freemexy's blog

This has been confirmed that Blizzard will officially release the content of Phase 2 on Tuesday, November 12, which includes the PVP Honor System and the new World Bosses update. Moreover, what fans are most looking forward to is the major content of the next expansion, such as the game story, the quests to complete, as well as the main characters.

The arrival of Sylvanas Windrunner, fallen leader of the Horde, revealed the veil between Azeroth and the realm of the dead, which directly threatens the balance between life and death throughout World of Warcraft: Shadowlands, and the heroes of Azeroth must complete for dealing with these consequences well.

Shadowlands will bring the players to a strange place and encounter some of the departed legends of the Warcraft universe, like Uther the Lightbringer, a hero who once fought against the dark forces of darkness.

What's more, the players always want to figure out the actual meanings of worldwide PVP, which is featured to compare every player on the server's efforts throughout the honor system.Until then, the players can track the honor by honorable kills throughout the entire server, based on getting kills from the opposing faction.

After that, all the players will be divided into different ranks according to their Honorable kills from the previous week, and every 14 ranks are grouped a faction, the higher the rank, the more difficulties to get them.

Once you achieve a rank, you'll get the rewards including the lowest ranks of Horde Scout and Alliance Private.

As a result, you have to kill as much as you in the Honor System to achieve your own honor.Phase 2 is still a part to be expected, even if it's not perfect, and you are able to earn more rewards with much fun. Beyond that, there are two new world bosses, Azuregos and Lord Kazzak, someone will kite them into major cities soon.

Since you always need Gold to complete your task or buy advanced equipment, you can't play Phase 2 very well. And farming is a chore for most players,

The site is selling a variety of in-game products related to WOW series, mainly featured WOW Classic Gold and WOW Classic Items, and it can be guaranteed that all products are really legal and usable.

World of Warcraft Shadowlands is set to release on or before December 31, 2020, Blizzard claimed, if everything runs smoothly, we might play the expansion in the first half of 2020.With Shadowlands, you would encounter unprecedented challenges throughout the realm of the dead in Warcraft lore, featured the first "level squish" and an overhauled leveling system. Beyond that, more quests will be added to the new update in different zones, dungeons, as well as raids.

Knowing that you expect WOW Shadowlands for a long time, but it won't happen until a few months later. And during which, World of Warcraft Classic will continue to add new game system for all consisting of six phases.

Do prepare well for the new expansion, maybe you just want to farm gold in Azeroth, but it means that it could take up a lot of your time. On the contrary, you can buy WOW Gold to skip directly the boring and repeated work, you'd better do it like someone else, or you will fall behind.

Here, it owns the world's leading World of Warcraft Gold, and more in-game items, this is a store dedicated to service related to WOW series, moreover, WOW Classic Gold is also available there, anyway, you can always find what you want on the site, even the CD Keys and Boosting.

The Idaho Lottery says one lucky player has a winning ticket that's

worth the top prize of $381,000 from Saturday night's draw of the Idaho

Cash game.Get more news about 菲律宾彩票包网服务,you can vist loto98.com

The winning ticket was sold in Ada County.The winning numbers were 07, 12, 13, 19, and 24.

"Everyone who played Idaho Cash for last Saturday night's draw needs to

check their tickets carefully for winners," said Jeff Anderson, Idaho

Lottery Director. “This is the single largest jackpot won on Idaho Cash

since it began in 2017.”

The winner has 180 days from the draw date to claim their prize.

In accordance with Governor Little’s stay-home order, Idaho Lottery offices are currently closed to the public.

All winners are encouraged to sign the back of their ticket and keep it

in a safe place until claiming their prize at the Idaho Lottery office

in Boise.

Players also have the option to mail winning tickets to the lottery office for payment. These winners will be paid weekly.

The winner can contact the Idaho Lottery during regular business hours

at 208-334-2600 with any questions about claiming their prize.

On Tuesday, the Idaho Lottery announced someone purchased a Lucky for Life ticket in Bannock County for last night’s draw. The winning ticket matched the first five numbers, but not the Lucky Ball, and is worth $25,000 a year for the winner’s life. The winning numbers from last night’s draw were 09, 13, 34, 36, 46, and the Lucky Ball was 10, according to a Idaho Lottery news release.

