User blogs

Tag Search

AvaTrade Review UK

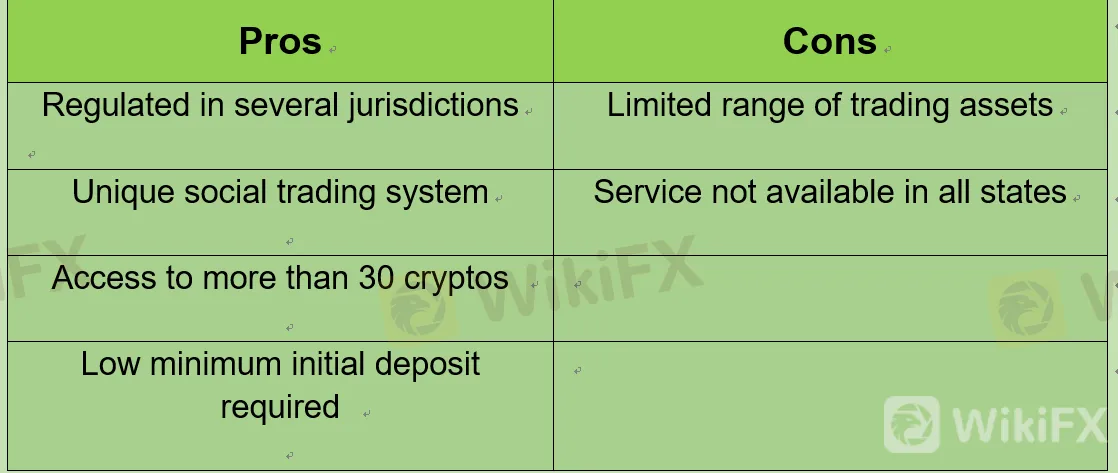

Founded in 2006, AvaTrade is tightly regulated by several bodies across the globe, providing a reliable and safe trading platform to its 200,000 customers worldwide. Today, AvaTrade facilitates over 2 million trades each month and has handled more than $1.47 trillion in traded value since its launch.To get more news about avatrade pros & cons, you can visit wikifx.com official website.

There is little doubt that the offering of customisable trading platforms on AvaTrade is impressive. With five different options to choose from, there is literally something for everyone from beginners to advanced traders.

In my AvaTrade review, I have compared AvaTrade to similar brokers in order to establish their position in the market in terms of assets offered, fees charged, customer service, and safety amongst other factors so you can make an informed decision as to whether this is a good platform for you.

Who are AvaTrade?

AvaTrade was initially founded as AvaFX and has headquarters in Dublin, Ireland as well as regional offices from around the world. AvaTrade claim that they are “committed to empowering people to invest and trade, with confidence, in an innovative and reliable environment; supported by best-in-class personal service and uncompromising integrity”.

To this end, AvaTrade have provided traders with Trading Central where a suite of tools provides trading strategies based on technical analysis. Today AvaTrade is considered one of the top forex brokers in the world.

Webtrader

Whilst it may not have the customisation options of some other platforms available, AvaTraders own web platform, Webtrader, is very well laid out and easy to navigate even for novice traders.The search functions allow traders to search by asset name or category and all the basic order types are available including Market, Limit and Stop.

Nervous about sustaining losses? AvaTrade provide a type of insurance against losses in the form of AvaProtect. You will be charged a fee for this service, however, for the period of the cover, any losses sustained on that trade will be reimbursed. This is available on market orders.

Charting is available with 90 indicators and the suite of tools from Trading Central is neatly integrated into the trading platform.

Where Webtrader does fall short is that there is no option for setting price alerts or receiving notifications. Also, Webtrader only provides access to around 200 tradable symbols, compared to the 800 offered on MetaTrader 4.

MetaTrader 4

The lack of customisation available on Webtrader is more than made up for with MetaTrader 4. MetaTrader 4 is a third party trading platform and the leading trading platform in the world. It is fully customisable with a plethora of features designed to enhance your trading performance. Monitoring positions is a breeze with the advanced charting functionality and order management tools. Within the search functions, assets are grouped into categories although you will find that you are unable to search by an asset’s name.

This trading platform was designed primarily to trade Forex, although it is possible to trade other financial instruments. Whilst you are unable to set alerts and notifications on the web version of this trading platform, this is a feature that is available on the mobile app and desktop trading platform.

AvaSocial

AvaSocial is one of the more recent launches at AvaTrade, a mobile app allowing traders to follow and chat with other traders and copy their trades. This is provided by a third party called Pelican Trading who are FCA regulated.

Within AvaSocial you can find successful traders to copy, examine their trading history, set budgets and limits, and access automated trading. This is an excellent platform for new traders to develop their skills and knowledge.

In addition to this, AvaTrade offers social trading through a further two third parties, DupliTrade and ZuluTrade. The minimum deposit for ZuluTrade is $500, however, in order to start social trading with DupliTrade, you would need a $2,000 minimum deposit.

