User blogs

Tag Search

If you have funds invested in open positions, you can free up more funds by closing positions. Once a position is closed, the invested amount +/- any profit or loss be returned to your available balance.

eToro withdrawal methods

eToro supports a variety of withdrawal methods. These are all the same methods as are available for making a deposit. However, it is essential to remember that you can only withdraw in the same way you have used to make your deposit.

If you use a combination of methods, such as credit card and bank transfer, you receive funds to the respective methods deposited.

If your deposit method is locked or unusable for any reason, you can use an alternative withdrawal method. eToro may ask you for proof of this to change to another withdrawal method.

Is there a fee for withdrawing from Etoro?

All your withdrawal requests are subject to a fee of 5 USD. By default, you withdraw USD. Withdrawals from an eToro account in any currency other than USD are subject to a conversion fee. The payment service provider collects this conversion fee.

Compared to the benefits that eToro provides, 5 USD is quite a comfortable fee. The purpose is to encourage users to consider withdrawing when they have reached a relatively stable profit instead of continuously withdrawing because withdrawal requests go through the payment control system and take longer to process than deposit requests.

However, if your eToro account is Platinum level or higher, you get a 5 USD free withdrawal fee.

How to know your withdrawal request has been processed?

You receive an email notification when your withdrawal request has been processed along with the payment provider details to which eToro sent the funds.

Alternatively, you can also tap on Portfolio and go to the History tab to see the status of your withdrawal.

How long does it take to process a withdrawal request, and when will the customer receive the funds?

The withdrawal process includes Withdrawal processing time and money receiving time. The processing of withdrawals is handled by eToro. Besides, the time to receive your money is already in the hands of the payment service provider.

How to cancel a withdrawal request?

As long as your withdrawal request is Under Review, you may cancel it via your Portfolio by clicking on the blue History icon and clicking the Reverse button on the request you wish to cancel.

What should you do if the money does not appear in your account?

Tap the category card. Then go to the history card to check your sent eToro payment method. Or, you can check the email you received regarding the processing of your withdrawal.

You should also note that it will take eight business days from eToro processing your withdrawal request for the funds to appear on your account statement.

If you have checked all the items above and still cannot find your money. Please get in touch with eToro for assistance. eToro will ask you for a payment method statement showing incoming and outgoing transactions from when you make your withdrawal until you contact eToro. It would be best to ensure that eToro can see your name, transaction date, and payment method details.

What is mirror trading?

Whether you are interested in mirror forex trading, or any other market, mirror trading is a strategy that can be applied to most markets. Mirror trading is a type of automated trading that emerged in 2000, even before the other variants, such as copy trading and social trading. Its name gives us a clear clue of what mirror trading means, since it consists of replicating or reflecting the strategy of a certain trader.

In this case, this strategy is hosted on the server of the company that offers the trading services - the broker - which, in turn, makes it available to its clients through its platform.

The trader who wants to replicate strategies of other market participants is able to see all the characteristics and the results of each one of them in the trading platform of his broker. Then they select one of them based on their profit goals, trading style, capital, risk tolerance level, etc.

Each one of the operations is copied automatically and configured in the account of the trader that replicates the strategy.

Advantages vs disadvantages of mirror trading

Before covering the advantages and disadvantages of mirror trading, I must present a clear warning: be careful, because absolutely everything in the strategy is replicated. That’s why it’s highly recommended that, before choosing this strategy, we dedicate time to researching the following:

Mirror trading vs Copy trading vs Social trading

The basis of mirror trading, copy trading and social trading is, broadly speaking, the same: a trader copies the strategies and techniques of another trader. However, these three variants have their differences when it comes to putting them into practice. Let's see them:

Mirror trading

In this case, the ‘original’ trader programs and directly hosts his strategy on the server of the company that provides this service for the rest of traders to replicate. The trader who facilitates the strategy must have programming knowledge so that he can send the signals that will later be replicated in the client's trading account.

Copy trading

When we talk about copy traders, we refer to the technique by which a trader connects their account to the system of the company that offers this service, becoming a signal provider. Like mirror trading, this strategy can apply to Forex copy trading or any other market.