“We are encouraging everyone who played Lucky for Life for last night’s draw to check their tickets carefully for winners,” Idaho Lottery Director Jeff Anderson said in the news release. “The winner should sign their ticket immediately and contact the Idaho Lottery to make arrangements for collecting their prize.”This is the sixth time an Idaho winner has won the $25,000 a year for life prize playing Lucky for Life.Last night’s winner has 180 days to claim their prize from Idaho Lottery headquarters in Boise. The winner has the option of taking a one-time, lump sum cash option of $390,000 or receiving $25,000 a year for as long as they live

For the last three weeks, developers across the country have seen home transactions slump to virtually zero after they closed down their sales offices as part of the government’s campaign to prevent the spread of the virus which has killed 2,236 people and infected 75,465 on the mainland as of Feb. 21. The China Real Estate Association issued a notice (link in Chinese ) on Jan. 26 urging the shutdown and many provinces, including Hunan, Jiangxi, Guangdong, Hainan and Heilongjiang, have instructed developers to suspend or reduce sales activities involving human-to-human contact, effectively forcing them to shutter their brick-and-mortar operations.“I’ve been in real-estate marketing for 20 years and I’ve never seen anything like it. Sales offices were closed literally overnight,”

Ke Min, founder of Hainan Youjia Zhixuan, a property sales agency based in the southern island province of Hainan, told Caixin.China Real Estate Information Corp. (CRIC), a property consultancy and data provider, said in a Feb. 14 report that local governments in more than 100 cities instructed property firms to shut their sales offices. Over the weeklong Lunar New Year public holiday that originally ran from Jan. 24 to Jan. 30, more than 90 cities had no new properties for sale, 24 had no transactions, and overall, sales slumped by 93% from the previous week. In the first week of February, there wasn’t a single transaction in 27 of the cities and total sales dropped 95% compared with the first week following the Lunar New Year holiday in 2019, it said.New Year gloomThe Lunar New Year is usually an important selling opportunity for property developers, especially in third- and fourth-tier cities, as millions of people making their annual trip home for the holiday make purchases. But the coronavirus epidemic has upended the tradition this year.One marketing executive with a major property firm told Caixin that it usually keeps one-third of its sales team working over the holiday period, but this year it cut back significantly and then sent them all home after the China Real Estate Association issued its notice.Some developers have tried to bolster sales by turning to online marketing, promoting new developments through WeChat accounts, mini programs and websites, and offering virtual tours. But so far, they’ve had little success,

as few buyers are prepared to put down a deposit without physically visiting the site.Even if the coronavirus outbreak ends by the beginning of March, real-estate sales are likely to plummet by 79% year-on-year in February and 43% in March, property services provider Savills PLC predicted on Monday. But if the epidemic lasts well into March, the slump that month could deepen to 69%, it said.Without sales, many developers, especially small private companies with weak balance sheets and no access to bank loans could go out of business. Funds raised from deposits, pre-sales and sales of apartments have become one of the biggest sources of cash for real-estate companies over the last few years as the government has squeezed other traditionally important channels such as bank credit and loans from trust companies.In 2019, real-estate developers took in 6.14 trillion yuan ($873 billion) from deposits and advances, 34% of the total amount of funds they raised, and the biggest single source of funding, while bank loans accounted for just 2.52 trillion yuan, government data show. Without income from deposits and advances,

many developers will struggle to fund construction of ongoing and new projects and to repay debt. A report by Ping An Securities estimated that based on an assumption of a 50% drop in operating cash flow, most developers only have enough cash to last another three months.More bankruptciesIf sales offices do not reopen soon, many small and midsize property firms could face a cash crunch within three months, Wu Jianbin, executive vice president of Fujian-based developer Yango Group Co., a Shenzhen-listed property developer, told Caixin. “This is just the beginning and without a significant alleviation in the epidemic, it’s going to continue.”Wu, a real-estate veteran who has worked for several big developers, said that a developer with annual sales of around 100 billion yuan would see its income cut by 20 billion yuan to 30 billion yuan if it had no sales for three months, but would still have to service its debts and make payments for the land-use rights it has bought from local governments, which might total around 10 billion yuan.So far, the epidemic doesn’t seem to have had a major impact on bankruptcies among property developers. Data from CRIC show that in 2020 up to Feb. 10, a total of 69 property firms have failed, including 20 in early February, similar to figures from the same period in 2019. But the research firm warned in its Feb. 16 report that as the epidemic continues, more developers are likely to apply for bankruptcy. According to government data (link in Chinese), the country had almost 98,000 property development companies in 2018.