AvaTradeGO

AvaTradeGO is AvaTrade’s flagship mobile trading platform, providing users with an intuitive, user-friendly mobile trading experience. In terms of features, users will recognise many of the tools available on the web trading platform including some extra social and copy trading features.

Other features include news, charting tools with 93 indicators, watchlists and risk management tools such as stop-loss, limit orders, and AvaProtect which I have gone into in more detail in the Webtrader section of this AvaTrade review.

The Pros and Cons of Forex Demo Trading

Despite its position as the world’s largest financial market, the forex market has only become readily accessible to retail traders in recent years due to the advent of Internet based trading via online forex brokers.To get more news about forex demo and real accounts, you can visit wikifx.com official website.

Aspiring forex traders can now use electronic trading platforms — like the very popular MetaTrader software offered as a free download by MetaQuotes Software Corporation — to access the huge forex market even if they are only able to trade in small amounts.Most online brokers will support MetaTrader and may also offer their own proprietary electronic dealing platforms or web based dealing interfaces.

These platforms typically permit traders to do a quick review of the currency market and perhaps perform some technical analysis, in addition to allowing them access to trading essentials like order entry and deal execution for a wide selection of currency pairs.As a common way of encouraging forex traders to use their deal execution services and deposit funds with them to use as trading account margin, most online forex brokers will offer a free forex practice account to potential or existing clients.

Generally known as a forex demo account, such accounts allow a trader to experience a hands-on demonstration of what it feels like to trade currency pairs in the forex market with that broker without putting any real money at risk.

Forex demo accounts are generally offered free of charge by online forex demo brokers and are often funded with generous amounts of virtual money.

Although using a FX trading demo account has numerous benefits for traders, some caveats are worth mentioning since the mechanics of entering a demo trade and the resulting emotional responses a trader can have while managing it can differ significantly from the experience of live forex trading using their own hard earned money.

Other common demo account conditions that make them differ significantly from a real money funded account include broker-imposed time limits and fixed deposits of virtual currency.

The following sections of this article will discuss opening up an online trading demo account, in addition to some of the most notable pros and cons of using a demo forex account compared to using a live forex account for trading currencies.

Opening Up a Free Forex Demo Account

Just about any reputable forex broker will allow prospective and current clients to open up a demo account with them free of charge to allow traders to practice forex trading using virtual money.

Demo account traders often also get access to at least some of the broker’s client services and customer support staff so that they can get a better sense for what dealing with the broker will be like when they decide to fund a trading account with real money.

Traders wishing to open up a demo trading account can typically navigate to the website of one or more forex demo brokers and follow instructions displayed there for opening up a demo or practice account with the brokers they select.

Choosing the best forex demo account for your needs might involve reviewing those offered by several online brokers with differing features in order to make an informed determination of which broker is the most suitable host for your particular trading style and preferences.

When opening a demo account, you may also need to select an amount of virtual money to fund the demo account with and enter some personal data to identify yourself with.

If you feel concerned about providing your real personal data to a broker you do not have an established business relationship with in order to open up a demo forex trading account, you can often use a fictitious name, address and contact information.

You can also open up a new e-mail account to receive messages regarding the demo forex account if you are worried about having your personal e-mail address sold to third parties like electronic mail marketers.

FOREX VS STOCKS

It’s never been easier to start trading in the financial markets. Advances in online brokerage accounts and charting software mean that you can earn money trading from the comfort of your home or office — it’s no longer confined to denizens of Wall Street or the Chicago trading pits.To get more news about forex vs. stock, you can visit wikifx.com official website.

When most people hear the word “trading”, they immediately envision people trading the stock market. However, forex trading has become increasingly attractive as the once-exclusive currency market has recently opened up to retail traders. But which is right for you? Stock trading or forex trading? We’ll take a closer look at the similarities and differences between stock trading and forex trading. We’ll also show you the pros and cons of each trading type to help you get started trading your asset of choice.

What is Forex Trading?

The word “forex” is short for “foreign exchange” and refers to a decentralized global marketplace for national currencies. You also might sometimes hear people refer to forex trading as “FX trading.” A transaction in the forex market involves an exchange of one currency for another.

Currencies trade in pairs in the forex market, and forex trading involves buying and selling currency pairs. In general, the goal of forex trading is to buy a currency pair when it’s undervalued and sell it when it rises in value, or sell when overvalued and buy back when the pair drops in value.