Unlike mirror trading, in this case it does not program its strategy on the company's server but instead hosts it on its own server and, from there, sends it to the trading platform for the broker to forward it to its clients. A client can then become a copy trader based on this strategy.

Social trading

Social trading is a kind of user community that works in the same way as a social network, but around a topic as specific as trading. In this case, we can talk about two types of actors that participate in this network: signal providers or professionals who share their operations; their followers, who seek advice, exchange opinions and investigate winning strategies.

Market sentiment - an alternative to mirror trading?

Admirals does not provide portfolio management or mirror trading services but is preparing a new copy trading service that is expected to be available in February 2021. Until then, it’s offering an alternative, thanks to its MetaTrader trading platform.

Admirals has the exclusive Supreme Edition plugin for MetaTrader 4 and Metatrader 5 that adds to these platforms, among other indicators, the Market Sentiment. You can consider this as something similar to an mt4 mirror trading function.

This indicator can help the trader know the majority positions of investors at a given time. What it does is measure the emotional state of market players and identifies whether the majority are long or short - that is, whether optimism or pessimism is dominating.

When trading in the financial markets, one needs 3 important elements: a robust trading strategy, risk management rules and the discipline to follow them. Andreas will cover all these topics in his presentation and you will have the chance to get a free '50 Trading Tips & Tricks' book. Don't miss out - see you in Hall 6 at the expo!

Win gifts and meet our team

Wanna participate in a ticket giveaway to Sevilla FC's football match? Wanna take a selfie with the NAGA team and get a chance to be featured in NAGA Vlog?Make sure to visit us at the NAGA booth and let's create some memories together!

Elevate your trading career

As the saying goes, it's worth reading books because you never know which one sentence will spark an idea that can change your future.

The same is true for events like the Forex Expo - you can meet so many leaders of the trading world and hear potentially life-changing insights, so don't miss out and see you there!

The Forex Expo Dubai is the largest B2B and B2C Expo in the MENA Region. After the first successful Forex Expo Dubai held in March 2019, which attracted tens of thousands of traders and investors from around the world, it was decided to launch the second edition of Forex Expo in Dubai.

The Forex Expo brings together most of the brilliant market influencers and professionals to discuss the significant topics in the Forex space. The event brings together and assembles a global network of traders and industry expert driving a worldwide Forex trading and financial service revolution. The Impressive gathering of the whole Forex industry in the region offers numerous networking opportunities and insights to the Forex landscape.

Build your confidence and learn to trade Forex, from how to get started to choosing a broker, creating a trading plan and placing an order for your first trade. Here at AskTraders, we’ll be with you every step of the way as you embark on your new and exciting path in currency trading.

Here’s our guide for beginner traders that will put the main ideas of the Forex market in a nutshell. The forex trader tutorial has been devised by the professional traders of the LiteFinance Company whose extensive experience helped optimize its structure and contents. The tutorial offers all you may need for a quick start of your trading career.

If you are not acquainted with the terms and don't have the least idea of how this system works, this Forex tutorial is exactly what you need. From the very beginning, you will appreciate the accessibility of the provided information. After reading the first section of our forex trading tutorial, you will understand the way the Forex trading system works and you will be able to communicate with your trading peers as an equal.

Traditionally, like any other Forex trader tutorial, this tutorial contains basic information on fundamental and technical analyses. The main mechanisms of price formation, the market impact of political and economic events, and other factors that affect stock prices are set forth in a simple and understandable way. Particular attention is paid to the popular methods of technical analysis. The author examines in detail the indicators and graphical patterns used by traders.

As you may have already noticed, a great deal of Internet blogs is devoted to trading psychology. It’s not for nothing! The Trading Psychology section of our Forex tutorial deals with the question of what the psychological pitfalls of trading are and why it’s so important to work on yourself.

The money management section of this Forex tutorial is worth a special mention. It reflects the authors’ personal experience since this subject is part and parcel of practical application and therefore cannot be examined separately. You will learn to control risks and place Stop Loss and Take Profit orders wisely, the way Forex market professionals do.

The last section of our Forex tutorial will help you build your own trading strategy. Starting with the basic idea and concluding with testing and adjustment, you will develop your first trading system together with the professional trader. This section is a logical conclusion of the whole tutorial as from now on you can start your safe journey in the world of Forex trading. Feel free to download our Forex tutorial right from LiteFinance’s official site.

