User blogs

Tag Search

Bill Lipschutz's tips on how to become a successful forex trader

A Google search for the top forex traders in the world will show Bill Lipschutz in the top 10. The co-founder and Director of Portfolio Management for Hathersage Capital Management, Lipschutz had also worked for Solomon Brothers as Global Head of Foreign Exchange from 1981 to 1990. He was responsible for the development of the exchange-traded and over-the-counter foreign exchange option markets. He has held a number of elected and appointed positions in the foreign exchange industry.To get more news about Graduation, you can visit wikifx.com official website.

Born in Farmingdale, New York, Lipschutz began his trading career while attending Cornell University. He has a bachelor’s degree in fine arts and completed his MBA in finance in 1982. Lipschutz’s education background has undoubtedly contributed to his success in the forex market.

He became interested in stocks after inheriting $12,000 worth of stocks when his grandmother died. Eventually, Lipschutz managed to turn his inheritance into $250,000, after hours of stock market research. He has had his share of ups and downs in his investing career; he once lost his entire portfolio balance on a single bad trading decision because he failed to use an appropriate risk-management strategy. He could have walked away from trading after this major setback. But it fuelled his interest in trading, and he decided to learn from his mistakes. In 1995, he formed his own company, Hathersage Capital Management.

Lipschutz has featured in books such as The New Market Wizards: Conversations with America’s Top Traders, by Jack D. Schwager, 1992 and The Mind of a Trader: Lessons in Trading Strategy From The World’s Leading Traders, by Alpesh B. Patel, 1998. He was inducted into the Trader Monthly Hall of Fame in October 2006.

Trading Strategy

Lipschutz says the primary focus point of investors while trading should be the risk-reward ratio. He always focuses on a 3 dollar return for 1 dollar risk. Also, according to Lipschutz, it is important to understand the difference between a winning trade and losing trade, including the timing of trades, stop loss-take profit set, and the size of trades.

"If you make any mistake in calculating the trading size and winning or losing trade, you may have to pay the price with your trading capital. However, it is also essential to understand the big picture of the market, which is a crucial element of price action trading," he said during an interview with Jack D Schwager.

Investors should focus on understanding the market well, whether they trade based on technical analysis or fundamental analysis. Many traders do not want to focus on fundamentals, he says, but it is critical to understand at least the essential function of fundamental analysis as it provides the logic and reason for market moves. "It is necessary to understand what the market is thinking and how to manage risks with the sentiment," he said.

Many traders come into the market and consider it as a money-making machine, which is not a wise thing to do, he says.Lipschutz has revealed many important tips for successful forex trading in his interview with Jack D. Schwager in "The New Market Wizards: Conversations with America’s Top Traders." Let's look at some of these tips.

Pay attention to risk-reward ratio

Investors need to pay attention to the risk-to-reward ratio, he says. They should be looking at positions where the potential profit is at least three times the amount they are risking on the trade. For short-term trades, Lipschutz looks for a 3-to-1 multiple of upside to downside. For more complicated trades where investors are risking significant capital, he says the ratio should be closer to 5 to 1 as a minimum. "A good rule of thumb for a short-term trade – 48 hours or less – is a ratio of three to one. For the longer-term trades, especially when multiple leg option structures are involved and some capital may have to be employed, I look for a profit-to-loss ratio of at least five to one," says the co-founder of Hathersage Capital.

Pay attention to details

Lipschutz stresses on the importance of structuring each trade to maximise the chances of success. Even if investors have a winning prospect, it’s easy to lose money if they don’t get the details right. "If your timing is slightly off, you could lose. You have to structure your trade in a manner that increases your probability, your upside, and decreases your downside. Getting your timing slightly wrong can lose you huge amounts of money. So it’s important to get the deal execution perfect. Do everything you can to increase your chance of winning, while limiting the risk in each trade," he says.

Understand the market

Lipschutz places importance on sentiment. Whether they are pure technical traders or have a different approach, he says, it is a mistake to ignore market perception. "It doesn’t matter if that perception is based on the Aztec calendar. If traders think that something is going to happen based on their charts, then something is going to happen just because of the momentum in the market. Unless you understand this, you’re going to end up compromising your trading positions," he adds.

