User blogs

Tag Search

Tag search results for: "crypto exchange scams"

Thieves Steal $9m from Crypto Liquidity Pool

Cyber-thieves have stolen $8.9m from cryptocurrency firm SafeMoon after exploiting a recently introduced vulnerability affecting the firm’s liquidity pool.To get more news about crypto currency liquidity, you can visit wikifx.com official website.

Liquidity pools are large sums of cryptocurrency locked in a smart contract that provide liquidity to decentralized finance (DeFi) exchanges.

However, the SFM:BNB pool run by SafeMoon was compromised on March 28, according to the firm’s CEO, John Karony.“In the hours since, our team has met with key advisors to agree a plan that protects token holders and the community. We have located the suspected exploit, patched the vulnerability, and are engaging a chain forensics consultant to determine the precise nature and extent of the exploit,” Karony explained.

“Users should be assured that their tokens remain safe. Because we have flexibility in our tech, we have faith that we will be able to bring this matter to resolution.”

Karony claimed that the firm’s exchange is not impacted, nor are other pools run by the firm or its SafeMoon Wallet.

A recently introduced update appears to have been the cause of the bug that was exploited in this attack.

“The attacker took advantage of the public burn() function, this function let any user burn tokens from any other address. The attacker used this function to remove SFM tokens from the SFM:BNB liquidity pool, artificially raising the price of SFM,” explained Dappd CEO, “DeFiMark,” on Twitter.

“The attacker was then able to sell SFM into this LP at a grossly overpriced rate within the same transaction, wiping out the remaining WBNB in the liquidity pool.”

Interestingly, the actor claiming responsibility for the attack now appears to be saying that they carried it out in error and want to return the funds. However, this could simply be a delaying tactic while they launder the stolen crypto.

However, the SFM:BNB pool run by SafeMoon was compromised on March 28, according to the firm’s CEO, John Karony.“In the hours since, our team has met with key advisors to agree a plan that protects token holders and the community. We have located the suspected exploit, patched the vulnerability, and are engaging a chain forensics consultant to determine the precise nature and extent of the exploit,” Karony explained.

“Users should be assured that their tokens remain safe. Because we have flexibility in our tech, we have faith that we will be able to bring this matter to resolution.”

Karony claimed that the firm’s exchange is not impacted, nor are other pools run by the firm or its SafeMoon Wallet.

A recently introduced update appears to have been the cause of the bug that was exploited in this attack.

“The attacker took advantage of the public burn() function, this function let any user burn tokens from any other address. The attacker used this function to remove SFM tokens from the SFM:BNB liquidity pool, artificially raising the price of SFM,” explained Dappd CEO, “DeFiMark,” on Twitter.

“The attacker was then able to sell SFM into this LP at a grossly overpriced rate within the same transaction, wiping out the remaining WBNB in the liquidity pool.”

Interestingly, the actor claiming responsibility for the attack now appears to be saying that they carried it out in error and want to return the funds. However, this could simply be a delaying tactic while they launder the stolen crypto.

However, the SFM:BNB pool run by SafeMoon was compromised on March 28, according to the firm’s CEO, John Karony.“In the hours since, our team has met with key advisors to agree a plan that protects token holders and the community. We have located the suspected exploit, patched the vulnerability, and are engaging a chain forensics consultant to determine the precise nature and extent of the exploit,” Karony explained.

“Users should be assured that their tokens remain safe. Because we have flexibility in our tech, we have faith that we will be able to bring this matter to resolution.”

Karony claimed that the firm’s exchange is not impacted, nor are other pools run by the firm or its SafeMoon Wallet.

A recently introduced update appears to have been the cause of the bug that was exploited in this attack.

“The attacker took advantage of the public burn() function, this function let any user burn tokens from any other address. The attacker used this function to remove SFM tokens from the SFM:BNB liquidity pool, artificially raising the price of SFM,” explained Dappd CEO, “DeFiMark,” on Twitter.

“The attacker was then able to sell SFM into this LP at a grossly overpriced rate within the same transaction, wiping out the remaining WBNB in the liquidity pool.”

Interestingly, the actor claiming responsibility for the attack now appears to be saying that they carried it out in error and want to return the funds. However, this could simply be a delaying tactic while they launder the stolen crypto.

However, the SFM:BNB pool run by SafeMoon was compromised on March 28, according to the firm’s CEO, John Karony.“In the hours since, our team has met with key advisors to agree a plan that protects token holders and the community. We have located the suspected exploit, patched the vulnerability, and are engaging a chain forensics consultant to determine the precise nature and extent of the exploit,” Karony explained.

“Users should be assured that their tokens remain safe. Because we have flexibility in our tech, we have faith that we will be able to bring this matter to resolution.”

Karony claimed that the firm’s exchange is not impacted, nor are other pools run by the firm or its SafeMoon Wallet.

A recently introduced update appears to have been the cause of the bug that was exploited in this attack.

“The attacker took advantage of the public burn() function, this function let any user burn tokens from any other address. The attacker used this function to remove SFM tokens from the SFM:BNB liquidity pool, artificially raising the price of SFM,” explained Dappd CEO, “DeFiMark,” on Twitter.

“The attacker was then able to sell SFM into this LP at a grossly overpriced rate within the same transaction, wiping out the remaining WBNB in the liquidity pool.”

Interestingly, the actor claiming responsibility for the attack now appears to be saying that they carried it out in error and want to return the funds. However, this could simply be a delaying tactic while they launder the stolen crypto.