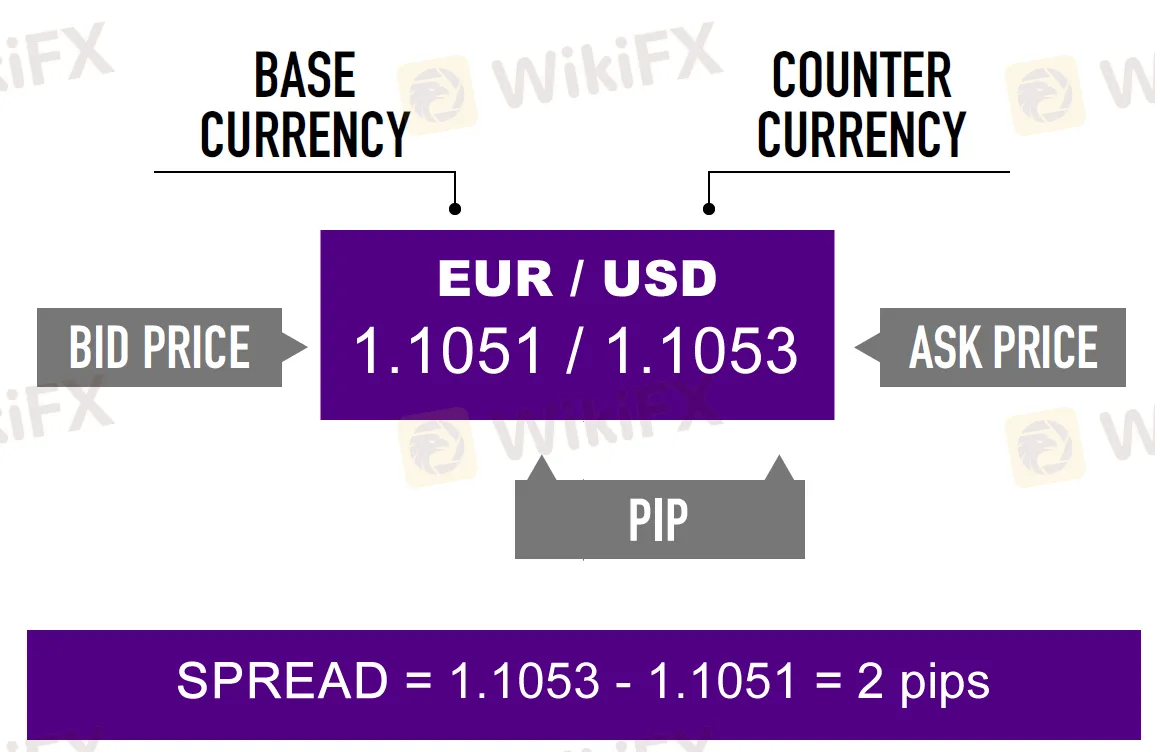

Most countries issue their own national currency. The value of each currency varies in relation to other currencies. The rate at which currencies are exchanged in the forex market is known as an “exchange rate”. Furthermore, the “dealing spread” for a currency pair is the difference between a market maker’s bid and offer exchange rates.

According to the concept of purchasing power parity or PPP, two currencies find their equilibrium exchange rate, which is known as the currencies being at par, when a basket of goods costs the same in both countries given their currencies’ exchange rate.

If you’ve ever traveled abroad, you might have converted a small amount of the cash you brought with you into the country’s local currency and found that your money went further or was spent faster than at home.

For example, if a U.S. resident travels to England, they might find that the UK’s pound sterling currency is worth 1.4000 U.S. dollars. They might pay $2 for a bottle of water in London that would only cost them $1 if it was bought somewhere in the United States. If this relationship was observed for a wider basket of goods, it would suggest that the U.S. dollar is undervalued versus the British pound.

Some long-term forex traders aim to take advantage of this difference in purchasing power among currencies by strategically exchanging an overvalued currency for an undervalued currency and then waiting for the market to shift toward equilibrium.

What is Stock Trading?

Stock trading involves buying and selling individual shares of a company, called “stock.” A share of stock is a small piece of ownership in a company.

While currency pairs have an exchange rate that moves frequently, shares of stock instead have a price that fluctuates in price throughout the day, week and month. Factors like a company’s management team, the overall state of the economy and the business decisions the company makes can all influence what each individual share of stock is worth.

Stock traders aim to buy a stock when it’s undervalued and sell it when it rises in value, or they might sell when a stock is overvalued and buy back when the price falls. There are 2 main types of stock traders who operate in the stock market for profit:

Similarities Between Stock Trading and Forex Trading

Stock and forex trading are similar in some ways, although in forex trading you speculate on movements in a currency pair’s exchange, while in the stock market, you buy or sell a share of a company in the hope that its price will shift in your favor. Let’s examine some additional similarities and differences between these financial markets.

Brokers

A stockbroker takes orders to buy or sell corporate shares on your behalf on a centralized stock exchange at a transparent price for a small fee or commission. Stockbrokers traditionally charged a commission for this execution service, although many major U.S. stockbrokers have recently eliminated such commissions.

A forex broker also executes orders on your behalf but in the decentralized forex market where currencies are exchanged. Also, the tradeable asset in a forex transaction is a currency pair that involves you buying one currency and selling the other. A forex broker usually does not charge commission but instead widens the dealing spread to make their money.