Work hard

The co-founder of Hathersage Capital says the best traders are highly intelligent and willing to put in what it takes to be successful. Just being a genius is not enough to be successful in forex trading. "Truly successful traders look at money as simply a way of keeping score and get deep satisfaction out of the trading itself," he says.

Be totally focused

Lipschutz explains that a truly successful trader has to be totally focused and involved in trading. Money shouldn't be the only reason for an investor to get into the trading profession. "Most of the top traders have a child-like fascination with the game. Whether it’s the psychological elements of the game, the technical elements of the game, whether it’s the nameless, faceless aspect of a market, or them as single individuals against the market, or beating their brains against everyone else’s. There’s a kind of almost insane focus you must have to achieve trading excellence," he says.

The price of phenomenal success is something not many investors are prepared to pay. For those with insane focus, he adds, there is virtually no price to pay as they love what they are doing.

Best Websites For Beginners to Learn Forex Trading (2022)

All products and services featured are independently selected by WikiJob. When you register or purchase through links on this page, we may earn a commission.To get more news about Summer School, you can visit wikifx.com official website.

Trading on the foreign exchange market, or forex trading as it is more commonly referred to, takes a considerable amount of skill and knowledge.

For beginner traders, there’s a lot to learn, from basic concepts to trading strategies, risk management and platform familiarisation.

Once you’ve built the confidence to begin trading, you’ll then need to stay on top of market trends, economic news and global events that may impact the market. You’ll also want to continually improve your trading skills, learning how to successfully execute increasingly profitable trades.

Thankfully, there is a huge amount of information available online and it is relatively easy for beginner and experienced traders alike to find all they need to know with a little bit of research.

You’ll want to be sure that the sources you turn to are legitimate and trustworthy. Whether you’re looking for news, technical analysis, strategy guidance or educational resources, it’s vital that the sites you use are reputable.

1. Asia Forex Mentor

Ezekiel Chew the founder at Asia Forex Mentor isn’t your typical trainer. He is a recognized expert in the finance industry where he is frequently invited to speak at major financial events. His insights into the live market are highly sought after by retail traders.

Ezekiel is considered to be amongst the top traders around who actually care about giving back to the community. He makes six figures a trade in his own trading and, behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms.

2. eToro Trading School

The one-day eToro Trading School course covers multiple trading areas including forex, cryptocurrency and stocks.In-person education is delivered by Henry Ward, a professional trader with over 10 years’ experience under his belt.

Though the course claims to be suitable for traders of all levels, the content is well suited to beginner traders, or those looking to learn more before dipping their toes into the water.

3. IronFX

IronFX is a leading recognised investment firm and international brokerage.

IronFX offers tailored trading products and services to retail and institutional clients, including a wealth of trading tools, the latest trading platforms and 24/5 multilingual support.As a multi-asset brokerage, IronFX provides more than 300 tradable instruments across six asset classes including forex, metals, indices, commodities, futures and shares.

4. How to Trade

Providing a trading education that is designed to take you from the basics through to the advanced strategy, How to Trade has a wealth of world-class educational resources.

There are more than 50 free trading lessons, designed by globally recognised mentors, and when you complete them, you will receive a certificate. You can expect the free courses to include both forex and stocks education – from a basic introduction through to charts, technical analysis, indicators, risk management and psychology.

5. Forex Trading Coach

Developed by Andrew Mitchem, who has been a Forex trading coach for more than 12 years, there are several training options available through this site – including several free resources.

With more than 3,000 successful students and a money-back guarantee if you do not make a 20% gain following the information given, The Successful Trader Course is a completely online system that comprises several video lessons that are designed to be beginner-friendly.

6. XTB

As a broker that you can trust, XTB is both well-regulated and listed on the stock exchange. The registered office is in Canary Wharf, London.

XTB offers investors and traders the opportunity to trade commodities, stocks, metals, forex, indices and cryptocurrencies, as well as ETFs and CFDs, and it is regulated in top-tier jurisdictions by FCA, CySEC, IFSEC and KNF.

7. Admiral Markets

Admiral Markets, rebranding to 'Admirals', describes itself as a ‘full-spectrum financial hub’.In practice, Admirals is a broker that offers several forex and CFD trading instruments in most currencies.