China’s real estate market was on a winning streak throughout most of the 2000s. In fact, local property buyers gained more than practically anyone else from the nation’s economic rise.Homes in major Chinese cities saw the largest gains. Real estate prices in Shanghai, Shenzhen, Guangzhou, and Shanghai tripled between the new millennium and the 2008 Global Recession.Something changed though. Property transaction volume since the “boom years” have entered freefall – especially in most of China’s first and second tier cities.Meanwhile, Chinese real estate developers are cutting sales prices of their new projects – often by as much as 30%.Rare signs of protest and public anger are showing as well. Would you be upset if you bought a condo, but prices dropped six months later giving new purchasers a better deal?

That scenario is now a reality for some Chinese property buyers.Furthermore, it’s all happening during peak season for housing sales. The locals normally label these auspicious months “Silver October” and “Golden November”.You might think a website called “InvestAsian” would suggest buying property in China – Asia’s largest economy. But we don’t. Here are several reasons why you should not own property in China – especially if you’re a foreigner.China boasts the world’s biggest population with nearly 1.4 billion inhabitants (although India will take that title by 2030). Nonetheless, there are plenty of houses available for everyone to buy.Estimates place the number of unsold properties in China at over 50 million.

That’s more than 1/5th of the entire country’s total private housing supply.The government also curbed mortgage lending to reduce the number of speculative purchases and second/third home sales. Very few Chinese citizens are buying houses in order to actually occupy them anymore.China will soon face a demographic crisis on top of everything else. Its population will peak at about 1.4 billion inhabitants by the year 2035.After that, China will rapidly age while shrinking in population size. Lower demand for housing will be just one of many negative repercussionsThey’ll soon become the first country to ever grow old before reaching developed nation status – a dire situation for China’s real estate market its and economy as a whole.I believe all those factors combined together will inevitably lead to a construction slowdown in China and/or a property crash.Equities in China have gone through a tough few years. Back in 2015, the Shanghai Composite Index was above 5,000 points. The index has since plummeted by half into the ~2,500 range.China’s stock market collapse has not been reported as such by the media. Yet a drop of 50%+ is certainly more than just a simple correction.Personally, I would call that a full-blown stock market collapse without any hesitation at all.

Conversations with clients have begun to slowly shift toward what a Democratic sweep may mean, Compass Points managing director for policy research Isaac Boltansky wrote in a note. Market participants will probably feel compelled to consider the policy implications at the end of this month or early August at the latest, as company earnings reports ebb and investors increasingly assess second-half 2020 themes, he said.

Boltansky also believes a Phase 4 government stimulus deal will be done by early August, and he flagged the beginning of the Democratic National Convention on Aug. 17 and the Republican National Convention on Aug. 24 as “the starting gun for the race to November 3.”

Separately, Vital Knowledge founder Adam Crisafulli said that one reason for the strong stock market on Monday might have been the sense that “Biden won‘t be that bad for markets.” The S&P 500 rose as much as 1.7% in morning trading, extending a five-day rally that’s the longest since mid-December.

“For the last several months investors watched Biden‘s rising poll momentum with trepidation, but now a narrative is emerging whereby he’s being painted as a neutral (and possible upside surprise) for stocks (as taxes wont rise by as much as feared while trade policy should be less disruptive and the volume of nonsense tweets will be substantially reduced),” Crisafulli wrote in a note.

Earlier, JPMorgan strategists including Dubravko Lakos-Bujas and Marko Kolanovic said Wall Street is too negative about a Biden win, as the Democrat is more market-friendly than analysts currently predict. They cited potential benefits from infrastructure spending, softer tariff rhetoric and higher wages, and they said the tax hit to S&P 500 earnings may be lower than many are expecting.