The pros, cons, and fees of AvaTrade

AvaTrade is an international CFD broker that has been around since 2006, although it was originally launched under the brand name AvaFX. It’s fair to say that AvaTrade has already attained a degree of popularity, as it has more than 300,000.To get more news about avatrade pros & cons, you can visit wikifx.com official website.

It claims to operate as a regulated broker in seven different countries, including Ireland, Australia, Japan, and a few others. It promises a user-friendly platform and it seems to offer competitive spreads (fees).But, of course, there are many questions that need answers before you can determine whether AvaTrade is a good option for you. For instance, which financial instruments am I able to trade, are there any hidden fees, is it a scam?, etc.

In order to answer all these questions, I prepared this review of AvaTrade and I’ll tell you all you need to know about this trading platform.

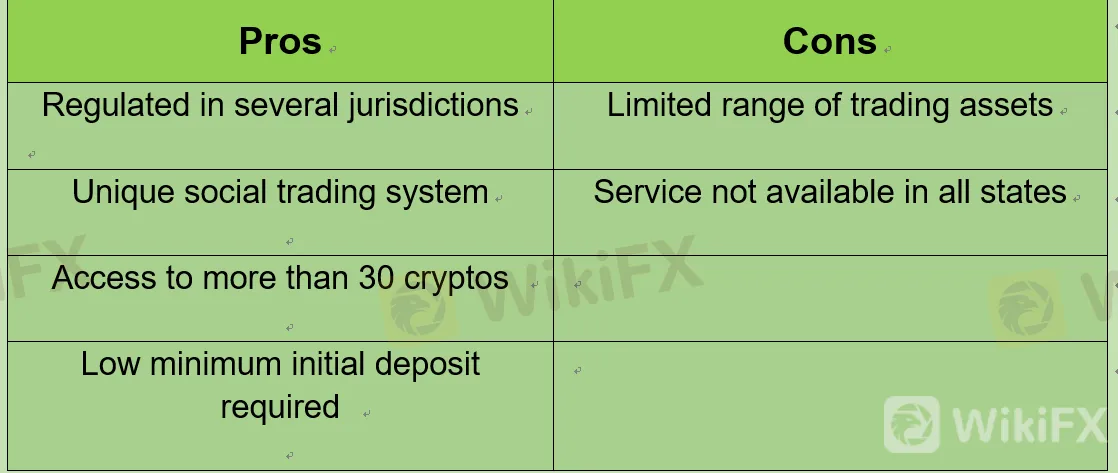

The pros and cons of AvaTrade

Before I explain all the features offered by AvaTrade, I want to tell you about its advantages and drawbacks, and about who might benefit from opening an account with AvaTrade.

Who should be using AvaTrade?

AvaTrade is a broker for investors who intend to invest exclusively in derivatives such as CFDs and Forex options. If you want to buy stocks, ETFs, or even cryptocurrency, there are better alternatives out there, like DEGIRO, eToro, or Interactive Brokers.

Is AvaTrade secure?

AvaTrade does go to great lengths to have a secure platform on which your investments are not at risk of being stolen/hacked by cybercriminals. For instance, it uses SSL encryption and has several security protocols in place, including McAfee Secure – not sure what this last one is, but sounds good.

That said, I’d prefer having two-step authentication – like DEGIRO or eToro offer. With that process, AvaTrade would ask you to confirm your identity with a verification code sent to your mobile, as is done by many banking apps. This would provide an extra layer of security to your account. Regrettably, it’s not available.

Who regulates AvaTrade?

If you are afraid that AvaTrade might be a scam, rest assured that it is regulated in a number of (reputable) countries, with many regulatory bodies supervising its activities.

What AvaTrade does with these spreads is it offers one price if you’re selling and a different one if you’re buying. This spread, which is already built into the transaction cost, is how AvaTrade and other market makers finance themselves.

The bottom line is that AvaTrade doesn’t allow you to invest in many different types of financial products. It’s really only possible to invest in derivatives. So, if you want to invest in stocks, investment funds, ETFs, or cryptocurrencies, it’s best you look for an alternative.