Founded in 2001, Admiral Markets is regulated by JSC, FCA, EFSA and CySEC, and offers traders access to both MetaTrader 4 and 5, with the opportunity to have several active accounts with different base currencies to take advantage of price instability.

Forex Trading Education: Can you really make it alone?

With more and more people looking to trading as an option to supplement their income and those who look to make it a more full-time endeavour, is it possible to learn all you need to know without following structured forex trading education?To get more news about Kindergarten, you can visit wikifx.com official website.

Whilst I’m sure there are exceptions, the general rule is that success is not likely without structured study or mentorship.

Just like any other professional career, forex trading should be afforded the same respect with regard to educating one’s self in order to succeed.

You wouldn’t hire a builder whose education consisted of watching a couple of videos on Youtube, so how could a trader who has tried to piece together what is publicly available online, whether it be Youtube videos or social media posts, expect to find success in such an unforgiving environment as forex trading.

A google search of how to trade forex at the time of writing this returns 26 300 000 results, so where to start, and how does one filter out the nonsense and go about getting the best forex education?

Most traders start out by following some guru on a popular social platform or youtube and do their best to build an understanding of how to be successful. This can waste months, if not years, as the trader flounders around chasing the next catchy video title that promises success with a fantastic trading strategy.

Simply put, structured study shortens the learning curve that a trader must go through to find consistency in forex trading.

So, where does one start? How is it possible to sort the real educators from the fake gurus?

Starting off as a new trader and finding education on trading for beginners is the easy part. Babypips is well known for a solid start. It covers the basics and gives a good grounding.

What is the next step? Where are you going to get the best forex education? This is where it’s time for you to start doing some research. Unfortunately, there is limited regulation on forex education, so this makes it imperative that you are able to distinguish between scams and quality education.

How would someone look to improve their trading through structured education be able to know where to find quality education that is going to accelerate their trading career? The easiest way is to ask yourself if the educator benefits from your success.

Let’s start by looking at prop firms, and some prop firms offer both forex trading education to people looking to learn how to trade and to traders looking to improve their trading, both technical studies and psychological education, an often overlooked and extremely important part of trading is psychology and coping with the many challenges a trader will encounter as well as offering to fund to successful traders.

Prop firms that benefit from successful traders trading their capital and taking a profit share, so it would be in their best interests to help create successful traders who would, in turn, improve their business through successful trading, so yes, they have something to gain from your success and are more likely to offer a quality education in trading forex, as they have an interest in you succeeding as a forex trader.

In the world of forex trading, it is easy to get caught up in hype and scams. While promises of overnight success always sound like a dream come true for the struggling trader, one always needs to remember that what appears to be an overnight success is from months of study and hard work, from a structured approach to learning and submitting to the time you need to grasp the concepts taught.

As with any career, the study pays off. Don’t get caught by the next catchy video title, and do your research to find the best educator you can.

Best Trading Robots 2022

Automated trading robots make it possible to trade crypto, stocks, forex, and more, all without putting in endless hours of analysis on your own. These platforms are designed to recognize potentially profitable setups in the market and then execute trades automatically on your behalf.To get more news about Forex Robot, you can visit wikifx.com official website.

Trading robots aren’t completely effort-free, but they can make it much easier for beginner traders to profit from the market. In this guide, we’ll review the 10 best trading robots in 2022 and explain how you can start using a trading bot today.

Best Trading Bots Reviewed

Want to know which automated trading robot is right for you? We’ve put together reviews of the 10 best trading robots so you can see what makes these bots stand out.

1. Bitcoin Prime – Overall Best Trading Robot in 2022

Bitcoin Prime is the overall best trading bot available today. Bitcoin Prime is able to automatically trade more than 75 different CFD pairs for Bitcoin. That includes pairings with most major currencies and a wide variety of popular cryptocurrencies. The net result is that Bitcoin Prime is able to find trading opportunities in virtually all market conditions.

Bitcoin Prime claims an impressive 90% win rate, although we have not been able to confirm this. The platform uses a deep learning algorithm to spot setups and even keeps track of crypto news to stay one step ahead of price movements.