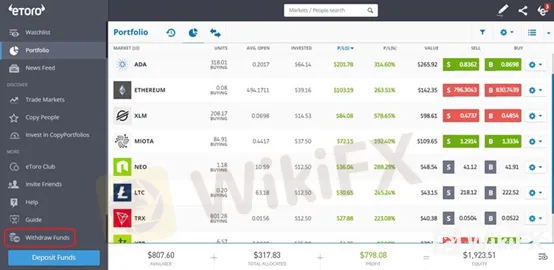

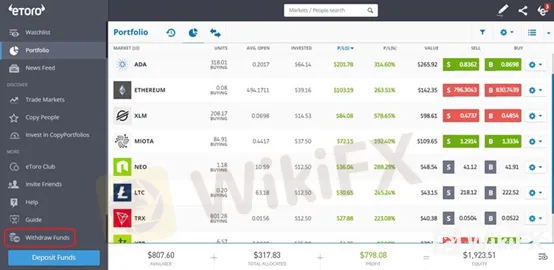

Best Cryptocurrency Exchanges & Trading Platforms in 2023

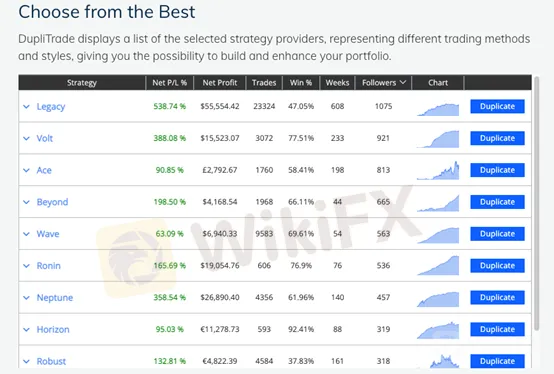

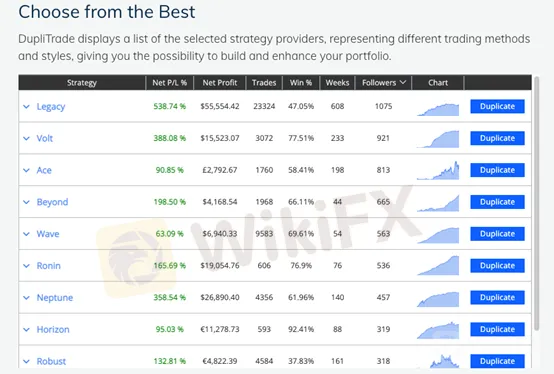

Finding the best cryptocurrency exchanges and trading platforms is no small feat. You may not have the time, capital, or expertise to go through every single exchange with a fine-tooth comb. Lucky for you, we have done all the heavy lifting. BeInCrypto has ranked the top exchanges based on 24-hour trading volume, market spread, and coins. We also discuss fees, deposit limits, withdrawal limits, ease of use, and security.To get more news about WikiBit App, you can visit wikifx.com official website.

A crypto exchange is a place where traders and investors go to buy cryptocurrency. An exchange primarily makes crypto purchases available. However, many also provide services, including derivatives trading, margin trading, staking, yield farming, and liquidity mining.

Getting started with Stormgain only takes a few minutes. All you need to do is register an e-mail. Stormgain provides an attractive 500x leverage for those experienced enough to take advantage. There is also a mobile app for Android and iOS.

There are zero deposit fees for those who deposit with cryptocurrency or via SEPA transfer incurs no fees.

There are no fees for using a Mastercard credit or debit card to deposit (only for E.U. countries).

Simplex charges 3.5% (or $10 USD, whichever is greater) for credit card deposits, while Koinal charges 4% (the conversion on the Koinal side of the transaction should also be taken into account).

Fees for trading are 0 for non-profitable trades and 10% for profitable.

The fees for leveraged trading depend on the cryptocurrency pair. For example, if you create an order with a leverage of 300, your fees will be multiplied by 300.

Moreover, Stormgain has fixed and additional withdrawal fees.

Minimum deposit

Stormgain’s minimum deposit varies by cryptocurrency. The minimum deposit for each currency is as follows: 0.00003 BTC, 0.003 BCH, 0.001 ETH, 0.0072 LTC, and 4 XRP. Each cryptocurrency minimum deposit should be approximately equivalent to 10 USDT. For deposits in fiat, the sum depends on the deposit method.

Cloud mining

Get access to powerful BTC cloud-mining software; earn free Bitcoin in USDT. You can trade with it and withdraw your profit whenever you want. All mining is done on StormGain’s cloud mining equipment, not your local device.

Bittrex does not charge any extra fees for deposits of cryptocurrencies or USD deposits.

The only withdrawal fees are the network and wire withdrawals, which are subject to a $25 fee.

Their maker fee ranges from 0.35%-0.00%, and their taker fee ranges from 0.35%-0.05%.

Is Bittrex safe?

You can verify your account in order to increase your allowance to 100 BTC per day. The verification process can take up to ten minutes. Bittrex uses a multi-stage wallet strategy that ensures that the bulk of user funds are saved in cold storage.

Getting started with Stormgain only takes a few minutes. All you need to do is register an e-mail. Stormgain provides an attractive 500x leverage for those experienced enough to take advantage. There is also a mobile app for Android and iOS.

There are zero deposit fees for those who deposit with cryptocurrency or via SEPA transfer incurs no fees.

There are no fees for using a Mastercard credit or debit card to deposit (only for E.U. countries).

Simplex charges 3.5% (or $10 USD, whichever is greater) for credit card deposits, while Koinal charges 4% (the conversion on the Koinal side of the transaction should also be taken into account).

Fees for trading are 0 for non-profitable trades and 10% for profitable.

The fees for leveraged trading depend on the cryptocurrency pair. For example, if you create an order with a leverage of 300, your fees will be multiplied by 300.

Moreover, Stormgain has fixed and additional withdrawal fees.