On the other hand, it can be your gateway into the world of trading via CFDs (contracts for difference). This type of product is suitable for short-term speculation, as the trading cost (the spread that I mentioned earlier) is low.

How does AvaTrade work?

With AvaTrade, there are only two types of accounts: retail investor accounts and professional investor accounts.

The main difference between these two types of accounts is that if you are a professional trader, you will have access to higher risk trades; e.g. the leverage levels are increased. Please bear in mind that these professional investor accounts may not be available in all countries.

Are Forex Demo Accounts Accurate?

For those who might not know, forex demo accounts are training accounts that you can make and practice trading. They do not use real money, and so there is absolutely no risk involved. You can use them to test out different trading strategies and get a feel of the market.To get more news about forex demo and real accounts, you can visit wikifx.com official website.

You can use them to see how the prices change, test entering and exiting positions, and try to earn some money without investing anything. Of course, the money you will earn will also be fake money that you can't cash out and use, but it is still good enough for practice.

With them, you can learn some basic, but still important concepts that you need to know for trading forex. Things like entering and exiting positions, long and short positions, pips, and alike are all necessary knowledge that you can pick up and test with a demo account.

You can also use them to test a new platform if you decide to move and give a new broker's platform a chance. This is certainly preferable to arriving at a new platform and going live immediately, without knowing which way is up. Lastly, if you wish to make a change in your trading strategy, test out a new approach, and alike — it is always good to use a demo account for such tests than to try them out live straight away.

That way, if they end up not working, you will lose some of your fake money and not have to worry about actual losses. You can learn on your mistakes here, and approach live trading with all the necessary knowledge for avoiding such events in the future when you actually start using real money.

However, you should still be cautious when using them, because it is too easy to forget that they are not so accurate and that things may still be quite different when you start trading live. Let's discuss why that is, and in what way do demo forex accounts differ from live accounts.

Demo accounts vs. live accounts: The biggest differences

1. You do not use real money

As mentioned, one of the biggest differences between demo accounts and live accounts is that you don't use real money when you trade on demo accounts. You might be thinking — why is this important?

This matters because it changes the way you think and approaches your trades. When it comes to demo accounts, you are much more likely to take risks because you know that you don't have anything to lose. This could lead to some risky moves, which you may regret if you repeat them later on, with real money.

2. Demo losses do not feel real

Also, it is harder to develop the feel for the trade for this same reason. Finally, you will not have to face the feeling of losing actual money. After losing fake money in case the trade goes bad, you would simply make a point to be more careful in the future. When you lose real money, that can hit you quite strongly, as you will realize that this is not a game. Your actual money — that you worked for and earned — is gone.

This can be very discouraging for first-time traders, and many abandon trading completely after seeing their first losses. This should not discourage you from trading, but you should keep in mind that it is a possibility and that it will happen. Someone always has to lose in order for someone else to win. Of course, your goal is to be on the winning side as much as possible.

3. Your demo order is always taken

Another big difference is how your trades will perform when you trade on demo vs. when you trade live. Demo accounts are created for orders to always go through. You need to experience the trade and see how the prices are moving. You also need to test out new strategies, and you have no time to lose.

This is not the case when it comes to live trading, where your order might not get taken right away, or at all. This can happen for a number of reasons. If there is low volume, or you just start trading in the time of day when the volume is low, your order might not take.

With demo accounts, this is simply not an issue, which can be quite frustrating for new traders that are just now going live for the first time.

4. Demo accounts are not always accurate

Another thing to remember is that demo accounts are created by brokers who want you to start trading as soon as possible. They offer demo accounts for you to practice and test out strategies, but they can only provide you wish some typical situations, which will not prepare you for all the scenarios.

As a result, the trades that you make while on Demo Account should not be taken as real situations. There are plenty of textbook situations that can take a weird turn in the actual market. The developments do not always follow the rules, and things do not happen as they should.

However, Demo accounts won't prepare you for that. This allows you to gain confidence and move on to the real, live account quicker. However, it can also give you a false sense that you cannot lose, which will, of course, lead to losses as soon as you start putting actual dollars on the line.

5. The emotional difference

When you trade real money, you may often approach without controlling your emotions. This is a trap that many can easily fall into. Whether you are experiencing losses or gains, if they keep coming one after another, you may start getting emotional and taking one risk after another, only for things to end really badly for your funds.