Bitcoin Prime requires a $250 minimum deposit but doesn’t charge account fees. The platform takes a 2% commission on profits, so you only pay to use Bitcoin Prime when you’re making money.

2. Oil Profit – 24/7 Automated Bitcoin Trading

Despite its name, Oil Profit isn’t a commodities trading robot. Rather, this platform is designed to automatically buy Bitcoin and sell it on your behalf. Oil Profit is driven by a sophisticated AI algorithm that the platform claims can win up to 90% of the crypto trades that it opens.

What’s great about Oil Profit is that it’s completely free to use. There are no account fees and no commissions on your profits. The platform requires a $250 minimum deposit to get started, but you can withdraw for free at any time.

You can access Oil Profit from a web platform, a mobile app, or MetaTrader 4. The MetaTrader 4 application is especially appealing because it allows experienced traders to monitor signals in real time and jump into manual trading when desired.

3. Bitcoin Era – Top Bitcoin Robot for New Crypto Traders

If you’re new to the world of crypto trading, Bitcoin Era is one of the best crypto trading bots to jump in. With this Bitcoin robot, you can trade a dozen popular cryptocurrencies including Bitcoin, Ethereum, Litecoin, Cardano, EOS, Ripple, and more. You don’t need any trading experience to use Bitcoin Era.

Since this platform trades such a wide range of cryptocurrencies, it is able to trade 24/7 under most market conditions. Bitcoin Era’s algorithm relies on a strategy of high-frequency trading, turning small price movements into gains that add up in your account over time. According to Bitcoin Era, the platform has an 85% win rate.

Bitcoin Era is available via a web platform as well as through mobile apps for iOS and Android. The platform is free to use and doesn’t charge commissions. You must make a $250 minimum deposit in order to start using Bitcoin Era.

4. Quantum AI – Powerful Crypto Robot with Claimed 90% Win Rate

Quantum AI is a powerful crypto robot that can trade Bitcoin, Ethereum, and Bitcoin Cash on your behalf. The robot uses artificial intelligence to spot trading setups in these markets, and it says its algorithm is highly effective. According to Quantum AI, the platform wins up to 90% of its trades, although we could not verify this claim.

Quantum AI is almost free to use. The platform doesn’t charge account fees and deposits and withdrawals are free. You just pay a commission of 0.01% on your trading profits, making this one of the lowest-cost AI trading bots available.

5. eKrona – Automated Trading Based on the eKrona Currency

eKrona is a unique trading robot that relies on the eKrona cryptocurrency for trading. All deposits you make to the platform are first converted to eKrona. From there, you can trade crypto pairs like eKrona-Bitcoin and eKrona-Ethereum. In total, eKrona supports trading across 14 different cryptocurrencies.

The benefit to eKrona is that if the eKrona coin gains value, your trading account also gains value. The platform doesn’t charge fees for holding eKrona, but there is a 2% commission on profits from automated trading. Even though your account funds are held in crypto, you can request a free withdrawal at any time.

IG Review 2022

In 1974, IG was founded in the UK, and it is considered one of the largest CFD brokers around the world. IG has been regulated by several top-tier regulators globally, like the UK’s FCA (financial conduct authority) and Germans BaFin (federal financial supervisory authority). Moreover, the IG group has been listed on the London stock exchange, and it is considered one of the most popular platforms for trading with CFDs in Europe. Besides, this company expanded its operations recently in the United States, and it offers a wide choice of foreign exchange assets for users who are looking for FX trading. Given its popularity and ability to fulfill traders’ needs, we decided to conduct the IG review to find if it is the right fit for online trading. Let us understand the IG broker review in detail.To get more news about IG Pros and Cons, you can visit wikifx.com official website.

What is IG?

IG trading is a leader in European foreign exchange trading. After gaining a reputation as being one of the best UK forex brokers also, this broker offers users access to industry-standard platforms with margin and cost accounts. This will help the traders leverage their deposits to earn a much bigger profit when executing the trades.

This online broker offers its users a quick search feature, which allows them to look for a specific currency by a symbol or name. IG supports various order types that range from market orders to trailing stop orders. It also offers a wide choice of several charting tools and indicators for intermediate traders; the traders can place several annotations and indicators in a single chart.