Minimum deposit

Stormgain’s minimum deposit varies by cryptocurrency. The minimum deposit for each currency is as follows: 0.00003 BTC, 0.003 BCH, 0.001 ETH, 0.0072 LTC, and 4 XRP. Each cryptocurrency minimum deposit should be approximately equivalent to 10 USDT. For deposits in fiat, the sum depends on the deposit method.

Cloud mining

Get access to powerful BTC cloud-mining software; earn free Bitcoin in USDT. You can trade with it and withdraw your profit whenever you want. All mining is done on StormGain’s cloud mining equipment, not your local device.

Bittrex does not charge any extra fees for deposits of cryptocurrencies or USD deposits.

The only withdrawal fees are the network and wire withdrawals, which are subject to a $25 fee.

Their maker fee ranges from 0.35%-0.00%, and their taker fee ranges from 0.35%-0.05%.

Is Bittrex safe?

You can verify your account in order to increase your allowance to 100 BTC per day. The verification process can take up to ten minutes. Bittrex uses a multi-stage wallet strategy that ensures that the bulk of user funds are saved in cold storage.

Getting started with Stormgain only takes a few minutes. All you need to do is register an e-mail. Stormgain provides an attractive 500x leverage for those experienced enough to take advantage. There is also a mobile app for Android and iOS.

There are zero deposit fees for those who deposit with cryptocurrency or via SEPA transfer incurs no fees.

There are no fees for using a Mastercard credit or debit card to deposit (only for E.U. countries).

Simplex charges 3.5% (or $10 USD, whichever is greater) for credit card deposits, while Koinal charges 4% (the conversion on the Koinal side of the transaction should also be taken into account).

Fees for trading are 0 for non-profitable trades and 10% for profitable.

The fees for leveraged trading depend on the cryptocurrency pair. For example, if you create an order with a leverage of 300, your fees will be multiplied by 300.

Moreover, Stormgain has fixed and additional withdrawal fees.

Minimum deposit

Stormgain’s minimum deposit varies by cryptocurrency. The minimum deposit for each currency is as follows: 0.00003 BTC, 0.003 BCH, 0.001 ETH, 0.0072 LTC, and 4 XRP. Each cryptocurrency minimum deposit should be approximately equivalent to 10 USDT. For deposits in fiat, the sum depends on the deposit method.

Cloud mining

Get access to powerful BTC cloud-mining software; earn free Bitcoin in USDT. You can trade with it and withdraw your profit whenever you want. All mining is done on StormGain’s cloud mining equipment, not your local device.

Bittrex does not charge any extra fees for deposits of cryptocurrencies or USD deposits.

The only withdrawal fees are the network and wire withdrawals, which are subject to a $25 fee.

Their maker fee ranges from 0.35%-0.00%, and their taker fee ranges from 0.35%-0.05%.

Is Bittrex safe?

You can verify your account in order to increase your allowance to 100 BTC per day. The verification process can take up to ten minutes. Bittrex uses a multi-stage wallet strategy that ensures that the bulk of user funds are saved in cold storage.

Getting started with Stormgain only takes a few minutes. All you need to do is register an e-mail. Stormgain provides an attractive 500x leverage for those experienced enough to take advantage. There is also a mobile app for Android and iOS.

There are zero deposit fees for those who deposit with cryptocurrency or via SEPA transfer incurs no fees.

There are no fees for using a Mastercard credit or debit card to deposit (only for E.U. countries).

Simplex charges 3.5% (or $10 USD, whichever is greater) for credit card deposits, while Koinal charges 4% (the conversion on the Koinal side of the transaction should also be taken into account).

Fees for trading are 0 for non-profitable trades and 10% for profitable.

The fees for leveraged trading depend on the cryptocurrency pair. For example, if you create an order with a leverage of 300, your fees will be multiplied by 300.

Moreover, Stormgain has fixed and additional withdrawal fees.

Minimum deposit

Stormgain’s minimum deposit varies by cryptocurrency. The minimum deposit for each currency is as follows: 0.00003 BTC, 0.003 BCH, 0.001 ETH, 0.0072 LTC, and 4 XRP. Each cryptocurrency minimum deposit should be approximately equivalent to 10 USDT. For deposits in fiat, the sum depends on the deposit method.

Cloud mining

Get access to powerful BTC cloud-mining software; earn free Bitcoin in USDT. You can trade with it and withdraw your profit whenever you want. All mining is done on StormGain’s cloud mining equipment, not your local device.

Bittrex does not charge any extra fees for deposits of cryptocurrencies or USD deposits.

The only withdrawal fees are the network and wire withdrawals, which are subject to a $25 fee.

Their maker fee ranges from 0.35%-0.00%, and their taker fee ranges from 0.35%-0.05%.

Is Bittrex safe?

You can verify your account in order to increase your allowance to 100 BTC per day. The verification process can take up to ten minutes. Bittrex uses a multi-stage wallet strategy that ensures that the bulk of user funds are saved in cold storage. Leaked ‘Tai Chi’ Document Reveals Binance’s Elaborate Scheme To Evade Bitcoin Regulators

Binance Holdings Limited, the world’s largest cryptocurrency exchange conceived of an elaborate corporate structure designed to intentionally deceive regulators and surreptitiously profit from crypto investors in the United States, according to a document thought to be created by a senior executive and obtained by Forbes. Cayman Islands-based Binance is currently responsible for about $10 billion in total crypto trades per day and its founder and CEO Changpeng “CZ” Zhao is one of the few known cryptocurrency billionaires.To get more news about BINANCE, you can visit wikifx.com official website.