Both stock traders and retail forex traders use brokers to facilitate their transactions. You can quickly create a stock or forex trading account online and begin trading as soon as you fund your account.

While U.S. stockbrokers will generally offer access to the stock market, not every broker provides access to the forex market, so you might need to open a separate account with an online forex broker to trade currency pairs. To learn more about online brokers that offer forex trading, check out our list of the top forex brokers.

Short-Term Trading

Both forex traders and stock traders rely on relatively short-term trading strategies. A stock trader who’s trading with the intent to make a quick profit usually won’t be interested in holding onto his or her stock for years to come. Similarly, a forex trader only wants to hold a currency position until they can trade out of it for a profit.

Technical Analysis

Technical analysis is a type of financial analysis that uses patterns and indicators to inform a trader when he or she should buy or sell an asset. Traders who use technical analysis to inform their trading strategy typically don’t spend a lot of time reading the news or researching a company’s business plan. Instead, they may look at candlestick charts for indicators that a stock or currency will drop or rise in price soon.

Both forex traders and stock traders primarily rely on technical analysis when they decide what they should buy or sell. Because the price of a stock or currency may change on a minute-to-minute basis, it’s important that you have a reliable technical analysis program to inform your trading.

Are Free FOREX Signals Useful?

If you spend any amount of time in the FOREX market, you are bound to come across an offer for free FOREX signals at some point. Using FOREX signals in general can be a profitable strategy for you to use. However, we have learned along the way in life that you get what you pay for. Therefore, you might be a little confused by an offer of free FOREX signals at some point. Here are a few things that you should consider with free FOREX signals.To get more news about free forex signals, you can visit wikifx.com official website.

The Foreign Exchange Market

The foreign exchange market or the FOREX market is the biggest financial market in the world. It has a daily volume of over $2 trillion and trades 24 hours a day. Traders in this market are hoping to profit from the small movements in the exchange rate of currencies. You can use much higher amounts of leverage with this market, therefore increasing your risk.

Trading Signals

FOREX signals aim to make the experience of FOREX trading a little easier on you. Those that provide FOREX signals are usually very experienced traders that want to profit from their expertise. They have developed a winning trading strategy and they are willing to share it with those that subscribe to their feeds.

Whenever a potential trading opportunity that meets their criteria comes up, they will alert you. The alert could come via text message or email. The message will tell you the conditions of the trade and when to place it.

It may tell you the stop-loss and take profit level to enter in your trading platform. Therefore, with the help of FOREX signals, you can let someone else do the difficult part and still benefit from the power of the market.

Why Free Signals?

When you are presented with an offer for free FOREX signals, it could be for a number of different reasons. Just because the offer is free does not necessarily make it bad. Someone could be giving out their signals for free for a number of different circumstances.

Sometimes you will see an offer for free signals for a limited time. You might be able to get the signals for a few weeks for free, and use them at your discretion. This is usually done to generate interest in their service. From the signal service's perspective, if they have a good product, they might as well give it away for free for a certain period of time. When they get some people using the signals successfully for a while, they will then be hooked. Once they start charging for the signals, many of the subscribers will pay the fee and keep getting the signals.

Other free signal services might be doing it just to capture your information so that they can sell you another FOREX product. When you are presented with an offer for free signals, you will want to test the signals on a demo account first. This way, you can judge whether the signals are actually worth the trouble or not without risking your own money.

What are Bollinger bands?

Bollinger bands are a popular form of technical price indicator. They are made up of an upper and lower band, set either side of a simple moving average (SMA). Each band is plotted two standard deviations away from the SMA of the market, and they are capable of highlighting areas of support and resistance.To get more news about bollinger band, you can visit wikifx.com official website.

How to calculate Bollinger bands

Bollinger bands are calculated using three lines drawn onto a price chart. The first line is the SMA of an asset's price, usually within a 20-day period. The upper band is the SMA plus two standard deviations, while the lower band is the SMA minus two standard deviations.

To calculate the SMA, you would take the closing prices for the number of days that you were looking at – normally 20 days – and divide the total sum of all the closing prices by the total number of days.Most trading platforms will calculate Bollinger bands for you automatically, but it is still useful for a trader to know what the different bands mean and what can be learnt from them.

What do Bollinger bands tell traders?

Many traders believe that Bollinger bands are an accurate indicator of market volatility. If the bands are wider, it means that a market is more volatile; while narrower bands mean that a market is more stable.

Traders also look for Bollinger ‘squeezes’ and Bollinger ‘bounces’, which are used as indicators for levels of support and resistance. Squeezes – when the upper and lower band contract toward the moving average – could show that there is about to be a breakout of the asset’s price. Conversely, bounces – which occur when the price movement hits the upper band and bounces back down – might be indicative of an upcoming retracement.

However, just like other indicators, Bollinger bands are not always 100% accurate. The information they provide should be used in conjunction with other forms of analysis.

Pros of Bollinger bands

Bollinger bands can be useful indicators of a trend in a market – strong trends cause volatility, which is easy to see as the Bollinger bands widen and narrow.