IG broker has been awarded several awards, which includes Forex brokers annual review 2020, Investopedia online brokers award 2019, and it is ranked as one of the best overall forex brokers and ranked best in overall futures broker in several categories.

Risk Warning – CFDs are complex instruments and come with a high risk of losing money because of leverage; 76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how this works, and you can afford to take the high risk of losing your money.

IG comes with an array of several features, and the traders can use it at their convenience. It also offers several trading and research tools, which include risk management models that are directly integrated. The only requirement is you need to take around 20 minutes to set up the layout, and the user can save the custom layouts for easy access.

By accessing the IG website, the trader can find information on the IG Twitter feed, news, market signals, webinars, and IG economic calendar. Besides, IG also owns a free online forex news website called DailyFX, offered to the traders. They can access the sites and find webinars, educational resources, and articles to learn more about trading in Forex.

As per our IG reviews, we can say that it provides an award-winning mobile application for iPad, iPod touch, iPhone, and Android app for devices with an operating system of 5.0 and above. Trade management can be possible from the mobile app, which offers several drawing tools, technical indicators, an economic calendar, and charting tools. Traders can also set up signals and price alerts using SMS and create personalized watchlists.

IG’s mobile apps are loaded with drawing tools, technical indicators, and timeframes, and they can also select from five different chart types, which include tick charts. The trader can access the menu and can set up the charts very easily. One of the major drawbacks is that the chart indicators that are added on the web do not sync with the mobile automatically, even though they can be saved.

As per our IG review, the educational section of this broker is known as IG academy. This course is broken down as per the broker’s experience, such as beginner, intermediate, and advanced level topics. Moreover, there are a total of eight courses, and the first course starts with an introduction to the financial markets. Some of the other topics include fundamental analysis, understanding risks, trading psychology, and several more. Although find more about various best forex brokers in detail to know their services and features, and if you are looking for country-specific you can visit our best trading platform Malaysia where we have it covered.

IG is the best broker for any user who wants to trade CFDs globally. In the United States, we can use this platform to trade Forex and Shares. It offers low spread costs, great customer service and educational tools, and a functional user interface that makes IG an established broker in the online trading market. Also, it is holding a good position in other countries; if you want the list of best forex broker Australia and the list of best forex broker in USA for more details, you can check it out.

This broker offers a wide range of assets for cryptocurrency markets, where the trader can trade by using CFDs. This removes the need for traders for setting up special wallets or accounts at a cryptocurrency exchange. It offers various unique features, and cryptocurrency instruments, which implies that it can be speculated just like any other financial asset.

This broker offers two-factor authentication for enhanced security. Besides, traders can enable alert notifications for price movements on their desktop. It also offers a wide range of platform tools, workspace tools, and cutting tools. This broker tops the charts for easy usability.

Risk Warning – CFDs are complex instruments and come with a high risk of losing money because of leverage; 76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how this works, and you can afford to take the high risk of losing your money.

FP Markets Review

Overall, FP Markets is considered a low-risk and can be summarized as trustworthy and reliable. FP Markets is fully licensed and regulated by the Securities Commission of the Bahamas (SCB). FP Markets is currently ranked #13 out of 992.To get more news about FP Markets Pros & Cons, you can visit wikifx.com official website.

FP Markets understands what traders need and has learned that the combination of pricing, execution speed, cutting-edge platforms, product range, customer support and market analysis are the key to giving clients trading confidence.

According to research in South Africa, FP Markets is an Australian broker that was established in 2005 and offers traders access to contract for difference (CFD) trading across forex, indices, commodities, stocks, and cryptocurrencies on consistently tighter spreads in supreme trading conditions.

Safe or Scam?

FP Markets has been globally regulated since 2005 and has proved itself as one of the most reliable forex brokers in the industry.

Regulators require a company to be adequately capitalized and ensure that client funds are not used for hedging.

This means that clients’ funds are held in separated client accounts from the company’s own funds. Australian regulation also demands that all funds be reconciled each day.

FP Markets is also fully licensed and further regulated by the Securities Commission of the Bahamas (SCB), a corporate regulator and financial watchdog.

