User blogs

Tag Search

The property and casualty insurance industry has seen a remarkable turnaround, flipping a USD 8.5 billion underwriting loss in Q1 2023 into a USD 9.3 billion gain by Q1 2024, with a combined ratio of 94.2%. This ratio, which falls below 100%, indicates a profitable outcome. But as the market continues to evolve, insurers must embrace new technologies to stay ahead of the competition and meet the rising expectations of their customers.

Generative AI (Gen AI) has emerged as a game-changer in the large language models insurance industry. According to a Deloitte survey, 75% of U.S. insurers are already using Gen AI in some form, particularly in claims processing and customer service. However, expanding its use across the industry isn’t as simple as flipping a switch. Insurers must tackle challenges such as data security, privacy concerns, and the integration of new technologies into existing systems.

While the potential for Gen AI is vast, so too are the risks. Insurers need to carefully consider compliance and operational challenges to fully unlock its benefits while maintaining profitability and trust.

How Generative AI is Reshaping Insurance Operations

According to a report from Capgemini Research Institute, 67% of high-performing insurers are preparing to leverage Generative AI by 2025 to enhance customer experiences and streamline operations.

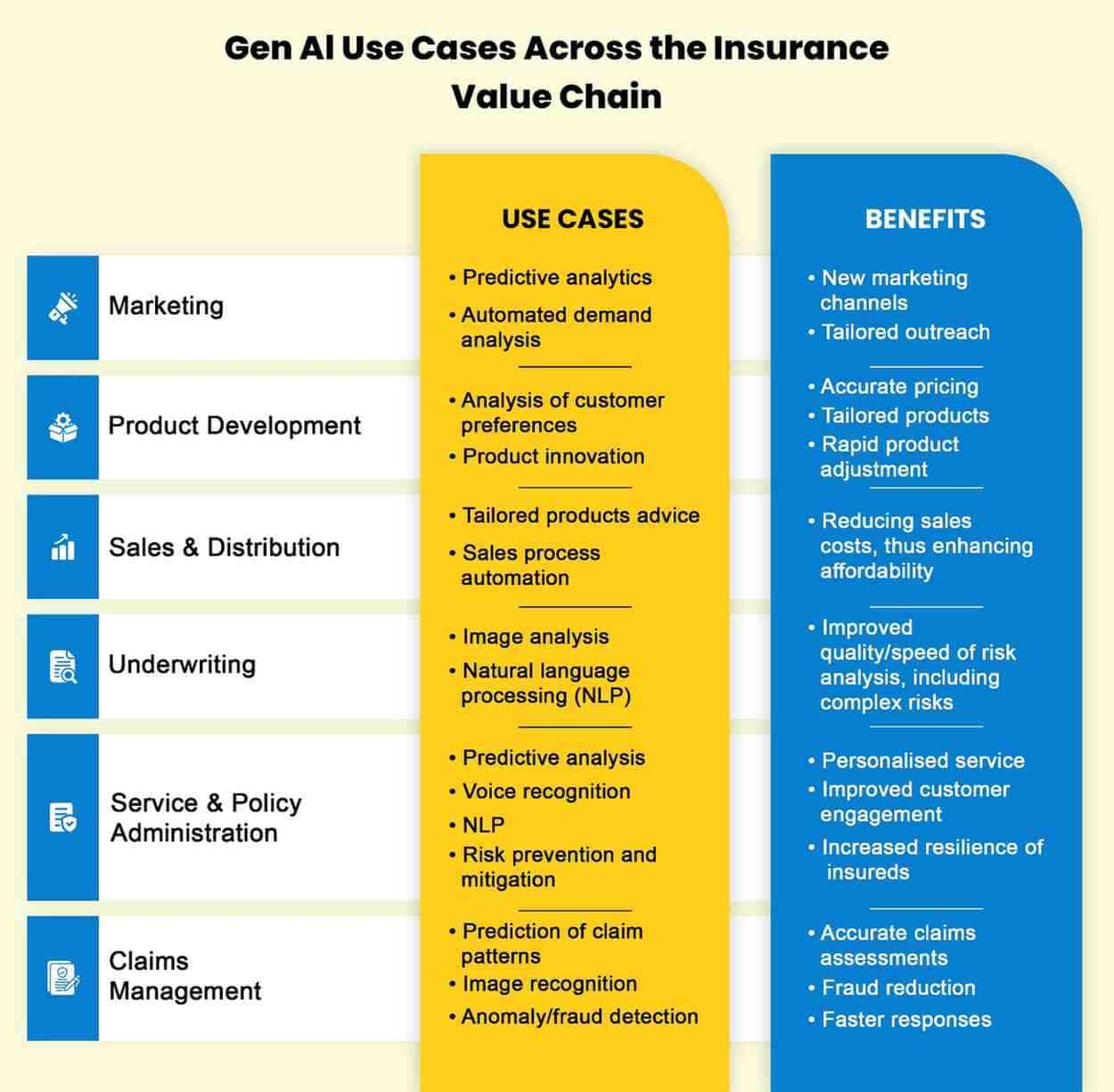

Unlike traditional AI, which focuses on analyzing data or automating predefined tasks, Gen AI goes further by creating new content and data. This ability to generate new, customized information is what sets Gen AI apart and makes it particularly valuable in transforming insurance operations. Here’s how it’s making an impact:

Automating Policy Document Creation and Boosting Claims Efficiency

One of the most promising applications of Gen AI in insurance is automating the creation of policy documents. By processing customer data, Gen AI can generate customized policy documents that not only meet regulatory standards but are tailored to individual customer needs. This significantly reduces the time and manual effort typically required for document creation.

In the realm of claims processing, Gen AI is helping insurers increase efficiency. It works alongside industry professionals like underwriters, actuaries, and claims adjusters to analyze and synthesize large volumes of data from various sources, such as call transcripts, medical records, and legal documents. This enhances productivity and shortens the claims lifecycle, resulting in quicker processing and improved accuracy, especially in property and casualty insurance.

Using Synthetic Data to Train Models and Predict Risks

Another key benefit of Gen AI is its ability to generate synthetic datasets that simulate potential risk scenarios. These datasets, built from historical customer data, are useful for training machine learning models in areas like fraud detection and risk assessment.

By using these realistic simulations, insurers can fine-tune their large language models insurance to more accurately predict future risks and customer behavior. This enables better pricing strategies and more accurate risk evaluations, keeping insurers ahead of the competition.

Personalized Marketing and Customer Engagement

Insurers are also turning to Gen AI to create personalized marketing content that resonates with each customer. By analyzing customer data and preferences, Gen AI can generate targeted marketing materials, including brochures, blog posts, and social media content. This not only improves customer engagement but also boosts conversion rates.

Moreover, Gen AI can streamline customer communication by automating tasks such as sending service emails, policy updates, and reminders. This ensures that interactions are timely and relevant, which helps build stronger relationships with customers. However, it’s important to have human oversight to ensure the quality and accuracy of AI-generated content.

Enhancing Customer Service with Context-Aware AI

Some insurers are incorporating Gen AI into their customer service platforms to create more personalized, context-driven interactions. By analyzing past customer interactions and policy details, Gen AI can provide precise, personalized responses to inquiries. For example, when a policyholder asks about the status of a claim or details of their coverage, the AI can pull relevant information from internal systems, significantly reducing response times and the need for human intervention.

This shift toward Gen AI is not just about improving efficiency; it’s about creating a more engaging and personalized experience for customers, which can lead to higher satisfaction and loyalty.

Navigating the Risks of Generative AI in Insurance

While the advantages of large language models insurance are undeniable, its integration also brings significant risks. These risks stem from the inherent challenges of ensuring the accuracy, security, and compliance of AI-generated content.

Hallucinations and Maintaining Decision Accuracy

A key risk with Gen AI is the possibility of “hallucinations”—when the AI generates plausible-sounding but incorrect outputs. In insurance, this can lead to flawed risk assessments, inaccurate policy pricing, and errors in claims decisions. Such mistakes can undermine the integrity of the underwriting and claims processes, leading to financial losses and reputational damage.

Despite these concerns, Gen AI can still be incredibly valuable for insurers. It boosts efficiency by quickly generating drafts for policies and coverage options and ensures consistency across documents. To mitigate the risks of hallucinations, insurers are implementing checks and validations and keeping humans in the loop to verify AI-generated content before it is finalized.

Vulnerabilities to Adversarial Attacks

Generative AI systems can also be vulnerable to adversarial attacks, where malicious actors manipulate inputs to deceive the AI into making incorrect decisions. In the insurance industry, this could mean AI systems approving fraudulent claims or altering risk assessments in favor of bad actors.

To protect against such risks, insurers need to put in place robust security measures. This includes data encryption, secure training practices for AI models, adversarial testing, and regular system audits. Additionally, strong authentication methods and continuous monitoring of AI systems can help detect and respond to unusual behavior, safeguarding the integrity of AI systems.

Balancing Innovation with Risk Management

Generative AI offers significant opportunities for insurers to improve efficiency, enhance customer service, and stay competitive in an ever-changing market. However, insurers must also remain vigilant about the risks associated with this powerful technology. By adopting best practices for security, compliance, and oversight, insurers can leverage the full potential of Gen AI without compromising on accuracy, trust, or governance.

The key to success lies in balancing innovation with prudent risk management, ensuring that AI enhances operations while protecting the interests of both the insurer and the customer.