User blogs

Tag Search

When will I receive my withdrawal?

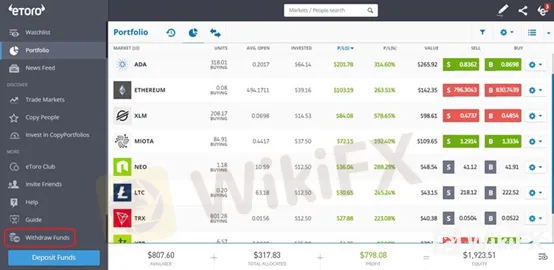

As long as the account is fully verified and no additional documentation is required, you may request to withdraw any and all funds that are available in your Available balance at any time without limitation.

We will send you an email confirming your withdrawal status within 2 business days of your request.To get more news about eToro Fund Withdrawal, you can visit wikifx.com official website.

Normally, you will receive your funds in a few days. However, from the time you request the withdrawal it may take up to 10 business days, depending on the payment method used:Please be aware that we reserve the right to send the withdrawal amount to the original payment method(s) used to deposit funds into your eToro account. If the amount you are requesting to withdraw exceeds the amount deposited with a single credit / debit card or bank transfer, we will send the full amount to another payment method used to fund your account if applicable.

If any of your original payment methods can no longer receive funds, we encourage you to contact our Customer Service team before you request the withdrawal so that we can exclude the inactive payment method from being used in future withdrawals.

You can withdraw money from your eToro account at any time up to the value of the balance of your account, minus the amount of margin used. You don't need to hold any money in your account, so it's possible to withdraw the full balance if you need to.

The important thing to remember is that any withdrawn funds will be sent directly to the account that you used to make the deposit. For example, if you made a deposit with a credit card then the money will be sent to your card.

Note that certain withdrawal methods take priority. If you are withdrawing your money onto a credit card, this will happen first, then PayPal and finally bank transfers. If your details have changed since you deposited the funds, then you will be asked by eToro to provide an alternative withdrawal method.

It can take up to 1 business day for eToro to process your withdrawal request – assuming that all the details on your account are correct. Once the withdrawal is processed, the estimated time to receive payment depends entirely on your payment provider.

If you're withdrawing funds in a different currency than USD, then you'll also be charged a conversion fee. This conversion fee will vary depending on your chosen currency.

You may also be charged a transfer fee by your own bank, credit card provider or PayPal once the transaction has taken place. You can keep up-to-date with the status of your withdrawal in the Portfolio tab. It's important to note that eToro fees are subject to change at any time, depending on market conditions.

AVATRADE DEMO ACCOUNT: TUTORIAL & REVIEW

One of the best ways to try out trading the financial markets is to open a free Demo account at AvaTrade. Below is a step-by-step guide on how to do that, with additional tips on how to get your virtual trading off to a good start. We’ll cover:To get more news about AvaTrade Demo Account, you can visit wikifx.com official website.

HOW TO OPEN AN AVATRADE DEMO ACCOUNT

1. Head Over to The AvaTrade Demo Account Page

Just click here to head directly to the AvaTrade Demo account registration page and sign up for risk-free, virtual trading. Once you click, you will be greeted with a following screen.

Registering through the dedicated Demo Account link involves entering in the minimal amount of information. It really is as simple as inputting some basic information such as phone numbers and email addresses into the registration page.

Alternatively, you can automatically populate the required fields by piggy-backing on your Facebook or Google profiles.

Although the Demo account involves risk-free trading, AvaTrade, like other regulated brokers, has a duty of care to anyone who registers. The contact details that build your profile are part of its requirement to comply with ‘Know Your Customer’ rules.

2. How to use the registration process to help your trading

If you want to start your journey into trading by finding out more about AvaTrade, then the homepage is found here. Or you may want to carry out more research by considering our in-depth Avatrade review.

The onboarding process, which involves providing more information, starts from the broker’s homepage. It can be a surprisingly useful way of introducing yourself to the markets.

The second page asks you to input some more information, including your main country of residence. This question is important as it determines which regulatory body you will be protected by. AvaTrade is regulated by six top-quality global regulators, and they need to match clients to respective T&Cs.

EU-domiciled users will be protected by the Cyprus Securities and Exchange Commission (CySEC). If you select ‘United Kingdom’, you will come under the umbrella of the Financial Conduct Authority (FCA).

These regulator-inspired questions are a good way for you to ask yourself useful questions that might make your trading more appropriate to your personal situation.

This is a valuable ‘sanity check’ on your trading aims and intentions. One useful by-product is that the questions asked will hopefully go on to influence your trading decisions and make your trading successful for you.