Read more: JPMorgan Says Wall Street Is Too Negative About a Biden Win

Also on Monday, Wedbush analyst Moshe Katri wrote that the U.S. elections were “likely the most important near-term regulatory event” for Visa Inc. and Mastercard Inc. Investors are already watching various outcomes, Katri said, and are viewing the Democrats controlling all three government branches as the worst case “scenario given past efforts to regulate interchange.” Visa rose as much 1.8% on Monday, while Mastercard climbed as much as 1.6%.

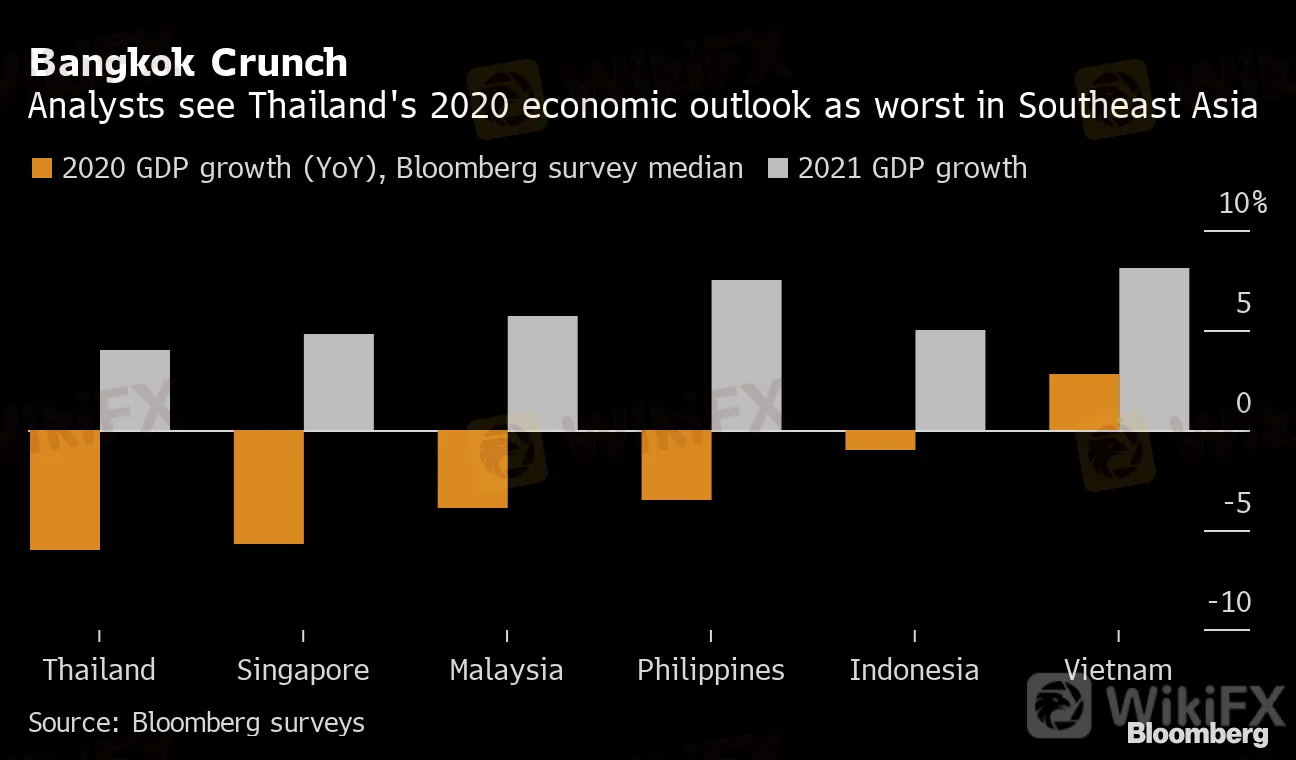

Gross domestic product is forecast to contract 8.1% this year, according to the Bank of Thailand. That‘s worse than official forecasts for any of the main economies across Asia, and would be Thailand’s biggest GDP decline ever, surpassing even its plunge during the Asian financial crisis two decades ago.