When plotted automatically by a trading platform, Bollinger bands are very user-friendly and can add another dimension to chart analysis for a trader.

Cons of Bollinger bands

As a lagging indicator, Bollinger bands can’t predict price patterns but instead, they follow current market movements. This means that traders might not receive signals until the price movement is already underway.

It is also worth noting that John Bollinger – the man who invented Bollinger bands – has said that they should be used in conjunction with other forms of technical analysis and that they are not fool-proof or fail-safe indicators of market trends.

How much do I need to start trading with a forex robot?

Typically, automated trading algorithms (or Expert Advisors) mimic what an expert human trader would do. The problem is that forex robots and their pre-wired thinking do not compensate for ever-changing market conditions.To get more news about forex robots trading, you can visit wikifx.com official website.

Genuine forex robots always require a great deal of user input. Typically, these systems maintain an edge and manage risk successfully. In the algorithm of his work is included the trading strategy we invented and special forex indicators ! They use their expertise to research and review every Forex autopilot trading robot available presenting the information in a concise and comprehensive format.

While the forex trading robot is free, the binary options investment brokers you chose to work with require an initial deposit amount of $250 to activate the robot. A forex trading robot is a computer program based on a set of forex trading signals that helps determine whether to buy or sell a currency pair at a given point in time.

Automated Forex trading makes use of a tool known as a Forex robot. Most Forex automated trading robots use technical indicators to help find profitable Forex trading opportunities, although different robots will use different trading strategies.

For this reason, automated forex trading is also known as algorithmic trading. Many companies create and sell forex robots, but be careful who you deal with if you're in the market to buy one. Some of the most sophisticated forex robots currently available will assume total control of the entire trading process, right from market analysis to exiting a position ensuring that you profit from the currency price actions 24/7.

A Forex automated trading robot can watch movements far more efficiently than a human and they aren't burdened with human emotion when it comes to making trading decisions. Expert advisor (robot) is written in a special programming language that is compatible with the Metatrader 4 platform and installed in the terminal for self-trading. You can read my forex robot reviews to see if the forex robot has back tests which will give you a good idea how it performed historically, some forex robots even back test as for as 15+ years! Using a fully automated system takes much of the work out of trading, leaving you free to do other things If you do not have much time to devote to forex trading, or if you find it difficult to stick to a trading strategy, then a fully automated system may be a good option.

It then sends the user trading signals with entry prices, stop-loss orders and profit targets, and it's up to the trader to decide whether to act on these and then enter the trade manually. With a Forex automated trading system, orders will be executed automatically provided a number of requirements have been met.

It offers 3 premium signals per day with an 89% success rate, live messaging service, clear SL and TL. FX traders want to use robots because they hope to make easy money from the Forex market, without having to devote a lot of personal time to it, or do anything manually.

The companies are not legitimate systems for assessing risk and opportunity. Big Breakout EA Using a fully automated system takes much of the work out of trading, leaving you free to do other things If you do not have much time to devote to forex trading, or if you find it difficult to stick to a trading strategy, then a fully automated system may be a good option.

It's not uncommon for a company to spring up overnight and start selling an "instant riches" forex robot, including a money back guarantee, only to disappear in about 45 days or so. Every expert advisor is fully automatic and loaded with features to dominate any chart.

That said, the actual efficiency of a working forex robot is quite unimpressive. The past has little effect on the future in a changing market. Your best bet to find a working forex robot is therefore to pore through feedback provided by actual users. With a push of a button, the forex robot runs continuously, making trades signaled by mathematical algorithms applied to past price history. The products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. The robot's algorithm can be based on pre-set parameters or trading strategies and the robot can either be instructed to trade automatically on a trader's behalf or give traders the option to enter the trade manually. Today, the robot trader is already helping binary options investors achieve commendable accuracy and generate a continuous stream of profit, as much as 125%+ on invested amounts depending on the preferred individual bot trader.

You will need enough funding in your forex account to have at least three forex trades open with enough room for drawdown . While some forex robots are customisable to a certain extent, traders may struggle to find a commercial system that exactly fits their own strategy and goals. ON Myfxbook is the professional automatic verification system that tracks RoFx trading performance, demonstrating real-time trading and verified results. However, in the forex market, there is no such thing as a consistent market.

You can click this table heading to rank the table of forex robots by the amount of days trading which will help you to see what are the best forex robots that have been performing for a good amount of time. With markets across the world active around the clock and in different time zones, you can't be online 24 hours a day, 5/6 days a week.

I will give you a step-by-step guide to getting the MAXIMUM returns from your Algorithmic Trading system. A fully automated trading system scans the market for trading opportunities and carries out trades electronically on behalf of its user, based on a set of predetermined rules. Forex auto trading robots are a piece of software that you can use to automate your trades along-side the main trading platform. Overall, GPS Forex Robots are user friendly and provide easy access to good customer support - contact details are clear and they answer almost immediately, which technically serves a user well - which is one more reason why they are in the list of top Forex robots providers.