AvaTrade offers a wide range of resources designed to help you locate profitable trading strategies.

Beginners can take advantage of the high-quality analytical software and a range of free live webinars.

As you progress, you might want to consider the SharpTrader tool, which contains a range of instruments, including trade signals. This is a valuable resource designed to help research and learning – all good for helping you generate a profit.As well as the trading and research sections, there are other areas of the site relating to account and profile administration.

Handy video tutorials on ‘How to Fund Your Account’ take a lot of the legwork out of getting to grips with that side of trading, leaving you able to concentrate on more market-focused activities.Broker accounts, such as the one provided by AvaTrade, are in many ways similar to online banking accounts, only you have your account log-in details and your cash deposits sit in your account unless you choose to use some of them on a trading idea in an effort to make a return.

The minimum deposit at AvaTrade is £100, so traders moving on from the Demo account are able to follow the tried-and-tested advice of starting Live trading in a small size.

Why Is New Oriental Education and Technology Group (EDU) Stock Skyrocketing Today?

Instead, the massive jump in price for EDU stock comes from an American Depositary Shares ratio change. This alters the price of the stock in a similar way to a reverse stock split. That’s to say that the price increases because multiple shares are consolidated down into one.To get more news about Undergraduate, you can visit wikifx.com official website.

In the case of the EDU stock ADS ratio change, the company went from a 1-to-1 ratio for its stock to a 1-to-10 ratio. The company originally announced its plan to undergo an ADS ratio change near the end of March.

There are a few different reasons that companies undergo ADS ratio changes or reverse stock splits. In some cases, it’s to keep their stock from being delisted due to the low price. Others do it to help prevent volatility as a higher price helps ward off retail traders.

New Oriental Education and Technology Group doesn’t say exactly why it put the ADS ratio change in place. It could have been for either of those reasons as the company’s stock was trading just above the $1 mark prior to the change. EDU stock is listed on the New York Stock Exchange, which requires shares to maintain a price of at least $1 to remain on the exchange.InvestorPlace has all the latest stock news that traders need to know about for Friday. That includes Aterian (NASDAQ:ATER) continuing to rally, this morning’s biggest pre-market stock movers, and more. You can get up to speed on all of this news at the following links!

While it’s no secret that the $5 trillion EV boom is underway, Tesla may not be the best stock for long-term gains. And the reason why is simple...

The EV boom has lit a fire under dozens of overlooked industries… from batteries to chipmakers… and companies operating in this space could see their share prices soar.

How to choose an FX Broker that meets your needs in 2022

Choosing an FX broker in 2002 isn’t necessarily easy. There is a range of factors you should be considering before you open an account with a CFD broker. We have listed a few essential factors to consider, including regulation, costs and trading platforms. To get more news about Middle School, you can visit wikifx.com official website.

Look at comparison sites and broker reviews

Before deciding who to trade with, make sure you do your research. Knowing who is a reputable broker is critical, and comparison sites are the best place to start. Broker Tested provides a range of reviews of all popular FX and CFD brokers, including Eightcap.

They have also tested and categorised some of the best brokers in each country.

A few things you should consider before choosing a broker:

Spreads, Cost and Trading Conditions

Considering pricing and transaction costs should be at the top of your checklist when finding a broker. You will want to find a CFD provider that can offer the best pricing in the industry. Brokers can offer both fixed and variable spreads. For example, clients can trade with Eightcap’s raw account with spreads starting from 0.0pips with a commission charged at $3.5 per standard lot traded. Whereas the standard account spreads can be wider, there is no commission charged with this type.

The different types of account types traders face:

→ Commissioned Accounts: This is where the trader will receive tight spreads on the markets while being charged flat-rate commissions.

→ Standard Accounts: Here, the trader is subject to wider spreads, but no extra fees/commissions are charged.

→ Micro Accounts: This is an account where fixed spreads are applied that remain the same despite market conditions.

You will also need to look into overnight fees. This is why finding a broker review site is essential, as they will be able to provide you with the details you need without you conducting too much research.

Overnight fees: These are also known as swap rates. Traders that keep positions (on margin) open for more than a day may incur an overnight fee. Traders may also be subject to an inactivity fee where if a trader leaves an account dormant for six months, they could incur an additional fee.

Eightcap only charges a swap rate for trades left open for more than a day. We do not charge any inactivity fees.

Type of Broker

Depending on your trading needs, you will need to understand the different types of broker offerings. You usually see Market Makers, Electronic Communication Network (ECN), Direct Market Access (DMA) and Straight Through Processing (STP) brokers.