This is not something that you will get when trading with a demo account, as you don't use real money. Therefore, there is no emotional response. Wins mean nothing, as you can't use the money you have won. Losses mean nothing, as you did not invest real funds.

Trading Forex vs Stocks: What's the difference?

Anyone new to trading is likely to wonder, "Which is better: Forex or stocks?". Let's begin answering our question with a little economics 101. We find ourselves today in a low interest rate environment. Central banks around the world are still wrestling with low growth for the most part. Loose monetary policy has been their main answer over the years. So what's the upshot for you?To get more news about forex vs. stock, you can visit wikifx.com official website.

Basically, leaving money in the bank does you little good. In many of the major economies, interest paid on savings is less than the rate of inflation. As a natural result, people are searching for better alternatives to invest their money into, such as the well-established financial markets of Forex and stocks. This article will consider the pros and cons of Forex vs stock trading.

FX vs Stock Trading: Markets

There is no hard or fast answer to the question of which is better, forex vs stock trading. Whether we are talking about for experienced traders or the stock market vs Forex trading for beginners, when comparing, there will be benefits and drawbacks for each market and for each type of trader.

It ultimately comes down to how important those features are to you personally. Let's take a look at an overview of each market first, and then we can move on to drawing some conclusions about Forex vs. stock trading.

What is Forex:

The Forex market is decentralized. It represents a trading network of participants from around the world. The large players in the Forex market include investment banks, central banks, hedge funds, and commercial companies.

What are Stocks:

Stock market trading is the overarching name given to the combined group of buyers and sellers of shares, or or people trading stocks. Shares in a company, as the name suggests, offer a share in the ownership. Usually, though not always, these transactions are conducted on stock exchanges. In order to raise capital, many companies choose to float shares of their stock.

Stock exchanges provide a transparent, regulated, and convenient marketplace for buyers to conduct business with sellers. Trading on these exchanges has historically been conducted by "open outcry," but the trend in recent years has been strongly toward electronic trading.

Stock market trading is immensely popular, but it is exceeded in size by the Forex market, which is the largest financial market in the world. When we weigh up the stock market vs Forex trading in terms of size, Forex takes the round. Why do we care about the size? The greater the size of the Forex market, the greater its liquidity will be.

If you are considering stock market trading to build your portfolio with the best shares for 2021, you need to have access to the best products available. One such product is Invest.MT5. Invest.MT5 enables you to start trading stocks and ETFs across 15 of the world's largest stock exchanges with the MetaTrader 5 trading platform.

Other benefits include free real-time market data, premium market updates, zero account maintenance fee, low transaction commissions, and dividend payouts.

Comparing Liquidity

The next important aspect to consider in the Forex vs stock trading debate is liquidity. The Forex market is extremely liquid. This is a result of the vast number of participants involved in trading at any given time.

If you are trading stocks, you will notice that large, popular stocks can also be very liquid. Vodafone and Microsoft are prime examples. Though once you move away from the blue chips, trading stocks can become significantly less liquid.

Why do we care about liquidity?

Liquidity makes it easier to trade an instrument. Generally speaking, superior liquidity tends to equate to proportionally tighter spreads, and lower transaction costs. Let's consider a trading example, and compare some typical costs. Let's use Microsoft as our liquid share, and EUR/USD as our liquid currency pair.

Best Forex Signals 2022 – Top Free Signals

If you’re looking to actively trade forex online but in a passive manner – forex signals could be the solution. This is because your chosen signal provider will send you suggestions on which currency pair to trade and what entry and exit orders to place.To get more news about free forex signals, you can visit wikifx.com official website.

In this guide, we review the Best Forex Signals for 2022 and walk you through the process of getting started today!

Stuck for time and looking to get started with the best forex signals right now? Check out which providers made the cut below. You can scroll down to read a full review of each forex signal provider!

With hundreds of forex signals services online – knowing which service to sign up with can be really challenging. In fact, you will find that the vast majority of forex signal providers make really bold claims that in reality – are impossible to validate with any certainty.

This is why it’s really important to perform lots of research in your search for the best forex signal platforms to ensure you are joining a legitimate provider.