Choosing FP Markets offers the investor a broker that complies with the most stringent regulations for protection.

FP Markets offers tighter spreads from 0.0 pips on its platforms and its Electronic Communication Network (ECN) pricing model is transparent so that traders can rely on institutional-grade liquidity from top-tier banks to ensure market-leading pricing.

FP Markets is connected to the NY4 Equinix server in New York via fibre optic technology to ensure a fast execution speed, so that neither price manipulation, desk dealing, nor re-quotes occur.

FP Markets has partnered with top financial institutions such as HSBC, JP Morgan, Barclays, and Goldman Sachs, to ensure multi-asset liquidity.

P Markets offers leverage of up to 500:1 on positions in FX and precious metal CFDs, along with stop losses, so that traders can make the most of price movements while ensuring robust risk management measures.

As one of the most common tools in the trading world, leverage allows a trader to invest much more in his trades, with relatively small deposit amounts. With FP Market’s leverage, a trader can trade much larger lots and increase his exposure to the markets.

FP Markets suggests minimizing the amount of capital needed to invest where the trader only needs to pay a portion rather than paying the full asset price.

The company provides the opportunity to trade in more expensive instruments with high liquidity, even for the trader with only a small amount of capital to invest.

FP Markets increases the traders’ exposure to the markets, allowing them to enter larger trades than what would have been possible with just their own capital.

Traders should however take note that larger leverage not only magnifies their profit but also their loss potential. So, always assess your risk tolerance before you choose a leverage ratio.

AVATRADE REVIEW

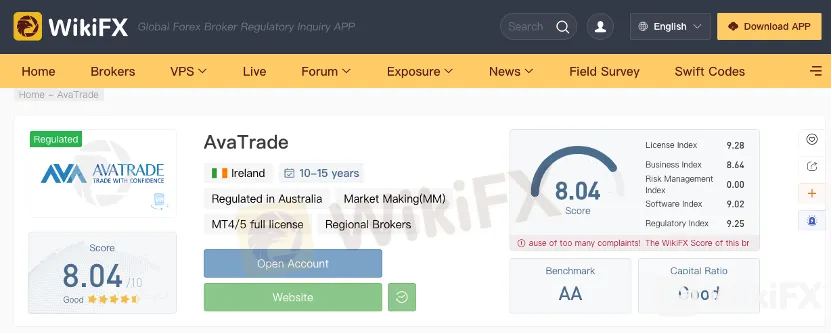

A fully regulated broker with a presence in Europe, South Africa, the Middle East, British Virgin Islands, Australia and Japan, Avatrade deals with mainly forex and CFDs on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in Dublin, Ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.To get more news about AvaTrade Pros & Cons, you can visit wikifx.com official website.

AvaTrade has been facilitating online trading since 2006 and has offices all over the world. But as with any brokerage (especially when dealing with forex!), you need to ensure your trades and investments are safe, fees and commissions are reasonable, and customer service is on point.

Who Uses AvaTrade?

AvaTrade caters to the needs of diverse client groups due to the options it provides in terms of its trading platforms/software and tradable asset classes.

Beginners. With the firm’s intuitive and simple interface and the solid backup provided by the AvaTrade’s customer support team, a beginner can easily and comfortably navigate through the complex investing world. The firm also provides specialized educational content for beginners to acquaint them with trading. A case in point is its “Trading for Beginners” section.

Advanced Traders. AvaTrade allows desktop, tablet, mobile and web-based trading with Meta Trader 4 and AvaTradeGO, which provide choices for advanced traders. It has a range of automated trading platforms and EA compatibility. The firm also conducts free webinars targeting traders at all levels.

Traders seeking well-diversified portfolios. The 250+ instruments in stocks, commodities, indexes, forex, CFDs and cryptos help traders diversify their portfolio and in turn mitigate the risk involved.