Market Makers:

Market makers act as the trader’s counterparty as they match orders internally using dealing desks. They set fixed bid/to ask spreads. Therefore, this type of broker is ideal for traders who want to benefit from fixed spreads.

ECN, DMA and STP: These types of CFD providers will match your order to external liquidity providers. The benefit of using one of these brokers is that there is no need for intermediaries.

Again, by consulting a broker review site, you will be able to find out this information relatively easily.

Execution Types

Choosing a broker with lightning-fast execution is also key due to the volatility of specific markets. At Eightcap, we have fast execution so that you encounter minimal slippage when placing your trades. Slippage defines the difference between the price at which the order is placed and the actual price at which the order ends up going through.

Eightcap has its servers in Equinix TY3, Tokyo. As well as this, we run a collection of cloud servers globally, which aims to improve latency via fibre optic connectivity.

Regulation and Reputation

The reputation a broker holds should play a significant part in your decision of where to trade. Eightcap is regulated in multiple jurisdictions and is trusted by trades on a global scale. The Eightcap Group is regulated by the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Securities Commission of The Bahamas (SCB).

You will want to ensure that you are trading with a provider regulated by a Tier-one regulatory body, as they require providers to segregate client money. Please refer to broker comparison sites such as Broker Tested for a full list of regulated brokers.

Margin call: What it is and how to avoid one

A margin call occurs when the value of securities in a brokerage account falls below a certain level, known as the maintenance margin, requiring the account holder to deposit additional cash or securities to meet the margin requirements. Margin calls only happen in accounts that have borrowed money to purchase securities, and they usually occur in fast-declining markets.To get more news about Margin Call, you can visit wikifx.com official website.

What is a margin call?

A margin call may sound like the sort of thing that only happens to big players on Wall Street, but it can also happen to small investors who have purchased securities on margin, or using borrowed money. Here’s how it works.

If you’ve opened a margin account with an online broker, it means that you’ll be able to purchase securities such as stocks, bonds and exchange-traded funds (ETFs) using a combination of your own money and money the broker has lent to you. The borrowed money is known as margin. This will allow you to trade more than you otherwise would be able to and will magnify your returns, either positively or negatively.

One caveat to buying on margin is that you’ll also have a maintenance margin requirement, which requires you to maintain a certain percentage of equity in your account. When your portfolio falls below the maintenance margin, usually due to declining security prices, you’ll be hit with a margin call from your broker.

When do margin calls happen?

Margin calls can occur at any time, but are more likely to happen during periods of high market volatility. Here’s what triggers a margin call:

A security you hold declines and takes the value of your margin account below the required maintenance margin. If you’re short a security (betting against it), a margin call can be triggered if it appreciates, or moves against you.

You’re then required to deposit additional capital into your account up to the maintenance margin level. The funds can be cash or additional securities.

If you don’t make a deposit, your broker may require you to sell something in order to meet the margin call.

How to avoid a margin call

The easiest way to avoid a margin call is to not have a margin account in the first place. Unless you’re a professional trader, buying securities on margin is just not something that’s necessary to earn decent returns over time. But if you do own a margin account, here are a few things you can do to avoid a margin call.

Have extra cash on hand. Having extra cash that’s available to be deposited in your account should help you if a margin call comes. Depositing additional funds is one way to get you in compliance with margin requirements.

Diversify to limit volatility. Diversification should help limit the chances of an extreme decline that might trigger a margin call quickly. Conversely, being overly concentrated in volatile assets could leave you vulnerable to sharp declines that could trigger a margin call.

Track your account closely. While most people are better off not looking at their portfolios every day, if you have a significant margin balance you’re going to want to track it daily. This will help you stay aware of where your portfolio stands and whether you’re close to the maintenance margin level.

Margin call example: How to calculate

Let’s say you’ve deposited $10,000 into your account and borrowed another $10,000 on margin from your broker. You decide to take your $20,000 and invest it in 200 shares of XYZ company, trading for $100 a share. Your maintenance margin is 30 percent.

In this example, if the market value of the account falls below $14,285.71, you’ll be at risk of a margin call. So if the stock price of XYZ falls to $71.42 or lower, you’ll be faced with a margin call.

Let’s say Company XYZ reports disappointing earnings results and the stock falls to $60 not long after you bought it. The value of the account is now $12,000, or 200 shares at $60 per share, and you’re $1,600 short of the 30 percent margin requirement. You have a few options.