The 2018 document details plans for a yet-unnamed U.S. company dubbed the “Tai Chi entity,” in an allusion to the Chinese martial art whose approach is built around the principle of “yield and overcome,” or using an opponent’s own weight against him. While Binance appears to have gone out of its way to submit to U.S. regulations by establishing a compliant subsidiary, Binance.US, an ulterior motive is now apparent. Unlike its creator Binance, Binance.US, which is open to American investors, does not allow highly leveraged crypto-derivatives trading, which is regulated in the U.S.

The leaked Tai Chi document, a slideshow believed to have been seen by senior Binance executives, is a strategic plan to execute a bait and switch. While the then-unnamed entity set up operations in the United States to distract regulators with feigned interest in compliance, measures would be put in place to move revenue in the form of licensing fees and more to the parent company, Binance. All the while, potential customers would be taught how to evade geographic restrictions while technological work-arounds were put in place.

Forbes reached out to Binance founder CZ as well as its chief compliance officer Samuel Lim about the leaked document and didn’t receive a response to our questions. Binance.US CEO Catherine Coley and Harry Zhou, the person identified as creating the document, also didn’t comment. [After the article was published CZ responded with several tweets claiming that the story was incorrect and that the document was not created by a current or former employee. He further wrote that “Binance has always operated within the boundaries of the law.” Ed note: Chief compliance officer Lim had previously sent an email to Forbes confirming that Zhou had been a Binance employee.]

The source of the document, whose identity we’ve agreed not to reveal, says it was first presented to CZ in Q4 2018 by Binance mergers and acquisitions manager Jared Gross, an attorney who Forbes believes is actually the exchange’s general counsel. The source says the document was created by former Binance employee Harry Zhou, a serial entrepreneur, who is the co-founder of Koi Trading, a San Francisco-based cryptocurrency exchange partially owned by Binance. The file is named “Presentation 2” so there may have been other strategies being considered. Still, an analysis of the document reveals that many of the specifics outlined within it, are already in place.

The strategy document has four main components, Goals, Proposed Corporate Structure, Regulator Engagement Plans and Long Term License Plans. The first goal, enforcement mitigation, is designed to minimize the impact of U.S. regulation. It explicitly mentions the need to undermine the ability of “anti-money laundering and U.S. sanctions enforcement” to detect illicit activity. More specifically, it describes a detailed strategy for distracting the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the New York Department of Financial Services (NYDFS). To do this, the document advocates for participating in the U.S. Department of Homeland Security (DHS) Cornerstone Program for detecting weaknesses in the financial systems. A representative of the Department tells Forbes that Binance.US did participate in the Cornerstone program, as a standard part of the process of becoming a Money Service Business, but declined to comment further.

Interestingly, Binance itself is now a client of the DHS-funded CipherTrace, based in Menlo Park, California, one of the first security firms with technology explicitly designed to investigate on-chain transactions of the exchange’s own cryptocurrency. Another CipherTrace client is the U.S. Securities and Exchange Commission, which signed a one-year deal with CipherTrace this July.

While the SEC declined to comment as to whether or not its engagement of CipherTrace was part of a larger investigation into Binance or Binance.US, the contract explicitly states that one of the main reasons for selecting CipherTrace is it is “the only known blockchain forensics and risk intelligence tool that can support the Binance coin (BNB) and all tokens on the Binance network.”

The leaked Tai Chi document, a slideshow believed to have been seen by senior Binance executives, is a strategic plan to execute a bait and switch. While the then-unnamed entity set up operations in the United States to distract regulators with feigned interest in compliance, measures would be put in place to move revenue in the form of licensing fees and more to the parent company, Binance. All the while, potential customers would be taught how to evade geographic restrictions while technological work-arounds were put in place.

Forbes reached out to Binance founder CZ as well as its chief compliance officer Samuel Lim about the leaked document and didn’t receive a response to our questions. Binance.US CEO Catherine Coley and Harry Zhou, the person identified as creating the document, also didn’t comment. [After the article was published CZ responded with several tweets claiming that the story was incorrect and that the document was not created by a current or former employee. He further wrote that “Binance has always operated within the boundaries of the law.” Ed note: Chief compliance officer Lim had previously sent an email to Forbes confirming that Zhou had been a Binance employee.]

The source of the document, whose identity we’ve agreed not to reveal, says it was first presented to CZ in Q4 2018 by Binance mergers and acquisitions manager Jared Gross, an attorney who Forbes believes is actually the exchange’s general counsel. The source says the document was created by former Binance employee Harry Zhou, a serial entrepreneur, who is the co-founder of Koi Trading, a San Francisco-based cryptocurrency exchange partially owned by Binance. The file is named “Presentation 2” so there may have been other strategies being considered. Still, an analysis of the document reveals that many of the specifics outlined within it, are already in place.

The strategy document has four main components, Goals, Proposed Corporate Structure, Regulator Engagement Plans and Long Term License Plans. The first goal, enforcement mitigation, is designed to minimize the impact of U.S. regulation. It explicitly mentions the need to undermine the ability of “anti-money laundering and U.S. sanctions enforcement” to detect illicit activity. More specifically, it describes a detailed strategy for distracting the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the New York Department of Financial Services (NYDFS). To do this, the document advocates for participating in the U.S. Department of Homeland Security (DHS) Cornerstone Program for detecting weaknesses in the financial systems. A representative of the Department tells Forbes that Binance.US did participate in the Cornerstone program, as a standard part of the process of becoming a Money Service Business, but declined to comment further.

Interestingly, Binance itself is now a client of the DHS-funded CipherTrace, based in Menlo Park, California, one of the first security firms with technology explicitly designed to investigate on-chain transactions of the exchange’s own cryptocurrency. Another CipherTrace client is the U.S. Securities and Exchange Commission, which signed a one-year deal with CipherTrace this July.

