn renderings, and viewpoints were the sector’s go-to tools. Today, these techniques have almost lapsed as the quick 3D renderings provide ample value to a 3D designer.

In its simplest type, rendering is a term from computer system graphics which explains the process of imaging, visualization, or development of models with the assistance of a computer 3D program.

3D rendering provides practical discussions of pictures, scenes, or in your situation, a visualization of your residence by capturing the elements in a thought-provoking manner via high levels of photo-realism.

It illustrates the construct out of walls, coatings, furniture, web traffic circulation, along with spatial relationship as well as the overall layout.

The Advantages of 3D rendering can be felt even in the preliminary stages of project planning.

As designers start to plan dividers, surfaces, as well as furniture layouts, they can simultaneously model the project to see precisely how surfaces can create the feeling the customer wants, or how furniture will certainly suit a provided area.

These renderings can also assist in recognizing problems which may otherwise be overlooked with the conventional 2D approach.

As soon as recognized, these problems worked over with the client and corrected before actual construction work.

3D renderings are incredibly beneficial in examining the right finish. A designer can examine out many paint shades to establish the one that fits the client’s style without raising a paintbrush or offering a mock-up.

The dollar hit a more than two-year low and a fourth straight month of losses on Monday in the wake of the U.S. Federal Reserves policy shift on inflation.To get more news about WikiFX, you can visit wikifx official website.

Against a basket of currencies the dollar was down 0.15% at 92.097 in midday trading, having earlier hit its lowest since April 2018. It is down 1.24% for the month, marking its worst August in five years and the longest run of monthly losses since the summer of 2017.

The euro, which makes up the majority of the basket against which the dollar index is weighted, was up 0.35% at $1.195, having gained 1.45% in August, also its fourth straight month of increases.

Investors are adjusting to a speech last Thursday in which Federal

Reserve Chair Jerome Powell outlined an accommodative policy change that

is believed could result in inflation moving slightly higher and

interest rates staying lower for longer.

The U.S. dollar index slipped to a record low of 92.07 under pressure on Monday, spurring gold prices to faster growth and the attempt of $1,970.To get more news about WikiFX, you can visit wikifx official website.

The FED Vice Chair Clarida said that an inflation target slightly higher than 2% is appropriate as inflation expectations play a critical role in policy making. This statement indicates that the FED has determined to further stimulate the economy. Subsequently, the dollar index sank to a record low of 92.07 under pressure, while gold prices retreated modestly after being inspired to edge up and attempt the level of $1,970.

The words of Clarida are not surprising and may limit the upside room

of gold prices in the near term. Markets before this Friday's Non-Farm

Payrolls (NFP) release may show a tame picture of tradings, putting the

brakes on the gold volatility..

According to gold hourly chart, gold prices are temporarily confined to the area of $1,972-1,976 with a pressure level which is significant in the short term of $1,976, where a breach above is necessary to pave the way for further upside. On the contrary, a failed attempt above the area may bring risks of sharp decline.

Moving forward, with another crucial zone of pressure lying in $2,000-2,002, bearish gold will be inevitably coincided with a distinct downtrend once the upside is defeated ahead of this zone; whereas if the upside claims a victory, another attempt is much more likely to be made to penetrate the earlier high of $2,015 or even higher .

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

In mid-August, it was revealed that Buffett bought gold-mining shares this Q2. As gold prices hovered around US$1,571.80-1,785.78 at that time, the investment of Warren Buffett is still profitable at present prices. This episode occasionally reminds me of a story nine years ago.To get more news about WikiFX, you can visit wikifx official website.

The story happened in 2011, when gold prices eased back after hitting

the all-time high of $1,920 on September and closed the year at

$1,562.92. Generally, gold prices in the year rose by 12% while the

Canadian Barrick Gold Corp, the world's largest gold-mining stocks,

decreased by 14%. According to records, some small-scale gold-mining

stocks even lost as high as 40% at that time, which made many prominent

investors suffer a great deal from these stocks, and even masters such

as Soros and Paulson were not immune.

This story from nine years ago sheds some light on the fact that traders shall not blindly jump into the market as even best investors like Soros cannot get a golden touch in gold markets. Long-term gold traders should consider gold ETFs rather than gold-mining stocks as the trends of gold prices and gold-mining stocks are not necessarily synchronized.

In Q2, Buffett's Berkshire Hathaway added gold-mining stocks in its trading list for the first time in its history, and reduced, or even sold out financial stocks at the same time. Gold prices climbed to $2,015 in the wake of the news but fell to $1,902 afterwards as no further support available. It is obvious that there were major players selling gold at a high price level which was pushed up by the news, with the sold amount large enough.

Buffett used to be a well-known anti-gold investor who has repeatedly stated that gold was not worth holding for long. The reason is that gold pays back no interest but requires storage charges, while stocks do pay back interest income. In my opinion, the situation that gold purchase becomes popular among investors who have never bought any gold or even are against buying gold is just similar to what described in Wall Streets famous saying: when the shoeshine boys talk stocks it was a great sell signal in 1929. The reason is that people who shouldn't trade stocks also trade stocks, reflecting that a bubble has appeared in the stock market.

In addition to the trend of the greenback, traders should also pay attention to the development of vaccines around the world. Besides Russia, many countries in Europe and America are expected to claim approval of vaccines, which will certainly hamper gold prices.