How to trade forex

Once you learn how to trade forex, you’ll understand why it’s such a popular market. You’ll discover that you can choose between many different currency pairs – from majors to exotics – and trade 24 hours a day. Use this guide to learn how to trade currency with our FX trading steps and examples.To get more news about forex education, you can visit wikifx.com official website.

Choose a currency pair to trade

We offer more than 80 currency pairs – from majors like GBP/USD, to exotics like HUF/EUR. When you trade with us, you’ll be speculating on these forex pairs rising or falling in value with spread bets and CFDs. These make use of leverage, which enables you to open a larger forex trade with a small upfront deposit (called margin). However, this means your losses as well as profits can far outweigh your margin amount as they are calculated based on the full position size, not just your margin.

Before choosing an FX pair to trade, you should carry out fundamental analysis and technical analysis on the two currencies in the pair. This means you should assess how the ‘base’ (the currency on the left) and the ‘quote’ (the currency on the right) move in relation to each other.

Decide whether to ‘buy’ or ‘sell’

Once you’ve chosen a currency pair to trade, you need to decide whether you want to ‘buy’ or ‘sell’, based on your analysis.

You would buy the pair if you expected the base currency to rise in value against the quote currency. Or, you would sell if you expected it to do the opposite. That’s because a currency pair’s price represents how many of the quote currency you’d have to spend to buy a single unit of the base currency.

For example if the price quoted for GBP/USD is 1.28000, it means you’d have to spend $1.28 to buy £1 – so the pound is stronger than the US dollar.

Set your stops and limits

The forex market is particularly volatile, which is why it’s important to have a plan to guide the entry and exit points of your trades. There are various stops and limits you can set to manage your risk when trading forex:

Open your first trade

If you want to trade on the value of forex pairs rising or falling with spread bets or CFDs, why not open an account with us? Once you’ve done that, simply go to our award-winning trading platform,1 search for the forex pair you want to trade, enter your position size and choose ‘buy’ or ‘sell’.

Monitor your position

Once you’ve opened your position, you can monitor your FX trade in the ‘open positions’ section of the dealing platform. You can also set price alerts to receive email, SMS or push notifications when a specified buy or sell percentage or point is reached.

Close your trade and take your profit or loss

Once you’ve decided it’s time to close your position, simply navigate to the ‘positions’ tab, select your position and click on ‘close’. Alternatively, just make the opposite trade to the one you opened. In other words, if you went long on GBP/USD, go short by an equivalent amount to close the position – assuming you’ve selected the ‘net-off’ option on our platform, rather than ‘force open’.

Forex spread bet

Forex spread betting lets you make a prediction on the direction in which a forex pair’s price is heading. You’ll bet an amount of money per point of movement, and if the price moves in the same direction that you predicted, the greater your profit. But, the further it moves in the opposite direction, the greater your loss.

Forex spread bets are also leveraged. This means that you’ll pay a small margin when opening a trade but gain exposure to the total position size. However, it also means your losses and profits can far outweigh your deposit amount.

Spread bet prices are displayed in points – for example, if GBP/USD is trading at $1.31425, its price would be displayed as 13142.5. This makes no difference to the price you deal at or your potential profit or loss: it simply makes it easier to track per-point movements. When you trade forex with spread bets, all of your profits are completely tax-free.2

What is Forex Day Trading?

Have you ever heard about intraday trading or Forex day trading? This article will give you a detailed explanation about Forex day trading for beginners.

This type of trading can be practised in any market but is most frequently applied to the Forex-, stock- and index markets.

Why?

The Forex day trader takes advantage of the small price movements within the day or session. The trader opens positions during the day or the session and closes these before the end of that day. The trader takes advantage of the market movements during the day session.

Therefore, these traders prefer liquid markets such as the currency-, stocks- or index markets.A prerequisite for success in intraday trading (or any other type of trading) is having sufficient market knowledge.

Some of those new to trading ask themselves, 'is Forex good for day trading?'. As you now know, because of its liquidity, many new traders start day trading in Forex. If you are interested in learning how to day trade in Forex, you can apply all the information you learn in this Forex day trading article to any market, including Forex.

How to Trade Forex Intraday?

The first step to getting started with Forex day trading is to gain access to the right Forex day trading tools. Many Traders ask, what platform is best for Forex day trading? What is the best Forex day trading software? Whether you are looking for the best Forex day trading platform in the UK or anywhere else in the world, MetaTrader 5 has you covered.

MetaTrader 5 is an elite trading platform that offers professional traders a range of exclusive benefits such as advanced charting capabilities, automated trading and the ability to fully customise and change this Forex day trading platform to suit your individual trading preferences.

Whilst intraday trading might be profitable it is not easy. Intraday trading, as any form of trading or investing, carries risks and should not be assumed without prior training and a vast understanding of the markets.