How to Trade Currencies, Avoid Forex Trading Scams

When people think of investments, they tend to think of the stock market. Stocks certainly get the most attention in the financial media. Other markets, such as bonds and commodities, also garner significant interest. However, there’s one financial market that is larger than all the rest put together in terms of trading volume. That is the foreign exchange market, or forex for short.To get more news about Forex Trading, you can visit wikifx.com official website.

According to the Bank for International Settlements’ 2019 Triennial Central Bank Survey, the forex market handles more than $6 trillion of trading volume every business day. Foreign exchange encompasses a large variety of participants, including governments, banks, multinational companies, institutional investors, tourists and business travelers, retail traders, and more. The immense amount of trading volume leads to significant opportunities for shrewd traders.

However, it’s important to realize that forex trading is a zero-sum market, meaning that for every winner in a transaction, there is someone who lost an equal amount. That’s because currencies don’t produce profits or pay dividends as a company would. The stock market, being a positive-sum game due to increasing corporate earnings and economic growth, tends to produce better long-term returns for investors than forex trading.

However, while forex may not be an ideal way to build steadily compounding long-term wealth, it does offer a number of intriguing trading possibilities due to the unique characteristics of the currency market. And although there are plenty of legitimate ways to make money in the foreign exchange market, scams do exist and can sidetrack investors. Here are some factors to think about before engaging in forex trading:

Forex trading has become particularly attractive in 2022 due to several factors, one of which is the sudden increases in interest rates and inflation. Much of currency trading is driven by differences in interest rates between different countries. A forex trader might buy a currency yielding 5% annually and sell short another one yielding 1% per year. That would result in an annual gain of 4% per year simply due to the interest rate differential. That interest rate difference is known as “carry.” Carry trading, or profiting from these interest rate differences, is an ever-popular forex strategy. With leverage, which is widely used in forex, that hypothetical 4% annual gain can be magnified many times over. It is important, however, to note that carry trades have significant risk, namely that the value of the underlying currencies could move by more than the interest rate spread, thus wiping out the potential profit.

Carry trading diminished in prominence after the 2008 financial crisis, as most major central banks set their interest rates at or near zero. This reduced opportunities for arbitrage among different interest rates around the world. Now, however, with central banks such as the U.S. Federal Reserve hiking rates quickly, opportunities are multiplying.

Geopolitical events are another key factor driving increasing interest in forex. The invasion of Ukraine has caused investors to seek safety in their portfolios. Traders turn to forex “in times of overall geopolitical uncertainty, as we have recently experienced with Russia, Ukraine and China,” says Stephen Akin, a registered investment advisor and founder of Akin Investments. “The safety trade, often referred to as ‘King Dollar,’ has been used to protect investors around the world seeking the safety of the U.S. dollar.”

Indeed, the dollar has appreciated sharply in recent months. For example, this summer, it reached parity against the euro. This means that, for the first time since 2002, $1 was equal to 1 euro. That’s a notable event, as historically the euro has generally been worth significantly more than the dollar. The dollar has also appreciated sharply against other leading currencies, such as the Japanese yen, Swiss franc and British pound.

Related to those geopolitical upheavals, there is also the surge in commodity prices and the inflationary impact associated with that. Countries that produce lots of raw materials, such as oil, copper and iron ore, benefit from the current inflationary environment. Meanwhile, nations that import raw materials are not faring as well on the global trade market.

Richard Gardner, CEO of leading M4 white-label forex trading platform Modulus, explains how this has played out in 2022: “This year, the events in Ukraine have increased the price of commodities, including oil and natural gas. That’s been a major boon for commodity-related currencies, especially in comparison to economies which tend to import those same commodities. You can see this play out, for example, by comparing the Norwegian krone to the Japanese yen this year.”

Given this dynamic, a forex trader might buy the currency of a commodity-producing country, such as Brazil, while betting against a commodity importer, such as Japan. Year to date, the Brazilian real has appreciated roughly 30% against the Japanese yen. Brazil also has a far higher interest rate than Japan, so this hypothetical trade would be benefiting from a high amount of positive carry interest on top of the capital gains. And then there’s leverage. It’s not uncommon for forex traders to use three-, five- or even tenfold leverage on positions, which could multiply a 30% gain into something much larger.

However, that leverage can be a doubled-edged sword. Akin explains: “There is significant risk in forex trading due to the leverage that it provides. That leverage allows you to control a large investment with a relatively small amount of money. This allows for strong potential returns, but can also result in significant losses.”

9 Forex Trading Tips

The best traders hone their skills through practice and discipline. They also perform self-analysis to see what drives their trades and learn how to keep fear and greed out of the equation. These are the skills any forex trader should practice.To get more news about Forex Trading Tips, you can visit wikifx.com official website.