To help point you in the right direction, below we discuss some of the most popular forex trading signals for 2022.

1. Learn2Trade – Overall Best Platform for Trading Signals

learn 2 trade best forex signal Telegram groupAfter reviewing the credentials of dozens of providers, we found that Learn2Trade offers the best forex signals in the market. The signal platform has been offering its service for many years – and reviews in the public domain are largely very positive. In terms of how the platform works, Learn2Trade specializes in forex and cryptocurrency trading signals.

It also offers a side package that includes stock trading signals. All signals are posted to the Learn2Trade Telegram group – which at the time of writing has more than 17,000 members. Upon receiving a signal, you will be told what forex pair to trade and whether you should place a buy or sell order. You will also be told what entry price action to execute the trade at, alongside the suggested stop-loss and take-profit order.

All in all, Learn2Trade forex signals provide you with all the required information to trade in a risk-averse manner – without needing to perform any research yourself. There are two forex signal plans offered by this top-rated provider. First, you might consider the free plan – which includes three forex trading signals per week. Or, if you want to get the full trading experience, the premium plans get you 3-5 signals per day.

2. PriceAction FX- Best Platform For Daily Expert Signals

Among the many forex signal service providers in the market, PriceAction Forex Ltd. has definitely positioned itself at the top. PriceAction Ltd. provides robust trading solutions for forex traders. Since its launch, the company has been serving hundreds of thousands of global traders. PriceAction Forex Ltd. has the biggest trading community on the Telegram platform, which it uses to communicate and provide its signal service.

Operating from the UK, PriceAction Ltd. was founded by a group of professional and veteran traders in the year 2017. On its Telegram platform, it serves 260K+ global clients with the most accurate and precise trading signals. Every day, approximately 5 to 7 signals are sent. The sent signals consist of the entry position, take-profit, and stop-loss. Traders just need to copy the position and paste it on their MT4 or MT5 platform. PriceAction Forex Ltd.’s signals are so accurate that in the year 2022, it has kept its signal accuracy level above 92%, a 19.079+ pips gain already.

3. Mega FX- A Complete Solution To Forex Trading

MegaFX Signals is one of the most popular forex signal providers in the market due to its high accuracy and transparent team behind the firm. This highly reputed signals provider is committed to serve traders of forex, indices, commodities and others simultaneously. MegaFX Signals has 100K+ clients around the world.

After trying out the forex signals from the MegaFX Signals VIP Telegram channel, we are pleased with its services. Keeping its promises of high accuracy, we have profited within this short period of experience. MegaFX Signals provides 5 to 6 forex signals every day on their Telegram VIP Channel. For the fastest and smoothest trading experience, the company sends signals with the entry position, take profit, and stop loss.

4. 1000pip Builder - Best Trading Signals for MT4

1000pip Climber System 1000pip Builder is a fully-automated forex signal service that allows you to trade in a 100% passive manner. This is because the signals come in the shape of a forex EA (Expert Advisor). For those unaware, EAs are trading robot files that you install and deploy through a third-party platform like MT4.

This means that the signals offered by 1000pip Builder will be traded on your behalf via your chosen MT4 broker. As such, there is no requirement to evaluate each signal nor head over to your trading platform to place the suggested orders.

5. Forex Signal Factory - Telegram Forex Trading Signals with 83k Members

Forex Signals Factory is an established signal provider that has a huge Telegram channel with over 83,000 members. This makes the provider one of the largest signal service groups globally.

The provider explains that it has no conflict of interest because it is not partnered with any third-party broker. Most forex signals are sent with two take-profit prices. This allows you to trade a risk/reward level you feel comfortable with.

What are Bollinger Bands?

Bollinger Bands are a technical analysis tool developed by John Bollinger in the 1980s for trading stocks. The bands comprise a volatility indicator that measures the relative high or low of a security’s price in relation to previous trades. Volatility is measured using standard deviation, which changes with increases or decreases in volatility. The bands widen when there is a price increase, and narrow when there is a price decrease. Due to their dynamic nature, Bollinger Bands can be applied to the trading of various securities.To get more news about bollinger band, you can visit wikifx.com official website.

