How to trade forex from freeamfva's blog

How to trade forex

Once you learn how to trade forex, you’ll understand why it’s such a popular market. You’ll discover that you can choose between many different currency pairs – from majors to exotics – and trade 24 hours a day. Use this guide to learn how to trade currency with our FX trading steps and examples.To get more news about forex education, you can visit wikifx.com official website.

Choose a currency pair to trade

We offer more than 80 currency pairs – from majors like GBP/USD, to exotics like HUF/EUR. When you trade with us, you’ll be speculating on these forex pairs rising or falling in value with spread bets and CFDs. These make use of leverage, which enables you to open a larger forex trade with a small upfront deposit (called margin). However, this means your losses as well as profits can far outweigh your margin amount as they are calculated based on the full position size, not just your margin.

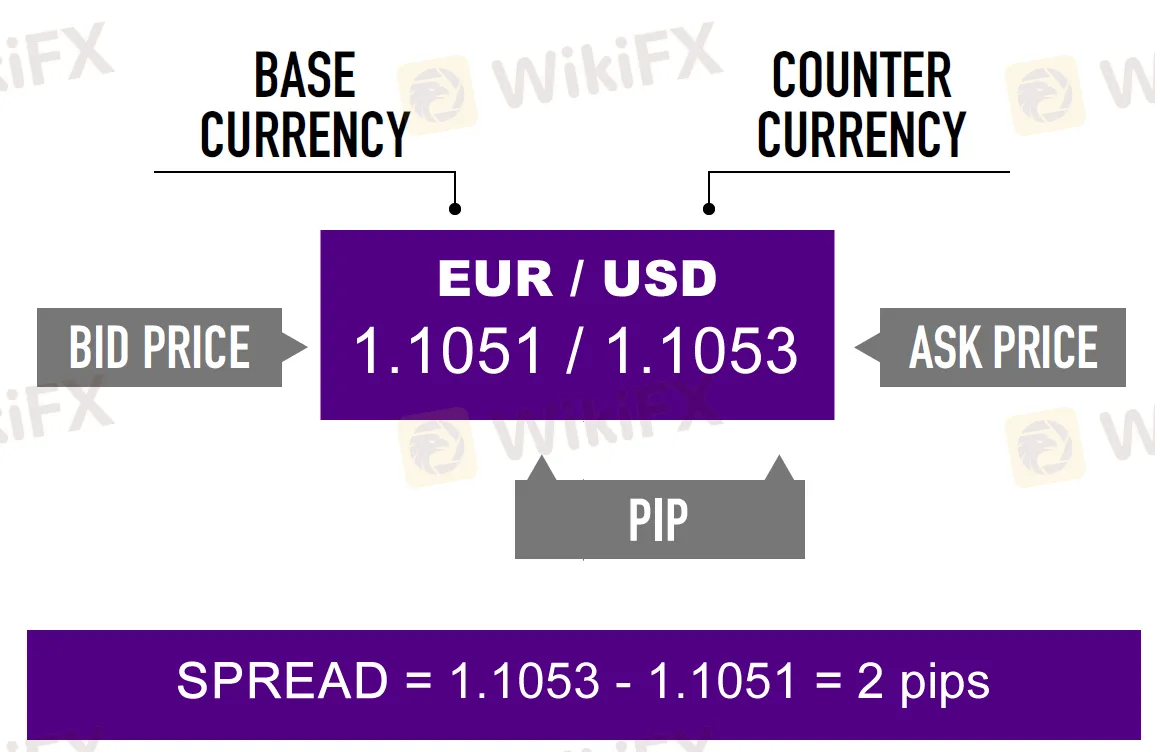

Before choosing an FX pair to trade, you should carry out fundamental analysis and technical analysis on the two currencies in the pair. This means you should assess how the ‘base’ (the currency on the left) and the ‘quote’ (the currency on the right) move in relation to each other.

Decide whether to ‘buy’ or ‘sell’

Once you’ve chosen a currency pair to trade, you need to decide whether you want to ‘buy’ or ‘sell’, based on your analysis.

You would buy the pair if you expected the base currency to rise in value against the quote currency. Or, you would sell if you expected it to do the opposite. That’s because a currency pair’s price represents how many of the quote currency you’d have to spend to buy a single unit of the base currency.

For example if the price quoted for GBP/USD is 1.28000, it means you’d have to spend $1.28 to buy £1 – so the pound is stronger than the US dollar.

Set your stops and limits

The forex market is particularly volatile, which is why it’s important to have a plan to guide the entry and exit points of your trades. There are various stops and limits you can set to manage your risk when trading forex:

Open your first trade

If you want to trade on the value of forex pairs rising or falling with spread bets or CFDs, why not open an account with us? Once you’ve done that, simply go to our award-winning trading platform,1 search for the forex pair you want to trade, enter your position size and choose ‘buy’ or ‘sell’.

Monitor your position

Once you’ve opened your position, you can monitor your FX trade in the ‘open positions’ section of the dealing platform. You can also set price alerts to receive email, SMS or push notifications when a specified buy or sell percentage or point is reached.

Close your trade and take your profit or loss

Once you’ve decided it’s time to close your position, simply navigate to the ‘positions’ tab, select your position and click on ‘close’. Alternatively, just make the opposite trade to the one you opened. In other words, if you went long on GBP/USD, go short by an equivalent amount to close the position – assuming you’ve selected the ‘net-off’ option on our platform, rather than ‘force open’.

Forex spread bet

Forex spread betting lets you make a prediction on the direction in which a forex pair’s price is heading. You’ll bet an amount of money per point of movement, and if the price moves in the same direction that you predicted, the greater your profit. But, the further it moves in the opposite direction, the greater your loss.

Forex spread bets are also leveraged. This means that you’ll pay a small margin when opening a trade but gain exposure to the total position size. However, it also means your losses and profits can far outweigh your deposit amount.

Spread bet prices are displayed in points – for example, if GBP/USD is trading at $1.31425, its price would be displayed as 13142.5. This makes no difference to the price you deal at or your potential profit or loss: it simply makes it easier to track per-point movements. When you trade forex with spread bets, all of your profits are completely tax-free.2

Post

| By | freeamfva |

| Added | Sep 14 '22 |

Tags

Rate

Archives

- All

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

The Wall