Experienced traders can attest to the fact that a trading plan which includes detailed risk management rules, is essential. Based on this plan, the trader scans the markets for trading opportunities, the best entry and exit points and assesses possible trading opportunities for a healthy risk/reward ratio.

Understanding the Dynamics of the Stock Markets in Intraday Trading

A thorough understanding of the market's dynamics and the main factors driving market movements is essential.

Intraday traders monitor technical and fundamental indicators to gain insight into the market sentiment and possible future price development. Solid insight into what moves the markets enables the trader to identify the most favourable opportunities and make informed trading decisions.

A Disciplined Approach for Intraday Trading

In all aspects of life, discipline, among other factors, is important.

Discipline: Trading without a systematic and disciplined approach is essentially gambling. Therefore long term success in trading without discipline is next to impossible.Monitoring: A trader must be able to monitor prices during certain periods without acting on emotions and making reckless decisions.

Strategy: follow a set trading strategy that clearly specifies the conditions for entering the market. The trader would scan the market based on the parameters set out in his strategy and would only act when a set up meets his rules.

When the markets move vigorously traders can be tempted to place trades to 'get in on the action' or be reluctant to enter into a position after a few losses. Acting in accordance with one's trading plan can be challenging and requires discipline.

Sometimes the market follows the course you expected, but just because you were able to predict a certain movement does not mean you should use your gut feeling as an indicator to place trades. Even though it can be painful to miss an opportunity you had anticipated, making random trading decisions will ultimately result in losses.

Best Forex Demo Account 2022

If you’re looking to trade forex online for the very first time – you might want to start off with a demo account. This will allow you to trade in live forex market conditions without needing to risk any capital. Then, when you feel comfortable with how currency trading works, you might then consider upgrading to a real money account.To get more news about forex demo accounts, you can visit wikifx.com official website.

Best Forex Demo Accounts Reviewed

Before you consider which forex demo account to use, it is important to remember that your chosen provider is also a brokerage site. In other words, you will need to open an account with a forex trading platform before you can use its demo facility.

As such, you need to look at factors other than just the demo account – such as tradable forex pairs, spreads, commissions, customer support, and more. After all, there is every chance that eventually – you’ll look to start trading currencies with real money.

1. eToro – Over Best Forex Demo Account

etoro review

eToro is now one of the most popular online trading platforms. With more than 17 million global clients, the broker is often the go-to provider for newbies.Not only is this because the trading platform is really easy to use, but eToro is home to a wealth of educational and training materials.

Plus, you’ll have access to a fully-fledged forex demo account facility as soon as you register. This mirrors the real eToro trading platform like-for-like, in terms of supported markets, real time pricing, and liquidity. The key difference is, of course, that you will be trading with paper money.

In fact, the forex demo account comes pre-loaded with a $100,000 demo fund balance – suitable for demo trading. In terms of supported markets, eToro gives you access to over 55 forex pairs. This covers majors, minors, and plenty of exotics, too. In addition to forex, eToro also supports stocks, ETFs, cryptocurrencies, indices, and commodities.

All supported assets – including forex, can be traded commission-free at eToro. This means that once you eventually start trading with real money, you’ll be doing so in a super cost-effective way. The eToro demo account can be accessed online or via the provider’s mobile app.

There is no time limit on this, so you can switch between the demo and real account any time you wish. An additional feature that some of you might be interested in is the eToro Copy Trading tool. As a social trading platform, eToro allows you to copy an experienced forex trader like-for-like – at an amount proportionate to what you invest.

Once you start trading forex with your own capital, the minimum deposit is just $200. The platform supports debit/credit cards, e-wallets, and bank transfers. eToro is heavily regulated, including an FCA license. Your funds are also protected by the FSCS.

2. Capital.com - Best Forex Demo Account for Beginners

new capital.com logo

On the one hand, experienced trading pros will look at the Capital.com platform as overly basic for their needs. However, if this is your first time trading forex - or any asset class for that matter, then the platform is likely going to be up your street.

Crucially, Capital.com is super easy to use, is free of complex jargon, and offers a free demo account facility to all users. This allows you to trade in a 100% risk-free manner until you feel comfortable testing your forex skills with real money. While learning the ropes, you might want to make full use of the many educational resources on offer.

3. Libertex – Forex Demo Account with Tight Spreads

Libertex is one of the most established forex and CFD trading platforms in the online space. Launched over 23 years ago, the platform is now home to almost 3 million traders.Perhaps the most attractive aspect of choosing this provider is that Libertex is a tight spread broker. This means that there is no gap between the buy and sell price of your chosen forex pair.

Plus, many of the markets offered by Libertex can be traded commission-free. In terms of its forex demo account facility, new traders could use a €50,000 paper trading balance to perform demo trading for free, which acts as a practice account. This is more than enough for you to get to grips with trading currency pairs in a risk-averse manner.