“Thailand has large exposure as a tourism hub, close to 15% of GDP, and it also has large exposure of the export-oriented sector,” said Kiatipong Ariyapruchya, senior economist for Thailand at the World Bank. “Hence the large shock to GDP.”

The state of emergency, nighttime curfew and business closings imposed across the country to fight the virus have crushed private consumption and investment, which were already on a modest downtrend last year. Purchases are expected to pick up as the lockdown restrictions are lifted and as government stimulus measures filter through to the economy, but investors could be slow to return given the gloomy prospects.

Thailand recorded no foreign tourist arrivals or receipts for a second straight month in May as the pandemic forced border closings. Annual tourist arrivals are forecast to drop to 8 million, just one-fifth of last years total.

Despite plans for travel bubbles with select countries, Thai authorities are proceeding to open the country slowly and carefully. Efforts to kindle domestic tourism won‘t offset the tremendous losses to this critical industry, which last year made up about one-fifth of Thailand’s economy.

At first glance, Thai exports appear to have held up relatively well this year, contracting for only two of the first five months of 2020.

As it turns out, distortions in one commodity have helped cushion the overall blow. Rising gold prices during the outbreak have led local investors to sell gold, boosting total exports. Excluding gold, total shipments have been hit hard by weak global demand and supply-chain disruptions.

Sources: Bank of Thailand, Bank for International Settlements data compiled by Bloomberg Economics

The Thai baht has gained almost 6% against the U.S. dollar in the past three months, the second-best performer in Asia tracked by Bloomberg. Despite the Bank of Thailand‘s three interest-rate cuts this year, which have brought the benchmark rate to a record low of 0.5%, the country’s success in containing the pandemic has kept the currency strong.

READ: THAILAND INSIGHT: BOTs Focus on Baht May Reduce QE Odds

The central bank has showed concern about the baht‘s strength, which hampers exports and will complicate the economic recovery. Officials have warned they’re considering additional steps to tame the baht if needed.