While the SEC declined to comment as to whether or not its engagement of CipherTrace was part of a larger investigation into Binance or Binance.US, the contract explicitly states that one of the main reasons for selecting CipherTrace is it is “the only known blockchain forensics and risk intelligence tool that can support the Binance coin (BNB) and all tokens on the Binance network.”

The leaked Tai Chi document, a slideshow believed to have been seen by senior Binance executives, is a strategic plan to execute a bait and switch. While the then-unnamed entity set up operations in the United States to distract regulators with feigned interest in compliance, measures would be put in place to move revenue in the form of licensing fees and more to the parent company, Binance. All the while, potential customers would be taught how to evade geographic restrictions while technological work-arounds were put in place.

Forbes reached out to Binance founder CZ as well as its chief compliance officer Samuel Lim about the leaked document and didn’t receive a response to our questions. Binance.US CEO Catherine Coley and Harry Zhou, the person identified as creating the document, also didn’t comment. [After the article was published CZ responded with several tweets claiming that the story was incorrect and that the document was not created by a current or former employee. He further wrote that “Binance has always operated within the boundaries of the law.” Ed note: Chief compliance officer Lim had previously sent an email to Forbes confirming that Zhou had been a Binance employee.]

The source of the document, whose identity we’ve agreed not to reveal, says it was first presented to CZ in Q4 2018 by Binance mergers and acquisitions manager Jared Gross, an attorney who Forbes believes is actually the exchange’s general counsel. The source says the document was created by former Binance employee Harry Zhou, a serial entrepreneur, who is the co-founder of Koi Trading, a San Francisco-based cryptocurrency exchange partially owned by Binance. The file is named “Presentation 2” so there may have been other strategies being considered. Still, an analysis of the document reveals that many of the specifics outlined within it, are already in place.

The strategy document has four main components, Goals, Proposed Corporate Structure, Regulator Engagement Plans and Long Term License Plans. The first goal, enforcement mitigation, is designed to minimize the impact of U.S. regulation. It explicitly mentions the need to undermine the ability of “anti-money laundering and U.S. sanctions enforcement” to detect illicit activity. More specifically, it describes a detailed strategy for distracting the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the New York Department of Financial Services (NYDFS). To do this, the document advocates for participating in the U.S. Department of Homeland Security (DHS) Cornerstone Program for detecting weaknesses in the financial systems. A representative of the Department tells Forbes that Binance.US did participate in the Cornerstone program, as a standard part of the process of becoming a Money Service Business, but declined to comment further.

Interestingly, Binance itself is now a client of the DHS-funded CipherTrace, based in Menlo Park, California, one of the first security firms with technology explicitly designed to investigate on-chain transactions of the exchange’s own cryptocurrency. Another CipherTrace client is the U.S. Securities and Exchange Commission, which signed a one-year deal with CipherTrace this July.

While the SEC declined to comment as to whether or not its engagement of CipherTrace was part of a larger investigation into Binance or Binance.US, the contract explicitly states that one of the main reasons for selecting CipherTrace is it is “the only known blockchain forensics and risk intelligence tool that can support the Binance coin (BNB) and all tokens on the Binance network.”

The leaked Tai Chi document, a slideshow believed to have been seen by senior Binance executives, is a strategic plan to execute a bait and switch. While the then-unnamed entity set up operations in the United States to distract regulators with feigned interest in compliance, measures would be put in place to move revenue in the form of licensing fees and more to the parent company, Binance. All the while, potential customers would be taught how to evade geographic restrictions while technological work-arounds were put in place.

Forbes reached out to Binance founder CZ as well as its chief compliance officer Samuel Lim about the leaked document and didn’t receive a response to our questions. Binance.US CEO Catherine Coley and Harry Zhou, the person identified as creating the document, also didn’t comment. [After the article was published CZ responded with several tweets claiming that the story was incorrect and that the document was not created by a current or former employee. He further wrote that “Binance has always operated within the boundaries of the law.” Ed note: Chief compliance officer Lim had previously sent an email to Forbes confirming that Zhou had been a Binance employee.]

The source of the document, whose identity we’ve agreed not to reveal, says it was first presented to CZ in Q4 2018 by Binance mergers and acquisitions manager Jared Gross, an attorney who Forbes believes is actually the exchange’s general counsel. The source says the document was created by former Binance employee Harry Zhou, a serial entrepreneur, who is the co-founder of Koi Trading, a San Francisco-based cryptocurrency exchange partially owned by Binance. The file is named “Presentation 2” so there may have been other strategies being considered. Still, an analysis of the document reveals that many of the specifics outlined within it, are already in place.

The strategy document has four main components, Goals, Proposed Corporate Structure, Regulator Engagement Plans and Long Term License Plans. The first goal, enforcement mitigation, is designed to minimize the impact of U.S. regulation. It explicitly mentions the need to undermine the ability of “anti-money laundering and U.S. sanctions enforcement” to detect illicit activity. More specifically, it describes a detailed strategy for distracting the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the New York Department of Financial Services (NYDFS). To do this, the document advocates for participating in the U.S. Department of Homeland Security (DHS) Cornerstone Program for detecting weaknesses in the financial systems. A representative of the Department tells Forbes that Binance.US did participate in the Cornerstone program, as a standard part of the process of becoming a Money Service Business, but declined to comment further.

Interestingly, Binance itself is now a client of the DHS-funded CipherTrace, based in Menlo Park, California, one of the first security firms with technology explicitly designed to investigate on-chain transactions of the exchange’s own cryptocurrency. Another CipherTrace client is the U.S. Securities and Exchange Commission, which signed a one-year deal with CipherTrace this July.