Bollinger Bands are comprised of three lines – the upper, middle, and lower band. The middle band is a moving average, and its parameters are chosen by the trader. The upper and lower bands are positioned on either side of the moving average band. The trader decides the number of standard deviations they need the volatility indicator set at. The number of standard deviations, in turn, determines the distance between the middle band and the upper and lower bands. The position of these bands provides information on how strong the trend is and the potential high and low price levels that may be expected in the immediate future.

Day Trading Uptrends With Bollinger Bands

Bollinger Bands can be used to determine how strongly an asset is rising and when it is potentially reversing or losing strength. If an uptrend is strong enough, it will reach the upper band regularly. An uptrend that reaches the upper band indicates that the stock is pushing higher and traders can exploit the opportunity to make a buy decision.

If the price pulls back within the uptrends, and it stays above the middle band and moves back to the upper band, that indicates a lot of strength. Generally, a price in the uptrend should not touch the lower band, and if it does, it is a warning sign for a reverse or that the stock is losing strength.

Most technical traders aim to profit from the strong uptrends before a reversal occurs. Once a stock fails to reach a new peak, traders tend to sell the asset at this point to avoid incurring losses from a reversed trend. Technical traders monitor the behavior of an uptrend to know when it shows strength or weakness, and they use this as an indication of a possible trend reversal.

Day Trading Downtrends With Bollinger Bands

Bollinger Bands can be used to determine how strongly an asset is falling and when it is potentially reversing to an upside trend. In a strong downtrend, the price will run along the lower band, and this shows that selling activity remains strong. But if the price fails to touch or move along the lower band, it is an indication that the downtrend may be losing momentum.

When there are price pullbacks (highs), and the price stays below the middle band and then moves back to the lower band, it is an indication of a lot of downtrend strength. In a downtrend, prices should not break above the upper band since this would indicate that the trend may be reversing, or it is slowing.

Many traders avoid trading during downtrends, other than looking for an opportunity to buy when the trend begins to change. The downtrend can last for short or long durations – either minutes, hours, weeks, days, months, or even years. Investors must identify any sign of downtrends early enough to protect their investments. If the lower bands show a steady downtrend, traders must be cautious to avoid entering into long trades that will prove unprofitable.

Trading W-Bottoms and M-Tops

W-Bottoms and M-Tops were part of Arthur Merrill’s work that identifies 16 patterns with a basic W-Pattern and M-Pattern, respectively. Bollinger Bands use W patterns to identify W-Bottoms when the second low is lower than the first low but holds above the lower band. It occurs when a reaction low forms close to or below the lower band.

The price then pulls back towards the middle band or higher and creates a new price low that holds the lower band. When the price moves above the high of the first pullback, the W-button is in place as shown in the figure below, and indicates that the price will likely rise to a new high.

John Bollinger used the M patterns with Bollinger Bands to identify M-Tops. In its basic form, an M-Top is similar to a Double Top chart pattern. An M-Top occurs when there is a reaction that moves close to or above the upper band. The price then pulls back towards the middle band or lower and creates a new price high, but does not close above the upper band. If the price then moves below the low of the prior pullback, the M-Top is in place as shown in the figure below.

Limitations of Bollinger Bands

Although Bollinger Bands are helpful tools for technical traders, there are a few limitations that traders should consider before using them. One of these limitations is that Bollinger Bands are primarily reactive, not predictive. The bands will react to changes in price movements, either uptrends or downtrends, but will not predict prices. In other words, like most technical indicators, Bollinger Bands are a lagging indicator. This is because the tool is based on a simple moving average, which takes the average price of several price bars.

Although traders may use the bands to gauge the trends, they cannot use the tool alone to make price predictions. John Bollinger, the Bollinger Bands’ developer, recommends that traders should use the system along with two or three non-correlated tools that provide more direct market signals.

Another limitation of Bollinger Bands is that the standard settings will not work for all traders. Traders must find settings that allow them to set guidelines for specific stocks that they are trading. If the selected band settings fail to work, traders may alter the settings or use a different tool altogether. The effectiveness of Bollinger Bands varies from one market to another, and traders may need to adjust the settings even if they are trading the same security over a period of time.

What are Forex trading bots? + 6 Best Forex Trading Robots 2022