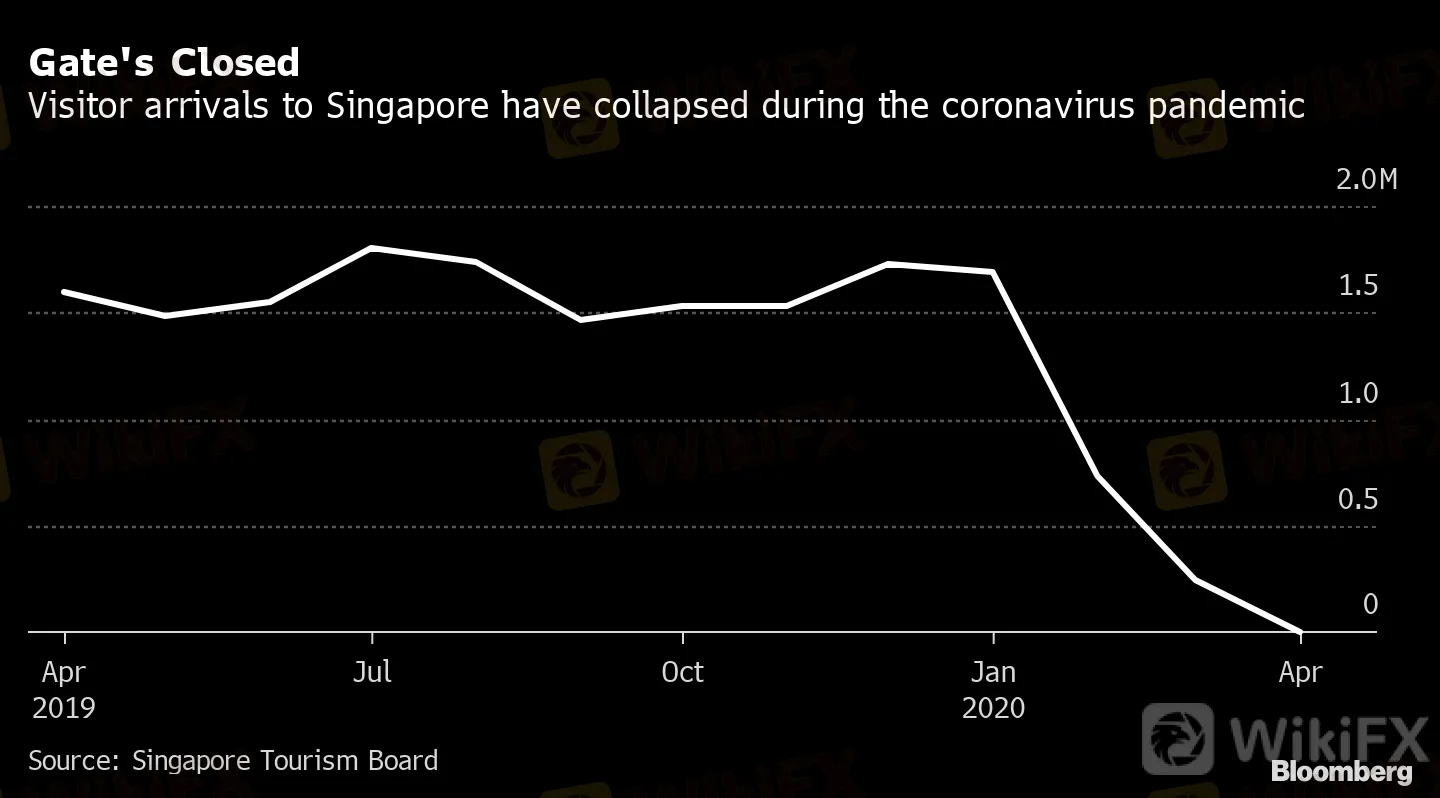

Residents of Singapore, a city-state smaller than New York City, have few such options, presenting a massive problem for its battered tourism industry. With borders closed to foreigners, hotels and tourist attractions need to count on ‘staycationers’ to plug the gap in an industry that brought in almost $20 billion in revenue last year. Its a tall order.

“Unless we have a return to international business, the hotel industry is going to be decimated as up to 90% of our bookings come from international travelers,” said Michael Issenberg, chief executive officer of Accor SAs Asia Pacific unit, the largest hotel operator in Singapore.

While tourism everywhere has been hammered by the pandemic, the gradual opening of some domestic travel has given a shot in the arm to airlines and hotels in places like Australia and Vietnam. Rosewood Hotel Group has seen occupancy rates as high as 70% at some of its China properties as leisure travel picks up, said CEO Sonia Cheng.

Read more on Hong Kong staycations

Singapores tourism sector faces a tougher challenge, as the hotels were just given a green light last week to request approval to welcome domestic tourists. Many locals like teacher Najeer Yusof prefer to save their money and wait for travel to resume in nearby hotspots like Thailand and Malaysia rather than spend it on a hotel down the street.

“There‘s more to see and experience overseas at a cheaper cost,” said Yusof. There’s also the “awe factor -- getting to see or experience something I wont otherwise be able to in Singapore, like the mountains and national parks in Indonesia and activities like diving and surfing.”

Though the country of 5.7 million people has reopened its economy after a lockdown of more than two months, its borders are still largely closed. It recorded a historic low of just 750 foreign visitors in April, down from 1.6 million in the same month last year. May‘s numbers weren’t much better, at 880.

“In the short-term, hotels, eateries and attractions can re-orientate to draw interest to staycations, attractions or food discounts,” said Selena Ling, head of treasury research and strategy at Oversea-Chinese Banking Corp. “However, our inherent small domestic market size implies it may not be a longer-term sustainable solution.”

GDP Boost

Tourism has been an increasingly important industry for Singapore, helping to diversify the economy from its traditional strengths of finance, oil refining and shipping. Attractions including the Marina Bay Sands hotel and casino, the Universal Studios theme park and the Singapore Zoo have drawn tourists from around the world.

Last year, Singapore hosted a record 19.1 million visitors, while tourism receipts rose to S$27.7 billion ($19.8 billion), from S$26.9 billion the year before. Singapore‘s tourism sector, which employs about 65,000 people, contributes about 4% to gross domestic product. The Singapore Tourism Board doesn’t track the share of local versus international tourism.