While the SEC declined to comment as to whether or not its engagement of CipherTrace was part of a larger investigation into Binance or Binance.US, the contract explicitly states that one of the main reasons for selecting CipherTrace is it is “the only known blockchain forensics and risk intelligence tool that can support the Binance coin (BNB) and all tokens on the Binance network.” Learn The Fundamentals Of Blockchain, Bitcoin, And Crypto

Getting to the money is an idea that most people can get behind. From becoming a social media influencer to navigating a traditional job or even jumping into entrepreneurship, people are looking for ways to secure the bag and maximize wealth.To get more news about learn blockchain, you can visit wikifx.com official website.

One of the ways people are expanding their worth is through investments and alternative forms of traditional currency like cryptocurrency. And although cryptocurrency has become more and more popular, the reality of it still makes people scratch their heads a little bit.

While crypto has been around since 2009, it has evolved. The digital currency market is expansive, and conversations around its use and inclusion in everyday life have become increasingly routine.

And with such evolution comes questions about its usage and what it means for the future. Even the IRS requires users to claim crypto on their taxes, but it’s categorized as property.

With so many uses, how can a person determine the best use of the currency? It is at this intersection that Blavity Deals enter the chat.

Blavity Deals is offering The Fundamentals of Blockchain, Bitcoin & Crypto course for people to learn more about creating an e-wallet, the basics of cryptocurrency, and comprehensive content around blockchain.

Taught by Senior Information Security Consultant and IT trainer Gabriel Avramescu, the hour-long course equips learners with the basics of cryptocurrency from a tech level and dives into the reality of the technology.

While crypto has been around since 2009, it has evolved. The digital currency market is expansive, and conversations around its use and inclusion in everyday life have become increasingly routine.

And with such evolution comes questions about its usage and what it means for the future. Even the IRS requires users to claim crypto on their taxes, but it’s categorized as property.

With so many uses, how can a person determine the best use of the currency? It is at this intersection that Blavity Deals enter the chat.

Blavity Deals is offering The Fundamentals of Blockchain, Bitcoin & Crypto course for people to learn more about creating an e-wallet, the basics of cryptocurrency, and comprehensive content around blockchain.

Taught by Senior Information Security Consultant and IT trainer Gabriel Avramescu, the hour-long course equips learners with the basics of cryptocurrency from a tech level and dives into the reality of the technology.

While crypto has been around since 2009, it has evolved. The digital currency market is expansive, and conversations around its use and inclusion in everyday life have become increasingly routine.

And with such evolution comes questions about its usage and what it means for the future. Even the IRS requires users to claim crypto on their taxes, but it’s categorized as property.

With so many uses, how can a person determine the best use of the currency? It is at this intersection that Blavity Deals enter the chat.

Blavity Deals is offering The Fundamentals of Blockchain, Bitcoin & Crypto course for people to learn more about creating an e-wallet, the basics of cryptocurrency, and comprehensive content around blockchain.

Taught by Senior Information Security Consultant and IT trainer Gabriel Avramescu, the hour-long course equips learners with the basics of cryptocurrency from a tech level and dives into the reality of the technology.

While crypto has been around since 2009, it has evolved. The digital currency market is expansive, and conversations around its use and inclusion in everyday life have become increasingly routine.

And with such evolution comes questions about its usage and what it means for the future. Even the IRS requires users to claim crypto on their taxes, but it’s categorized as property.

With so many uses, how can a person determine the best use of the currency? It is at this intersection that Blavity Deals enter the chat.

Blavity Deals is offering The Fundamentals of Blockchain, Bitcoin & Crypto course for people to learn more about creating an e-wallet, the basics of cryptocurrency, and comprehensive content around blockchain.

Taught by Senior Information Security Consultant and IT trainer Gabriel Avramescu, the hour-long course equips learners with the basics of cryptocurrency from a tech level and dives into the reality of the technology. Next Level Crypto Projects Polkadot (DOT)

In the crypto space, projects are not created equal. PolkaDot (DOT), Ethereum (ETH), and Uwerx will lead the next bull market cycle. A unique value proposition drives each, and analysts expect all three to post excellent returns in 2023.To get more news about crypto projects, you can visit wikifx.com official website.

Polkadot (DOT)

Polkadot (DOT) was created by Gavin Wood, one of the core developers of Ethereum (ETH). Polkadot (DOT) presents the solution for blockchains’ core problem: their natural isolation. Polkadot (DOT) creates a foundational layer, or layer zero, allowing for the free flow of assets and information between all the Polkadot (DOT) chains. Polkadot’s (DOT) core blockchain is the Relay chain that provides security and relays information and assets, as the name suggests. Polkadot’s (DOT) other chains are called parachains, and these purpose-specific chains can hyper-specialize, allowing for an enormous ecosystem. Polkadot’s (DOT) elegant solution to interoperability will drive its growth in 2023.

Ethereum (ETH)

Ethereum (ETH) is the oldest smart contract-capable blockchain. Ethereum (ETH) launched in 2015, and the developers at Ethereum (ETH) have been shipping upgrades to the network ever since. The most recent upgrade saw Ethereum (ETH) transition to proof of stake, and the coming Ethereum (ETH) hard fork, the Shanghai hark ford, will enable staking withdrawals. Making analysts expect that once Ethereum (ETH) can be withdrawn, investors will rush to buy Ethereum (ETH) so they can stake the Ethereum (ETH) token and earn passive income from validator rewards.

Uwerx (WERX)

Uwerx has analysts and experts buzzing. This relatively unknown microcap crypto project has outrageous upside potential in 2023. Uwerx will release a decentralized blockchain based freelance platform that will set a new standard for the freelancing industry. Until now, centralized platforms have choked innovation through high platform fees and unnecessarily heavy bureaucratic systems. Uwerx provides a blockchain-driven solution and replaces intermediaries with smart contracts. InterFi Network and SolidProof have both already audited the protocol, and liquidity will be locked for twenty-five years after launch.