Define Goals and Trading Style

Before you set out on any journey, it is imperative to have some idea of your destination and how you will get there. Consequently, it is imperative to have clear goals in mind, then ensure your trading method is capable of achieving these goals. Each trading style has a different risk profile, which requires a certain attitude and approach to trade successfully.

For example, if you cannot stomach going to sleep with an open position in the market, then you might consider day trading. On the other hand, if you have funds you think will benefit from the appreciation of a trade over a period of some months, you may be more of a position trader. Just be sure your personality fits the style of trading you undertake. A personality mismatch will lead to stress and certain losses.

The Broker and Trading Platform

Choosing a reputable broker is of paramount importance, and spending time researching the differences between brokers will be very helpful. You must know each broker's policies and how they go about making a market. For example, trading in the over-the-counter market or spot market is different from trading the exchange-driven markets.

Also, make sure your broker's trading platform is suitable for the analysis you want to do. For example, if you like to trade off Fibonacci numbers, be sure the broker's platform can draw Fibonacci lines. A good broker with a poor platform, or a good platform with a poor broker, can be a problem. Make sure you get the best of both.

A Consistent Methodology

Before you enter any market as a trader, you need to know how you will make decisions to execute your trades. You must understand what information you will need to make the appropriate decision on entering or exiting a trade. Some traders choose to monitor the economy's underlying fundamentals and charts to determine the best time to execute the trade. Others use only technical analysis.

Whichever methodology you choose, be consistent and be sure your methodology is adaptive. Your system should keep up with the changing dynamics of a market.

Determine Entry and Exit Points

Many traders get confused by conflicting information that occurs when looking at charts in different timeframes. What shows up as a buying opportunity on a weekly chart could show up as a sell signal on an intraday chart.

Therefore, if you are taking your basic trading direction from a weekly chart and using a daily chart to time entry, be sure to synchronize the two. In other words, if the weekly chart is giving you a buy signal, wait until the daily chart also confirms a buy signal. Keep your timing in sync.

Calculate Your Expectancy

Expectancy is the formula you use to determine how reliable your system is. You should go back in time and measure all your trades that were winners versus losers, then determine how profitable your winning trades were versus how much your losing trades lost.

Take a look at your last ten trades. If you haven't made actual trades yet, go back on your chart to where your system would have indicated that you should enter and exit a trade. Determine if you would have made a profit or a loss. Write these results down.

Although there are a few ways to calculate the percentage profit earned to gauge a successful trading plan, there is no guarantee that you'll earn that amount each day you trade since market conditions can change. However, here's an example of how to calculate expectancy:

Before trading, it's important to determine the level of risk that you're comfortable taking on each trade and how much can realistically be earned. A risk-reward ratio helps traders identify whether they have a chance to earn a profit over the long term.

Stop-Loss Orders

Risk can be mitigated through stop-loss orders, which exit the position at a specific exchange rate. Stop-loss orders are an essential forex risk management tool since they can help traders cap their risk per trade, preventing significant losses.

Using the example above, imagine the trader had a very wide stop-loss order for each trade, meaning they were willing to risk losing $1,200 per trade but still made $600 per winning trade. One loss could wipe out two winning trades. If the trader experienced a series of losses due to being stopped out from adverse market moves, a far higher and unrealistic winning percentage would be needed to make up for the losses.

Although it's important to have a winning trading strategy on a percentage basis, managing risk and the potential losses are also critical so that they don't wipe out your brokerage account.

Focus and Small Losses

Once you have funded your account, the most important thing to remember is your money is at risk. Therefore, your money should not be needed for regular living expenses. Think of your trading money like vacation money. Once the vacation is over, your money is spent. Have the same attitude toward trading. This will psychologically prepare you to accept small losses, which is key to managing your risk. By focusing on your trades and accepting small losses rather than constantly counting your equity, you will be much more successful.

Positive Feedback Loops

A positive feedback loop is created as a result of a well-executed trade in accordance with your plan. When you plan a trade and execute it well, you form a positive feedback pattern. Success breeds success, which in turn breeds confidence, especially if the trade is profitable. Even if you take a small loss but do so in accordance with a planned trade, then you will be building a positive feedback loop.

Perform Weekend Analysis

On the weekend, when the markets are closed, study weekly charts to look for patterns or news that could affect your trade. Perhaps a pattern is making a double top, and the pundits and the news are suggesting a market reversal. This is a kind of reflexivity where the pattern could be prompting the pundits, who then reinforce the pattern. In the cool light of objectivity, you will make your best plans. Wait for your setups and learn to be patient.