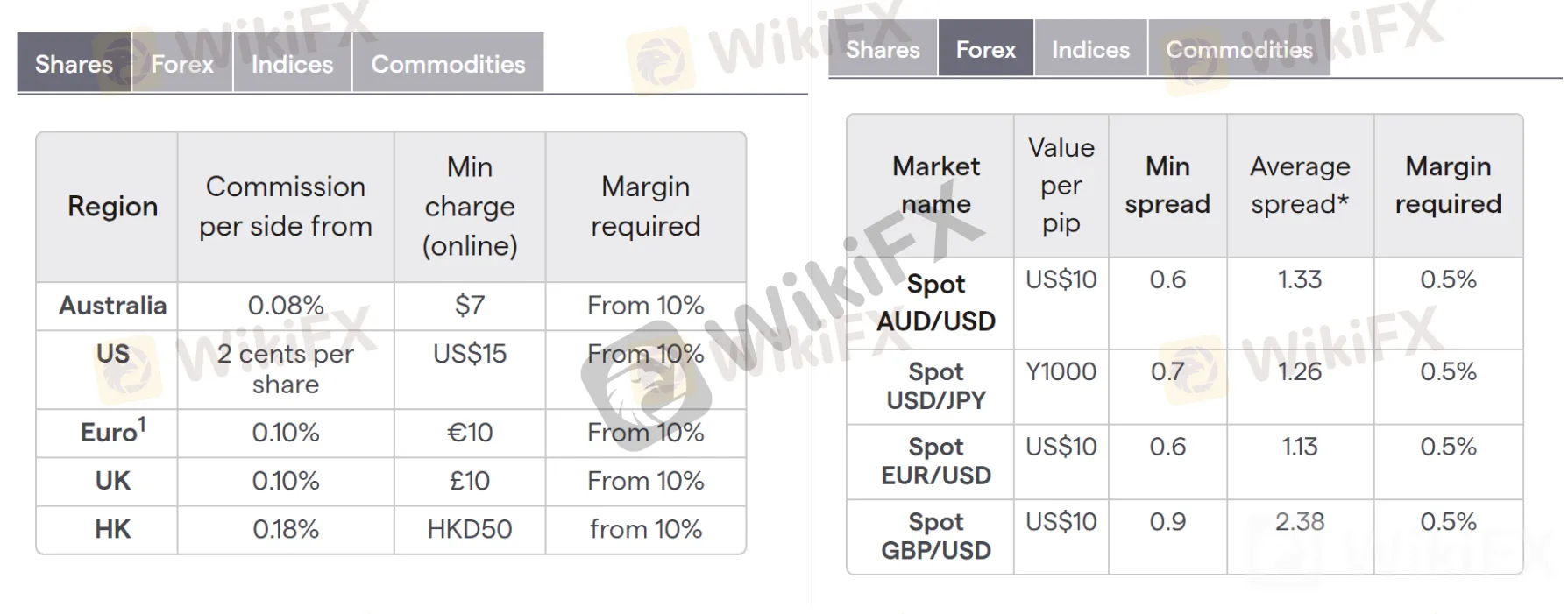

AvaTrade Commissions and Fees

Account opening requires a minimum deposit of $100 if the deposit is made through credit card or wire transfer. The minimum opening balance depends on the base currency of a client’s deposit.

For forex trading, Avatrade doesn’t charge any commission on any trade but is compensated through the bid-ask spread. If the spread is 3 pips on 1,000 units of a currency pair, then the compensation to the brokerage amounts to $0.30.

The firm also charges inactivity fees of $50 for 3 consecutive months of non-use. The inactivity fee will be deducted from the customer’s trading account. AvaTrade charges an administration fee of $100 after 12 consecutive months of non-use.

Research from AvaTrade

AvaTrade carries a wide range of educational tools in a webpage dedicated for education. It provides educational content for beginners, focusing on online trading forex, CFD, along with technical analysis. It also provides information on order types and economic indicators that impact currency market.

An ebook is available for download by clients. Online videos on topics such as advanced trading tools, beginner lessons, forex trading strategies, MetaTrader 4 for beginners, MetaTrader 4 Guide and MyAva guide are available for use.

AvaTrade has a dedicated website called “The Sharp Trader,” which provides all information a trader may need for trading. It has videos that explain various topics needed by traders with different levels of trading knowledge, daily technical and fundamental analysis by the firm’s market analyst, analytical videos and trading tools, including an economic calendar, trading platforms, calculators, etc.