Uwerx flags all the indicators of a hidden gem, and this project could become a blue chip as early as 2024. With millions of freelancers ready to migrate to a better alternative and Uwerx providing one, the growth potential remains obscene. Analysts have predicted WERX can rally by up to 9,000% in 2023 alone, and Uwerx is an opportunity to buy a potential blue chip crypto project at a lucrative price.

Parabolic Year For Uwerx

When Uwerx breaks into the mainstream, its disruptive nature will do the rest. With lower platform fees and better security, Uwerx will offer a fundamentally superior service to those currently available on the market. 2023 belongs to freelancers and Uwerx holders. Get in on the presale now and win $5,000 alongside the ongoing 25% purchase bonus..

Ethereum (ETH)

Ethereum (ETH) is the oldest smart contract-capable blockchain. Ethereum (ETH) launched in 2015, and the developers at Ethereum (ETH) have been shipping upgrades to the network ever since. The most recent upgrade saw Ethereum (ETH) transition to proof of stake, and the coming Ethereum (ETH) hard fork, the Shanghai hark ford, will enable staking withdrawals. Making analysts expect that once Ethereum (ETH) can be withdrawn, investors will rush to buy Ethereum (ETH) so they can stake the Ethereum (ETH) token and earn passive income from validator rewards.

Uwerx (WERX)

Uwerx has analysts and experts buzzing. This relatively unknown microcap crypto project has outrageous upside potential in 2023. Uwerx will release a decentralized blockchain based freelance platform that will set a new standard for the freelancing industry. Until now, centralized platforms have choked innovation through high platform fees and unnecessarily heavy bureaucratic systems. Uwerx provides a blockchain-driven solution and replaces intermediaries with smart contracts. InterFi Network and SolidProof have both already audited the protocol, and liquidity will be locked for twenty-five years after launch.

Uwerx flags all the indicators of a hidden gem, and this project could become a blue chip as early as 2024. With millions of freelancers ready to migrate to a better alternative and Uwerx providing one, the growth potential remains obscene. Analysts have predicted WERX can rally by up to 9,000% in 2023 alone, and Uwerx is an opportunity to buy a potential blue chip crypto project at a lucrative price.

Parabolic Year For Uwerx

When Uwerx breaks into the mainstream, its disruptive nature will do the rest. With lower platform fees and better security, Uwerx will offer a fundamentally superior service to those currently available on the market. 2023 belongs to freelancers and Uwerx holders. Get in on the presale now and win $5,000 alongside the ongoing 25% purchase bonus..

Ethereum (ETH)

Ethereum (ETH) is the oldest smart contract-capable blockchain. Ethereum (ETH) launched in 2015, and the developers at Ethereum (ETH) have been shipping upgrades to the network ever since. The most recent upgrade saw Ethereum (ETH) transition to proof of stake, and the coming Ethereum (ETH) hard fork, the Shanghai hark ford, will enable staking withdrawals. Making analysts expect that once Ethereum (ETH) can be withdrawn, investors will rush to buy Ethereum (ETH) so they can stake the Ethereum (ETH) token and earn passive income from validator rewards.

Uwerx (WERX)

Uwerx has analysts and experts buzzing. This relatively unknown microcap crypto project has outrageous upside potential in 2023. Uwerx will release a decentralized blockchain based freelance platform that will set a new standard for the freelancing industry. Until now, centralized platforms have choked innovation through high platform fees and unnecessarily heavy bureaucratic systems. Uwerx provides a blockchain-driven solution and replaces intermediaries with smart contracts. InterFi Network and SolidProof have both already audited the protocol, and liquidity will be locked for twenty-five years after launch.

Uwerx flags all the indicators of a hidden gem, and this project could become a blue chip as early as 2024. With millions of freelancers ready to migrate to a better alternative and Uwerx providing one, the growth potential remains obscene. Analysts have predicted WERX can rally by up to 9,000% in 2023 alone, and Uwerx is an opportunity to buy a potential blue chip crypto project at a lucrative price.

Parabolic Year For Uwerx

When Uwerx breaks into the mainstream, its disruptive nature will do the rest. With lower platform fees and better security, Uwerx will offer a fundamentally superior service to those currently available on the market. 2023 belongs to freelancers and Uwerx holders. Get in on the presale now and win $5,000 alongside the ongoing 25% purchase bonus..

Ethereum (ETH)

Ethereum (ETH) is the oldest smart contract-capable blockchain. Ethereum (ETH) launched in 2015, and the developers at Ethereum (ETH) have been shipping upgrades to the network ever since. The most recent upgrade saw Ethereum (ETH) transition to proof of stake, and the coming Ethereum (ETH) hard fork, the Shanghai hark ford, will enable staking withdrawals. Making analysts expect that once Ethereum (ETH) can be withdrawn, investors will rush to buy Ethereum (ETH) so they can stake the Ethereum (ETH) token and earn passive income from validator rewards.

Uwerx (WERX)

Uwerx has analysts and experts buzzing. This relatively unknown microcap crypto project has outrageous upside potential in 2023. Uwerx will release a decentralized blockchain based freelance platform that will set a new standard for the freelancing industry. Until now, centralized platforms have choked innovation through high platform fees and unnecessarily heavy bureaucratic systems. Uwerx provides a blockchain-driven solution and replaces intermediaries with smart contracts. InterFi Network and SolidProof have both already audited the protocol, and liquidity will be locked for twenty-five years after launch.