4. AvaTrade - Best Forex Demo Account for Mobile Trading

Although you are best advised to trade via a desktop device to get the most out of a demo account, some of you might also like the option of doing this through a mobile app.

If so, it's well worth checking out AvaTrade. This popular forex and CFD trading platform has been active in this space for over 12 years and it is regulated in 6 jurisdictions.

5. Forex.com – Best Forex Demo Account for Professional Traders

So far in this guide, we stressed that forex demo accounts are ideal for newbies that wish to learn the ropes of currency trading before risking any capital. However, we should make it clear that demo accounts are also suitable for experienced traders that wish to test or perfect a new strategy.

If this sounds like you, then Forex.com is well worth considering. As the name implies, this popular online platform is a specialist forex broker. It gives you access to more than 80 currency pairs - many of which come from the emerging markets.

Like many terms in retail investing, 'automated trading' covers a broad range of activities intended to make monitoring markets and executing trades faster and more efficient by outsourcing certain tasks to computer programs.

Basic automation might entail inputting a specific set of buy and sell parameters into your preferred trading software with a command to execute an order when those parameters are met. The sophistication of your automation largely depends on the complexity of your trading strategy and knowledge of programming, with more experienced traders adding increasingly narrow conditions and interlocking sets of commands.

Whether it’s a simple set of buy-sell price conditions or an elaborate combination of if-then commands, all automated trading relies on a computer program to perform each part of the trading process. Once you’ve input your order prerequisites, you’re free to step away from the screen while the faithful robot tirelessly scans the markets for opportunities, moving with lightning speed to act on your behalf when it spots a suitable trade.

As technology has evolved, automated trading has come to include other trading styles, such as algorithmic trading, social trading and copy trading.

Algorithmic Trading

Algorithmic trading allows traders handling large quantities of assets to manage trading costs by slicing orders that might otherwise be too large to execute efficiently under favourable conditions into smaller tranches.

Many traders use 'algorithmic trading' and 'automated trading' interchangeably, but they’re not quite the same. Traders can automate an algorithmic strategy to allow computers to handle each part of the transaction, including when to trade, however, the algorithm that gives the trading strategy its name only handles one component: the division of the order and its execution

Social and Copy Trading

Social trading and copy trading use specially created trading bots to send ‘signals’ to a trader when a particular investor places an order. A separate automation then mimics this order, in the case of copy trading, or simply observes and assesses if you’re a social trader.

Given its exceptional popularity, you might wonder just what makes automated trading so special.

For some traders, the practical benefits make it a better choice than self-managed strategies, leaving a trading bot to monitor the markets frees up valuable time for refining a strategy. Others like the idea of managing risk by simultaneously trading across multiple platforms. In general, however, the benefits of automated trading can be summarized as 'fast' and 'logical'.

Improved Trading Discipline

The same volatility that makes forex a profitable trading environment can wreak havoc on your trading strategy if you allow emotion to take over. Watching the markets rise and fall, glued to your screen and scanning frantically for an opportunity to enlarge your profits or mitigate your losses, you’re likely to trade impulsively and abandon your carefully-planned strategy. Or perhaps you can’t bring yourself to execute an order, even though every indicator says you’ll win the trade.

Because your participation in the trading process begins and ends with developing a strategy and instructing or creating a trading robot to act on your behalf, automated trading eliminates the risk that you’ll deviate from the best-laid plans due to anxiety or over-optimism.

More Refined Strategies

The only way to test a strategy with manual trading? Put your money in the market and track your progress over time in hopes of identifying patterns in your wins and losses. It’s an expensive and time-consuming learning process that requires you to consciously sit out opportunities that arise or hold tight during downturns, both of which are emotionally taxing.

Automated trading, on the other hand, offers the option to see how your trading rules would’ve performed against historical data. Backtesting not only offers you a risk-free opportunity to refine the rules you apply to your trades, it also makes it much easier to assess what’s working in your strategy and what’s not. Without the 'noise' of one-off trades you couldn’t help but execute and months, if not years, of historical market data to use as a testing ground, you have access to clear, actionable information without risk.

Risk Mitigation

Trading robots operating on multiple accounts, or even multiple platforms, can help you to control the inherent risk of trading in highly volatile markets in several ways. Without the need to constantly monitor markets and input orders yourself, you’re free to trade across several asset classes simultaneously, distributing risk as you see fit. Alternatively, you can assign different strategies to individual trading robots in the same asset class, ensuring that you’re always on the right side of a market trend.

Faster Order Execution

One of the first things novice traders learn is seconds count. The adage that time is money was never more accurate than in the context of trading forex, where entering or exiting a trade at the right millisecond can mean the difference between significant profits and just breaking even.

Automations react immediately to market conditions, moving to execute orders as soon as your desired preconditions are met. While the human brain needs to recognize those conditions, process them and then signal your body to take action, the trading bot not only opens your position seamlessly but generates the necessary orders to protect your investment or execute the trade. All in less time than it takes a human trader to blink.