The border closure means Singapore needs to persuade locals to spend more money at home. Even with overseas travel off limits, Singapore residents will still want to venture out, said Tourism Board CEO Keith Tan.

“They may therefore be open to take time off in their own city and rediscover all that Singapore has to offer,” he said in an emailed statement.

Singapore has set aside S$90 million for the tourism sector and a task force is developing domestic and international recovery plans to be shared soon, Tan added.

Hotels including the Shangri-la are also getting a small boost from the thousands of Singaporeans and expats who had been traveling abroad and are slowly being allowed back in. When they arrive, most are being forced to quarantine for 14 days in a hotel, at a cost of about S$2,000.

With occupancy running at just 15% for August, the iconic Raffles Singapore is offering a two-night special for about S$795, complete with a complimentary Singapore Sling, free breakfast, city tour and spa discounts.

Some tourist spots are also offering price cuts to attract residents whove been cooped up in their apartments for weeks. Sentosa Development Corp., which manages a resort island with attractions including Madame Tussauds and Universal Studios, has waived admission fees until the end of September, said Lynette Ang, the chief marketing officer.

The central bank will reduce its overnight policy rate by 25 basis points to 1.75%, the lowest in records dating back to 2004, according to the median estimate of 25 economists surveyed by Bloomberg. Fourteen analysts predict a 25 basis point cut, while four expect the bank to ease by 50 basis points; the rest project no change.

A cut would mark Bank Negara Malaysias fourth policy easing this year, a period in which the economy has faced a triple whammy of coronavirus pandemic, low oil prices and political uncertainty. Unemployment surged 49% in April from a year earlier, to 778,800 people, exceeding the annual average in the last 30 years, as the government imposed a three-month lockdown to curb the virus.

Malaysia began gradually reopening the economy two months ago, with chief statistician Mohd Uzir Mahidin warning in May that the country was headed for a recession. The government has announced 295 billion ringgit ($68.9 billion) in stimulus to cushion the effects of the pandemic, and is drafting a bill of economic recovery measures.

Bank Negara Malaysia last updated its full-year forecast for gross domestic product in April, ranging from 0.5% growth to a 2% contraction. The central bank said in May the economy is expected to contract in the second quarter, before gradually improving in the second half of the year and recording positive growth in 2021.

Indicators point to the economy contracting in the three months through June: Exports plunged 25.5% in May, the most in 11 years, while industrial production shrank by a record 32% in April.

What Bloombergs economists say:

Though the worst has likely passed, we expect contractions to persist in 3Q and 4Q as well. Re-opening the economy will have its limits until a vaccine is widely available.

Tamara Mast Henderson, Asean economist

More recent data suggest a nascent recovery. Malaysias manufacturing sector returned to growth in June for the first time since December as factories restarted operations. The equity market rally suggests investors are positive about the gradual reopening of the economy, CGS-CIMB analysts Ivy Ng and Nagulan Ravi wrote in a research note.

Stimulus spending -- which includes 45 billion ringgit of direct fiscal injection -- has weighed on the governments balance sheet amid outlook downgrades from ratings agencies. The government expects the budget deficit to nearly double to 5.8%-6% of GDP this year, while total government debt could hit its statutory limit of 55% of GDP by year-end.

Bank Negara Malaysia pledged in May to “utilize its policy levers as appropriate” to aid the recovery. So far this year it has cut banks reserve ratio requirement by 100 basis points to 2%, and allowed them to count government bond holdings toward statutory reserve requirements. Those measures have released billions of ringgit worth of liquidity into the banking system.

The inflation rate has remained negative since March, with prices dropping by 2.9% for a second straight month in May, mainly due to lower transport costs on cheaper global oil.

“We expect inflation to remain in negative territory for much of the year, given still-weak commodity prices, as well as mild demand-pull inflation as the economy shifts into the new normal,” RHB analyst Ahmad Nazmi Idrus wrote in a research note. The central bank projects full-year inflation of -1.5% to 0.5%.