Uwerx flags all the indicators of a hidden gem, and this project could become a blue chip as early as 2024. With millions of freelancers ready to migrate to a better alternative and Uwerx providing one, the growth potential remains obscene. Analysts have predicted WERX can rally by up to 9,000% in 2023 alone, and Uwerx is an opportunity to buy a potential blue chip crypto project at a lucrative price.

Parabolic Year For Uwerx

When Uwerx breaks into the mainstream, its disruptive nature will do the rest. With lower platform fees and better security, Uwerx will offer a fundamentally superior service to those currently available on the market. 2023 belongs to freelancers and Uwerx holders. Get in on the presale now and win $5,000 alongside the ongoing 25% purchase bonus.. Egypt arrests dozens over alleged online crypto scam

Egyptian authorities have arrested 29 people, including 13 foreign citizens, accused of running an online cryptocurrency scam that defrauded thousands of investors, state media reported.To get more news about crypto exchange scams, you can visit wikifx.com official website.

The network pocketed about $620,000 at the expense of victims in the country now battered by an economic crisis and rapid inflation, a report said on Sunday.

The online platform “HoggPool”, which appeared in August according to local media, promised clients “financial gains after having lured them by fraudulent means”, said a statement released by the prosecution service late on Saturday.

The scheme promised large profits from cryptocurrency mining and trading services, for fees charged at an attractive foreign exchange rate.

It is illegal to dabble in cryptocurrency in Egypt – the act may be punishable by prison and a fine of up to $325,000.

HoggPool abruptly ceased operations in February and vanished with the money, the state-run daily Al-Ahram reported.

Authorities said the network was planning to launch a new platform called “Riot” when they were arrested.

The interior ministry said 16 Egyptians and “13 foreign nationals of the same country”, who were not identified, had been arrested. Officials also seized 95 mobile phones, 3,367 SIM cards and 41 foreign bank cards, it said.Since March 2022, Egypt’s pound has depreciated by nearly half its value against the US dollar. An acute dollar shortage has suppressed imports and caused a backlog of goods at ports, with a knock-on effect on local industry.

Inflation surged to 25.8 percent in January, the highest level in five years, according to official data. Prices for many staple foods have risen much faster.

Official data classified about 30 percent of the population as poor before COVID-19 struck, and analysts say numbers have risen since then. Nearly 60 percent of Egypt’s 104 million citizens are estimated to be below, or close to the poverty line.

The scheme promised large profits from cryptocurrency mining and trading services, for fees charged at an attractive foreign exchange rate.

It is illegal to dabble in cryptocurrency in Egypt – the act may be punishable by prison and a fine of up to $325,000.

HoggPool abruptly ceased operations in February and vanished with the money, the state-run daily Al-Ahram reported.

Authorities said the network was planning to launch a new platform called “Riot” when they were arrested.

The interior ministry said 16 Egyptians and “13 foreign nationals of the same country”, who were not identified, had been arrested. Officials also seized 95 mobile phones, 3,367 SIM cards and 41 foreign bank cards, it said.Since March 2022, Egypt’s pound has depreciated by nearly half its value against the US dollar. An acute dollar shortage has suppressed imports and caused a backlog of goods at ports, with a knock-on effect on local industry.

Inflation surged to 25.8 percent in January, the highest level in five years, according to official data. Prices for many staple foods have risen much faster.

Official data classified about 30 percent of the population as poor before COVID-19 struck, and analysts say numbers have risen since then. Nearly 60 percent of Egypt’s 104 million citizens are estimated to be below, or close to the poverty line.

The scheme promised large profits from cryptocurrency mining and trading services, for fees charged at an attractive foreign exchange rate.

It is illegal to dabble in cryptocurrency in Egypt – the act may be punishable by prison and a fine of up to $325,000.

HoggPool abruptly ceased operations in February and vanished with the money, the state-run daily Al-Ahram reported.

Authorities said the network was planning to launch a new platform called “Riot” when they were arrested.

The interior ministry said 16 Egyptians and “13 foreign nationals of the same country”, who were not identified, had been arrested. Officials also seized 95 mobile phones, 3,367 SIM cards and 41 foreign bank cards, it said.Since March 2022, Egypt’s pound has depreciated by nearly half its value against the US dollar. An acute dollar shortage has suppressed imports and caused a backlog of goods at ports, with a knock-on effect on local industry.

Inflation surged to 25.8 percent in January, the highest level in five years, according to official data. Prices for many staple foods have risen much faster.

Official data classified about 30 percent of the population as poor before COVID-19 struck, and analysts say numbers have risen since then. Nearly 60 percent of Egypt’s 104 million citizens are estimated to be below, or close to the poverty line.

The scheme promised large profits from cryptocurrency mining and trading services, for fees charged at an attractive foreign exchange rate.

It is illegal to dabble in cryptocurrency in Egypt – the act may be punishable by prison and a fine of up to $325,000.

HoggPool abruptly ceased operations in February and vanished with the money, the state-run daily Al-Ahram reported.

Authorities said the network was planning to launch a new platform called “Riot” when they were arrested.

The interior ministry said 16 Egyptians and “13 foreign nationals of the same country”, who were not identified, had been arrested. Officials also seized 95 mobile phones, 3,367 SIM cards and 41 foreign bank cards, it said.Since March 2022, Egypt’s pound has depreciated by nearly half its value against the US dollar. An acute dollar shortage has suppressed imports and caused a backlog of goods at ports, with a knock-on effect on local industry.

Inflation surged to 25.8 percent in January, the highest level in five years, according to official data. Prices for many staple foods have risen much faster.

Official data classified about 30 percent of the population as poor before COVID-19 struck, and analysts say numbers have risen since then. Nearly 60 percent of Egypt’s 104 million citizens are estimated to be below, or close to the poverty line.